Director's Cut: Valuations (Apr 2015)

'Over the long-term, disciplined, historically-informed, value-conscious analysis pays off. But over shorter horizons, I promise from personal experience that it will periodically be the bane of your existence'.

– John Hussman.

No one has felt the pain of the bull market more publically than value investor John Hussman. After posting 'impressive relative results during the 2008 crash by losing only 9% while the S&P 500 was down 37%', according to Ben Carlson 'it's been downhill ever since.'

Hedging his market exposure throughout the entire bull market recovery, Hussman's 10-year returns are -1.2% annually. Meanwhile, the S&P has delivered around 7.1% a year. 'That's over 105% in relative underperformance over 10 years,' says Carlson.

Painful as this is for clients and manager alike, Hussman is sticking to his guns. Current US stock valuations are amongst the highest ever and, unlike in 1999 when the dotcom bubble left high quality blue chips trading cheaply, this time there's nowhere to hide. Even junk bonds are yielding less than 6%.

Key Points

Valuations are high...

...and based on high profit margins

Think carefully about your exposures

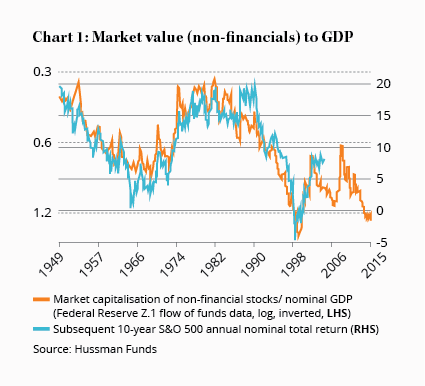

A year ago Hussman's research implied 10-year nominal total returns (capital gains plus dividends) of only 2.7% per year, compared to 10-14% in 2009. More recently, he published a version of one of Warren Buffett's favourite valuation tools, which essentially compares the market value of stocks with GDP (see Chart 1).

The model has a startling predictive power and suggests returns over the next decade will be… zero. Hussman's estimate is a meagre 1.6% a year. A few years ago we performed the same exercise for the Aussie market and reached much the same conclusion.

Profit margins

Okay, let's really get our geek on. Depending on which measure you use current valuations are around similar levels to the peak before the great depression, yet corporate profit margins are reportedly 40% higher due to job losses since the GFC, low interest rates and tepid business expansion.

These factors are temporary. As the US economy recovers we can expect higher business investment, higher interest rates and higher wage growth, which so far has been weak. As unemployment falls further wages will start to rise, just as multinational profitability will start to suffer from a strong US dollar.

High profit margins have become a fixture of the post-GFC world but Jeremy Grantham claims they're 'probably the most mean-reverting series in finance'. For high profit margins to become permanent, capitalism must fail in an elemental way. If history is any guide, it won't. Profit margins will fall, taking stock prices with them.

It would be easy to write Hussman off as a perma-bear, or worse, an academic. But Société Générale's charts are flashing red, too.

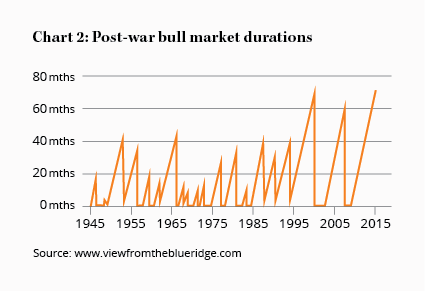

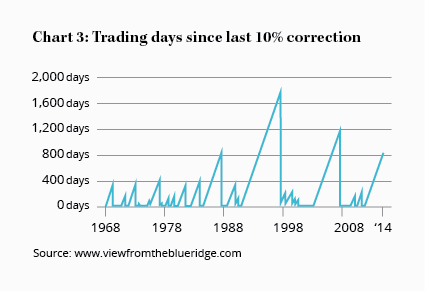

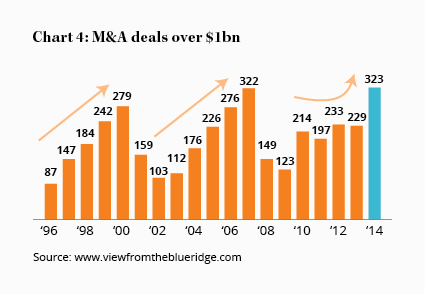

Chart 2 shows the current bull market is the longest in post-war US history. Chart 3 shows that the 800 days up until March since the last 10% correction sits only behind the periods ending in 1999 and 2007. Chart 4 also shows that merger and acquisition activity reached a cyclical high in 2014.

