ARB hits the skids

Recommendation

There are many things that make four-wheel drive accessories manufacturer and retailer ARB Corp a value investor's best friend: passionate owner-managers; conservative accounting; miserly cost management; a debt-free approach to growth and a path to international expansion.

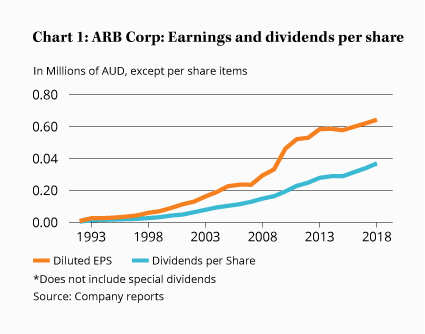

That's translated into wonderful performance for shareholders, and a dividend that has not fallen once since listing (see Chart 1). Unfortunately, one key ingredient has been missing for a while: a reasonable price.

Key Points

-

4WDs continue to take market share

-

But total car sales contract due to housing correction

-

Lowering price guide a little to compensate

We last wrote about the company when it was flying high, and we were rueful for having ever let it go, having first upgraded back in 2005 on a price-earnings ratio of just 13 times. Sadly, those days appear to be long gone; the stock traded at a record high of $23.94 earlier this year, representing a multiple of 35 times the 68 cents of underlying earnings per share it went on to make for the year to June.

Fortunately for those on the sidelines, those high hopes appear to have been dashed. Falling Australian property prices mean that home equity - a key source of vehicle financing - has declined in tandem, sending ripple effects through the automotive industry. New car sales have seen year-on-year falls for every month since April, culminating in a 7.4 per cent fall in November.

Many buyers get ARB accessories fitted at the dealership and packaged up with their initial car financing - so it's bound to affect earnings.

ARB's secret sauce

It's difficult to know what car sales are going to look like over the next few years but we'd expect them to recover eventually. Over the long term, what matters more is ARB's competitive position and there are a host of factors that come together to make it one of the strongest around.

For starters, ARB enjoys scale benefits. Its size allows it to invest more in advertising and research and development than smaller competitors, and to keep its factories and stores operating more efficiently.

There are also considerable barriers to entry. The company's factories in Melbourne and Thailand, and its distribution centres in Australia, Thailand, the USA, the Czech Republic and the United Arab Emirates give it platform for international expansion that's hard to replicate. Its network of 63 stores across Australia, of which 25 are company owned (as is the land upon which they're built in many cases), also helps it get close to customers.

If you asked one of ARB's engineers to pick out its main competitive advantage, though, they'd likely tell you it was research and development. Operating under the mantra that 'if it's not broken, break it anyway and find a better way of making it', ARB has been able to stay ahead of the curve, bringing new, high-quality products to market on a regular basis.

But leads in technology are closed down fast. Apple replaced a dozen household gadgets with a one-button phone in 2007, but it took just a few years for dozens of competitors to match it. And with each iteration of the technology, the marginal utility falls: the first camera phone was a revolutionary leap forward, providing huge benefits, but improvements are now limited to small improvements in picture quality.

It's the same with locking differentials, suspension and bull bars. The original invention was a game changer, but now each improvement is of a marginal benefit. It's why Chinese manufacturers are closing in, and with low-cost labour and efficient machinery, there's no reason they couldn't build similar or even better products in future.

It's all about the sticker

It's hard to stay ahead of competitors, then, based on product improvements alone. That brings us to perhaps ARB's most powerful advantage: its brand.

After recently contacting a number of ARB stockists, it's clear that the bull bars are easily the most popular product. Without downplaying the engineering involved, a bullbar isn't a highly sophisticated widget with many moving parts - it's a piece of moulded steel. The biggest difference between an ARB bullbar and one from competitor TJM is the sticker on it, which suggests that end consumers are more concerned about the brand.

It makes sense; the average punter doesn't care or even understand the engineering behind the ARB 'Air Locker'. All that matters to them is that it's a safe option - which it is.

