Auckland Airport's longest runway

Recommendation

Business could be such a breeze - if it weren't for all that pesky competition. Imagine freely raising prices, knowing customers have nowhere else to turn. Or wielding so much staying power that your accountants classify your biggest asset as having an indefinite useful life. A dream for most, this vision of corporate utopia is just another business day for Auckland Airport.

When an industry has extremely high fixed costs, a natural monopoly tends to form. Airports are textbook monopolies because they take up lots of space and cost a lot to build. It makes sense to land as many planes as possible on one runway before you start building a second.

Key Points

-

Pricing ceiling may be reached

-

Freehold land could be worth ~$7bn

-

Land value provides valuation floor

The usual argument against monopolies, however, is that they can use their negotiating strength to overcharge customers and waste society's resources. So, in most parts of the world, industries that would normally cascade towards a monopoly - airports, toll roads, electricity generators, Google, railways etc. - are usually heavily regulated. Governments will set prices directly or cap revenue.

That makes Auckland Airport a special company indeed. While the airport is a monopoly, regulation is considered 'light handed' by world standards. When Auckland Airport was privatised in 1998, the Airport Authorities Act was amended to give the airport permission to set pricing as it sees fit.

Auckland Airport is, however, subject to information disclosure rules, whereby it has to keep the Government informed about its activities. But pricing is still negotiated directly between the airport and its customers, principally airlines and retail tenants.

Unsurprisingly, Auckland Airport milks this cash cow with enthusiasm. The company's earnings before interest, tax, depreciation and amortisation (EBITDA) margin was 74% in 2018, higher than any other airport in Australia or New Zealand - except Sydney Airport, with its margin of 81% (a story for another day). Internationally, there's only a handful of airports that have an EBITDA margin above 70% and the average is in the mid-50s.

Your move

Auckland Airport re-sets aeronautical pricing every five years, most recently in 2017. In the decade to 2018, landing charges per tonne rose by around 2% a year.

However, the airport made a surprise move in February: it voluntarily lowered its landing and passenger charges following a report from the New Zealand Commerce Commission that concluded the airport's target return on capital was unjustified. The lower fees will shave around NZ$33m from net profit over the next three years and reduce the airport's target return on capital from 7.0% to 6.6%.

It's a curious decision. The Commerce Commission is the Government agency responsible for monitoring the airport, but it has no power to force the airport to lower prices. The worst the Commission can do is launch an investigation into whether the airport is abusing its monopoly, then recommend legislative changes. But Auckland Airport's management was free to ignore the report.

It's a curious decision. The Commerce Commission is the Government agency responsible for monitoring the airport, but it has no power to force the airport to lower prices. The worst the Commission can do is launch an investigation into whether the airport is abusing its monopoly, then recommend legislative changes. But Auckland Airport's management was free to ignore the report.

The airport's step back shows the edge of its competitive advantage. Having a monopoly, as Auckland Airport does, may allow the company to increase prices faster than costs for a period of time, but that can't go on forever. Eventually the price will hit a ceiling - not so much a ceiling equal to what airlines and passengers are willing to pay, but a ceiling in what the Government will allow before it considers the airport to be acting against the spirit of its light-handed regulation. The airport's recent price reduction suggests that ceiling has been knocked.

Land value

While the airport's pricing power has weakened, it does have a billion dollar trump card: a lot of land. As we've explained before, it may be better to think of Auckland Airport more as a property developer than as a traditional airport. The case is getting stronger.

Auckland is quickly running out of industrial land. Since 2012, undeveloped industrial land in the metro area has fallen from roughly 1,150 hectares to 750 hectares. Around 40-70 hectares is being developed each year, which means the city may run out of vacant industrial space in 10-20 years.

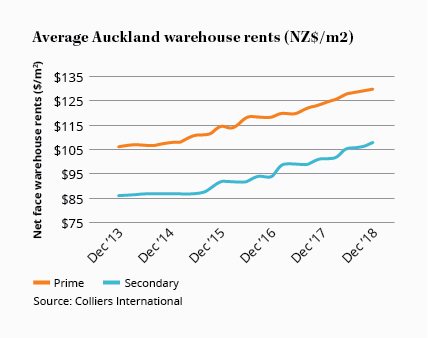

With a booming local economy, demand for industrial lots has been strong. Rental vacancy rates in the corridor between the airport and city are currently 0.7% - a 20-year low and down from 2.4% last year. Industrial land prices have risen 30% over the past two years.

Auckland Airport is sitting on a goldmine. Of the company's 1,500 hectares of freehold land, 443 hectares are available for development; more than half of all the vacant industrial-zoned land in Auckland is within the airport's borders. Around 185 hectares already has infrastructure in place.

A recent Colliers International report found that values for secondary industrial land around the airport averaged NZ$538 per square meter. At that rate, the airport's 443 hectares are worth around NZ$2.3bn, about NZ$1.0bn of which is in the form of the 185 'ready-to-go' hectares.

Remember, this is just the land earmarked for development; the airport has another thousand hectares beneath the runways and terminal. For balance sheet purposes, the airport values its total land holding at NZ$4.6bn, implying that the airport itself is using around NZ$2.3bn of land.

We have no qualms with that valuation, but it's more likely to be undercooked than over. The cheapest industrial land in Auckland sells for NZ$475 per square meter. If the airport were entirely repurposed for industrial development, that last 1,057 hectares would be worth NZ$5.0bn or so, for a total land value of NZ$7.3bn.

The odds of the airport being cleared is essentially zero but it's still important to consider its worth from a 'next best use' perspective. It provides a floor to our valuation. If we deduct the company's NZ$2.0bn of net debt from its land value of NZ$7.3bn, we're left with a 'valuation floor' of NZ$5.3bn, or around $4.40 per share.

With the current share price of $7.88, we're a long way from that. But the stock still trades below our estimate of intrinsic value, which takes into account the long-term earnings from its airfield operations.

We're raising the price guide to account for the optionality inherent in Auckland Airport's huge undeveloped land holding and the strong growth in industrial property prices over the past couple of years. Nonetheless, there are better opportunities on our Buy list. We're sticking with HOLD.

Recommendation