Add oOh!media to your watch list

Recommendation

The media business is being disrupted. Television audiences are splintering into smaller groups; magazine readership has collapsed and newspapers – well, we all know what's happening there.

While traditional advertising mediums struggle, two forms of advertising stand out for the growth in their audience numbers and share of the marketing pie: online advertising is the obvious choice; out of home advertising is the more surprising winner.

It's a trend that is so well hidden that oOh!media, the market leader in outdoor advertising in Australia, had to reduce its offer price by 28% before floating last year.

Key Points

Outdoor ad sector is growing

Digitisation of assets can increase margins

Decent business, a tad too dear

We often steer clear of private equity floats but it is worth peering closer at the out of home ad market and the fortunes of its largest participant.

Ad changes

Table 1 tells an amazing story. Ten years ago, newspapers and television commanded over 60% of advertising revenues. Online advertising accounted for just 2.4% of total ad spending and outdoor media 3.1%. Over the decade, newspaper revenues have collapsed, print directories have all but disappeared and magazines have been savaged.

| 2003 | 2013 | Change | |

|---|---|---|---|

| Newspapers | 34.3 | 17.8 | -48% |

| Print directories | 13.1 | 5.3 | -60% |

| Magazines | 8.5 | 4.7 | -45% |

| TV | 30.3 | 29.9 | -1% |

| Radio | 7.6 | 7.7 | 1% |

| Cinema | 0.7 | 0.8 | 14% |

| Online | 2.4 | 29.8 | 1142% |

| Outdoor | 3.1 | 4.1 | 32% |

Online now vies with television as the biggest destination for ad dollars. Although outdoor advertising growth hasn't been as spectacular, it is taking market share from other sources and now accounts for 4.1% of the ad market.

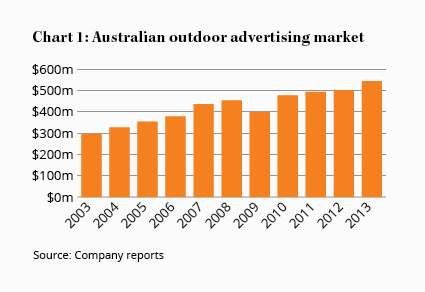

Importantly, as audience numbers in other mediums fragment, outdoor audiences are growing at 6% per annum and revenues are growing at twice the rate of traditional advertising (see Chart 1). If the previous owners of oOh!media were looking for a nice story to tell, they've found one here.

Digitisation

The best part of the narrative isn't about growth, it's to do with digitisation. Just think what happens to utilisation rates when a static board is replaced with a digital screen and what this means for revenue.

Traditional boards carry a single advertiser for two weeks, and it can take a week or more to change content at each site. In contrast, digital screens take just 15 minutes to update and can be changed at the press of a button. Content can be changed with almost no marginal cost, so businesses can do away with crews to take down signs and put up new ones. A digital portfolio, although more expensive to construct, should be less capital intensive over time.

Digital boards also make it possible to draw in audiences with touch screens, moving pictures, sounds, QR codes and cameras.

One campaign launched in Melbourne, for Porsche, used a camera on a prominent billboard that would identify passing Porches and congratulate their owners on their purchase in real time.

In top locations, advertisers can be charged by the minute with different rates applying at different times to generate higher revenue from the same site. Because of all these benefits, we estimate that per screen revenues at digital sites are five times higher than at static sites. That ratio will fall as the best sites are digitised first but margins will still rise, perhaps considerably.

Overseas, businesses in the industry routinely earn EBITDA margins well over 20%; oOh earns just 16%. In oOh's largest segment, roadside billboards, an inventory of 4,000 screens includes less than 10 digital screens. With less than 30% of revenues currently coming from digital assets, a clear growth path lies ahead.

Segment results

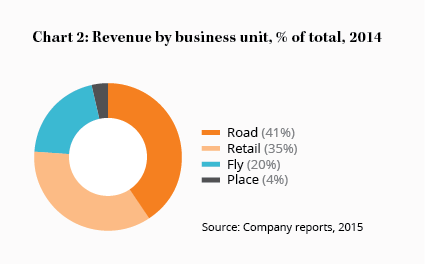

oOh operates four divisions: 'Road' operates roadside billboards; 'Fly' operates screens within airports; 'Retail' runs sites in shopping centres and supermarkets and 'Place' operates screens in sports venues, pubs, cafes, hospitals and other public places.

