Can IAG float our boat?

Recommendation

Suppose that Westpac has introduced a flashy new credit card with a unique set of terms and conditions. Like an ordinary credit card, this one offers a revolving loan of say, $10,000; but, unlike normal credit cards, it charges no interest and no fees. As long as you make your monthly repayment, you can keep the card maxed out.

You may have spotted the opportunity. Why not withdraw the $10,000 and put it into a savings account to earn interest?

Key Points

-

Float is low cost leverage

-

Historically, better than free

-

Fair price; Hold

Insurance Australia Group (IAG) has such a credit card. When people take out an insurance policy, they pay their premium up front but generally only make a claim months or years later. In the meantime, IAG gets to hold onto the money, and the sum of this money, at any point in time, is known as the 'float'.

Why float matters

Unlike our hypothethical credit card, though, an insurer's float is only free if it's careful about the policies it sells. If it makes sure the premiums at least match the eventual claims, then the float will indeed be free (or better); if the claims exceed the premiums, however, then the float will come at a cost. We'll come back to the cost of the float shortly, but let's first look at how it's invested.

Being able to invest its float can be a huge driver of an insurer's performance over the long term if it can keep the cost low and make good investment returns. No company has managed this better than Warren Buffett's Berkshire Hathaway – indeed it's the secret sauce he uses to leverage his stock picking skills.

The Institute of Actuaries of Australia says Australian insurers have 'complete freedom of insurer action in relation to investments, with appropriate additions to solvency where this action results in additional risk'. In other words, insurers can invest their float in stocks, bonds, Tasmanian goat farms – pretty much anything, so long as they hold enough capital overall to please the regulators.

All floats, though, are not created equal. IAG's policies, such as car insurance, are generally short term and made year-to-year. Some of Berkshire Hathaway's insurance operations, on the other hand, have very long-term policies, spanning decades.

This means Berkshire can hold more volatile assets that outperform over the long term, such as equities. IAG, though, plays it safe with 90% of its investment portfolio in bonds and cash, and the balance mainly in stocks. IAG won't be earning Buffett-like returns on its float any time soon but its portfolio still earned around 5% before tax in 2015.

How much float?

When it comes to float, nailing down a precise figure isn't for the faint of heart. Let's try to simplify the balance sheet into something more manageable.

At the bottom of this article in Table 2, you can see IAG's balance sheet as at December 2015. On the asset side, the big-ticket item is the company's $14.0bn investment portfolio of stocks and bonds labelled 'Investments'.

Then there is all the money IAG is owed by policyholders and other insurance companies, as well as various prepayments that haven't been expensed in the income statement. We'll call this hodgepodge of assets 'Money we don't actually have', and it totals $11.5bn. Everything else we'll classify as 'Other'.

| ASSETS | $m |

|---|---|

| Investments | 13,960 |

| Money we don't actually have | 11,544 |

| Other | 4,759 |

| LIABILITIES | |

| Rainy day fund | 18,168 |

| Debt | 1,781 |

| Other | 3,165 |

| EQUITY | 7,018 |

Now for the main course. In the lower half of the balance sheet you'll see the premiums IAG has received from policyholders for future coverage, which comes to around $6bn. Below this we find the $12bn IAG has earmarked for claims but is yet to pay out. We'll group these two together as IAG's 'Rainy day fund'.

You can also see $1.8bn of interest bearing liabilities (which is a polite way to describe 'Debt') and everything else – such as unpaid wages or money owed to suppliers – we'll throw in the 'Other' basket. So our streamlined balance sheet looks something like Table 1.

From here, calculating the float is just a matter of taking IAG's 'Rainy day fund' and deducting 'Money we don't actually have'. IAG has just over $6.6bn of float.

You may notice that by adding the company's float and equity together we get a figure close to the value of its investment portfolio. One way to think about it is that shareholders have contributed $7bn to the portfolio and policyholders another $6.6bn – but remember, all of the investment income goes to the shareholders. Float magnifies investment returns, so the 5% or so earned on the portfolio helped the company achieve an 11% return on equity in 2015.

