Deconstructing Brickworks

Recommendation

It might have one of the dullest names on the ASX, but Brickworks isn't quite as boring as it appears.

There are three parts to the business. A building products business makes and sells bricks, timber products and pre-cast cement; a property business develops land used at depleted quarries and spins them into a property trust to provide stable rental income and juicy revaluation profits. There is also a 42.7% stake in Soul Pattinson, a diversified conglomerate.

That web of activities increases complexity but enhances security by taming the famously cyclical construction cycle. Uniquely for a building materials business, this is no cyclical pig.

Key Points

-

Building boom has lifted returns

-

Don't capitalise peaky earnings

-

Complex structure

In fact, Brickworks holds one of the more illustrious records on the ASX: it is one of only eight companies that has not cut dividends for 15 years. This is no mere brick business.

Building profits

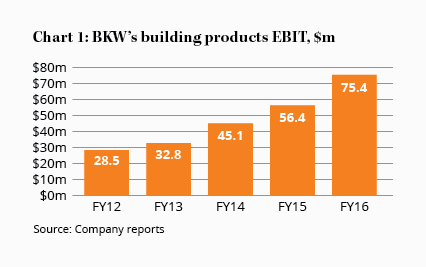

For most of recent history, the building products business has been the smallest part of Brickworks. That is no longer true (see Chart 1). A tremendous construction boom has transformed the profitability of the materials business and it is now the largest contributor to profits.

Three years ago the building products business generated EBIT of $32m; last year that had risen to $75m thanks to higher prices and higher volumes. It is now the single largest contributor to profit.

The building boom has helped but so has vanishing competition in the brick market where three competitors have become two. Brickworks has also changed strategy to sell higher margin bricks by treating them much as a retailer treats fashion: turning over inventory quickly and frequently releasing new designs.

This has made a mark on returns with a return on tangible assets over 12% – twice what it was a few years ago.

These are, of course, boom time earnings and we don't expect the boom to last forever. But it may be more enduring than many believe.

Construction activity is at record levels but a decade of housing undersupply, between 2003 and 2013, needs to be filled. The supply deficit was estimated to be 108,000 dwellings in 2013 and has now shrunk to 50,000. The boom is making inroads into demand but it could go on for some time yet.

This is not to suggest that investors should pay more for today's peaky earnings – we have not changed our valuation – but it is interesting that the market appears to be sceptical about the construction market. Brickworks is experiencing boom time conditions without a boom time price.

We estimate that the building products business is worth $200m–300m. For a business generating EBIT of $75m that is deliberately conservative. Capitalising cyclically high earnings is a mistake.

| Low ($m) |

High ($m) |

|

|---|---|---|

| Building products | 200 | 300 |

| Property trust | 312 | 320 |

| Operating property | 245 | 370 |

| Land bank | 70 | 230 |

| Sub-total | 827 | 1,220 |

| less debt | (263) | (263) |

| DTL | (214) | (214) |

| Total | 350 | 743 |

| Shares on issue (m) | 147 | 147 |

| Value per share excl. SOL ($) | 2.38 | 5.05 |

| SOL value | 2,685 | 3,929 |

| BKW equity value | 1,844 | 2,982 |

| Value per share ($) | 12.54 | 20.29 |

Property developments

The property trust, a joint venture with Goodman Group, is well managed and has a long pipeline of opportunities yet to be developed. We expect the $15m in rental income to grow steadily over time as new properties are added to the portfolio.

It should be noted that, of the $73m earned by the property business, over $40m came from revaluations and lower capitalisation rates. If the building boom is aiding the materials business, lower interest rates are doing the same for property.

Even excluding revaluations and redevelopment profits, Brickworks property trust earns a 7% yield on property, a decent sum. We assume book value for the property trust and apply a small discount to book in our low case. To that we add a little for land and development on the balance sheet. The details are shown in Table 1.

Brickworks' holding in Soul Patts is notionally worth around $1.6bn at current prices, by far the largest chunk of Brickworks' $2bn valuation. The calculation is complicated by the fact that Soul Patts itself owns a 44.1% stake in Brickworks. The cross-shareholding needs to be sorted out mathematically and we cannot simply take market prices or we would be valuing Brickworks partly using the market's valuation of Brickworks (confused? See The Great Unwinding where we set out the detail).

Sorting out the cross-ownership, we arrive at a valuation between $13 and $20 a share, shown in Table 1. The low side of that valuation assumes a 30% discount to Soul Patts' sizable market holdings and the high side marks them to market. A fair price is probably in between those two figures and, below $14 a share, Brickworks makes decent buying.

This isn't a business that will generate outrageous returns but it is stable, well managed and diversified. The balance sheet, with $270m in net debt and interest coverage of over 15 times, is strong. Brickworks is mildly underpriced and there is nothing dull about that. BUY.

Recommendation