Flight Centre's split ticket

Recommendation

'The Internet is the first thing that humanity has built that humanity doesn't understand, the largest experiment in anarchy that we have ever had.' So said Google chairman Eric Schmidt – and if he doesn't understand it, then what chance the rest of us?

Yet as investors we have to try; or at least we have to try to anticipate its impact, because it's profoundly changing how consumers consume and how businesses do business. That impact has been mostly negative for a string of incumbents, who have had the rug pulled from under them – newspapers, TV stations and retailers for example. But it's been extremely positive for a number of businesses that have been able to take advantage of the internet to replace them – such as Google and Netflix and local classified businesses like REA Group, and Seek.

The travel agency business is an interesting case because it has elements of both. At one end of the scale are the highly commoditised domestic flight and hotel bookings, which have largely been taken over by the airlines themselves, the likes of Webjet and Wotif.com, and increasingly international giants like Expedia and Booking.com.

Key Points

-

Corporate travel business performing well

-

Retail business growing slowly and under threat from internet

-

Earnings can be volatile; need a large margin of safety

Above this comes the consumer international travel market that still forms Flight Centre's bread and butter. This market itself forms a spectrum from a trip to visit a mate in Singapore, to a family booking flights, trains, hire cars and hotels for a three-week trip of a lifetime around Europe. We'd expect the internet to continue to make incursions into the lower end of this market, although the complexity and cost of the (more lucrative) big trips should keep them safe for the forseeable future.

Corporate on the attack

Adding further complexity and cost brings us to the corporate travel market. Ironically, technology has actually helped travel management companies add value for their corporate customers, saving both time and money compared to what in-house teams can accomplish. Corporate Travel Management (CTM), for example, has developed an app that it claims saved one client $14,000 a month in taxi fares by sending texts to employees arriving at airports at the same time, encouraging them to share a taxi.

CTM and Flight Centre's FCm Travel Solutions offer clients an impressive array of reporting and analytical tools, respectively through their SMART and Everyware portals, helping them save on travel expenses. This has encouraged an increasing number of companies to outsource their travel management functions, thereby increasing the size of the market. At Intelligent Investor we're in a somewhat different market segment (when anyone goes on a business trip we'll drive them to the airport and wave them off), so we'd love to hear of people's experience of either of these products.

CTM grew its total transaction value (TTV – the total money flowing through its tills for air fares and the like) by 41% a year (35% organic) in the nine years leading up to its 2010 float, to $352m. Following a string of acquisitions, it has since risen to an annual run rate of $2.5bn. Earnings per share have tripled in the four years since the float and the share price has near-enough tenbagged. Well done to anyone who got on board that train. With CTM now priced at about 30 times prospective earnings, though, it's too rich for us and we won't be initiating official coverage for the time being. We will, however, be keeping an eye on the stock in the hope of a more obvious opportunity.

| Year to 31 Dec | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|

| TTV ($m) | 10,894 | 12,200 | 13,238 | 14,259 | 16,049 |

| Rev ($m) | 1,763 | 1,817 | 1,781 | 1,945 | 2,208 |

| U'lying PBT ($m) | 199 | 240 | 289 | 341 | 380 |

| U'lying NPAT ($m) | 140 | 140 | 200 | 240 | 264 |

| U'lying EPS ($) | 1.39 | 1.39 | 1.99 | 2.38 | 2.62 |

| DPS ($) | 0.70 | 0.84 | 1.12 | 1.37 | 1.52 |

Flight Centre has also been no slouch, firing up its corporate business in the 1990s before consolidating most of it into FCm Travel Solutions in 2004. By 2009 it had reached TTV of around $2.6bn (excluding the corporate business done through its retail outlets), since when it has grown at around 15% a year to approximately $5.3bn.

We estimate that the corporate business generates a revenue margin of 6–7% on its TTV, somewhat less than half the 17% or so achieved by the retail business – but it makes most of that back in lower operating expenses (it doesn't need a store network and each consultant can handle more TTV) so that the earnings before interest and tax margin on TTV is only a little behind.

Retail on the defensive

For all FCm's growth, though, retail still contributes about two-thirds of group profit. Technology also has a role to play here, and in recent years Flight Centre has been making much of 'blended access' to its products, whereby customers can browse products however they want, online and offline, and chat, phone or SMS with consultants.

