An eye on international LICs

Key Points

- Five ASX listed LICs offer broad international share exposure

- Each trades at substantial discounts to the value of the underlying shares

- Shareholders benefit from long term power of compounding plus upside if performance attracts the attention of new investors

Background

In LICs) often trade at a discount to their net tangible assets (NTA), the value of the shares in which they invest. LICs investing in overseas shares trade at larger-than-average discounts. If you want to add some international flavour to your share portfolio, they’re worth a look.

| Company/Fund | ASX Code | Security Type | Market Cap 30/6/12 ($m) | Manager | Performance | Management Fees | Listing Date | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MER% | Outperf? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

managed fund than an index fund or ETF. We suggest a read of the earlier article if you’re not familiar with them. Table 1 shows the dividend yield than if you bought the managed fund (which trades at NTA).

Over the long term the compounding effect of earning a higher dividend yield, and re-investing at a discount, can add up. This benefit is not as great with international LICs (due to their low yields) but they do offer the potential bonus of good performance increasing the value of the underlying shares and reducing the NTA discount, as investors take more interest. Magellan Flagship Fund’s great performance over the last 12 months has seen its NTA discount drop from 17% to 4%. Owning the underlying shares would have produced a 26% return but the LIC shares have returned about 45%. Like an actively managed fund, with an LIC you’re backing the manager. The best way to get an understanding of their approach is by reading the monthly performance reports (see links provided).

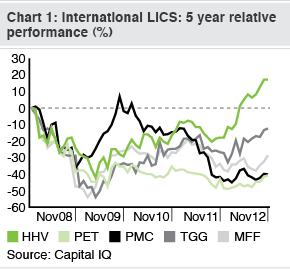

Remember also that these LICs aren’t index huggers. There will be periods when they will significantly outperform or underperform their benchmark index. As Chart 1 shows, returns will vary. Indeed, it is that that allows us to buy them at such a discount. Just make sure you diversify your exposure rather than relying on one LIC to ‘go international’. Let’s now introduce the five LICs, although please understand these are not specific recommendations, just general pointers for those looking for international exposure. Hunter Hall Global Value Limited (HHV)HHV is managed by Hunter Hall, a value-focused manager, applying an ethical screen to its investments (it doesn’t invest in weapons or tobacco manufacturers, for example). Its global portfolio includes Australian and New Zealand securities, accounting for almost a third of its investments (as of 31 Oct 12 according to the performance report). The investment strategy of HHV is similar to that of the Hunter Hall Value Growth Trust. The benchmark index for both HHV and the Value Growth Trust is the MSCI World Total Return Index (Net), in Australian dollars. So the manager benefits from a devaluation of the Aussie dollar, providing an incentive to keep the natural foreign currency exposure. For investors seeking to diversify into foreign currencies this is attractive, although the manager can enter into hedging contracts to manage their foreign currency positions. At of 31 Oct 2012, HHV has indicated that 48% of its currency exposure is hedged, leaving a reasonable portion of the portfolio exposed to AUD movements. Magellan Flagship Fund Limited (MFF)MFF may appeal to those keen ‘short’ the AUD in a more powerful way. Magellan’s managers are quite bearish on the AUD (see 31 Oct 12 performance report) and the company has quite a high level of cash, all held in foreign currency. Borrowing is allowed (up to 20% of the fund) and its AU$77m of borrowings (at 30 Jun 12), more than offset by foreign currency holdings, increases the potential to benefit from a fall in the local currency. The manager, Magellan Asset Management, also runs the successful and popular Magellan Global Fund. Whilst the strategies and portfolios aren’t identical, they are similar. Many of the same names appear on the top 10 holdings lists and both portfolios are up over 20% over the last 12 months. Similar to HHV, MFF is benchmarked against an AUD-denominated index—the MSCI World ex-Australia index (the exclusion of Australia reflects MFF’s international focus). Platinum Capital Limited (PMC)PMC’s portfolio is invested in a manner similar to its flagship Platinum International Fund. Like MFF, PMC may be attractive if you want to diversify away from the local dollar as it holds little in the way of Australian shares or dollars. The manager, Platinum Asset Management, was established by Kerr Nielson, a renowned value investor and one of the major shareholders in PMC. According to the 30 Sep 12 quarterly report, more than half of PMC’s portfolio is invested in North America and Europe. If you’re considering US or European funds or ETFs, it might be worth a look. Like HHV, PMC’s benchmark is the AUD denominated MSCI World Index (net). Peters MacGregor Investments (PET)PET is quite a different beast. Even by LIC standards, it’s very small with little liquidity. The portfolio is also concentrated in relatively few stocks (12 shares and one alternative investment at 30 June 12). Finally, a lot of the currency exposure is hedged, so it doesn’t ride the waves of AUD movements to the extent of some of the others. If you’re not actively seeking the currency exposure, this last factor might be a selling point. The other big positive is that PET currently trades at a massive 23% discount to NTA. There’s a lot of potential upside if performance goes well and investors start taking notice, plus the 2-cent fully franked dividend gives it a (grossed up) yield of 3.25%pa PET is managed by Peters MacGregor, a boutique fund manager focused on long term value investing. We spoke with Peters MacGregor and they advised that they manage the portfolio consistent with their individual managed accounts (their core business). The 30 September quarterly report provides a good snapshot of the holdings and outlook. PET is benchmarked against the MSCI World Total Return Index (net local). Unlike the AUD denominated indices, this index seeks to separate the underlying share price moves from currency movements, reflecting Peters MacGregor’s approach of hedging a large portion of their currency exposure. Templeton Global Growth (TGG)Like PMC, TGG has more than half its fund invested in US and Europe (with a larger allocation to Europe as at 31 Oct 12). The manager, Franklin Templeton Investments Australia, doesn’t hedge the currency exposure, making TGG another candidate for the ‘short AUD’ crowd. Its holdings are similar to those in its unlisted international share funds (Templeton Global Trust Fund, Templeton Global Equity Fund and Franklin Global Growth Fund). The 2012 Investment Manager Report offers an overview of holdings and strategy. An attraction of TGG is its large discount to NTA (15% at 31 Oct 12). If you are considering venturing into European shares, its overweight allocation to Europe makes it worth a look. Again, it benchmarks performance against the MSCI World Index, in AUD. The pitfallsInvesting in LICs comes with risks; Discounts to NTA can vary over time; Management may change or behave unexpectedly; Tax on capital gains may get realised; and laws may change. The case for LICs expands on these risks. Slippage risk is higher with international LICs. Managers, competing on a global stage, may stray further from their benchmark indices in the effort to get outperformance. Plus there’s the potential for currency movements. These LICs are far more like managed funds than ETFs—higher risk but higher potential return. Dividends also tend to be less regular, although partially due to a lack of performance of international shares in recent years. In a nutshellThese international LICs won’t simply track the MSCI World Index like an ETF or index fund. But they are worth a look as an alternative to owning overseas shares directly or investing in an actively managed fund. The current NTA discounts may not ever close but these LICs provide investors the opportunity to gain more share (and dividend) exposure for their buck, plus some upside if investors start taking more of an interest. IMPORTANT: Intelligent Investor is published by InvestSMART Financial Services Pty Limited AFSL 226435 (Licensee). Information is general financial product advice. You should consider your own personal objectives, financial situation and needs before making any investment decision and review the Product Disclosure Statement. InvestSMART Funds Management Limited (RE) is the responsible entity of various managed investment schemes and is a related party of the Licensee. The RE may own, buy or sell the shares suggested in this article simultaneous with, or following the release of this article. Any such transaction could affect the price of the share. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||