A tale of two capitalisms: Telstra vs the banks

Well-schooled by PR flaks and media-savvy consultants, CEOs welcome competition in public.

In private, they spend their working lives dreaming up ways to eliminate it. This is not a criticism. A CEO's job is to build the profitability of a business over the long term. Achieving pricing power over customers and suppliers is one way of doing so.

These are the businesses investors want to own. If late payment fees on our credit card bills are the price of dividend and share price growth over two decades, hands up who isn't happy to pay it?

If that doesn't appeal, the promise of competition offers psychological balm. Other profit-maximising CEOs have the same goal. The theoretical result is a never-ending struggle for market dominance that delivers product innovation, competitive pricing and better services for customers.

This week we've seen one industry support this theory and another defy it.

In Australia between 1990 and 1995 there were 129 bank mergers, triple those of Canada, our nearest “comp” in the lingua franca of finance. A big number, for sure, but the party was only getting started. In the five years from 1996 everyone was up and dancing. There were 389 mergers in this period, more than in any other country except the UK and US.

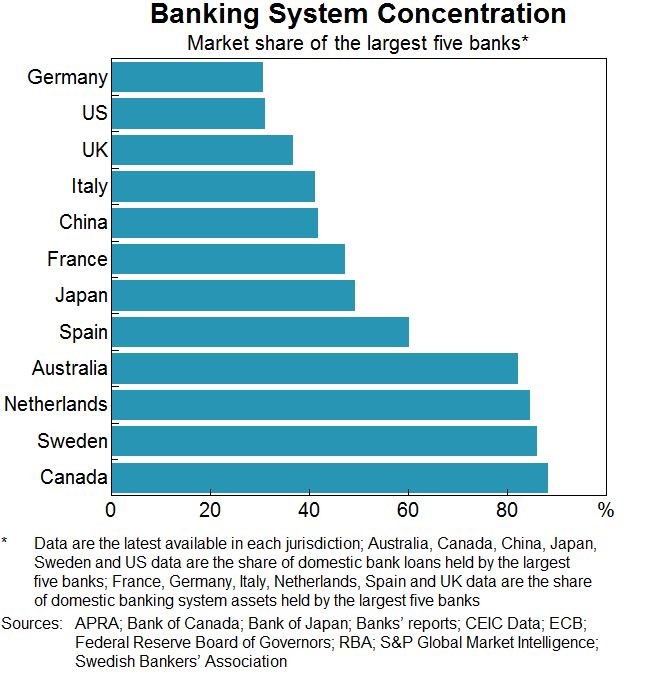

Unsurprisingly, the after-party barely registered. Between 2002 and 2007 there were just 31 mergers, largely because there wasn't much left on the shelf. The result is one of the most concentrated banking sectors in the world:

Source: RBA, House Representative Standing Committee on Economics

Accusing bank CEOs of using acquisitions as a way of achieving market power is like remonstrating with a cat over a dead bird. Capitalism is defined by its instincts. A board's primary obligation is to act in the best interests of shareholders, within the confines of the law – an important caveat.

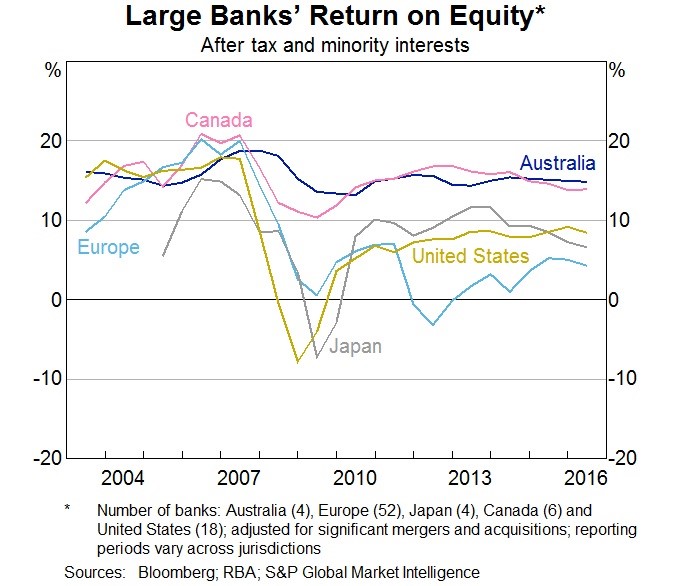

On this measure bank boards have done a fine job.. Australia has one of the most profitable banking systems in the world:

Source: RBA

Our banks are at least twice as profitable as those in the US and Europe. In Canada, with similar levels of concentration, banks reap similar levels of profitability. Which is to say increasing concentration has probably (one can never be sure of these things) delivered pricing power to the major banks.

Now, please arrest your outrage; this isn't capitalism acting alone. Every bank acquisition requires approval from the Australian Competition and Consumer Commission and the Australian Prudential Regulation Authority. Section 50 of the Trade Practices Act prohibits a merger if it has the effect of “substantially lessening competition”. And there's a national interest test under the Financial Services Shareholding Act. There's plenty in the regulators' toolkit if they wanted to block a deal.

