Few weaknesses in Link

Recommendation

There's a whole bunch of things you need to do to run a business. And to provide the best deal for your customers, and to maintain your own margins, you need to do all of them well. You don't, however, need to do all of them yourself.

The better bet may be to focus on the areas that represent your competitive advantage and to outsource non-core tasks to a specialist. By doing the same administrative tasks for many customers, that specialist can develop its own economies of scale and reduce costs for everyone.

Key Points

-

Solid business model

-

LAS acquisition brings some risk

-

Initiative coverage with a Hold.

If it sounds dull, that's because it is, but where there's muck there's brass, so they say, and outsourced administrative services provide an attractive line of work for Link Administration Holdings.

Super business

The group's largest business is Fund Administration, which contributes around a third of revenue, providing a range of services to local superannuation funds.

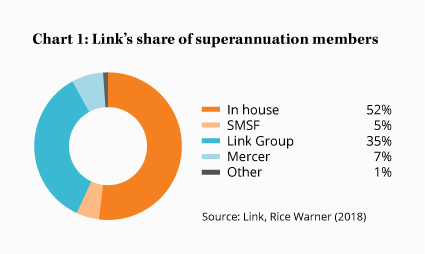

Link is the largest provider, with an estimated market share of around 35% of superannuation members, around five times that of second-placed Mercer. Administration is a scale business and the largest player is likely to be the most efficient, so it's little surprise that Link promotes itself as the industry's lowest-cost provider.

Customers tend to be very sticky. Shifting administration providers is a complex process and mistakes can be costly, so there needs to be a good reason to change providers. This is a good thing for Link's existing revenue base, but it may also explain why 52% of super funds still do their own administration (see chart 1).

Over time, we'd expect to see more of these funds outsourcing their administration due to increased complexity and customer expectations about service levels, as well as regulatory scrutiny on costs. It's likely, however, to be slow going.

The immediate future is also clouded by Government proposals to sweep inactive super accounts with balances below $6,000 over to the Australian Taxation Office. Link warned last month that these proposals could cut up to $55m (or about 5%) from its revenue, which is dependent on the number of accounts. Management expects the revenue impact to be mitigated by funds engaging with affected members and by volume protections in contracts, but the news still knocked about 15% off its share price.

Many markets

Link's other main local business is Corporate Markets, which includes the share registry business with which share investors will be familiar, as well as a range of other services such as employee share plans and shareholder analytics. It contributes about 13% of revenue.

In Australia and New Zealand, Link plays second fiddle to Computershare in share registries but is more dominant in other services. Link's market position is unlikely to change, but the third-largest player, Boardroom, has been competing aggressively.

Link's contracts with customers are somewhat different to Computershare's with a greater reliance on fees and less exposure to interest earned on client balances. This should make revenue less volatile, but it also means the company doesn't stand to benefit like Computershare from rising rates.

As a result, revenue growth from this business is likely to be slow. Increased corporate activity, such as takeovers and equity raisings, could provide a boost but it's hard to predict.

Off to Britain

Prospects are brighter for Link's newest division, Link Asset Services (LAS), which is almost as large as the Fund Administration business at around a third of revenue.

Acquired in November 2017, LAS takes Link to the UK and parts of Europe. That entails some risks, as does the fact that it was purchased from Capita PLC, a struggling British outsourcing group that may have underinvested in the business..png)

Those concerns aside, LAS's four subdivisions have some (familiar) attractive features: earnings predictability, scalability, good margins and sticky customers.

LAS's Fund Solutions business is among the largest administrators in the UK for fund managers. Revenue is dependent on funds under management, which probably provides better growth prospects than the member-based fee structure for the local Fund Administration business.

We're less enthused about the Banking and Debt Solutions, which administers mortgages (without taking on exposure to the loans themselves). Growth here is dependent on new business outpacing the run-down of the loan portfolio. That's no certainty, and there's plenty of competition such as from Computershare which is the largest player in the UK.

LAS's Corporate and Private Client businesses offer legal and financial administration to companies and high net worth individuals. It's a highly fragmented market and Link's share is quite small, although it might provide a platform to participate in any consolidation.

The final component of LAS is Market Services which includes share registry and associated services. There are opportunities to cross-sell to Link's customers and consolidate operations with the local Corporate Markets division, but otherwise growth is likely to be slow.

The remainder of Link's revenue comes from its Information, Digital and Data Services (IDDS) division, which acts as the company's IT department. IDDS develops and maintains the company's IT systems and software and also services external clients. Chart 2 shows the divsion's revenue, prior to eliminations in the consolidated accounts.

Noting risks

It may look boring, but Link is really a technology company and its competitive positioning depends on the quality of its software. It therefore needs to keep spending heavily in this area, and there are risks that it may invest in the wrong areas.

There's a risk too in the management of data, such as the transfer of new customers onto Link's systems. These can end up being costly, with long delays.

Link's acquisitive ambitions are a further risk. Some of Link's products are in fragmented markets, so acquisitions may be appropriate, but there is always the risk of overpaying and in integrating new businesses.

While LAS is within Link's business competencies, it paid a steep price at over 12 times earnings before interest, tax, depreciation and amortisation. It's too early to tell if it was worth it.

Management has been swift in raising capital following the purchase of LAS, reducing debt to around 1.6x expected EBITDA, which is easily manageable – and leaves the door open to further acquisitions.

It's therefore reassuring that management has plenty of skin in the game, with managing director John McMurtrie owning shares worth around $100m.

Getting reasonable

All up, Link is a high-quality business, and we'd be keen to buy it at the right price. That price is closer now than when the company listed, with a lower price-earnings multiple and better growth prospects.

The 2019 financial year will be the first with the full benefit of LAS and market expectations are for earnings per share of around $0.49, after adding back some amortisation related to prior acquisitions. We'd expect cash earnings to approximate that as well.

That puts Link on a forward price-earnings ratio of around 15. That already looks like reasonable value, although we'd want to see the price slightly lower before upgrading. We're initiating coverage with a HOLD.

Recommendation