Cochlear: the hearing industry heavyweight

Recommendation

Ask any Cochlear executive what the main pillars of the company's strategy are and they'll probably say four things – innovation, manufacturing, marketing and price. The company's task is to do such a great job on the first three that customers forget about the fourth.

A cochlear implant is a medical device that's surgically implanted into your head and then stays there for up to 70 years. For children, it can be the difference between developing language and a lifetime of silence. If your children needed this device, are you going to shop around for something cheap and on sale? No, probably not. Cochlear's customers just want the best quality.

This has a few benefits. The first is pricing power – management doesn't need to hold a prayer session every time it wants to raise prices because it knows that price usually isn't a deciding factor for customers. A cochlear implant sells for more than three times what it costs to make, giving Cochlear an impressive gross margin of 71%, and – with few capital expenditure requirements – a return on equity of 47%.

Key Points

-

Price increases may be harder to achieve

-

Dominant position; gaining market share

-

Premium price, but deservedly

Unfortunately, having customers that don't care about price is also attracting the wrong kind of attention. Including the surgery itself, a cochlear implant can cost upwards of US$50,000, though most of that is covered by insurance and government rebates.

In the USA – Cochlear's largest market, accounting for around 40% of sales – the Centre for Medicare and Medicaid Services (CMS) funds a fixed amount for the device and surgery. Because the cost of the cochlear device is more than 80% of the total cost of the procedure, cochlear implants are classified as ‘device-intensive' procedures. However, in 2015, something changed.

The CMS reclassified reimbursement for a cochlear implant under a new ‘comprehensive ambulatory payment classification' (try saying that three times under anaesthetic). The change combined separate reimbursement codes for individual features of the surgery – including the device – under one all-inclusive payment.

Anchored pricing

The switch to an all-inclusive payment may not seem like a big deal but it could have long-term implications on the prices Cochlear can charge. By combining the device and surgery's reimbursement under one payment, it incentivises hospital's to push for better pricing of the device so the hospital can get a larger cut of the rebate.

The clinical team is the ultimate decision maker when it comes to purchase decisions so quality is still going to be the deciding factor – but the change brings a new financial incentive into the equation, and if we know anything about human behaviour it's that financial incentives can work in subtle ways.

Indeed, in August, CMS reimbursement for a cochlear implant procedure was increased 2.4% to US$30,428, while reimbursement for bone-conducting hearing implants (ie Cochlear's BAHA range) rose 3.1% to US$10,538. That isn't much of an increase in funding, which means Cochlear will have a harder time increasing prices – especially if the hospitals push for a larger slice of the pie. We suspect the change will put some downward pressure on Cochlear's revenue growth.

Gaining market share

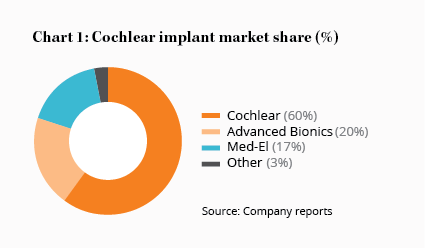

Just three companies dominate the industry. Cochlear has roughly a 60% market share, with the rest split between Advanced Bionics (owned by Swiss-based Sonova), Austrian-based Med-El and a couple of tiddlers (see Chart 1).

All three companies know that customer relationships in this industry last for decades. Every time a patient wants to upgrade or replace their external processor, they're locked into buying from the same company (see Cochlear: The perfect razor and blade).

All three companies know that customer relationships in this industry last for decades. Every time a patient wants to upgrade or replace their external processor, they're locked into buying from the same company (see Cochlear: The perfect razor and blade).

Given the strong customer captivity and recurring revenues, the initial sale is paramount. It's vital that the doctors prefer Cochlear devices over the competition, so the company tries to differentiate itself in terms of implant size, processor features and other services, such as repairs or help in navigating the insurance scene.

Cochlear's strategy seems to be working. In the year to June, the company achieved strong growth in all its markets – particularly in the USA, UK and Australia – with unit sales and revenue both up 12% after removing the effect of currency fluctuations.

More importantly, perhaps, is that the industry's second-largest player posted a lousy result. In constant currency terms, Advanced Bionics saw revenue from implant sales fall 2% in the year to March. Advanced Bionics' management says the overall implant market is growing in the ‘mid-single digits', implying Cochlear is increasing its market share from an already dominant position.

Premium price

Congenital hearing loss affects around 1–2 children per 1,000 births and the total number of patients requiring cochlear implants is growing steadily at around 2–3% a year.

Cochlear's revenue growth, however, will probably exceed this once you factor in rising prices, which we assume should at least be able to keep up with inflation of 2–3%. So, as a base case, we would expect earnings growth in the mid-single digits – given stable margins – though there's plenty of room to exceed this hurdle if Cochlear continues to increase its market share.

Depending on how the reimbursement changes mentioned above affect pricing, growth may slow; however, we still expect the market to be materially bigger 10 years from now and for Cochlear to command a large share of it.

At current exchange rates, management expects net profit of $210–225m in 2017, a 10–20% increase, and is targeting a dividend payout ratio of 70% of net profit. That puts the stock on a forward price-earnings ratio of 33 and a dividend yield of around 2%, using the midpoint of that range.

Even for a high-quality company, that's a steep price – and especially so relative to Sonova, which has a forward price-earnings ratio of 24.

However, with long-term customers, mouth-watering margins and returns on equity, a dominant, improving industry position, and a clean balance sheet, we think Cochlear deserves a premium. HOLD

Recommendation