CSL: Australia's best resource stock-Part 2

Recommendation

Drugs, money, blood – even allegations of cartel-like behaviour: the plasma industry has all the ingredients of a crime thriller. In Part 1 we explained how CSL's large, reliable source of raw plasma and its status as the lowest-cost producer make it the industry's equivalent of Saudi Arabia. But the resemblance runs deeper.

Saudi Arabia leads OPEC, a cartel of petroleum exporting countries that coordinates the supply of crude oil to ensure 'a fair return on capital' for producers. To be sure, explicit price-fixing cartels are illegal in the corporate world; OPEC only gets away with it because it's a group of governments rather than companies.

In 2009, the prestigious Mayo Clinic and a group of 20 other US hospitals launched a class action lawsuit against CSL and its largest competitor, Baxter, for allegedly constricting the supply of blood products to drive up prices.

Key Points

Plasma industry is an oligopoly

Products can't be substituted

Little price competition, though capacity constraints easing

The case was settled outside of court, so we don't know how things washed up – except to say that CSL and Baxter weren't found guilty of any wrongdoing. But you don't have to operate a cartel to reap the economic benefits of a tightly supplied market: a dominant market share, barriers to entry, and discipline will do the job perfectly well.

Protected industry

The plasma industry is highly concentrated and there are significant barriers to entering the market. It would take decades of research and development spending to build an economic portfolio of patented medicines. Each step of the manufacturing process also requires substantial upfront costs, intellectual property relating to purification, as well as burdensome and lengthy regulatory approvals.

Furthermore, the plasma industry is largely protected in the United States. Only plasma collected in the US is FDA approved to make products sold domestically. Imports are banned. This regulatory quirk combined with the economies of scale of running a fractionation plant mean that while the US constitutes only 40% of plasma product demand, it accounts for some 70% of the world's production.

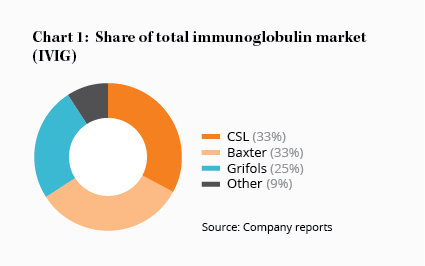

It would take years for a new competitor to build the network of collection centres needed to secure an adequate supply of US plasma. No new firm has entered the sector in 20 years. In fact, after several mergers, the number of plasma product companies has declined from 13 in 1990 to just 6 today — CSL, Baxter and Grifols, which together account for roughly 90% of the market, and three small European firms – Octapharma, Biotest and Kedrion – which share the rest (see Chart 1).

The industry 'operates as a tight oligopoly, with a high level of information sharing' according to statements made by the US Federal Trade Commission (FTC) during the Mayo lawsuit. The FTC even found that CSL and Baxter had 'explored means of punishing firms that dare[d] to “break ranks” and chase market share'.

The industry 'operates as a tight oligopoly, with a high level of information sharing' according to statements made by the US Federal Trade Commission (FTC) during the Mayo lawsuit. The FTC even found that CSL and Baxter had 'explored means of punishing firms that dare[d] to “break ranks” and chase market share'.

CSL and its peers no doubt do their utmost to avoid any wrongdoing, but the plasma industry has a low level of competitive rivalry nonetheless. Indeed, the way things stand, there's a clear disincentive from doing anything that might upset the status quo.

No substitute

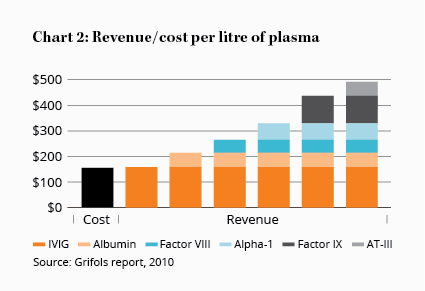

Only around 30g of saleable product is extracted from one litre of plasma. The most abundant product by weight is albumin, which is used to treat severe blood loss and burn victims – but it's also the most commoditised and least valuable product at only a few dollars a gram.

