A-REITs expensive on almost every measure

Recommendation

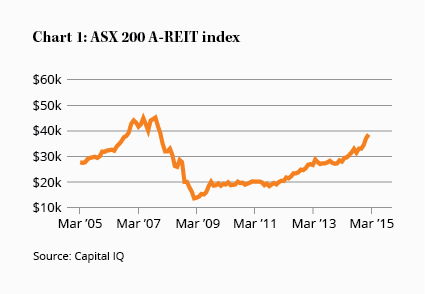

Australian Real Estate Investment Trust (A-REIT) shares have been highly volatile over the past decade, as Chart 1 shows. Ably assisted by the liberal use of debt, they boomed in the pre-GFC years when many raised capital to conquer the US and Europe. This rash bout of collective stupidity had a predictable end.

The subsequent decline in property values decimated the sector, resulting in large capital raisings and plummeting share prices. This was once a happy hunting ground for many members, especially those that followed our positive recommendations on their hybrid securities. But now A-REITs are booming again. Low interest rates have forced investors out of term deposits and government bonds into higher-yielding shares, including A-REITs. For that reason, you won't find any bargains here.

What you will find, though, are plenty of easily valued, expensive stocks. By adding an A-REIT's net tangible assets (NTA) to the estimated value of any funds management or development business and then comparing the result to the share price, you'll get a good indication of whether to buy or sell.

Key Points

Sector has outperformed due to low interest rates

Most A-REITs expensive

Higher interest rates a risk

Having completed this exercise for 24 stocks in the sector we can confidently say that if you're looking for A-REITs to buy you can move on. Quite simply, there aren't any cheap stocks in this group. Don't waste any more of your time reading on from here unless you want the company-specific details.

If you do own A-REITS you have a more difficult decision to make. The search for yield means most A-REITs are selling at a premium to NTA. Moreover, even this figure is inflated by property values being pushed up by low interest rates and declining debt costs. Even the mediocre yields are unattractive, which is why our sweep of the sector reveals no Buys, six Holds and a truckload of Avoids. Let's start our analysis with the office sector.

Office A-REITs

| Company name | Market cap ($m) | Gearing (%) | Dist yield (%) | Premium (disc) to NTA (%) | Reco | Portfolio limit (%) | Potential upgrade? |

|---|---|---|---|---|---|---|---|

| Cromwell | 1,938 | 43 | 7.0 | 76 | Avoid | n/a | n/a |

| GPT Metro Office | 276 | 28 | 8.1 | 13 | Avoid | n/a | n/a |

| Investa Office Fund | 2,462 | 31 | 4.8 | 18 | Avoid | n/a | n/a |

The office markets in Brisbane and Perth continue to suffer from the end of the mining boom. Despite both having the highest capital city vacancies in the nation - 15.6% and 14.8% respectively - CBRE estimates that supply will rise by 8% in Brisbane and 9% in Perth over the next three years. That's not the kind of exposure any investor wants.

Melbourne and Sydney, where CBD vacancy rates are 9.1% and 7.4% respectively, are better placed. Here, office towers are being replaced by or converted into residential developments. Yet office supply will still likely increase significantly in Sydney over the next few years and with 5,000 apartments expected to be built in Sydney's CBD over the next five years and 20,000 either built or approved in the Melbourne CBD, vacancies are likely to remain elevated. Effective rents (face rents less incentives) are therefore likely to be subdued.

After selling its last foreign asset in Belgium, Investa Office Fund is now solely Australia focused with 59% of its assets in Sydney and 18% in Melbourne. The company's management platform is being sold by owner Morgan Stanley, which has prevented Investa from participating in the sale. Investa holds pre-emptive rights that will only be triggered in certain circumstances so it is uncertain whether it will be able to internalise its management. Either way, an 18% premium to NTA and mediocre 4.8% yield doesn't hold much attraction. AVOID.

Cromwell Property Group CEO Paul Weightman believes 'that the pursuit of yield [is] driving up asset values without appropriate provision being made for risk'. Got to love the plain speaking. True to his contrarian nature, Weightman recently purchased the Valad Europe funds management business to add to Cromwell's collection of second-tier assets in Australia. As well as increasing funds under management by over 200%, the acquisition has increased gearing to 43%, albeit with the convertible bond used to fund the purchase issued at a very low rate. At a significant premium to estimated value even after including the value of its funds management business, it remains an AVOID.

