Carsales offers yield and growth

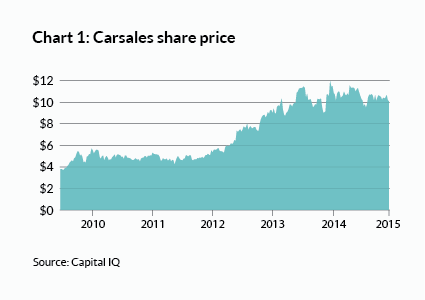

What a difference a year makes. In September 2008, Lehman Brothers filed for bankruptcy and financial markets were effectively shut. By September 2009, markets had very definitely reopened and Carsales.com got its float away at a prospective price-earnings ratio (PER) of 22 (a share price of $3.50), before watching it stretch to 34 in four months (a share price of over $5).

The stock promptly flat-lined for two years before doubling again in 18 months. For the past couple of years, however, it has been back in neutral (see Chart 1). Earnings, however, have continued to grow, so that the PER is almost back where it started, at about 24 times forecast 2015 earnings per share. Particularly in the context of a low-interest rate environment, Carsales now offers an appealing combination of income and growth.

- Local business dominant with more growth to come

- Overseas businesses just getting started

- Reasonable yield, with attractive growth potential

Most importantly, in the five years since listing, Carsales has entrenched its position as Australia's leading car classifieds website. In February, it had 4.8m site visits, compared to 1.8m and 1.5m, respectively, for competitors Drive.com.au and Carsguide.com.au (according to data from SimilarWeb).

Crucially, the levels of engagement are much higher for Carsales than for its rivals: almost half the traffic comes to it directly instead of via searches, ads and links on other sites (compared to 10% and 14%); only 22% of visitors leave the site after visiting only one page (compared to around 60% for the others); and the average visitor spends 10 minutes on the site per visit (compared to about three).

?Buyers and sellers both benefit from dealing with the industry's biggest player. Carsales gets the best industry data to enhance product offers and improve the user experience. This is a business with huge network effects.

No wonder it can charge $65 for a standard private display ad (compared to $40 and nothing for Drive and Carsguide). To get a premium ad – which will display more prominently – you'll need to stump up $125. This is the way of the future, with consumers effectively competing for positioning on Carsales' site and thereby ensuring that it gets its share of the value it provides – whether it's $65 or $125, it's small beer if it helps you get a good price quickly on a $20,000 car.

This pricing power leads to breathtaking financials. In the six months to December, operating margins were 47% and the annualised return on tangible capital was over 100%. Carsales barely requires any capital to grow, allowing all of its earnings to be used to fund acquisitions or to pay dividends.

Shrewd acquisitions

In the past couple of years acquisitions have been focused on overseas auto classifieds sites where it can lend its skills to help develop clones of itself (through joint ventures in Brazil and South Korea, and a stake in businesses in Malaysia, Thailand and Indonesia through a 20% holding in ASX-listed iCarAsia).

Last July it also paid $60m for a 50.1% stake in Stratton Finance, with the very sound strategy of increasing its exposure over its sites (Stratton is a long-standing advertising customer) at the same time as helping to sell cars by providing finance for buyers. Carsales clearly has grander ambitions for the business, though, judging by the 41% increase in sales and marketing expense during the latest half, apparently pretty much all due to Stratton.

We love to see companies making shrewd acquisitions and investing in them rather than just cutting costs and we have high hopes for all these businesses.

Despite spending almost $300m on these acquisitions over the past couple of years, Carsales has paid out around 75% of its net profits as dividends. If it does the same this year, it would mean dividends of around 33 cents per share, to give a fully franked yield of about 3.2%.

So here's the pitch: long-term growth in the high single digits would deliver a total return of 10% a year. In the current low-growth environment, that's attractive enough, but Carsales has a high chance of eclipsing that.

The overseas businesses operate in much bigger markets and are only just getting started, but the local business should also have a fair bit of growth remaining. Although the online advertising market is nearing the same size as the pre-internet print classifieds market, we'd ultimately expect it to be significantly larger, because it adds so much more value.

In a newspaper you might have got a headline and a column inch or two. Through Carsales, private sellers will get help valuing their car, the opportunity to load up to 15 photos to help sell it, an ad until the car sells, the ability to edit it as many times as they like and a weekly ad performance email. Dealers also get more 'leads' from interested buyers, enabling quicker sales and greater returns on their investment in inventory.

| Six months to Dec | 2014 | 2013 | /(–) (%) |

|---|---|---|---|

| Revenue ($m) | 150.9 | 112.3 | 34 |

| EBIT ($m) | 70.8 | 62 | 14 |

| Net profit ($m) | 46.7 | 43.9 | 6 |

| EPS (c) | 19.6 | 18.5 | 6 |

| Interim div. | 16.2c (up 10%), fully franked, ex date 23 Mar | ||

Listings down

So why have investors been down on the stock? The main thing is probably to do with recent falls in vehicle listings, which have dropped from about 220,000 to 202,000 over the past year. New car listings, in particular, have fallen from about 50,000 to about 35,000 over the past year due to a ban by some car manufacturers on dealers listing their new vehicles.

Dealer used car listings have also slipped 4% over the past year, although used car enquiry volumes from would-be buyers have risen 7%. Private listings also fell 12% to about 73,000, although this was mainly due to cars selling more quickly, which Carsales management described in its interim results presentation as a 'very positive consumer metric'.

We've reached a stage now when most used cars for sale are being listed on Carsales, so the number of listings is a less important number than time to sell, pricing and the proportion of premium ads. We think the latter should keep revenues ticking higher even if new listings don't grow.

There's also been some concern about a possible resurgence from Drive and Carsguide, following an aggressive advertising campaign by the latter in particular. But the numbers we mentioned earlier suggest that Carsales is maintaining its advantage.

The greater concern is that Google or Facebook attacks Carsales from side-on: network effects work for Carsales because it's where the most people, most interested in buying a car, spend the most time. But those people also spend a lot of time on Google and Facebook, it's just that the structure hasn't yet been put in place to harness their interest.

The specialist knowledge and skills necessary to establish that structure, though, shouldn't be underestimated and Carsales has this in abundance. Even if one of the internet titans turned its attention to cars, Carsales would not be swept aside easily.

Excepting these risks, Carsales should continue on its merry way, growing at around 10% a year and rewarding investors with a 3.2% fully franked yield along the way. We rate the stock a BUY up to $11.