Generally, though, they haven't. The sector consolidation that saw St George Bank, Advance Bank, BankWest, Bank of Melbourne, State Bank of NSW et al fall into the warm embrace of ANZ, NAB, Westpac and Commonwealth Bank faced few roadblocks.

Instead of preventing deals, regulators have danced toe-to-toe with the banks, waving through each acquisition, aware of the evidence that increasing concentration reduces competition but being unwilling or unable to do much about it.

There are three reasons why. First, regulators must enforce the bipartisan four pillars policy. Big banks taking over smaller ones aren't affected by this policy. As long as regulators maintained the four pillars, believing it was enough to deliver a competitive market, every other merger wasn't a problem.

Second, no regulator wants a banking crisis on their watch. They are less concerned with competitive issues than systemic stability. Having smaller institutions absorbed into the big four made a crisis less likely because, like a teacher with a smaller class, it permitted a greater focus on the biggest banks.

Third, the implied government guarantee that supports too-big-to-fail banks lowers their funding costs relative to smaller counterparts. The Reserve Bank calls it “an unexplained funding advantage over smaller Australian banks of around 20 to 40 basis points on average since 2000”.

Are regulators right to believe the banking system is safer as a result of increasing concentration and astonishing profitability?

There's evidence the four pillars policy has worked. In Australia and Canada, regulations limit the asset size of major banks and prevent hostile takeovers. Banks in both countries survived the Global Financial Crisis in good shape. Many think the policy environment played a major role. One might also argue the banks were indirectly bailed out by China's huge stimulus that produced a surge in commodity prices. It's an open question.

What isn't in doubt is the unlikely coalition of interests the approach has formed. The big four banks have been allowed to consolidate to the point where they now control almost 90 per cent of the market, leading to world-beating levels of profitability, record CEO bonuses and rising dividends. As long as this helps banks to meet increasing capital requirements and bolster systemic stability, regulators appear not to mind. In fact, this might be viewed as the price of financial stability, if indeed that's what we get down the track.

The findings of the Royal Commission are unlikely to much change this. Fines will be levied, business models will be tweaked (or offloaded altogether) and the shame might deepen. But the big four's dominance over the banking system will endure, because that's the way the regulators like it. The alternative – breaking up the banks – is barely mentioned.

Of course, events demand that something must be seen to be done and the banks have prepared for it.

On Thursday, news broke that Commonwealth Bank will levy a “regulatory reform fee” of $102.50 a year on some superannuation and pension fund members, potentially raising $80 million from Colonial First State customers alone. Other banks are expected to follow suit.

In a genuinely competitive market a substantial portion of this compliance cost would be absorbed. It is revealing that it is instead being imposed on customers, and so quickly. That's what happens when you have genuine market power in a sector where regulators view a concentrated market and high returns on equity as beneficial, although the bankers' union – the Australian Bankers Association – engaging in its unique form of collective bargaining obviously helps.

One final point before moving on. Every company wants to minimise compliance costs. A large company, able to spread the cost over a broad customer base, can do so more easily than a small one. Regulations equally applied across a sector might be a pain, but they enhance the competitive advantage of the big banks.

That's the big picture. The smaller one is that the Royal Commission might produce a buying opportunity. Having recently lowered the buy price on Commonwealth Bank to $63, there's a chance we may soon be able to add it to the Buy List.

While competition in the banking sector may look like a race between Usain Bolt and a one-legged bloke pulling a truck with a flat tyre, in telecommunications it's more like 200 seagulls fighting over a chip.

Earlier this month TPG announced that its new mobile network would be available to customers free for the first six months, after which a charge of $9.99 would apply, including unlimited data. Telstra's cheapest SIM plan (BYO mobile) is $39 a month, with a whopping 2GB of data.

The news shocked even Gaurav Sodhi, our telecoms analyst, and would have landed like a blue whale on a packet of Iced Vovos around Telstra's board table (tell me if these analogies are wearing thin).

We got off lightly, backing out of our buy on amaysim but reiterating our positive view of TPG. Telstra is not so lucky.

As Gaurav wrote in his review this week: “Average revenue per user (ARPU) has already fallen and we think it has a long way to go. TPG and other competitors could force ARPU to fall from $65 today to below $50 and we expect EBITDA margins to crumble from 40 per cent to 30 per cent. That will have a calamitous impact on profit, which would fall from over $4bn today to less than $3bn. And that is from Telstra's best business.”

Source: ASX

The market had been pricing in falling mobile margins. The company's share price had fallen from $4.49 a share in early June last year to $3.26 on the 8th of this month. Since TPG's announcement the following day it has fallen a further 12 per cent per cent to $2.87.

Welcome, dear investor, to genuine, arduous, frightening competition, and no regulator in sight. Telstra looks cheap at under eight times historic earnings but, as Gaurav says, “This is no bargain and now is not the time to start piling in.”

A few years back, when yield was everything, many investors put the big banks and Telstra in the same bucket. Both enjoyed dominant market positions and high margins, had prominent, well-known brands and supposedly reliable, attractive yields. In truth, they were living in different worlds. Yield is just a number; behind it many stories lie.

Enjoy your weekend (and those excess data charges, because neither will last).