Low-cost leverage

Having lots of float isn't enough for shareholders to do well – as we noted at the beginning, the float doesn't always come for free. Insurers often get themselves into trouble by underpricing policies to increase their float, which over the long term can result in an excess of claims. This slowly chips away at shareholder equity (and sometimes not so slowly).

Float is only valuable to shareholders if its cost is consistently below the cost of obtaining alternative sources of funding.

If an insurer pays out more in claims each year than it earns in premiums – an underwriting loss – then that expense can be considered the cost of holding onto policyholder money.

If an insurer pays out more in claims each year than it earns in premiums – an underwriting loss – then that expense can be considered the cost of holding onto policyholder money.

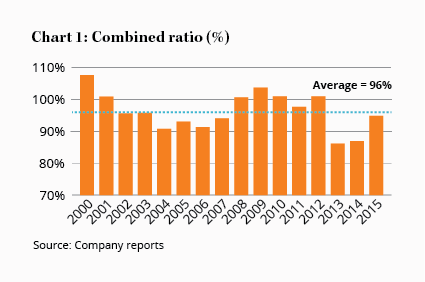

In analyst jargon, the 'combined ratio' is the most important measure of an insurer's profitability. Working it out can be a bit fiddly, but it's more or less about taking operating costs and claims and dividing them by premiums earned (for details, see this blog post). Thankfully, insurers almost always disclose their combined ratio in their financial reports.

A combined ratio below 100% means the company is making money from its insurance business, before adding the income from investing the float.

Between 1995 and 2010, competition for float was so strong that the global insurance industry had an average combined ratio of 105%, meaning their operations were actually loss-making. Insurer's relied on investment income to turn a profit.

So how does IAG score? Though there are peaks and troughs that coincide with severe storms and high claims, IAG's combined ratio has averaged 96% over the past 15 years (see Chart 1).

The company's float wasn't only low cost – it was better than free. IAG earned billions in investment income and, thanks to the disciplined pricing of policies, it was actually paid to use policyholders' money.

IAG's $6.6bn float is recorded as a liability on its balance sheet but it's a huge source of value – so long as the company continues to operate at an underwriting profit.

Management expects premium growth to be flat in 2016 with the insurance margin 'at the lower end' of 14–16%. With a current market capitalisation of $13.5bn, IAG is trading at a valuation that roughly matches its float plus shareholder equity. That makes some sense if you think that the returns from its investments will pass through to shareholders and that the float will come at no cost. Remember, though, that around 90% of IAG's investments are in bonds and cash, so there won't be much to pass through over the long term and equity investors are relying on IAG's ability to grow its business to bring its returns up to a suitable level. All up, we think the stock offers fair value at current levels and we'd be interested in buying at prices around 20% lower. HOLD.

| ASSETS | $m | Label |

| Cash held for operational purposes | 310 | Other |

| Investments | 13,960 | Investments |

| Premium receivable | 3,058 | Money we don't actually have |

| Trade and other receivables | 636 | Money we don't actually have |

| Current tax assets | 30 | Money we don't actually have |

| Reinsurance and other recoveries on outstanding claims | 4,298 | Money we don't actually have |

| Deferred levies and charges | 121 | Money we don't actually have |

| Deferred outwards reinsurance expense | 1,856 | Money we don't actually have |

| Deferred acquisition costs | 996 | Money we don't actually have |

| Deferred tax assets | 549 | Money we don't actually have |

| Property and equipment | 214 | Other |

| Other assets | 190 | Other |

| Investment in joint venture and associates | 455 | Other |

| Intangibles | 658 | Other |

| Goodwill | 2,932 | Other |

| Total assets | 30,263 | |

| LIABILITIES | ||

| Trade and other payables | 1,233 | Other |

| Reinsurance premium payable | 1,018 | Other |

| Restructuring provision | 30 | Other |

| Current tax liabilities | 11 | Other |

| Unearned premium liability | 6,027 | Rainy day fund |

| Outstanding claims liability | 12,141 | Rainy day fund |

| Non-controlling interests in unitholders' funds | 250 | Other |

| Employee benefits provision | 277 | Other |

| Other liabilities | 346 | Other |

| Interest bearing liabilities | 1,781 | Debt |

| Total liabilities | 23,114 | |

| EQUITY | 7,018 |

Recommendation