However, unlike the corporate business, which can clearly demonstrate the value that technology adds, the developments here look defensive, helping the company cling onto sales rather than grow its underlying market. People who currently use Flight Centre to book their overseas vacations might be encouraged to carry on doing so, but those that book trips themselves aren't likely to start using an agent just because they can chat with them online.

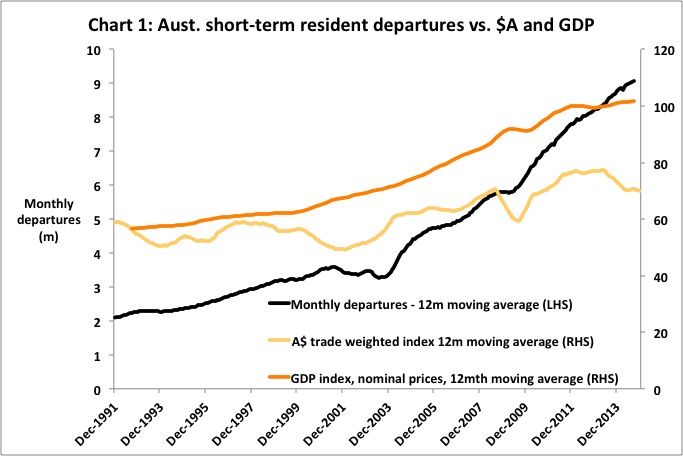

Overall, the internet is likely to nibble away at the retail business – and the big question for investors is the degree to which this will offset the overall market growth. Flight Centre likes to say that ever-cheaper air fares put us at the 'Dawn of a Golden Era of Travel', but a quick look at Chart 1 suggests it's at least elevenses, after growth in Australian resident departures of 7% a year since 1991.

Flight Centre management plays down the impact of the Australian dollar, but it undoubtedly has an effect, by making overseas trips cheaper relative to domestic holidays. In Chart 1 we've also plotted the Australian dollar trade weighted index and gross domestic product (using 12-month moving averages to smooth out seasonality), and it clearly shows dips around the periods of economic and Aussie dollar weakness in 1993, 2002-3 and 2008-9.

The longer-term trend, though, is undoubtedly positive, and we'd expect it to be enough to offset the encroachment of the internet and keep Flight Centre's retail TTV ticking along in the low single digits – in line with the 4.4% a year achieved since 2009.

Heading overseas

With growth in its retail business hard to come by, Flight Centre has been looking overseas, with mixed success. As you can see from Table 2, Australia still contributes 76% of earnings before interest and tax, but the UK is beginning to make a difference, with 10% of EBIT in 2014. The US business, however, continues to struggle, increasing TTV by just 2% a year in US dollar terms since 2009, which means it's actually gone backwards in Aussie dollars. That still gives it 13% of total TTV, but a derisory margin on that TTV of 0.6% means it only contributes 3% of overall EBIT.

| Stores | Share of total stores | TTV ($bn) |

Share of total TTV | TTV per store ($m) | EBIT ($m) |

Share of total EBIT |

EBIT/ TTV |

EBIT per store ($'k) |

|

|---|---|---|---|---|---|---|---|---|---|

| Aus | 1,421 | 53% | 9.1 | 57% | 6.4 | 289.4 | 76% | 3.2% | 204 |

| USA | 295 | 11% | 2.1 | 13% | 7.1 | 12.7 | 3% | 0.6% | 43 |

| UK | 262 | 10% | 1.5 | 9% | 5.7 | 39.8 | 10% | 2.7% | 152 |

| Canada | 255 | 10% | 1.1 | 7% | 4.3 | 0.4 | 0% | 0.0% | 2 |

| NZ | 187 | 7% | 0.87 | 6% | 4.7 | 16.0 | 4% | 1.8% | 86 |

| SA | 163 | 6% | 0.45 | 3% | 2.8 | 10.6 | 3% | 2.4% | 65 |

| India | 41 | 2% | 0.34 | 2% | 8.2 | 3.5 | 1% | 1.0% | 85 |

| China | 30 | 1% | 0.20 | 1% | 6.5 | 2.3 | 1% | 1.2% | 77 |

| Singapore | 15 | 1% | 0.12 | 1% | 7.7 | 2.6 | 1% | 2.2% | 173 |

| Dubai | 9 | 0% | 0.07 | 0% | 7.7 | 2.2 | 1% | 3.2% | 244 |

| Total | 2,678 | 100% | 16.0 | 100% | 5.9 | 380 | 100% | 2.4% | 142 |

Flight Centre is also looking for growth through vertical integration, such as with the acquisition of Topdeck Tours last year. This makes sense because Flight Centre can add value to these businesses by taking them to a wider audience, but it's hard to see them making much difference to growth.