Framework

The key point is that stock valuations are high. Let's say that again: Right now, stocks are expensive. Here's how I'm approaching that fact, professionally and personally.

First, I accept that I have no ability to forecast large market movements. Just because the market appears fully valued doesn't mean it can't go higher or stay that way for years.

Stanley Druckenmiller famously bought in to the tech boom just hours before it imploded, losing US$3bn almost instantaneously. I do not intend to make that mistake. I will not dispense with my investing approach, which has served me well, and succumb to the fear of missing out.

Second, I will remain invested in stocks for the long term. Given enough time cash loses almost all its value but stocks return around 9% a year. That's a good hedge against inflation. The question is how long I'm prepared to wait to realise those returns.

For me, aged 39, I've hopefully got decades. Retirees aged 70 may not be prepared to wait 10 years and may rather hold cash until there's better value. Do not mistake this difference in approach for market timing, which is a fool's game.

Third, I know that good businesses tend to emerge from a downturn more strongly. Because I can handle temporary paper losses but not large permanent ones, I will remain focussed on high quality stocks, of which there are plenty on our Buy list. This is not the time to do a Druckenmiller and throw discipline out the window.

Lastly, you don't need the entire market to be on sale to do well. Even in a bull market plenty of stocks and industries are out of favour, giving you a chance to earn more than 9% per year.

What is out of favour?

- Resources stocks

- Mining services

- Some European stocks

- Some emerging markets

- China

- Complex stocks

- Low dividend paying stocks

What is in favour?

- Reliable and fast growers

- Companies with overseas exposure

- Interest rate sensitive stocks

- US stocks

- Small cap stocks

- Dividend stocks

- Businesses simplifying

You should also consider what 'well known facts' or sure things are priced into stocks that aren't as certain as many believe. If the market is wrong you can make huge returns.

Well-known facts

- Australian interest rates are going lower

- Aussie dollar will fall further

- Property prices only rise

- Low interest rates and foreign buyers will support property prices

- Economy will remain strong

- Valuations will be supported by low interest rates

- China will successfully switch from a fixed asset investment economy to a consumer-led economy

- Foreigners will fund our big banks

Model portfolios

There's quite a bit of cash in the model Growth Portfolio and a handy amount in the Income Portfolio. To minimise the impact of a downturn, perhaps the Income Portfolio should have more but we assume income investors need that income and simply can't afford to have too much in cash. Look out for an update soon.

There is minimal exposure to speculative stocks and our largest positions are reserved for reliable businesses that will continue to throw off cash and pay dividends under almost any circumstance.

We've also kept away from businesses that rely on a strong Aussie economy. As China's growth slows we expect the pain currently being felt in the mining and commodities sectors to spread, increasing unemployment and slowing borrowing and spending.

My personal portfolio follows the Jeremy Grantham approach of least regret. Whatever the future holds you'll be wrong, so don't get caught out betting on just one outcome.

About a quarter is invested in a US hedge fund that shall remain nameless. If markets keep going up it should perform okay, but its short book should help cushion the blow during a downturn. Betting against stocks is not something I'm prepared to do on my own.

Another quarter is in US dollars, and the rest is mostly invested in eight US or European-listed stocks. I'm only holding a small amount of Aussie dollars but my future savings will go straight into my (wife's) ING account as I've got enough invested abroad. Who knows, maybe I'll be able to afford a house one day. Anything's possible.

Peter Lynch said, 'Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.' No one can consistently predict the ebbs and flows of the market. Despite the current risks, perhaps the best thing you can do is nothing.