CSL takes on China

Recommendation

First, do no harm. Doctors have taken this oath for 2000 years but, when it conflicts with financial greed, the results can be harrowing.

In the 1990s, the Chinese government wanted to develop a market for blood products to compete with foreign heavyweights like CSL. The public was encouraged to donate blood, with a few dollars paid in return. Poverty-stricken farmers lined up in droves and the ‘Plasma Economy' campaign was considered a huge success.

However, in an effort to cut costs, syringes, blood bags and other equipment were often reused without sterilisation. Blood wasn't screened for disease. Tragically, more than 1.2 million participants now have AIDS.

Key Points

-

Chinese supply/demand imbalance

-

New acquisition gives CSL access to full market

-

High growth rates expected, but high price

Understandably, the Chinese population is still afraid to give blood some 22 years after the program was ended. China has one of the lowest donation rates in the world. On a per capita basis, Australia has 15 times as many donors.

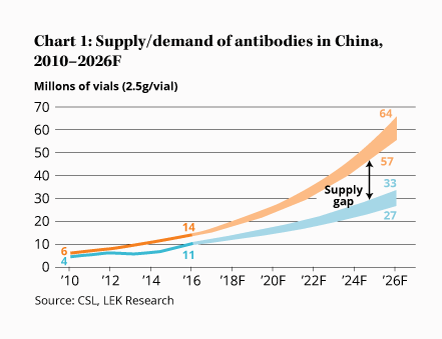

Shortages of plasma, antibodies and albumin are now common in Chinese hospitals, particularly those in rural areas. What's more, the gap between supply and demand for antibodies is expected to grow from 3 million vials in 2016 to 24 million vials by 2026 – even on the most optimistic forecasts (see Chart 1).

China is the second largest antibody market in the world and also the fastest growing. In 2016, plasma product sales topped US$3.3bn in the country, and that number is expected to reach US$4.9bn by 2020 for an 11% growth rate. ‘Improved physician awareness and recent changes to reimbursement coverage for plasma-derived products such as [antibodies] will continue to drive strong demand', said CSL's management.

Local presence

With this as a backdrop, CSL's push into the Chinese market makes perfect sense. The company has purchased an 80% stake in plasma therapy maker Wuhan Zhong Yuan Rui De Biological Products (thankfully also known as ‘Ruide') from Humanwell Healthcare. If that name rings a bell, Humanwell purchased Ansell's condom division in May.

The company should make a cosy fit for CSL and overlaps in many of its plasma-derived product categories, including injectable antibodies and coagulation proteins for the treatment of haemophilia. Ruide has a single manufacturing facility in Wuhan, Central China, and owns four plasma collection centres to complement the 140 already operated by CSL in Europe and the US.

There's plenty of room to grow. Relative to China, Factor VIII protein usage in the US is some 44 times greater; antibody usage is 14 times greater; and just 223 grams of albumin – plasma's main constituent – is used in China per 1000 people, compared to 548 grams in the US. These are expensive treatments, so it's unreasonable to assume that China will reach the US's level of usage any time soon. But as incomes rise, demand for these therapies will undoubtedly grow.

There's plenty of room to grow. Relative to China, Factor VIII protein usage in the US is some 44 times greater; antibody usage is 14 times greater; and just 223 grams of albumin – plasma's main constituent – is used in China per 1000 people, compared to 548 grams in the US. These are expensive treatments, so it's unreasonable to assume that China will reach the US's level of usage any time soon. But as incomes rise, demand for these therapies will undoubtedly grow.

The only thing that makes us hesitate about the acquisition is the price. Ruide's total revenues in 2016 only amounted to US$30m. Management expects sales to reach US$100m in the next five years and for Ruide to eventually achieve an EBIT margin comparable to CSL.

Even so, with a purchase price of US$352m for an 80% stake, we're talking about a price tag more than 16 times EBIT some five years out. Though Ruide's current profitability hasn't been disclosed, the price is almost surely more than 50 times EBIT. That long-term growth had better materialise.

Strategic value

However, beyond the current numbers, the acquisition has obvious strategic value. CSL is currently only able to sell albumin to China as the country restricts the sale and distribution of all other imported plasma therapies.

CSL needed to buy a local manufacturer and collection centre network to sell most of its product lineup. Management said its immediate priority is to increase volumes from the four Ruide plasma collection centres and to commercialise the company's product pipeline still waiting on approval.

The real honeypot, however, will be unlocked when CSL gets regulatory approval to start local manufacturing of its core products, such as Hizentra, which allows patients to use a portable pump to self-administer their antibody dose by injection under the skin, and Privigen, an intravenous treatment.

So far as we can tell, CSL is the first of the big three plasma companies – including Baxalta and Grifols – to now have Chinese operations. We expect its current 16% share of the Chinese market to increase significantly in coming years as it ramps up Ruide's collections and manufacturing.

The acquisition is expected to complete in the next six months or so, subject to regulatory approval. CSL also has the option to buy the remaining 20% of Ruide for between US$96m and US$142m based on performance milestones.

Though the purchase price looks high, we think the acquisition of Ruide was probably an opportunity too good to refuse. Local Chinese operations gives CSL a huge advantage over its main competitors in one of the largest and fastest growing markets in the world.

Management expects CSL's net profit to rise 18–20% in 2017, and earnings per share should grow slightly faster due to the company's ongoing share buy-back.

The stock has more than quadrupled in the six years since our initial Buy recommendation on 18 Mar 11 (Long Term Buy – $33.97). While a forward price-earnings ratio of around 33 is high for most stocks, CSL's quality, competitive advantages and growth prospects mean we continue to recommend you HOLD.

Recommendation