China woes: It's better than you think

This was meant to be a deep dive into the diversity-challenged local sharemarket and how it forces people to pick stocks even when they don't want to. But headlines like 'Sell everything': Bank warns clients to brace for cataclysmic year and Dow has worst four-day start to year on record warrant a change of tack.

Resource stock share prices have continued to slump. BHP, for example, is down 47% since first upgrading it on 27 Jan 15 (see Biting into BHP Billiton Pt 1 (Buy - $27.88). Coal companies are entering administration and the ASX 200 is down 7.3% since the start of the year. The panic is palpable, and to be welcomed, as recent upgrades to IOOF and Perpetual indicate.

For journalists, these are salad days. Faced with the choice of measured reporting and a clickbait headline like that from the likes of RBS, emotion wins out. Complexity is vanquished, facts are cherry picked and the reliability of conclusions are usually inversely proportional to the vehemence with which the argument is made.

Key Points

Lower growth is a good thing

China is transitioning to consumer-led growth

Long term benefits to Australian investors

Forming an appropriate response to volatility in this environment is difficult. M'colleague James Greenhalgh neatly refuted the notion of selling everything right now but views on what happens next in China are deeply divided. The buffet of opinion has every imaginable option from Martin Wolf, who believes investors are right to worry about China, to Anatole Kaltesky, who thinks China is not collapsing.

Written over four years ago at a time when many investors were as optimistic about China as they are pessimistic now, The coming China crash detailed our concerns, including the nature of the country's industrialisation, its need to switch from investment to consumption-led growth and the stocks most likely to be impacted by a crisis.

As the author of that report I now find myself in an odd position. At a time when everyone is terrified of the local consequences of a China slowdown, I'm less concerned now than I was a few years ago. The risks of a Chinese financial crisis and political upheaval cannot be discounted but right now investors are neglecting the many positive aspects of China's continued development and its burgeoning middle class. Let's go through the looking glass and see what they are:

1. Lower Chinese growth is a good thing

For almost three decades, China has been the world's fastest growing economy. That growth is now slowing. According to the IMF, China's growth rate has fallen from 10.6% in 2010 to a projected rate of 6.3% in 2016, a source of much anguish.

This slowdown should be welcomed. Mathematically, no country can grow at 10% a year forever. It is a measure of how backward China was that it has grown so quickly for so long. The moderation is a measure of its development, not its imminent collapse. Where once a vast supply of cheap labour fuelled export-led growth, Chinese leaders are now working towards higher incomes driving domestic growth.

Consumption accounts for about a third of Chinese GDP. In developed economies the figure is twice that. The country's latest five year plan aims to increase urban household disposable income from $11,000 to $46,000 by 2030 (rural incomes are far lower, which is why policy actively encourages more people to move to urban areas). That sounds like a goal out of reach, until one considers that between 1995 and 2013 urban household income increased seven-fold. And if a five-year plan sounds even more crazy, remember that this is how China has grown so successfully so far.

What will be the impact of this policy? Sleeping Giant: China's Consumer by ANZ Research believes it will create a further 300 million new middle class consumers by 2030, lifting consumption as a portion of GDP to nearly half and increasing Australia's total exports to China from $130bn in 2014 to around $250bn in 15 years' time. If you think our airports and universities are already packed with Chinese travellers and students, you ain't seen nothing yet.

This offers Australia a once-in-a-lifetime chance to shift our economy from a dig-it-up-and-flog-it base to something more sophisticated, more employment-intensive and more profitable. It will bring lots of investment opportunities with it.

2. Analysts are worrying about the wrong stuff

In 2005 China's GDP was US$2.3tn. In 2014 it was $10.3tn. As an investor what would you prefer, a 10% rate of growth on the first figure or 6% on the second? China is growing more slowly now but its economy is far larger than it was. It is contributing more to the global economy than ever before, a fact forgotten amid the panic.

The so-called base effect is good news for our export-led services sector and means even resources should be fine, eventually. To focus on the rate of slowdown in growth is like looking at your toe nail whilst your nose bleeds.

Here's another bone to pick with the professionals: once convinced of a point of view they cherry-pick data to support it. How else can one explain their eagerness to cite woeful government stats showing huge falls in activity in construction and steel output whilst claiming that positive state data showing increases in retail sales are unreliable? Commentators on China can have it both ways, revealing the superficiality of their analysis.

3. The shift is already on

It's already a myth that China is an economy propped up by low wage workers looking for a suicide option. China is already shifting to a consumption-led economy. The country now contributes about 13.3% of Apple's total third-quarter revenue, compared to less than 4% in the year ago quarter, with CEO Tim Cook claiming that 'we are just scratching the surface.'