Recently floated GPT Metro Office Fund also owns a collection of second-rate business parks and office towers in Sydney, Melbourne and Brisbane. Managed by GPT Group, its 8.1% forward yield appears attractive but a tenant paying 4.5% of its rental income is suffering financial difficulties and has just negotiated the surrender of its lease. The share price offers no compensation for the risk its suburban properties face from increasing competition for tenants from higher quality, better located properties near transport hubs in eastern state CBDs. AVOID.

Retail A-REITs

| Company name | Market cap ($m) | Gearing (%) | Dist yield (%) | Premium (disc) to NTA (%) | Reco | Portfolio limit (%) | Potential upgrade? |

|---|---|---|---|---|---|---|---|

| BWP | 1,927 | 23 | 5.2 | 38 | Hold | 6 | Below $2.35 |

| Carindale | 468 | 28 | 4.9 | -9 | Hold | 3 | Below $5.20 |

| Charter Hall Retail | 1,611 | 36 | 6.2 | 22 | Avoid | n/a | n/a |

| Federation Centres | 4,397 | 26 | 5.4 | 27 | Avoid | n/a | n/a |

| Novion | 7,816 | 31 | 5.4 | 31 | Avoid | n/a | n/a |

| SCA Property | 1,321 | 36 | 5.5 | 19 | Avoid | n/a | n/a |

| Scentre Group | 20,126 | 38 | 5.5 | 23 | Sell | 5 | Below $3.10 |

| Westfield Corp | 20,054 | 41 | 2.6 | 99 | Hold | 8 | Below $7.50 |

According to JLL, average specialty store vacancies fell in all states and across all retail categories in the six months to 31 Dec 14. The larger 'regional' shopping centres have lower vacancy rates (1.1%) than the smaller, neighbourhood centres (3.9%) but all sizes experienced falling vacancies, continuing an improving trend over the past 18 months despite Australia's economy spluttering along.

Despite lower overall vacancies, long term challenges remain from the impact of online sales, which reduces the power of shopping centre owners to continue increasing specialty stores' 'occupancy cost' (specialty tenants' rent as a percentage of their revenue). A-REITs that already have a high occupancy cost are particularly vulnerable, as shown by Novion continuing to renew leases at lower rates.

Shopping centres that minimise the negative impact of online competition by becoming entertainment and recreational destinations rather than just places to shop are the most likely to prosper in future.

This is Westfield Corp's strategy, as described in Why Westfield's the winner on 12 Feb 15 (Hold — $9.71). The Lowy family backed Westfield Corp after the recent restructure, as do we. With greater capacity to increase specialty store rents and a large development pipeline – including the World Trade Center in New York and a mall in Milan, Italy – Westfield Corp has more growth potential than its sibling Scentre Group. HOLD.

Scentre Group is poised to become even more Australia-centric after selling a 50% interests in five New Zealand centres with the intention of selling out entirely from its remaining four. Scentre still has development opportunities (it is currently redeveloping its Miranda and Chatswood centres) and contract work for third parties (the redevelopment of Macquarie Centre for AMP Capital, for example) but that's not enough. All but full occupancy and high specialty store rents mean growth is likely to be limited. SELL.

Scentre and Carindale Property Trust each own half of the Carindale Westfield in Brisbane. Earnings have dramatically improved after completing a redevelopment in August 2012 but with the centre almost fully occupied there is limited growth potential. We'd need a greater discount to NTA to upgrade. HOLD.

Novion (which changed its name to CFS Retail Property Trust after internalising management) and Federation Centres (formally Centro Retail) have recently announced a plan to merge. If achieved, Novion's higher quality assets (such as 50% interests in Emporium Melbourne and the Chadstone Shopping Centre) will be combined with Federation Centres' collection of regional and suburban malls. Both are selling at significant premiums to NTA and the merger is primarily being justified on financial engineering grounds. Ugh. AVOID both.

Charter Hall Retail – now untangled from its ill-fated overseas expansion – and Woolworths' spinoff SCA Property Group each own a collection of sub-regional and suburban malls along with stand-alone supermarkets. AVOID both. They're fully priced and offer low growth prospects.

As noted in BWP Trust: Interim result 2015, the risk of owning this slow-growing trust that rents most of its properties to Bunnings Warehouse is rising with its share price. For the moment it remains a HOLD but we're watching, slightly nervously.

