ALE Property Group: Result 2018

Recommendation

This is the endowment effect – a bias that causes us to overvalue things that we already own and feel familiar with. This is particularly relevant in investing, where it can cause you to become blind to better investments and less vigilant about the ones you already own.

It's also particularly relevant to old favourite ALE Property Group. We've owned it for a little over 6 years, over which time we've yet to see a 15% correction. In the meantime, it's tracked up steadily and has provided a steady stream of distributions – both of which make it a prime candidate for the endowment effect. With that in mind, we've taken the opportunity to revisit the investment case and see if it still stands up.

ALE: The next Google?

Protection from inflation and an attractive yield are what attracted us to the company, when we upgraded it to buy in 2012. By any definition, ALE has been an outstanding investment. The stock has returned an astonishing 22% per year since listing in 2003, trouncing its peers and the ASX All Ords. We've enjoyed the past six years of this run, with a 23% internal rate of return since our original upgrade.

These are the type of returns you expect to see from compounding machines like Google or Cochlear – not a boring-old property trust with revenue growth indexed to inflation.

That's the thing; if you only look at the past returns, you can easily forget that this isn't the next Google or Cochlear. Notwithstanding the high quality of its portfolio, this is not a business that will grow earnings at double-digit rates each year, so it's share price shouldn't either. When it comes to share price performance, it's almost certain the next 15 years will not look like the last. Importantly, it's the next 15 years that are going to be most important to today's shareholders, so that's where we need to cast our eyes.

Full-year result

To set the context for that, though, let's take a look at the year just completed.

| Year to June | 2018 | 2017 | /(–) (%) |

|---|---|---|---|

| Rental income ($m) | 58.1 | 57.0 | 1.9 |

| Total revenue ($m) | 59.1 | 58.3 | 1.4 |

| Expenses ($m) * | 33.6 | 32.2 | 4.3 |

| Property carrying value ($m) | 1,136 | 1,080 | 5 |

| Net debt ($m) | 480 | 462 | 3.9 |

| Gearing ratio (%) | 41.6 | 42.7 | (2.6) |

| Cap rates (%) | 4.98 | 5.12 | (2.7) |

| CFO | 28.7 | 29.5 | (2.7) |

| Distribution (c) | 20.8 | 20.4 | 2 |

| *Excludes hedging related expense | |||

Rental income (of which three-quarters comes from Victoria and Queensland) rose by inflation, but lower cash balances meant that total revenue growth looked more sluggish. Concerningly, non-hedging-related expenses rose three times faster than revenue due to higher Queensland land tax (which in the coming year will be increasing to 2.5% from the current level of 2%) and elevated management fees. Management fees should subside, though, following the completion of market rent reviews taking place in the coming year.

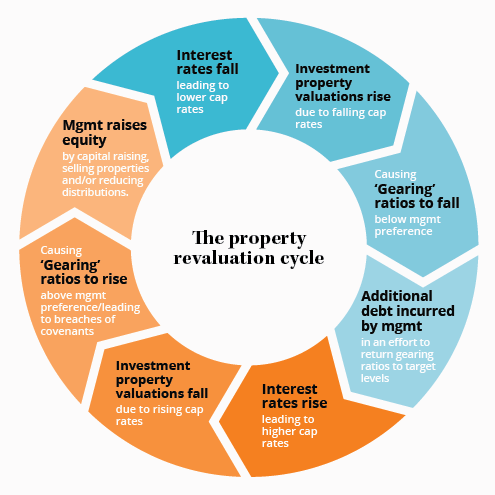

Net debt increased, but gearing fell to an all-time low, the result of upward revisions to property values. The property valuations remain conservative, which explains ALE's sizable premium to net tangible asset value. The rising book value of the property portfolio reflects increasing rental income and lower cap rates.

Current debt remains fully hedged until the end of 2025, with maturities spread over that period. Rate risk will reappear some time before 2020, when a little over 40% of ALE's debt is set to mature. Distributions rose again this year, with management signalling that it expects 2019 distributions to be 50% tax-deferred.

The company provided scant detail on the market rent review that's currently underway, highlighting that not all properties will receive the full 10% uplift that's up for grabs.

Looking forward.

ALE owns some of the best real estate in the country. It also boasts one of the best tenants in the country; with all 86 pubs leased to ALH, which is 75% owned by Woolworths. The terms of the contracts are equally appealing because ALE is not responsible for routine costs or capital expenditure on the properties. The contracts guarantee that rents will rise in line with inflation every year, as measured by the consumer price index (CPI), with market rent reviews every 10 years.

It gets better, though, because ALE's finance costs are fixed in the short to medium term. During periods of heavy inflation, revenues will rise but costs won't keep up – at least until the next debt refinancing – meaning that much of any incremental gain in revenue will fall through to the bottom line.