CapitaMalls recently reported a 100% increase in quarterly profits from rising traffic and sales at its shopping malls in China while Burberry opened 50 new China stores last year. In December, Chinese auto sales rose 18% compared with the prior period and in 2013 the GDP share of services was higher than manufacturing for the first time.

As senior analyst Gaurav Sodhi put it in a blog post last September, 'Everyone agrees that China needs to make the transition from a growth model led by fixed asset investment to one led by consumption. That is exactly what is happening.'

4. The shift is occurring in industry, too

It isn't just the consumer sector that's undergoing a radical shift. In order to sustain higher wages, China must move up the value chain. That means a better educated workforce and higher quality products. Evidence of this shift is plentiful.

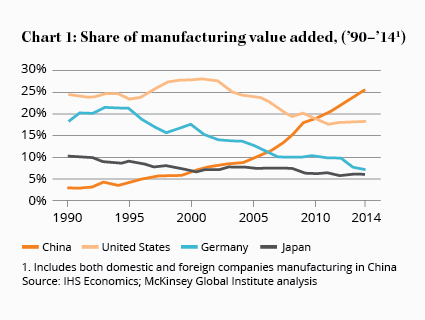

This year China's universities will produce 7.5m graduates. A decade ago it was less than half that. Apple manufacturers its products in China because its suppliers can recruit 9,000 engineers in a few weeks to run a new factory employing 250,000 people, as this HBR article explains. Cheap labour has nothing to do with it. Countries that want that are moving out of China and into places like Vietnam. With a fledgling aircraft manufacturing industry, high speed rail technology and a burgeoning electronics sector China is moving up the value chain fast, as Chart 1 shows.

At the recent Consumer Electronics Show in Las Vegas Chinese companies dominated, and not just with knock-off products and components. The country is producing innovative, high quality electronics that are giving the Japanese, Americans and Koreans a run for their money. Chinese brands like Huawei, ZTE and TCL may soon be as familiar as Sony, Toshiba and Panasonic. Meanwhile, former Vice Premier of China H.E. Zeng Peiyan claims that the country's expenditure on R&D has increased to 2.1% of GDP (in 2013 Australia's figure was 0.44%) and that the country is registering 10,000 new businesses per day.

None of this should come as a surprise. China invented the abacus, the clock and compass, gunpowder, iron and bronze, paper money and many other things we value in the west. China is home to an entrepreneurial people with deep roots in trading and business. After decades of stagnation since Mao and a taste of the fruits of economic development, it wants more. The political compact between ordinary Chinese and their leaders is predicated on those leaders delivering it. That is good for China and the rest of the world.

5. The Chinese sharemarket means nothing

As Martin Wolf saliently puts it, 'One must distinguish between what is worth worrying about and what is not. The decline of the Chinese stock market is in the second category.' Although his comments relate to the last time Chinese markets tumbled (in July 2015), he's still right.

The Chinese stockmarket is a place where the greater fool theory dominates like no other. It is almost entirely disengaged from the real economy. In China, aggregate market capitalisation equates to about a third of GDP. In most other markets it's at least 100% of GDP. Only about 1-in-30 Chinese invest directly in shares compared to 1-in-7 in the US and 1-in-3 in Australia.

Whilst inept government action to stem market losses is a concern, much of the current panic centres around rapid falls in share prices. Pay no attention to them. The market is a casino that does not reflect what's going on in the real world, where things aren't as bad as they seem.

6. Much of the damage of a China slowdown is already priced in

With the local market back where it was in mid-2013, largely driven by falls in the resources sector, much of the potential damage of a Chinese slowdown is already priced in. That doesn't mean that resource stocks can't fall further from here but we're probably a lot closer to the bottom now than the top, hence our recent upgrades of South32 and BHP Billiton.

The situation in China and its implications for local investors aren't as bad as is being made out. But even if we assume the worst and that China enters a deep, prolonged recession bought on by a financial crisis, the US experience shows that this is survivable. The counter-argument, that the US is democratic and responsive whilst China is totalitarian and out-of-touch, is also not as strong as it appears.

None of this is to suggest that China's transition is guaranteed. The country has to carefully move to a more market-based economy and is actively working on reducing the size and increasing the profitability of its state-owned enterprises. Deflating the bubble in the financial sector and reforming how it functions will be especially tricky, with Russia a vivid example of how badly so-called liberalisation can go. But China's achievements thus far have been impressive and we should not underestimate the leadership's desire and capacity to meet the challenge.

Right now, investors and market commentators are underestimating that capacity. For value investors like us, there is more than a whiff of opportunity in the air. In preparation, I suggest you re-read How to handle share price falls and check your cash position. If this continues, we'll get some great opportunities to put some of it to work. Bring it on.