That perception is something that can only be ingrained in the minds of stockists and end consumers through years of consistency and quality - 40 years in ARB's case. It's something a Chinese manufacturer can't easily match, and it's ARB's most sustainable competitive advantage. So long as ARB continues to do the right things, it's hard to see the brand not being as strong here and abroad in ten years, if not stronger.

The rise of the SUV

| Car | Type | Rank | Sales |

|---|---|---|---|

| Toyota HiLux | 4x4 Utility | 1 | 4,671 |

| Ford Ranger | 4x4 Utility | 2 | 3,469 |

| Toyota Corolla | Small Passenger | 3 | 2,659 |

| Mitsubishi Triton | 4x4 Utility | 4 | 2,404 |

| Hyundai i30 | Small Passenger | 5 | 2,378 |

But to suggest that ARB's success has been all its own doing would be to ignore the elephant in the room. 4WD vehicles have enjoyed unprecedented growth in recent years, so that 4WD dual-cab utes now make up three of the top four best-selling cars in Australia (see Table 1).

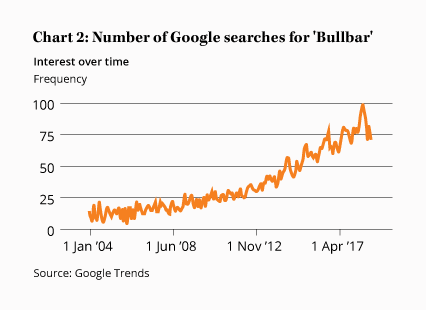

In 1995, 4WD and SUV sales (excluding compact SUVs) made up 10 per cent of total auto sales in Australia; today that number is closer to 45 per cent. They all need accessories, or at least they'll look a lot better with them, and Google Trends does a good job of highlighting this (see Chart 2).

One of the consequences of this rapid growth, besides being hugely profitable for ARB, is that competition within the industry has been relatively benign. ARB has been able to hike prices regularly, and average gross profit margins are a juicy 55 per cent. But high margins and sales growth is easier when your addressable market is growing faster than you can supply it.

Unfortunately, this source of growth has to tap out eventually. Given that 4WDs tend to be more expensive, it's even possible that they could fall as a percentage of total sales from here.

When that day comes, the only way to increase sales will be to take market share from competitors, which will ultimately lead to fiercer competition. That means we can't blindly extrapolate the company's domestic success into perpetuity.

But for this, too, ARB has an answer: international growth. Exports have grown at 14.3 per cent a year for the past five years, now making up 28 per cent of the company's sales.

The company is well placed to execute on its international expansion, particularly in the US, where its distribution network continues to grow. The new Thai manufacturing facility set to be completed in late 2019 should also help, offering cheaper labour, shorter shipping distances and, importantly, being outside the purview of a US/China trade war. ARB could become a formidable global brand - who wouldn't want suspension crafted for the harshest conditions in the Aussie outback?

Valuation

All of this is to say that ARB is a very good company, which has been operating with some very favourable conditions in the background. However, we suspect the domestic competitive environment will eventually become more difficult, and in the meantime there are some short-term concerns around declining auto sales.

These concerns have been reflected in a share price that's fallen 33% since June. With the stock now trading at 21 times consensus earnings estimates for next year, it's as cheap as it has been for a while.

It's important to note, though, that the company needs to invest capital to grow. All those distribution centres and stores need to be paid for (the more so since the company often buys the land outright), and inventory and receivables tend to increase as sales expand.

We've no problem with that, because the additional capital earns attractive rates of return. However, it does hold back the free cash flow that shareholders can expect in the meantime, to a yield of about 4.3% based on estimates for 2019. When valuing the company it's important not to double count the growth you expect it to achieve, as well as the profits that need to be reinvested to achieve it.

With this in mind and given the risks around 4WD sales, the competitive environment and the economy, we're inclined to be greedy and we're lowering our Buy price to $15, which represents around 20 times 2019 earnings estimates and a 4.5 per cent free cash flow yield. We're also going to reduce our recommended maximum portfolio weighting from 6% to 5%.

We're hopeful that further weakness in vehicle sales could provide a buying opportunity, but we're not quite there. HOLD.

Recommendation