Dreamtime for ARB

Recommendation

When we last reviewed ARB Corporation just over a year ago, we ‘dared to dream' that we might soon get an opportunity to buy it, but we opted to stick with Hold.

Pity. Since then, the stock has risen over 50%, leaving our Buy price for dust and recently charging past our Sell price. This week's operational update provides some insight as to why.

Australia's infatuation with SUVs and 4WDs (which get accessorised with ARB products more than any other brand) shows no signs of abating.

Key Points

-

4WD sales growing strongly

-

Big export opportunity

-

High-quality company; Hold

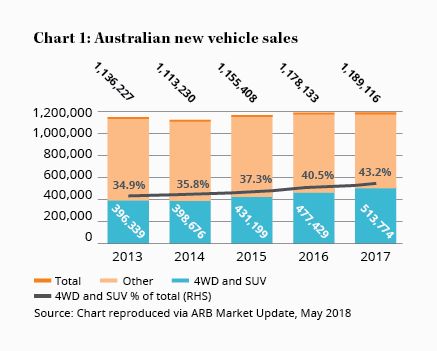

In calendar 2017, sales of SUVs and 4WDs (excluding ‘Compact SUVs', which typically aren't adorned with ARB products) rose 8%, compared to 1% for all new vehicles. Sales of 4WDs – which get by far the most ARB bling – have been even more stunning, with a 16% increase in the nine months to March 2018.

This continues a well-established trend. Since 2013, new vehicle sales have risen a grand total of 4%, while 4WD and SUV sales have jumped 30%, taking them from 35% of all vehicles sold to 43% (see chart).

Just Gotta Ask

ARB has ridden the wave, with Australian Aftermarket revenues rising 11% in the first nine months of the 2018 financial year. The segment generates 66% of group sales by selling into the local market through new vehicle dealers and fleet operators as well as 61 stores (31 independents and 25 owned by the company).

The ‘Just Gotta Ask' advertising campaign has apparently driven strong dealer sales, while a new format has helped in-store sales. Seven new stores are planned by the end of the 2019 financial year.

A further 6% of sales are to original equipment manufacturers (OEMs), who build the parts into their new vehicles. Sales in this segment rose 8% in the nine months to March, but that was a sharp turnabout from the 6% contraction in the same period a year ago (which was affected by OEM contract losses).

A further 6% of sales are to original equipment manufacturers (OEMs), who build the parts into their new vehicles. Sales in this segment rose 8% in the nine months to March, but that was a sharp turnabout from the 6% contraction in the same period a year ago (which was affected by OEM contract losses).

The big opportunity for ARB, though, is with exports. This segment comprises sales made through distributors around the world, via major hubs in the USA, the Czech Republic, Dubai and Thailand, with product sourced from factories in Australia and Thailand. Revenue for this segment increased 16% in the nine months to March and now counts for 28% of the total.

In its update, management highlighted that the '4WD market is growing in many parts of the world and represents strong growth potential for ARB' and that 'exports remain a key focus, attracting investment in both infrastructure and marketing'. For most companies you'd write that sort of thing off as hubris, but given ARB's track record of candid commentary the words actually mean something.

Flavour of the decade

All this begs a crucial question, though – why exactly are 4WDs the flavour of the decade, and is it just a fad? It's not as if we've only recently discovered a love for the great outdoors, or decided that we can only express ourselves through more macho vehicles.

More likely it's simply that technology is catching up with a latent demand. We didn't all decide only ten years ago that we really wanted smartphones; in fact we really wanted them all along, but it was only then that technology became able to deliver them. In the same way, 4WD enthusiasts always needed pneumatic selectable locking differentials, but it was only in the 1980s that ARB (and Tony Roberts from whom it bought the technology) made it possible for them to have them.

Since then, ARB has added a stack of innovations, including forged gears and two-piece assemblies. In the investment lexicon, locking differentials specifically and 4WD accessories more generally just ‘add more value' than they used to.

As a specialist provider, ARB is in a strong position to deliver the extra value, because it has a unique ability to understand the market's needs – as Gareth Brown noted in our original upgrade to Long Term Buy 14 years ago, this is a company built by enthusiasts.

Its independence from the vehicle manufacturers also means that any technological leaps can be applied across the entire market. And they keep coming, with this week's presentation highlighting, amongst other things, a digital driver interface and a new hydraulic jack. Imagine walking out the store without one of those and then getting stuck.

If we were betting folk – and we can in fact be persuaded (you know, on Melbourne Cup day) – we'd reckon that demand for 4WD accessories will keep growing quickly and that ARB will keep developing the products to meet it.

Little miracle

That brings us to the thorniest question of all, how much should we pay for this little miracle?

In the past we've dreamed of buying ARB again on a forward multiple of about 20, but it didn't quite get there and we don't want to miss out again. As my colleague James Greenhalgh frequently observes, good things happen to good companies and ARB is one of the best, so we're going to raise our Buy price to 24 times the 71 cents of earnings expected for the year to June 2018 – which amounts to $17.

We won't be holding our breath, but if there's a short-term setback or the market has a wobble, then we'll be ready to pounce.

By the same token, we'd recommend that ARB's fortunate existing shareholders (those who ignored my Sell recommendation back in 2013) hang on tight – at least up to about $25, which translates to a forward multiple of (I can hardly bring myself to say it) 35. HOLD.

Disclosure: The author is proud to say that ARB was the first ASX stock he bought – at $2.99 back in 2005 (on a P/E of 14). He's embarrassed to admit that he was shaken out of it by the GFC three years later at $3.83 (a P/E of 13). It's not the last time he's spoiled a great buy by selling too soon.

Intelligent Investor is loading up the van and going on tour in May, with events on the QLD mid-north coast and in Perth, Adelaide, Melbourne, Sydney and Canberra. If you'd like to hear us talk about building a portfolio to weather any storm, book your spot here.

Recommendation