Adding a fresh coat to Dulux

Recommendation

Dulux's famous Old English Sheepdog has finally gone into retirement, and after 350 dog years you'd have to say he's earned a rest. Replacing him are the quirky scientists from Mythbusters, who front Dulux's latest campaign for the launch of its new Wash & Wear paints.

Along with its namesake paints, Dulux owns brands such as British Paints, Selleys, Yates, Lincoln Sentry and Garador, many of which are aimed at the premium section of their respective markets. These are the company's major sources of value and high-profile advertising campaigns are essential to keeping them fresh in consumers' minds.

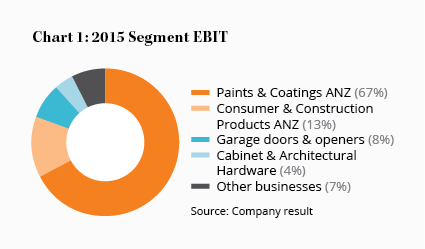

The brands are spread across five segments that do business throughout Australasia and Asia, with 82% of sales in Australia and 11% in New Zealand. The company's Paints & Coatings segment – which contains the flagship Dulux brand – is its biggest by far, contributing 51% of sales in 2015. With an operating margin of 16.9%, the segment's profit contribution was higher still, at 67% of earnings before interest and tax (EBIT) in 2015 (see Chart 1).

Key Points

Stable of well known brands

More cyclical than it appears

Adding to coverage list

Strong competitive position

These high margins are the result of Dulux having the largest share of the Australian architectural and decorative paints market, which it dominates along with competitors Wattyl and Taubmans (owned by US-listed Valspar and PPG Industries, respectively). Dulux minimises the effect of price competition from Wattyl and Taubmans by positioning its brands at the premium end of the market.

As a result, this business has generated high returns on invested capital for many years, both before and after Dulux was spun off from Orica in 2010, and these high returns have attracted many new competitors over the years. Yet successfully competing has proved very difficult, with companies ranging from Nippon Paints to Benjamin Moore – owned by Warren Buffett's Berkshire Hathaway – suffering major losses and having to leave with their tails between their legs.

As a result, this business has generated high returns on invested capital for many years, both before and after Dulux was spun off from Orica in 2010, and these high returns have attracted many new competitors over the years. Yet successfully competing has proved very difficult, with companies ranging from Nippon Paints to Benjamin Moore – owned by Warren Buffett's Berkshire Hathaway – suffering major losses and having to leave with their tails between their legs.

Whilst foreign paints are formulated differently to Australian paints, a bigger reason for their failure is that consumers tend to purchase paint by brand. Most customers aren't in a position to objectively judge Dulux's claims that its new Wash & Wear brand is 'the biggest technology breakthrough in 20 years' but instead purchase Dulux paint based on their familiarity with the brand and its reputation for quality.

Along with customers not knowing or caring how much a litre of paint costs to manufacture and whether they're being overcharged, this enables Dulux to charge premium prices.

The power of the Dulux brand also helps it negotiate on a more equal basis with powerful customers such as Wesfarmers-owned Bunnings, which began stocking Nippon Paints in 2009 only for it to be a dud with customers.

Limited growth

As well as the significant investment required in manufacturing and distribution facilities – or in an efficient supply chain if importing paint from overseas – new entrants need to spend considerable sums on marketing to introduce their brands to consumers and convince them that they are of equal quality to the incumbents' products.

So the economies of scale in production, distribution and marketing mean that Dulux, Wattyl and Taubman's are likely to continue to dominate this market for many years. However, Dulux's strong market position and high returns on equity mask the low growth potential of this market, with volumes expected to grow at just 1-2% per year over the long term. Moreover, applying a new coat of paint to your home is discretionary in nature and so can be postponed, potentially for years, if needed, potentially imposing wide swings over this long-term trend.

This means that to achieve significant profit growth Dulux must either increase market share or cut costs, but its already high market share and margins suggest this will be difficult.

The lower Australian dollar will also make it hard to increase margins, since 30-40% of inputs – such as titanium dioxide and latex resins – are imported and priced in overseas currencies. In the long term, however, the company's brand and premium nature should enable it to pass any cost increases on to customers as it has done in the past.

New housing booming

The low growth nature of Dulux's main business has led management to pursue growth in other areas, with its biggest purchase since listing being that of Alesco in 2013. This brought brands such as B&D Doors, Lincoln Sentry and Parchem into the Dulux stable. Together with the boom in new housing approvals and construction, this has led to sales from building and construction (including new housing) rising to 30% of revenue, from 20% in 2009, with new housing representing half that figure.

| Year to 30 Sep | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|

| Revenue ($m) | 996 | 1,068 | 1,485 | 1,611 | 1,688 |

| Operating income ($m) | 72 | 116 | 134 | 174 | 174 |

| Net profit ($m) | 93 | 86 | 64 | 103 | 111 |

| EPS (cents) | 26 | 24 | 20 | 28 | 29 |

| DPS (cents) | 15 | 16 | 18 | 21 | 23 |

| Dividend yield (%) | 3.6 | 3.6 | 3.6 | 3.6 | 3.6 |

Unfortunately, the new housing business has lower margins and is more cyclical than the revenue earned from maintaining and improving existing homes, which has in turn fallen to 65% of revenue, from 75% six years ago. This is despite assistance from declining interest rates, the easy availability of housing finance and the booming property market.

These beneficial influences have recently been slowing and are perhaps starting to reverse, and with new construction also close to the top of the cycle, the stock's multiple of 20 times 2016 underlying earnings and 3.6% yield (fully franked) leaves little margin of safety.

Nevertheless, this is a high-quality albeit slow-growing company with a number of excellent brands. The balance sheet is robust, with net debt of $280m and an interest bill that's covered about ten times by EBIT and 6.5 times by free cash flow. That free cash flow will be reduced by about $60m a year over the next couple of years by capital expenditure on a new paint factory and distribution centre, but should stabilise from 2018.

We're adding Dulux to our coverage list and will hope for an opportunity to upgrade at lower prices. For now, HOLD.

Recommendation