The free capital expenditure, though, remains the key benefit. Not only is free cash flow more reliable, but any upgrades to properties are at the cost of ALH despite the property reverting to ALE at the expiration of the lease. To date, Woolworths has invested hundreds of millions improving ALE's properties, refurbishing outdated pubs, completely rebuilding others, restoring accommodation facilities and installing 23 Dan Murphy's.

That's great news for ALE. Rents average around 40% of a pub's earnings before interest, tax, depreciation, amortisation and rent (EBITDAR), so every new dollar of EBITDAR generated by a new Dan Murphy's or hotel room on ALE's property increased the potential market rent by 40 cents – which sets us up for a mouth-watering rent review come 2028. So, what's the catch?

Distributions at risk

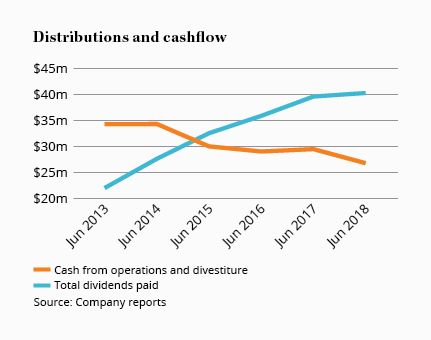

Well, there's a few, the first being distributions. Management has highlighted that a key capital management priority is growing distributions by at least CPI. ALE should be able to sustainably distribute its cash flow from operations, plus or minus the cash it raises or spends on the sale or purchase of new properties (which have been negligible since the 2016 financial year).

In fact, it's actually a little less than that figure, because about a third of ALE's debt carries no cash-interest which isn't reflected in the statement of cash flows. Despite being somewhat flattering, cash flow from operations should be a good proxy for distributable earnings.

This year, ALE distributed a whopping 150% of cash flow from operations. Even if we assume rental income is set to grow by 8% following the market rent reviews, the only way to grow distributions from here is to use remaining cash or issue new debt. Indeed, at 42.1% gearing – it's likely to be a combination of the two, and there should be no problem with that if interest rates remain low.

Our fear is that levering up to pay distributions leaves the company more vulnerable to a rise in interest rates. We're not saying that is about to happen, but we're closer to that point today than we have been since the rate cutting cycle first began. Higher interest rates lead to higher gearing – meaning debt-financed distributions may be crimped or severely cut.

In a worst-case scenario where rates rise far enough, ALE may need to raise equity to avoid breaching debt covenants. There's also the double whammy from higher long-term financing costs. Regardless, payout ratios like this suggest a rise in interest rates could endanger distributions.

Pubs face headwinds

The bigger problem in the long term is growth. In rough terms, more than half of pub profits come from poker machines, with another third from retail liquor sales. The small amount left over is made up of bar sales and accommodation, with some pubs using bar sales to attract customers to gaming machines. ALH was recently caught up in the news for offering free meals and drinks to keep its 'best' gamers on the machines.

Ethics aside, a business that relies on generating half its earnings from highly addictive, socially destructive poker machines is at risk of regulatory changes, higher taxes and the effects of education campaigns – not to mention a shift towards online gaming and other forms of gambling.

Indeed, the Victorian government has made a move towards the mandatory roll-out of pre-commitment technology, which gives gamers the ability to set up a gambling limit before beginning. The threat to earnings from poker machines is obvious, and it's supported by the numbers.

In Victoria, where ALE earns half of its rental income, losses on gaming machines (a huge number of which ALH owns) have stayed flat since 2009. The picture is similar in Queensland, where losses have only slightly outpaced inflation. Then there's per capita losses on gaming machines in Victoria and Queensland. After adjusting for inflation, they've fallen by 30% and 20% respectively from their peak early to mid 2000's. People are clearly wising up.

And it's hurting pubs. Over the past ten years, revenues earned across all pubs in Australia have grown at just 1.5% per year. Over the past four, sales have been basically flat. Granted, ALH is one of the industry's best operators, so we'd expect them to do better than average. On a per pub basis since 2013, ALH has grown EBITDAR by a shade under 3.5% per year in nominal terms. But that's still less than GDP growth – a worrying sign given the amount of investment that's been undertaken at these sites.

If pubs do fall behind GDP growth over a long period of time, it's likely the properties will eventually be repurposed. These are premium locations after all – so a block of apartments would probably sell for a princely sum. But right now, these are pubs on long-term contracts, so we need to value them as such.

Taking inflation of 2.5% and adding that to the stocks current cash flow yield of 2.7% gives a potential return of a little over 5% (assuming you hold forever and nothing changes). This of course excludes the value of any market rent reviews. On that basis, the current price means that growth in the underlying pub business is the key here and, given the aforementioned risks and the concerns around slow growth, we're lowering our Sell price a little. However, the stock remains a HOLD.

Note: The InvestSMART Australian Small Companies Fund and the Equity Income Portfolio own shares in ALE Property Group. You can find out about investing directly in Intelligent Investor portfolios by clicking here.

Disclosure: The author holds ALE Property Group via units in the InvestSMART Australian Small Companies Fund.

Recommendation