CBA: Interim result 2015

Recommendation

Commonwealth Bank has again shown why it's our favourite bank. While ANZ is busy expanding in riskier Asian markets and National Australia Bank grapples with the remnants of its misguided UK expansion, Commonwealth Bank continues to churn out cash with an industry leading 18.6% return on equity from investing in technology, cutting costs and selling more products to its army of customers.

We could explain the latest result in more detail, but you can see the numbers in the tables. Unlike those of its rivals, Commonwealth Bank's results are usually clean and this result was no exception. There's no need to dig through a mountain of significant items to get at the underlying result.

Instead, let's focus on the only question that matters right now: is the incredible ride for bank shareholders over or are low interest rates going to send Commonwealth's share price to a level that's so often unachievable for Australian batsman Shane Watson, triple figures?

Key Points

Good result but growth slowing

Valuation nearing historic highs

Watch your portfolio limit

For several years we've been warning that slower economic growth in China, and by extension Australia, would lead to a lower Aussie dollar and lower interest rates. That call's been right on the money, but we would have expected the financial pain to be more widespread before we got a record low interest rate of 2.25%.

Out of ammo

The RBA has painted itself into a corner, as there's little ammunition left to fight the bigger fight should the property market or China's economy crack. It seems inconceivable that the RBA could hike rates any time soon, risking a collapse in house prices while the economy is slowing.

| Half-Year to 31 Dec | 2015 | 2014 | /(–) (%) |

|---|---|---|---|

| Revenue ($bn) | 11.6 | 11.1 | 5 |

| Cash net profit ($bn) | 4.6 | 4.3 | 8 |

| Cash EPS ($) | 2.84 | 2.64 | 8 |

| Dividend ($) - 17 Feb ex date | 1.98 | 1.83 | 8 |

| Franking (%) | 100 | 100 |

Low interest rates are likely here to stay for a while, and there's no reason we won't end up with zero interest rates like the US, Europe and Japan if the resources boom turns to bust like every other resources boom that preceded it.

That means investors could continue to bid up the prices of bank stocks, along with any other high dividend paying stocks. Who's to say that while Mr Market is satisfied with a 4.3% fully franked dividend yield today, he won't be delighted with a 3% yield in a year's time if term deposit rates fall below 2%. Keep in mind that stockmarkets regularly take good ideas to extremes before combusting. How close we are will only be known in hindsight.

If we submit to the idea that interest rates are heading lower, comfortable in the knowledge that if they were heading significantly higher it's highly unlikely you'd want to own any bank shares at current valuations, how should you proceed.

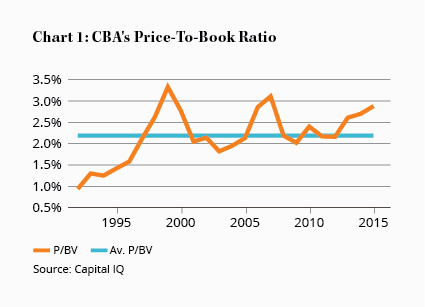

Let's first shine the light on Commonwealth Bank's valuation, which is indicative of the banking sector in general. The bank's price-to-book value is currently 2.9, and the only periods that have exceeded this level are 1999 and 2007.

Boom to bust

Like Y2K there was nothing to be alarmed about in 2000, as the share price continued its relentless rise until 2007 when it peaked at roughly $60 per share before dropping nearly 60%. That's usually the way it goes with banks, long periods of stability and growing profits breed the conditions for instability and steep share price falls.

Australia's consumer debt levels remain at record levels, and surely just about anyone who can afford a loan has already got one. What's holding it all together is low interest rates, so as long as the economy keeps ticking along, albeit at a slower pace, Commonwealth Bank may at least hold its value. That's hardly a green light for buyers, but it may stop you from selling out completely just yet. Indeed, we have a petite holding in our model Income Portfolio, which is likely to be a permanent holding until we find more attractive and safer opportunities. Think of it more as a hedge against us being wrong.

But the risks are clear to anyone that cares to look. Commonwealth is trading near a record high valuation based on its price-to-book value, which is a more useful barometer for banks over long periods than earnings multiples due to the regularity of significant items and fluctuations in bad debts.

| Half-Year to 31 Dec | 2015 | 2014 | /(–) (%) |

|---|---|---|---|

| Retail Banking ($m) | 1,992 | 1,784 | 12 |

| Business & Private Banking ($m) | 743 | 686 | 8 |

| Institutional Banking ($m) | 653 | 670 | (3) |

| Wealth Management ($m) | 347 | 393 | (12) |

| New Zealand ($m) | 435 | 355 | 23 |

| Bankwest ($m) | 378 | 350 | 8 |

| Other ($m) | 75 | 30 | 150 |

Australia's economy is slowing, property prices are increasing, as is the amount of debt needed to buy a home, and lower interest rates are an increasingly impotent method of growing the economy. The proportion of mortgages getting doled out to investors has also increased rapidly, a clear sign of increasing property speculation. Commonwealth's provisions for bad debts have also dropped to a minuscule 0.14% of assets, meaning there's no stuffing in the cushion to protect against an economic downturn.

The longer this trend continues the more coiled the spring becomes before it explodes in the opposite direction, but who knows how long it will be before the trend changes.

Keep it simple

The key is to make sure you know what type of investor you are. If you're going to own the banks come what may, sit back, relax and enjoy the dividends.

If you're a conservative investor that demands a margin of safety in everything you own, then your portfolio limit should be below, say, 5% for Commonwealth Bank, and 10% for the banking sector as a whole. Like our model Growth Portfolio, maybe you won't take the risk of owning any bank shares at all.

For all the banking sector's complexity, the point is to keep things simple and make sure you don't put yourself in a situation where a major downturn would blow a permanent hole in your portfolio.

We've increased the prices in our recommendation guide slightly, chiefly due to the passage of time, but because of the stock's wonderful performance since we recommended it way back in 2011 we're a long way from adding it to our Buy list. HOLD.

Note 1: Our model Income Portfolio owns shares in Commonwealth Bank.

Note 2: Our maximum recommended portfolio weighting for the banking sector as a whole is 20%, though conservative investors might consider a limit of 10% at current valuations, particularly if you have other large exposures to residential property.

Recommendation