ANZ: Interim result 2015

Recommendation

The headline numbers from ANZ's interim result were much healthier than Westpac's. While Westpac is prepared to sacrifice some market share to maintain the quality of its massive mortgage portfolio, ANZ is lending larger amounts to increase market share.

ANZ's Australian retail division increased profit by 8% compared to the same period last year and 2% compared to the prior six-month period. That's well above the corresponding figures of 0% and -2% for Westpac (see Table 2).

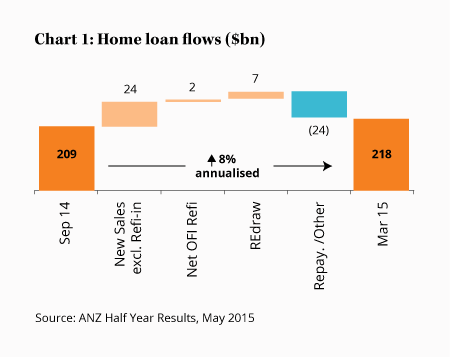

Homeloan flows for ANZ increased 8% (see Chart 1), virtually double that for Westpac. Though Commonwealth Bank and Westpac will likely need to raise more capital than ANZ and National Australia Bank to satisfy new regulatory capital rules as they have larger mortgage books, ANZ's average loan size at origination is currently over 20% larger than Westpac's at $376k.

Key Points

Healthier result than Westpac's

Suffering from similar issues

ANZ assuming more mortgage risk

It's not surprising then that ANZ is gaining market share in New South Wales and Victoria, where growth has been the strongest and property prices are the highest. Investors in particular are prepared to borrow heavily to get on the property ladder while interest rates are low. Remarkably, 35% of ANZ's loans are interest-only, which is why we don't see the RBA increasing interest rates much over the next decade despite many homeowners and investors being ahead on their loan repayments.

ANZ's net interest margin – the spread the bank keeps between the rates it offers on loans and pays on deposits and borrowings – has fallen from 2.09% (adjusted for currency movements) to 2.04%. Only two basis points relates to cutting loan rates, with the markets and treasury divisions responsible for three basis points. Just like Westpac, ANZ is finding it difficult to park and move money profitably while interest rates are so low.

| Six months to 31 Mar 15 | Six months to 31 Mar 14 | /- (%) | |

|---|---|---|---|

| Revenue ($bn) | 10.2 | 9.7 | 5 |

| Cash Earnings ($bn) | 3.7 | 3.5 | 6 |

| Cash EPS ($) | 1.34 | 1.28 | 5 |

| Return on equity (%) | 14.7 | 15.5 | -5 |

| Dividend ($) | 0.86 | 0.83 | 4 |

| Interim dividend | 86 cents fully franked, ex date 8 May | ||

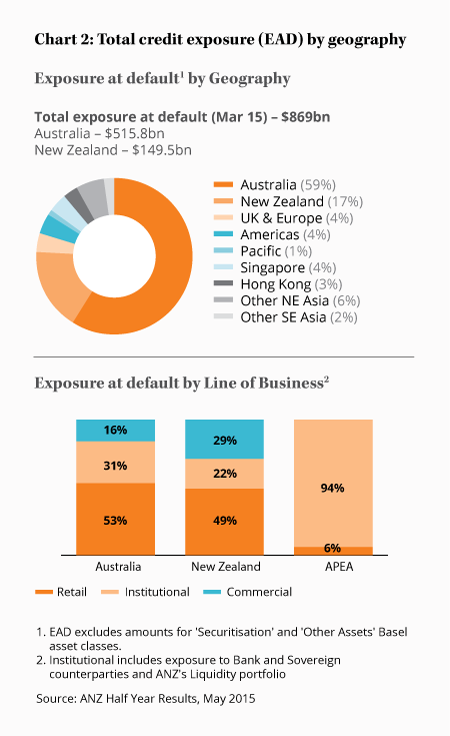

In contrast to its Australian franchise, ANZ's Asian business is focused on clipping the ticket on low-risk transactional flows. What it does lend is mostly to institutions (see Chart 2), which we expect is only for short periods.

That's why ANZ hasn't recently suffered billions in losses like Asian-focused rival Standard Chartered. Standard Chartered sailed through the GFC as China unleashed the world's largest stimulus package, but recently loans have soured as China's growth has slowed and commodity prices have fallen. ANZ's bad debts increased recently suggesting they have bottomed after falling since the GFC, but they remain very low.

Management doesn't split out return on equity for Asia as it's well below what it achieves in Australia. That's not a major issue, but we're keeping an eye on Asian lending as corporations often borrow large amounts and a downturn in Asia is likely to run parallel with one in Australia, offering little protection.

Staying the course

Despite ANZ suffering from many of the same trends as Westpac, including minimal business lending growth, low interest rates, stricter regulatory capital rules on the way, return on equity falling from 15.5% to 14.7% and macroeconomic headwinds hitting ANZ's institutional banking division, chief executive Mike Smith hasn't walked away from his target of increasing return on equity to 16% by the end of 2016.

| Division | Six months to 31 Mar 15 ($m) | Change from prior six months (%) |

|---|---|---|

| Australia | 1,602 | 2 |

| Int'l & Institutional Banking | 1,459 | 9 |

| New Zealand | 566 | 7 |

| Global Wealth | 259 | -16 |

| GTSO & Group | -210 | 50 |

| Total | 3,676 | 2 |

If Smith is successful, earnings and dividends should increase and it could coincide with the announcement of his departure following a pretty successful tenure (albeit one for which he has been paid accordingly).

In contrast to Westpac, which is underwriting its dividend to help raise $2bn to meet impending capital requirements, Smith will consider selling businesses to raise capital if necessary. ANZ's dividend reinvestment plan is operating with a 1.5% discount in the interim.

ANZ's share price is essentially where it was 18 months ago and our preferences among the big four remain Commonwealth Bank and Westpac as they continue to benefit from their dominance of the Aussie market. But if you're comfortable with the extra risk of owning ANZ then sit back and enjoy the dividends, and hope the architect of ANZ's super-regional strategy Mike Smith hangs around for a while yet. SELL.

Note 1: Our maximum recommended portfolio limit for the banking sector is 20%, although conservative investors might consider a limit of less than 10% at current valuations, particularly if you have other large exposures to residential property.

Recommendation