The real money spinners are the 3-4 grams per litre of infection-fighting antibodies, known as immunoglobulins, which sell for around $75 a gram, and the tiny quantities of blood clotting proteins to treat haemophilia, which can cost customers up to $350,000 a year.

Plasma therapies are medical necessities, and the hospitals and insurers buying them will pay very high prices if necessary. What's more, in many cases there are simply no viable substitutes for these products – at any price. As customers can't walk away, CSL has significant pricing power.

Rational pricing

As mentioned in Part 1, CSL's substantial economies of scale mean its total cost per litre of $100 is nearly a third less than the industry average. As the lowest-cost producer, it could theoretically offer the lowest-priced products, but it often stands to gain more by maintaining high prices and accepting a lesser market share.

The big producers don't compete on price and instead try to gain market share with proprietary protein modifications that mean they last longer in the blood or can be administered more conveniently.

CSL's management says it focuses on 'rational pricing' rather than market share. An example of this was seen recently at a Brazilian government tender for Factor VIII protein. When the reverse auction price fell below the standard price, CSL pulled out. Grifols won the auction, but lacked the capacity to produce enough product, so it supplemented its supply with a 'white label' version bought from CSL. The market price was kept high, and CSL still ended up with a share of the tender.

CSL's management says it focuses on 'rational pricing' rather than market share. An example of this was seen recently at a Brazilian government tender for Factor VIII protein. When the reverse auction price fell below the standard price, CSL pulled out. Grifols won the auction, but lacked the capacity to produce enough product, so it supplemented its supply with a 'white label' version bought from CSL. The market price was kept high, and CSL still ended up with a share of the tender.

Cartel or not, the industry's disciplined approach to pricing has worked. The average sale price for a gram of immunoglobulin has increased from about $48 in 2005 to $75 today, while CSL's price for a gram of albumin has nearly tripled over the past 10 years. CSL's gross profit margin has increased from 38% in 2005 to 51% today.

The OPEC curse

With rational pricing and economies of scale, it's no surprise the big three plasma producers are highly profitable – CSL, being the lowest-cost producer, has an operating profit margin of 31%, compared to Grifols' 26% and Baxter's 20%.

But, as fellow analyst Gaurav Sohdi explained in Does OPEC matter?, when information sharing is imperfect, there's a strong incentive to break ranks and chase market share.

CSL has benefited from its competitors' recent capacity constraints, with the company's sales of immunoglobulin growing 22% over the past two years, compared to 14% for the industry as a whole.

Baxter experienced supply constraints in 2013/14 due to the temporary closure of its Los Angeles fractionating facility while it was being upgraded. The facility is now back online and supply is returning to normal. Grifols, too, is building a new fractionating plant in California, which is expected to be up and running later this year.

As capacity increases at Baxter and Grifols, we expect CSL's above average growth rate of recent years will be hard to sustain and should return to the industry average of 5-8% a year.

More worrying, there may be signs that price competition is on the rise. If capacity gets ahead of demand, we could see a return to the days of supply gluts and volatile pricing prior to the last decade's round of mergers.

CSL's latest interim result showed immunoglobulin revenue increased 5% in the six months to December, but required an 11% increase in volume – which implies a 5% fall in the average selling price.

Collectively, CSL, Baxter and Grifols are all better off sticking to the status quo, so we expect this to be a short-term phenomenon as the latter try to regain lost market share. In any case, CSL's industry-leading margins mean it's well placed to weather price competition, so we're not too worried.

CSL isn't your average low-cost producer. With patents and rational pricing, significant economies of scale, steady growth and a clean balance sheet, CSL may well be Australia's best resource stock.

The share price has barely changed since CSL: Australia's best resource stock from 23 Mar 15 (Hold – $94.49) and we continue to recommend you HOLD.

Disclosure: Staff own shares in CSL but they do not include the author, Graham Witcomb.