Bitcoin Group on the block

It seems unlikely that Bitcoin Group, which is looking to raise $20 million in an ASX float closing on October 30, consulted a PR firm when designing their website.

If they did, it is unlikely that they would show footage of staff joking around the office, being hit in the face by flying teppanyaki or describing the creation of a bank account as a 'Kafkaesque task beset by bureaucracy'.

However, considering that people who use bitcoin tend to be young and generally distrusting of authority it might make some sense. In fact the whole idea of a bitcoin miner launching an IPO seems quite subversive considering the community's distrust of middlemen.

Key Points

Bitcoins created as reward for processing transactions

No barriers to entry

Profits highly dependent on bitcoin price

What is Bitcoin?

Bitcoin was created in 2008 by something called 'Satoshi Nakamoto'. It could be a person, it could be a group of people or it could even be 'Skynet'. Whatever or whoever it is, it didn't lack for brains, ingenuity or gumption.

Bitcoin is known as a 'cryptocurrency'. Rather than existing as physical coins and notes, bitcoins are evidenced by transactions on a on a giant ledger known as the 'blockchain'. Bitcoin owners get the right to transfer their bitcoins through randomly generated and secret 'personal keys' that are stored in electronic wallets. No-one will ever 'touch' a bitcoin, and no-one will know who owns one.

The main attraction of this system is that it's considered free from manipulation from central banks and governments. The theory is that by cutting out these people, the purchasing power of a bitcoin will not be eroded over time. It is also hoped that transaction fees will be lower than those typically charged by credit cards.

So where, you might ask, do bitcoins actually come from? Well they don't grow on trees, but they do almost grow out of computers – which is where Bitcoin Group comes in.

Bitcoin Group is 'bitcoin miner'. Miners are central to the stability of the entire network and secure the system by authenticating transactions on the blockchain. Miners compete to solve a mathematical puzzle by attaching a new block of transactions to the chain in a particular way (using the SHA-256 secure hash algorithm, no less – keep up at the back).

The successful addition of a block earns a reward of newly minted bitcoins – currently 25 of them, in fact, worth about $8,000. The puzzle is such that miners must essentially use trial and error to solve it, meaning that earning bitcoins essentially comes down to probability based on the computing power thrown at the problem. As the overall computing power on the network increases, the difficulty of the puzzle is increased so that the average time between new blocks being added stays at about 10 minutes.

The reward for adding blocks is also halved every 210,000 blocks, with the next halving due to take place in July 2016. It will halve again roughly every four years before being reduced to nothing when an arbitrary limit of 21 million bitcoins is reached. This limit is expected to be reached some time in 2140 but 99% of all bitcoins are expected to be mined by 2033. After the limit has been reached, record-keeping will be rewarded only by transaction fees.

Is it really worth it?

Given that the entire system appears to rely on new capacity entering the network and competing for reduced reward, it's easy to understand why many critics consider bitcoin to be a pyramid scheme. The processors most miners use, known as ASICs, are expensive to purchase, use large amounts of energy and generate enormous amounts of heat.

Scale is now everything, with many miners operating warehouses of machines 24 hours a day. Many miners choose countries like Sweden and Iceland due to the abundance of cheap and reliable electricity, as well as their cold climates, which reduce the cost of cooling.

Many miners also now work as part of larger pools, sharing prize money according to how much computing power they each bring to the table.

Most of the capital raised through Bitcoin Group's IPO will be used to invest in new hardware, which will be located mostly in China. The trouble is that, as the company itself readily concedes, hardware in this line of work typically needs to be replaced after just 18 months. Don't expect a dividend from this company; they will need to reinvest everything they can.

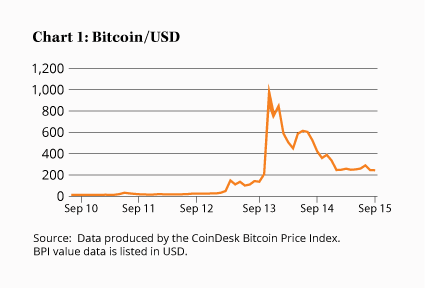

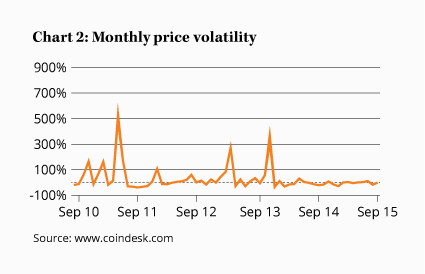

Bitcoin Group forecasts that it will successfully mine between 80 thousand and 115 thousand bitcoins in the 2016 financial year. At current prices this means it would generate revenue of $28–40 million, but considering the volatility (Chart 2) in the price of bitcoins, it's hard to have any confidence in this figure.

Operating costs for 2016 are forecast at just over $20 million. Whilst some of the costs are paid using bitcoins, others require more traditional payment methods, so a slump in the price of bitcoins could see profitability eroded very quickly.

Historical figures for Bitcoin Group show a profit of $69,000 generated from $1.7 million of revenue from its brief time operating (it was incorporated in September 2014), but only $10,000 of this profit actually came from minting bitcoins, with the remander coming from gains on the value of bitcoins held by the company.

The total employment expense is also much lower than it will be in future years with key management being paid $250,000 a year once the company is listed with further plans for bonuses and incentive schemes beginning in the 2017 financial year. All in all, one financial statement doesn't really provide the investor with any help to predict the future.

Big risks

One way or another, though, we'd expect competitive forces to maintain a marginal rate of profitability over the long term, although the enormously volatile price of bitcoins could make bitcoin mining unviable times.

With competition eating away at the rewards of minting new bitcoins, miners will likely respond with higher transaction fees, but this risks undermining one of the great advantages of the platform over more conventional methods.

More worrying perhaps is the real threat that that the whole platform could become obsolete. New technology could disrupt or governments could just rule bitcoin illegal. The latter would stop legitimate businesses from using it and send it back to being nothing more than a niche payment method for drug dealers.

Big banks around the world, including Commonwealth Bank, have also caught on and are researching blockchain technologies in the hope of creating their own alternatives. This would bring the technology to the conventional and more regulated world. It may be a complete coincidence but the big banks in Australia are also shutting down the accounts of bitcoin exchanges in Australia, severely hampering their ability to operate.

Finally, there have been instances of bitcoins being stolen by hackers. Due to the anonymous nature and unregulated structure, there is nothing the victims can do to get them back. Similarly, if a user forgets their private key, there is simply no way for the person to access their bitcoins. Neither of these would allow an average person such as myself, who regularly forgets things like passwords, to feel confident in using the system as a payment system and/or store of wealth.

Innovation does not always mean good investment

Bitcoin sounds like a great idea, but great ideas are only good if they are viable in the long term.

Unless the general public, who don't understand secure hash algorithms, feel safe using it then it is unlikely to gain critical mass and become a real alternative for payments.

The technology behind bitcoin is a clever innovation but the infrastructure remains fragile. If the legitimate miners stop mining then the whole system's security will go with it. Perhaps they might one day wish there was a central bank to protect them.

Bitcoin miners are capital-intensive, low-margin businesses and we're very happy to watch on, with interest and bemusement. We recommend avoiding the float and we won't be providing ongoing coverage of the stock.