Caltex: A fuel's errand

Recommendation

- Caltex is becoming a better business

- Quality is starting to be reflected in its share price

- Longer term risks remain

Everyone knows Mount Everest is the tallest mountain in the world. It's why Edmund Hillary is a household name, why there are no books or films about Ludwig Purtscheller and why Tenzing Norgay is the world's most famous sherpa.

In fact, Everest isn't the worlds' tallest mountain. Mauna Kea, in Hawaii, measures 10,200m from base to top compared to Everest's 8,900m. Most of Mauna Kea, however, is underwater which doesn't change the facts but does change the story.

Everyone knows Caltex is a lousy business, demanding vast swathes of capital deployed at unpredictable and frequently tiny rates of return. And yet the market prices the business at multiples of book value. Thus it appears to offer a charmless combination of miserable quality and a high price.

Like Mauna Kea, however, the most significant thing about Caltex lies beneath the surface, invisible to the naked eye and beyond the ken of most investors. Caltex is getting out of the lousy refining business.

The company will spend $430m shutting down the Kurnell refinery and another $250m turning it into an import terminal for refined products. Lytton, in Queensland, will remain the company's sole operating refinery, although Caltex will limit capital expenditure on the asset.

So, instead of refining crude oil, Caltex's future profit will come from fuel retailing and convenience store sales. And that, it turns out, is a far better business.

Separate and inspect

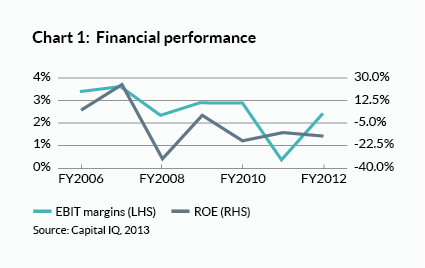

'Old' Caltex was characterised by low, volatile margins and woeful returns on capital (see Chart 1), classic signs of chronic competition and zero pricing power. The new Caltex should be a great improvement.

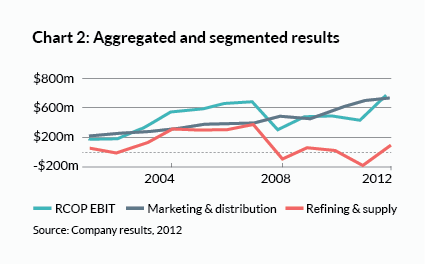

By separating the profit contribution of crude oil refining from marketing, Chart 2 shows how aggregated numbers have long misrepresented results.

The marketing business has generated consistent and rising operating profit, a fact obscured by poor performance from the refining business. Its imminent closure will leave stable and growing profits from marketing and unmask a hidden truth: as a fuel retailer, Caltex is a better quality business than most realise.

So what might it look like in 2016, unencumbered by transformations and without the anchor of its refineries? We need to have some idea of future profits to be able to estimate value today.

Future prophets

We assume that the company's sole refinery, Lytton, will neither contribute nor consume cash flow. Management has committed to spending as little on the facility as possible and we expect it to break even, meaning all Caltex's earnings will come from its fuel marketing business.

Over the past five years, that division has increased earnings before interest and tax (EBIT) from $452m to $765m, a growth rate of 11% per year. We assume that, over the next two years that will fall to 6% as easy productivity gains are exhausted and the business matures. From that point, we expect growth to merely match economic growth at around 3%.

| Multiple | Multiple |

|---|---|---|

EV ($m) | 6,880 | 10,320 |

Debt ($m) | (827) | (827) |

Corporate costs ($m) | (200) | (200) |

Equity ($m) | 5,853 | 9,293 |

Shares on issue (m) | 270 | 270 |

Value per share ($) | 22 | 34 |

This suggests that by 2016 the new look Caltex could be making EBIT of about $860m. To this we'll apply multiples of eight at the low end and 12 at the high end. As you can see from Table 1, that gives a value range of $22–34 per share. As project risks fall, the high end of that range becomes more relevant.

Not in the numbers

For a business with stable earnings, strong cash flow and low capital expenditure requirements our valuation multiples are conservative, but there are risks that aren't reflected in the numbers. Fuel volumes are falling as cars become more efficient and less popular but earnings are fortified by higher margins, driven partly by a preference for premium fuels.

This preference appears to be driven by government regulations that require low octane fuel to be blended with ethanol. This appears to be driving consumers towards premium blends, but if the rules about ethanol content changed, customers would likely switch back to ordinary fuel blends and margins would fall.

Similarly, Caltex earns higher margins from retailing diesel fuels, profits that should be eroded by competition over time. There is no reason why diesel should be more lucrative than petrol. Finally, the impact of electric cars has barely been felt but could be an existential threat. Every major car maker has an advanced electric car program that could decimate fuel volumes.

So although Caltex is morphing into a decent business, it isn't without risks. We'd make the stock a Sell at prices closer to $34, but at current levels we're happy to HOLD.

Recommendation