Flight Centre leans into the breeze

Recommendation

It's unfortunate that Austrian economist Joseph Schumpeter has become known for wind. But Schumpeter's gale, as his concept of 'creative destruction' is called, has most certainly been buffeting travel company Flight Centre.

So much so that the company's shareholders own a very different business from fifteen years ago - perhaps without realising it. They're hardly alone; many still think of News Corporation as a newspaper business even though most of its value derives from online real estate listings.

The destructive side of capitalism dominates the headlines - 'disruption' is the fashionable term isn't it? But the very same headlines tend to ignore the 'creative' side of the ledger, Flight Centre being a textbook example. Most of the company's value now comes from selling corporate travel to business customers, a division that's growing just as fast as the leisure travel brands did in their heyday.

Key Points

-

Corporate accounts for most of value

-

Australian leisure earnings slumping

-

Existing Buy price retained

Between upgrading Flight Centre to Buy at $31 in 2016 and downgrading it to Sell at $64 in 2018, we spent little time exploring the corporate travel business. But it was clear how important the division was becoming to the company as far back as 2009. If you'd like, jump back to our three-part series from that era - A new perspective on Flight Centre, Part 1, Part 2 and Part 3.

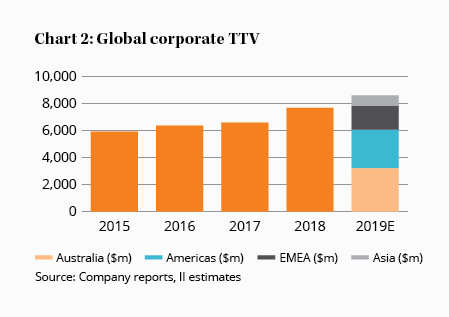

Decent growth

Since 2009, Flight Centre's corporate travel business has grown its total transaction value (TTV) - the value of travel sold - from $3.9bn to a forecast $8.6bn this financial year. That represents an annual growth rate of 8%, although admittedly some of it has come from acquisitions.

Flight Centre is now the fourth-largest corporate travel company behind American Express, Carlson Wagonlit and BCD. Flight Centre operates through the 'FCm' brand for multi-nationals, and 'Corporate Traveller' for small-to-medium enterprises, although margins are superior in the latter segment.

While the corporate travel division backstops the business, it's the swings in the leisure division that have provided buying opportunities in the stock. In 2016 we upgraded because the leisure business was hit by various one-off and cyclical factors.

Six profit downgrades were the result. We were cognisant of the online threat to the Australian leisure business at the time but TTV was still growing nicely.

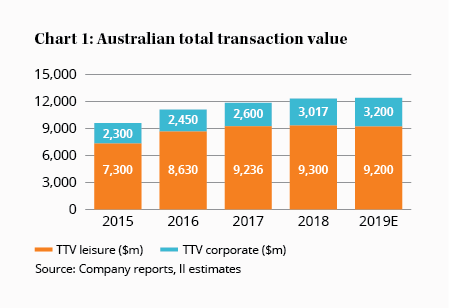

That's now changing. Internal restructuring and cyclical swings remain temporary issues, but Flight Centre's Australian retail stores are finally losing market share. Australian leisure TTV was flat in the first half and, with the online leisure operations growing fast, the implication is the stores are going backwards. You can see the early evidence that Australian leisure is beginning to struggle in Chart 1.

Operating leverage

Like all retailers, Flight Centre has a great deal of operating leverage. So, as revenue from leisure travel falls, the fixed nature of expenses like rent and staff causes profits to plummet. While the company doesn't reveal 'Australian leisure' earnings, we estimate they will fall by more than 40% in 2019. The company recently lowered its 2019 pre-tax profit guidance to $335m-360m, a 14% downgrade.

At the mid-point, that equates to earnings per share of $2.40. Flight Centre, then, is trading on a prospective 2019 price-earnings ratio (PER) of 17. But it's best to see this multiple as an aggregate number - the combination of a fast-growing corporate business and a weaker leisure business. Corporate deserves a high multiple and leisure a lower one.

So we need to split Flight Centre into its component parts, as we do for News Corporation. The company reports profitability by geography rather than business line but, with the titbits management does disclose (and a few assumptions), we can piece together the puzzle.

Management has stated that corporate operating earnings are about half the company's total; let's say about $170m. That represents an operating earnings to TTV margin of about 2% - similar to ASX-listed competitor Corporate Travel Management, as you'd expect.

Totting it up

Deducting tax and assuming a PER of 20 for Flight Centre's corporate business, we get a value of $2.4bn (for corporate alone). We think that's conservative given that Corporate Travel Management trades on a 2019 prospective PER of 26. Add Flight Centre's net cash and investments, and we get to $2.5bn, implying its global leisure businesses are worth $1.7bn (given the company's market capitalisation of $4.2bn).

| Value of leisure division at current share price | ||||

| Corporate | Leisure | Net cash | Market cap. | |

| After tax earnings ($m) | 120 | 120 | ||

| PER (x) | 20 | 14 | ||

| Implied value ($m) | 2,400 | 1,674 | 147 | 4,221 |

| Value of leisure division at $35 | ||||

| Corporate | Leisure | Net cash | Market cap. | |

| After tax earnings ($m) | 120 | 120 | ||

| PER (x) | 20 | 8 | ||

| Implied value ($m) | 2,400 | 992 | 147 | 3,539 |

But leisure earnings remain at risk, particularly in Australia. If the value we've attributed to the corporate business is correct - and it could be considerably higher - then the global leisure businesses are trading on a PER of 14.

That's probably somewhat high given the risks. There's a chance the leisure division needs major surgery, which would involve redundancies and store closures. It's not inconceivable that Flight Centre's leisure business could deteriorate sharply given the operating leverage, which would divert management time away from the promising corporate division.

While the corporate business provides a nice soft valuation cushion, we don't want to pay very much for the threadbare leisure division. Bear in mind we're valuing the two divisions individually, but they wouldn't be easy to separate in practice; Flight Centre's buying power means it can offer corporate customers better deals because of its leisure TTV.

At our existing $35 Buy price we'd probably be paying a PER of about 20 for the corporate business and 8 for the leisure business. Both figures are reasonable given their respective growth profiles. We're more comfortable at those multiples and therefore our Buy price is unchanged.

It's clear the winds of change are blowing harder for Flight Centre's leisure business. Thankfully the corporate travel division is at the company's back and we're sticking with HOLD.

Note: The Intelligent Investor Equity Growth and Equity Income funds own shares in Flight Centre.

Recommendation