Carsales: the canary in the car yard?

Recommendation

Carsales.com recently announced that profit growth this year would be 'moderate'. Popping that into our management-speak translator, it means net profit for the online car classifieds company will grow by perhaps 4-5% in 2019. Management also said growth would be 'weighted towards the second half', so don't expect much in the current half.

As the market had become used to management predictions of 'solid' growth - more like 8-10% - the announcement was perceived as disappointing. The news has contributed to the stock falling from more than $16.00 in August to less than $12.00 now.

Management said there were two main reasons for the slower than expected growth: display advertising 'has experienced disappointing trading', while its Stratton finance business has been 'impacted by credit tightening'. So let's have a gander at what's going on in the real world to put the announcement into context.

Key Points

-

Downgrade to 2019 expectations

-

Some cyclical risk emerging

-

Stock reasonable value again

First up, the new vehicle market is currently contracting. Australian new vehicle sales fell for the seventh consecutive month in October, dropping 5.3%. The decline seems to be getting worse too, particularly in states where house prices are falling. October new car sales fell 9.2% and 4.2%, respectively, in New South Wales and Victoria. The 2018 calendar year is shaping up as the first decline in the new vehicle market since 2014.

So how do new vehicle sales affect Carsales, which operates a website that mainly advertises used cars?

Pay and display

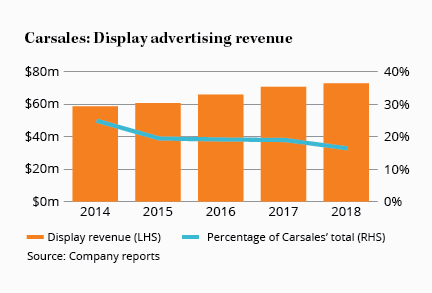

Well, while the percentage has been declining, 16% of Carsales' revenue still comes from display advertising on its collection of websites. The company has the highest proportion of display advertising revenue of any of the online classified companies we cover. New car manufacturers, insurers and finance providers, for example, all pay to advertise on Carsales' sites.

But display advertising - such as banners on websites - is a little old-fashioned. It's used by advertisers to promote their brands or highlight offers, but it's not well-targeted or suited to mobile devices. It's also the first type of marketing that gets cut if advertisers start feeling the pinch. So that's probably what's happening here - new car manufacturers are curtailing ad spend as vehicle sales weaken.

The second issue highlighted by Carsales was credit tightening. Following the Royal Commission into the financial services sector, credit has become harder to obtain. As around 90% of car buyers use some type of finance (don't they read Graham Witcomb's advice?), difficulty in obtaining loans appears to be affecting both new and used car sales.

It's worth noting the connections between all these markets - and how they might affect Carsales. Weak housing markets and difficulty in obtaining credit make people less likely to buy a new or used car. Fewer people buying new cars also implies that fewer used cars will be traded in.

Follow the leads

What we haven't yet seen - but which is certainly possible - is a downturn in buyer enquiries on used cars. Remember that Carsales operates a 'leads' model for its dealer customers, which is slightly different to the 'listings' models of other online classifieds companies. Dealers have to pay Carsales a fee (currently $48) every time the Carsales website delivers a buyer enquiry about a car. Fewer buyer enquiries - whatever the cause - would mean less revenue for Carsales.

What's also been affecting market sentiment this week is the announcement that Facebook will extend Facebook Marketplace to car dealers. Trade Me shareholders will be familiar with Facebook Marketplace - see Trade Me and Facebook square off, as well as subsequent reviews - which has caused the kiwi company to lose a little market share in recent years.

Essentially Facebook will allow car dealers to upload their vehicle inventory onto Facebook Marketplace for free. As with Trade Me, Carsales is likely to lose a little market share, particularly if dealers somehow encourage buyers to head to Facebook for their inventory (where they wouldn't need to pay Carsales for leads).

We're not particularly concerned, mainly because Carsales systems are embedded in dealers' businesses. Carsales is likely to remain the go-to site for the vast majority of qualified buyers, with Facebook Marketplace and Gumtree offering a 'no frills' experience.

To our minds, the more significant question is whether the decline in display advertising and credit tightening presages a more significant downturn for Carsales. The answer is: it's possible.

More cyclical

Carsales should be considered more cyclical than it once was. The print-to-online structural shift has already played out, while common sense tells you that advertising is linked to the economy and consumer confidence. A sustained decline in the vehicle market would certainly be reflected in weaker sales and earnings for Carsales.

'Moderate' growth in earnings this year implies Carsales will achieve earnings per share of 56-57 cents. However, vehicle sales and/or advertising markets may weaken further because of house price declines and credit tightening. We wouldn't be totally surprised to see earnings per share of 50 cents next year in this scenario.

Picking economic cycles, however, is notoriously tricky. The stock has already fallen more than it did ahead of our last upgrade - at $9.93 in 2016 - and, based on management guidance, it's trading on a forecast 2019 price-earnings ratio of 21. That's very reasonable for a business of this quality that should produce 5-10% annual profit growth over the long term.

Further profit weakness would likely lead to a lower share price in the short term, but Carsales is once again offering a decent discount to our valuation. It's perhaps not a standout opportunity, particularly given our view that it's the weakest of the three major online classified stocks (as outlined in previous reviews).

However, with the stock facing a barrage of bad news and having returned to a reasonable price, it's certainly good enough to upgrade. BUY.

Disclosure: The author owns shares in Trade Me.

Recommendation