And the move into cycle shops – '99 Bikes' (because only 99 bikes could fit into the original store) – looks at best like a distraction and at worst like outright nepotism. The business operates through a joint venture with Flight Centre chief executive Graham Turner's family company and is run by his son Matthew. The idea is that it takes advantage of the 'systems and processes' and general business acumen of its illustrious parents, but it's hard to see much overlap.

According to an article in BRW last year about $20m of capital has gone into the bikes venture, to produce 2014's EBIT of $2.1m, a return on investment of just 10%. You have to take the rough with the smooth with owner managers, though, and as a rule we find we get plenty more of the former – particularly from those with Turner's mix of inspiration, determination and business nous.

Battle lines

The interplay of the internet and overall growth in the travel market, though, is where the battle lines will be drawn on Flight Centre, and sentiment around this can swing around dramatically. In 2009, for example, when the GFC sent earnings plummeting, all the talk was suddenly about the internet killing off traditional travel agents. The result was a share price that fell to around $3.40 in March 2009 – just three times the earnings per share the company went on to make in 2010.

By early last year when the stock hit its high of $55, talk of obsolescence was long forgotten, but the bears are now back, with the local economy struggling and the Aussie dollar back below 80 US cents. These factors fed into Flight Centre's December profit warning, which reduced the company's 2015 guidance for profit before tax from $395m–405m to $360m–390m.

The company blamed a slowdown in Australian leisure travel spending that began late in the 2013/4 financial year, which resulted in lower sales growth in the first half of the 2015 year and 'slightly lower margins, as FLT's sales people have reduced commissions to lower overall ticket prices and stimulate demand'.

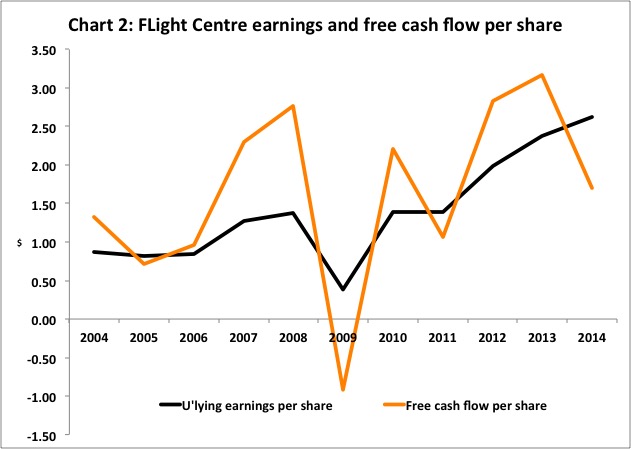

The poor cash flow performance in the 2014 full year adds a negative gloss to the recent performance, with free cash flow falling to $172m (83% of net profit) from $319m in 2013 (129% of net profit) (see Chart 2). The 2012 and 2013 financial years saw a build-up in payables – mostly owing to airlines, probably resulting from a weak negotiating position driven by overcapacity – but this reversed in 2014, perhaps indicating a shift in the balance of power. The concern is that it may develop from a cash flow hiccup into full-on margin pressure and it will be a key area of focus in the forthcoming half-year result (due on 24 Feb).

All this makes us nervous. Although we have faith in Flight Centre's long-term prospects, the stock has shown immense volatility and the best results have come from sticking to a big margin of safety. With the road ahead looking increasingly rocky, we're keeping that front of mind.

If Flight Centre lands in the middle of its new guidance range, it'll mean earnings per share for the current year of about $2.60, putting the stock on a prospective price-earnings ratio of 14, which is not expensive, especially given that it translates to a free cash flow yield of a little over 6% (assuming a 90% conversion rate).

If you're keen to own this stock for the long term and you're happy to ride out short-term volatility, then it could make sense to start nibbling at the stock around $35. We're inclined to be patient, though, and will look for a return to $30 before upgrading to Buy. In line with this, we'll also notch down our Sell price from $60 to $50. HOLD.

Recommendation