Roadside billboards are the most visible part of the business and they account for the largest chunk of revenue (see Chart 2).

With more than 1,000 metro billboards and 3,000 regional billboards, oOh has the largest number of boards and accounts for 44% of industry revenue. The company claims it can reach over 90% of the population in metro areas, an audience unmatched by any other medium.

Its dominance is even more entrenched in retail, where oOh accounts for over 70% of industry revenue and Fly, where it also collects over 70% of airport based revenues.

Advertisers typically seek to run national or regional campaigns so access to a network of billboards are far more valuable than the sum of their parts. Such a network is almost impossible to build from scratch. Billboards themselves are highly regulated with contracts of 5–10 years and several renewal clauses.

Most sites are leased on a long-term basis with fixed rental increases although some shopping centres charge a revenue share. Contract renewals depend on competition, and here there is good news for industry incumbents.

Cosy competitors

The industry, like so many in Australia, is a cosy oligopoly where the top four firms account for about 80% of revenue, about the same concentration as the Big Four banks. Even better, the incumbents typically specialise in different forms of outdoor advertising.

oOh!media dominates airports and retail; APN dominates rail and transport; JCDecaux is top dog in street signs and furniture. With competitors each focused on self-imposed niches, competition is surprisingly tame.

This is evident from lease renewals. An incumbent generally owns site infrastructure and usually commands an advantage when leases are renewed but, even so, the overwhelming majority of sites are renewed by the incumbent and many sites aren't even put to open tender. Competition does exist, especially for top locations, but it isn't as fierce as many would expect.

Valuation

Favourable industry conditions and a clear growth path are only attractive if they haven't been counted in today's price. To see if that's the case, we need to estimate earnings for the business, which we present in Table 2.

| FY2013 | FY2014 | FY2015E | FY2016E | FY2017E | |

|---|---|---|---|---|---|

| Revenue | 250 | 261 | 273 | 285 | 298 |

| EBITDA | 33 | 42 | 46 | 49 | 54 |

| Depreciation | 14 | 14 | 14 | 14 | 15 |

| Amortisation | 10 | 9 | 11 | 11 | 12 |

| EBIT | 9 | 19 | 22 | 23 | 27 |

| Reported NPAT | -4 | 9 | 12 | 13 | 16 |

| Adjusted NPAT | 6 | 18 | 23 | 25 | 28 |

| Reported PER (x) | n/a | 40 | 31 | 28 | 23 |

| Adjusted PER (x) | 66 | 20 | 16 | 15 | 13 |

We estimate revenue growth of 4.5% per year for the next three years and EBITDA margins that rise from 16% to 18% over that time. In such a scenario, NPAT would rise from $9.2m last year to $16m in 2017. Although a prospective PER of over 25 in three years' time doesn't sound appealing, we need to make adjustments to that profit number.

oOh!media has made 27 acquisitions over the past decade. Each time it buys a competitor, it takes over site leases and pays a rent expense defined by those leases. On its balance sheet, however, it must record the market value of leases even if it is paying lower rents. The difference between market price and actual price is recorded as an asset on its balance sheet and amortised over time.

Amortisation in this case is largely an accounting expense rather than an operating one. Internally-owned leases create no such asset, so the amortisation charge largely reflects an acquisition strategy rather than a real cost.

While rents will no doubt rise, that is true of its internal assets too which attract no amortisation. We think amortisation should be added back to profit and have done so in our 'adjusted NPAT' line. That changes the valuation a lot.

Last year's profit rises from $9.2m to $18.1m and, by 2017, adjusted profits should rise to about $28m. That translates to a PER of 22 today and 14 in 2017. For a business with a clear growth path, that sounds reasonable. Doesn't it?

Perhaps not. We don't doubt that digitisation will generate higher profits within the industry. We wonder, however, whose pockets those profits will ultimately line. Despite limited competition, site owners can still demand a greater share of profits through rent increases. The fact that market rents are above contracted rents suggests this may be happening already.

A little lower

Although oOh!media is a decent business, investors should consider that it can never earn outsized returns because site owners can demand a higher profit share. For that risk we demand a higher margin of safety.

At around $2.20, the stock would trade at 18 times last year's earnings and about 11 times 2017 earnings. That target is just 17% from today's price but represents a far more favourable risk-reward equation.

oOh!media is worthy of your watch list and we think we have a shot at upgrading it at some stage. It's a classic illustration of how an out-of-favour sector can yield interesting ideas for the patient. HOLD.

Recommendation