Aurizon: Australia's safest asset (really?)

Recommendation

Net profit rising 52% in the first half of the financial year isn't usually an indicator of a company in serious trouble. Yet executives are squirming at Aurizon, Australia's largest rail freight operator.

In a sense, Aurizon is a simple business. It owns the Central Queensland Coal Network and charges coal exporters a fee to access it. Understanding what fees Aurizon is allowed to charge, though, is a bit more complicated.

Key Points

-

QCA sets lowest regulated return for any asset

-

Maintenance will be cut, growth to slow

-

Premium to book value is undeserved

Every four years, Aurizon goes to the Queensland Competition Authority (QCA) to seek approval for the rate of return it can earn. The QCA then decides a maximum amount of revenue Aurizon can generate, which prevents the company from using its monopoly position to set unfair prices.

The details are intricate and complicated – the full decision ran to 579 pages – but the practical outcomes are straightforward.

An appropriate return figure is decided using an equation painfully familiar to most first-year business students – the weighted average cost of capital (WACC). The short of it is that the QCA allows Aurizon to earn a return that's a weighted average of the interest rate it must pay to borrow funds and the yield equity investors would require to contribute capital.

Most of the time, the QCA just tinkers a little with the allowed margin. Most of the variability from one four-year period to the next is down to prevailing interest rates. In December, however, the regulator set Aurizon's maximum revenue for 2018–2021 at $3.9bn – a billion dollars below the figure Aurizon said it would need to cover its costs. The QCA's draft decision lowered Aurizon's WACC from 7.17% to 5.41%.

We can see what assumptions have changed by comparing the most recent draft decision to the last. The bulk of the fall is from declining yields on long-term Government bonds, which fell from a bit over 3% to a bit below 2%. Another needle-mover was a reduction in the risk premium on debt. Finally, the return on equity that the QCA says investors require fell from 8.41% to 6.99%. All this is to say that the QCA believes both the company's investors and lenders are so hungry to put their capital to work that they're willing to accept much lower returns than before.

Australia's safest asset

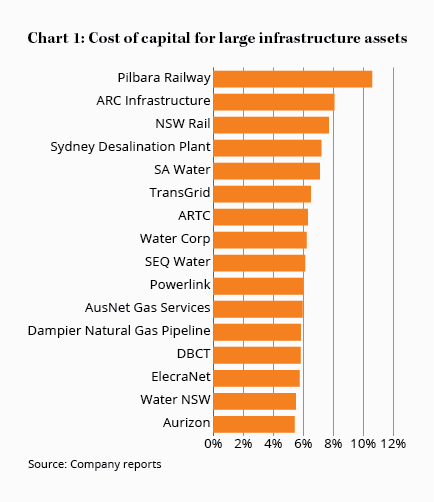

Two things stand out about the decision. The first is that WACC figure of 5.41%.

As you can see in the chart, it's the lowest proposed WACC of any large infrastructure asset in Australia. It's below the Australian Competition and Consumer Commission's (ACCC) recent 6.3% recommendation for the Hunter Valley Coal Network, a similar asset serving the NSW coal industry. And – get this – it's even below the 6.1% approved in December for SEQ Water, which is owned by the Government and supplies water to two-thirds of Queensland's population.

As the company said in its official response to the draft decision, a WACC of 5.41% ‘implies that Aurizon Network is the lowest risk regulated asset in Australia'.

As the company said in its official response to the draft decision, a WACC of 5.41% ‘implies that Aurizon Network is the lowest risk regulated asset in Australia'.

Aurizon has some formidable competitive advantages – no-one is going to build a competing network any time soon. Its balance sheet is also in reasonable shape, with $3.4bn of net debt and interest expenses covered a good five times over by operating profits.

However, even a basic understanding of Aurizon's business should tell you this is not Australia's safest asset. For one thing, half of earnings are from so-called ‘above rail' operations – hauling coal, iron ore and freight – which is exposed to the booms and busts of the resource industry. The weighted average length of current contracts is around 10 years but prices could be materially lower at the next reset depending on the state of the mining industry.

What's more, the risk of ‘asset stranding' is ever-present because mining customers with high operating costs can quickly find themselves unprofitable if commodity prices move against them. That danger is negligible for water and electricity utilities. Aurizon may be low risk one day to the next, but its long-term future is anything but certain.

Same budget, bigger house

The other eye-opener in the decision is that the company's allowable capital expenditure on maintenance was unchanged from the prior period despite Aurizon's asset base being some 20% larger and freight volumes being up 15%.

The QCA is unsubtly telling Aurizon to be more efficient and to stop ‘gold plating' its network – unnecessary spending to increase the asset's size, and so increase company profits when that larger asset base is fed into the magic equation described above.

Aurizon's management believes that ‘the draft decision reflects a clear approach by the QCA to drive maintenance to the lowest possible cost regardless of the impact on the supply chain'. Lower capital expenditure accompanied by falling rates of return is a nasty double whammy for a business that earns a regulated return on an approved asset base.

To complicate matters, while the current framework is still only a draft, Aurizon can't hold out for the final ruling (due later this year) because it is implemented retrospectively to July 2017. Historically, there have only been trivial differences between the draft and final decisions, so the company needs to cut back on maintenance immediately. Still, Aurizon has appealed to the Supreme Court, alleging that conflicts of interest led to a lack of procedural fairness.

Don't overpay

We don't know if the decision will be amended or overturned by the courts. Whatever the case, it's clear that a favourable regulatory period will soon be replaced by a less generous one, and shareholder returns will almost certainly be lower.

As things stand, Aurizon has a book value of $2.41 per share and the draft decision only allows for that equity to earn a return of 6.99%. If you require an 8% return on your investment, you'll need to buy the stock at a discount to book value – something in the order of 25% if we assume the company retains a third of earnings to grow the network, which is the five-year average. Even generous assumptions for QCA's final decision and higher retained earnings would only warrant a 30-50% premium to book value.

The current share price of $4.36 is an 80% premium to book value. That being the case, we're unlikely to consider upgrading Aurizon until the stock is trading well below where it is today. There's no margin of safety and we're sticking with AVOID.

Our Intelligent Investor Equity Income Portfolio is now available as a listed fund trading under ASX code: INIF. Holdings in the fund will mirror our current Equity Income Portfolio and have the same low costs, but you'll be able to buy it on the ASX. You can save yourself the broking commission by applying during the initial offer. The offer closes on Friday, 8 June, 2018.