Austbrokers faces new threat

Recommendation

Corporate disasters usually stem from many small problems conspiring to cause one very big one. A dip in sales, distracted management, a little too much debt; for want of a nail, the kingdom was lost. Austbrokers, however, is threatened by the opposite principle: one enormous problem that will cause many other enormous problems. Warren Buffett wants to put the company out of business.

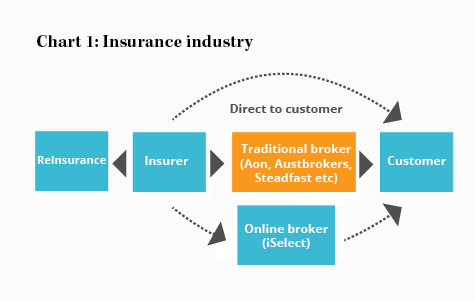

Historically, Buffett's conglomerate, Berkshire Hathaway, has focused on auto insurance and reinsurance (that is, insuring the insurers themselves). However, the rising popularity of catastrophe bonds, an alternative form of reinsurance, is forcing Berkshire and other reinsurers to lower their rates to remain competitive.

That's a problem for Austbrokers for a couple of reasons. As we explained in Austbrokers: Sins of commission, it's enabled general insurers, like Insurance Australia Group and Suncorp, to write cheaper policies: in Australia, prices fell nearly 30% on commercial lines in the six months to December. As insurers reduce their premiums, Austbrokers earns less in commissions. This domino cascade of price reductions caused the company's underlying net profit to fall 15% in the six months to December.

Key Points

Industry deteriorating rapidly

Berkshire to compete directly

Not worth the risk; Sell

The big issue, however, is that catastrophe bonds and falling premiums are undermining the once profitable commercial operations of reinsurers and general insurers, making these companies desperate to cut costs and find new lines of business.

In an interview with The Wall Street Journal earlier this month, Berkshire's head of reinsurance, Ajit Jain, discussed the company's plans to offer commercial insurance online and bypass the brokers to reduce costs.

'Since the reinsurance business isn't going to offer as many opportunities for the foreseeable future,' Jain said, 'we feel like we should go down the food chain.' If this were the Discovery Channel, that's the moment when the grizzly bear looks at the cameraman, and then calmly puts down the salmon.

Trouble ahead

Austbrokers is in trouble. Berkshire has offered commercial insurance policies for many years but expanded significantly in 2013 by forming Berkshire Hathaway Specialty Insurance. Berkshire's commercial business earned $5.6bn in premiums in 2014.

The company now intends to use its established position and substantial resources to sell commercial insurance online with a new initiative called Berkshire Hathaway Direct, and thus cut out brokers once and for all. Berkshire will focus on small to mid-size businesses – Austbrokers' bread and butter.

The company now intends to use its established position and substantial resources to sell commercial insurance online with a new initiative called Berkshire Hathaway Direct, and thus cut out brokers once and for all. Berkshire will focus on small to mid-size businesses – Austbrokers' bread and butter.

Austbrokers takes up to 25% of the first year's premium as a commission. Selling insurance directly and bypassing the broker is an obvious way for an insurer to reduce costs.

Until now, we felt Austbrokers was relatively protected due to the complexity of insuring a business compared to an individual or car. However, Berkshire's decision to focus on Internet-based, direct-to-customer commercial insurance suggests technology is now at a standard where policies can be priced and written entirely online.

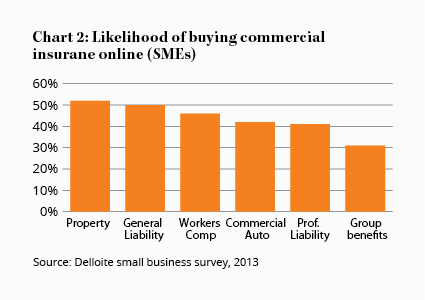

In fact, nearly a fifth of small businesses buying property, general and professional liability insurance already initiate their purchase online, with more than half willing to do so if they have previously purchased personal insurance using the Internet (see Chart 2). That so many small businesses are already comfortable shopping for insurance independently suggests the market is ready to take the next step and complete actual transactions online. Things could move quickly from here and Austbrokers has little protection because its small business customers have more straightforward policies than large, complex corporations.

History repeats

Berkshire has played – and won – this battle before. In the 1930s, auto insurance was almost exclusively sold through brokers. Then GEICO, now a Berkshire subsidiary, started marketing directly to customers to save on broker commissions. It was classic 'cut the middleman'.

Berkshire has played – and won – this battle before. In the 1930s, auto insurance was almost exclusively sold through brokers. Then GEICO, now a Berkshire subsidiary, started marketing directly to customers to save on broker commissions. It was classic 'cut the middleman'.

GEICO went on to be an early adopter of Internet sales and is now one of the largest auto insurers in the world – the 'jewel in Berkshire's crown', as Warren Buffett likes to call it. As for auto insurance brokers, when was the last time you used one?

While Berkshire is the first major insurer to move aggressively into online commercial insurance, Australian insurers will inevitably follow and they're already seeing success with Internet sales for personal lines: IAG, for example, had a 24% increase in online sales in the six months to December.

Time to cut losses

Two years ago, in Hail the insurance middleman, we made the case that a shift to online commercial insurance would be slow and that Austbrokers was protected due to the complexity of a typical commercial policy. We were wrong. The industry is changing far more rapidly than we expected and the risks are mounting.

Austbrokers faces two immediate hurdles: (1) If general insurance and reinsurance rates remain depressed or fall further, it will have a hard time increasing commissions, making us particularly wary of the next few results announcements; and (2) If Berkshire's move into online commercial insurance is successful, and general insurers follow suit, Austbrokers' current business model is toast.

Management expects net profit to increase between 0% and 5% in 2015, down from earlier expectations of 5–10%. If underlying profit is flat in 2015 and the dividend is unchanged, then the company currently trades on a forecast price-earnings ratio of 15 and a 4.3% fully franked dividend yield. This may seem attractive, but, if profits fall, today's price will prove expensive.

Austbrokers' share price has increased 4% since Austbrokers: Sins of commission from 4 May 15 (Hold – $8.64) but is down 10% since Austbrokers upgraded to Buy from 16 Oct 14 (Buy – $9.98). It's time to cut our losses while they're relatively minor and move on to the next opportunity. Given the increasing risks it's also hard to pin down a price at which we'd be happy to buy the stock again and we're therefore dispensing with the price guide. SELL.