Argo: staying the course

Recommendation

With the ASX's biggest stocks struggling recently, the country's two largest listed investment companies have both underpeformed the index, but they're responding in different ways.

At its full-year result a fortnight ago, Australian Foundation Investment Company revealed a 1.6% loss for the year, compared to the 0.6% positive return of the S&P/ASX 200 Accumulation Index. However, it said it had increased its weighting to small and mid-capitalisation companies from 15% to 22%, in a bid to find better returns (see AFIC: turning a big ship on 25 Jul 16 (Hold – $5.84).

Today it was Argo Investments' turn to 'fess up to a loss of 1.6% (even after accounting for management fees from the company's listed global infrastructure fund launched just over a year ago.)

The 70-year-old LIC declared a fully franked final dividend of 15.5 cents per share taking the total for the year to 30.5 cents, 1 cent higher than in 2015. The dividends flowing in from its investments are clearly under pressure and managing director Jason Beddow said he expected ‘further challenges to dividends from a number of companies'.

Unlike AFIC, however, Argo seems intent on staying the course. Instead of selling down its larger holdings and increasing its exposure to smaller stocks Argo seems happy to back its existing portfolio. Beddow made specific mention to this, saying that despite the negative impact the larger sectors had on its investment performance in 2016, he was confident that the portfolio would deliver growth and income over the long term.

This is a point of difference investors should watch. Argo and AFIC's performance numbers were pretty much in line last year with Argo returning 0.4% more. However, AFIC's strategic shift means that future performance may diverge by more.

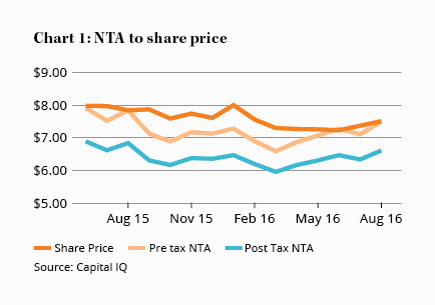

Over the past twelve months Argo has consistently traded at a premium to its pre-tax net tangible assets (NTA), and that continues to be the case, although the premium currently stands at a skinny 0.40%. To argue that the stock is undervalued we'd need to see a decent discount to pre-tax NTA and ideally closer to post-tax NTA. But, as with AFIC, it is nevertheless a reasonable option for long-term investors that don't want to pick their own stocks. HOLD.