Conservative investors: Two case studies

We analysed the risk maps and possible retirement outcomes for Luka and Angela in Aggressive investors: Two case studies. This time we’re at the other end of the scale, examining conservative investors.

Feisty Phyllis

Phyllis is a feisty 87 year old widow. Her husband, Frank, passed away four years ago and had always handled their money. Phyllis is terrified of making investment mistakes and seeing her $190,000 nest egg (not in a super fund) reduce more quickly than is absolutely necessary – but nor would she trust an advisor to make decisions on her behalf.

She owns her own home and has a 68-year-old married daughter, Shirley (whom we’ll meet shortly). Phyllis has invested in a mixture of cash and term deposits of various lengths for many years. She plans to maintain that stance.

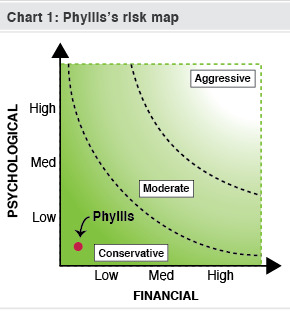

Chart 1 illustrates Phyllis’s position on the risk map we introduced in A dance through the financial aspects of risk. You can see that she’s as conservative as possible from both a psychological and financial perspective.

Phyllis lives on a full age pension (around $20,000 per year) plus interest on her investments (about $10,000). Soaring electricity bills have put some strain on her purse but she’s been able to cut her cloth and match her budget to her means, only dipping in to her capital for unexpected large expenses, such as major house repairs or replacing whitegoods.

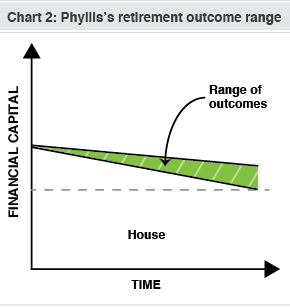

Chart 2 shows the range of outcomes for her financial capital over time. In short, there’s no chance of it growing and the possibility of it shrinking if Phyllis incurs major unplanned expenses.

Clearly, Phyllis is an ultra-conservative investor. She’s aiming to maintain a dignified lifestyle through a combination of her pension, earnings on her investments and modest withdrawals from her capital. Aggressive investments of any kind are inappropriate for her.

The next generation

Phyllis’s daughter Shirley is married to Jack. They’re both 68, retired and in good health (Phyllis claims full credit for Shirley’s robust genes). Five years ago they downsized from their large family home, which freed up some capital and enabled them to top up their self-managed super fund (SMSF). Today, their SMSF is in pension mode (and therefore tax free).

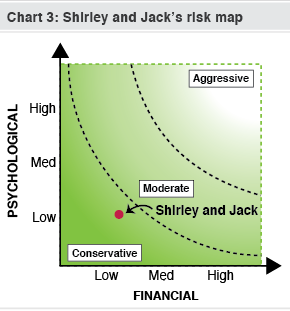

Psychologically, they’re prepared to accept some variability in their investment returns but have no tolerance for negative overall returns from their SMSF portfolio. They realise that this means they must also forego the possibility of large positive returns.

Their SMSF balance is $900,000 and their annual budget plans for $40,000 in expenditure, including a $4,000 ‘margin of safety’ for unexpected expenses. They received several hundred thousand dollars from the estate of Jack’s parents 15 years ago, which enabled them to pay off their mortgage. They were grateful for that and aim to pass on as much as they comfortably can to their own two children. Shirley and Jack don’t intend to SKI (Spend the Kids’ Inheritance).

They’re also hopeful that many years lie ahead of them and so are concerned about the impact of inflation on their capital over the long haul. So they’re prepared to have a modest allocation to more volatile assets but never so much that they risk negative returns from their whole portfolio. Chart 3 plots their position on the risk map.

Balancing these issues, their strategy is to draw the minimum amount annually from their fund (5% in the 2014 financial year for people their age) and target an investment return slightly higher than that rate in order to grow their balance a little and protect against future inflation as much as possible.

The 5% annual minimum will see Shirley and Jack draw $45,000 in the 2014 financial year, which is $5,000 more than their budgeted expenditure. They’ll keep this excess in a ‘rainy day’ fund outside of super, in a term deposit.

They should be able to increase their SMSF balance, despite the drawings, without taking on a lot of risk. The minimum annual return they’re prepared to accept is 2% (which would see their fund shrink by 3% a year after their 5% drawings).

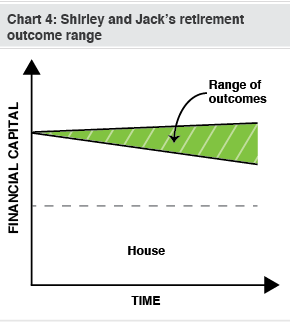

Shirley and Jack realise this means their SMSF must remain heavily skewed towards conservative investments, with a relatively small amount in more volatile assets. They know this will limit their potential upside. You can see this graphically in Chart 4, which shows the range of outcomes for their financial capital over the coming decades.

Shirley and Jack are a conservative couple, with their means and desires quite closely matched. Their main fear is inflation eating away at their spending power over time and leaving them significantly worse off. This introduces the need for some allocation to more volatile investments but only in an amount that they’ll be comfortable with both psychologically and financially.

An unusual conservative investor

While the two conservative examples above are retirees, it’s possible that a handful of younger people would also fit into this category. Imagine a musician like Gotye, who’s become an international sensation over the past few years.

It’s unclear whether Gotye is in for a sustained career like Bruce Springsteen or Madonna, or whether his star will fade rapidly. In other words, his human capital is highly variable and unpredictable. We assume he’s made enough that he has no need for his returns to shoot the lights out. So, financially, the smart move would be for him to ‘lock away’ a large portion of the financial capital he’s accumulated in recent years by investing it conservatively.

Summary

As we found in our case studies of aggressive investors, aside from illustrating the interaction between psychology, human and financial capital, these discussions open the door to the crucial topic of asset allocation. That is, how we all apportion our portfolios into the various asset classes available to us.

We’ll be diving into that crucial topic next week after examining our final pair of case studies later this week. These will focus on two investors who fall into the ‘moderate’ category for quite different reasons.