Industrial A-REITs

| Company name | Market cap ($m) | Gearing (%) | Dist yield (%) | Premium (disc) to NTA (%) | Reco | Portfolio limit (%) | Potential upgrade? |

|---|---|---|---|---|---|---|---|

| Industria | 249 | 32 | 8.1 | -2 | Hold | 4 | Below $1.65 |

| Goodman Group | 10,904 | 47 | 3.5 | 104 | Avoid | n/a | n/a |

Industrial property average capitalisation rates recently hit lows only previously reached just before the GFC. Although influenced by falling interest rates, industrial property prices are benefitting from less speculative development activity than in prior booms. If prices continue to improve, however, we'd expect speculative activity to rise as owners increasingly develop their land banks.

The continued rise in online retailing along with more sophisticated supply chains should continue to support demand for modern sheds located near airports and major transport corridors. Strong housing prices are also encouraging owners of industrial property to sell to residential developers, or have the land rezoned for residential use.

After listing in late 2013, Industria REIT failed to meet its prospectus forecasts for the December 2014 half due to high exposure to technology and business parks in suburban Brisbane and Sydney. Given the projected supply increases in these cities, Industria's properties will be less attractive to tenants compared to more centrally located and modern CBD properties. However, priced around NTA and with an 8.1% forward yield, and with interest rates probably declining further, we've increased the Sell price in the recommendation guide. Recently announcing a buyback of up to 5% of its shares, Industria REIT remains a HOLD.

Many A-REITs got burned pursuing adventures overseas but Goodman Group generated 54% of 2015 first half earnings from its international operations. It owns, develops and manages industrial properties worldwide and has significant opportunities to profit from selling or converting its properties to residential use. Yet with a 3.5% forward yield and at a 40% premium to estimated value, it remains overpriced. AVOID.

Diversified A-REITs

| Company name | Market cap ($m) | Gearing (%) | Dist yield (%) | Premium (disc) to NTA (%) | Reco | Portfolio limit (%) | Potential upgrade? |

|---|---|---|---|---|---|---|---|

| Abacus | 1,583 | 32 | 5.8 | 21 | Avoid | n/a | n/a |

| Aveo | 1,294 | 18 | 1.9 | 7 | Avoid | n/a | n/a |

| Charter Hall | 1,869 | 37 | 4.4 | 122 | Avoid | n/a | n/a |

| Dexus | 6,903 | 32 | 5.3 | 21 | Avoid | n/a | n/a |

| GPT Group | 8,088 | 28 | 4.8 | 13 | Avoid | n/a | n/a |

| Lend Lease | 9,034 | 13 | 3.1 | 186 | Avoid | n/a | n/a |

| Mirvac | 7,506 | 26 | 4.5 | 26 | Avoid | n/a | n/a |

| Stockland | 10,781 | 19 | 5.2 | 29 | Avoid | n/a | n/a |

We recently downgraded Abacus after it reached our $3.00 Sell price. Its strategy of buying unloved properties and improving their returns is getting more difficult. The company recently described the appetite from local and foreign investors for properties bought for rental income as 'ferocious'. That makes life hard for Abacus. AVOID.

We also bid farewell to Aveo after the gap between its share price and NTA narrowed. The retirement sector is capital intensive with thin margins and the company no longer has a margin of safety. AVOID.

Charter Hall continues to grow its funds management business, concentrating on assets with long leases. Now managing $12.7bn, it expanded into the hospitality industry via its recent purchase (along with super fund HOSTPLUS) of 54 hotels leased to a Woolworths subsidiary. After including the value of its funds management business, it too is overpriced. AVOID.

GPT Group has completed $4bn in transactions, rejigging its portfolio more towards the office and logistics sectors. It also raised $1.4bn in capital during calendar year 2014 – including the launch of GPT Metro Office Fund – to increase funds under management. Occupancy at trophy asset MLC Centre has improved – helped by new leases being at lower rates – as both it and the adjoining retail precinct undergo a $170m refurbishment. Yet a mediocre 4.8% forward yield and premium to estimated value make it an AVOID.

Having bedded down its acquisition of the Commonwealth Property Office Fund, DEXUS continues to expand its funds management business, increasing funds under management by more than 50% since 2012. Unfortunately, it also isn't cheap. AVOID.

Lend Lease's share price has increased 38% over the past year after a long period in the doldrums. With a $40bn development pipeline including public-private partnerships and large construction and funds management businesses, the company is profiting from strong residential markets in Australia and the UK. Yet the volatile nature of the development business and its importance to Lend Lease's results mean we'd require a much lower price to be interested. AVOID.

As well as making an $80m profit from its unsuccessful tilt at Australand, Stockland has been benefitting from ramping up its development business. The biggest residential developer in Australia, it's highly exposed to what we believe are elevated house prices. AVOID.

Mirvac is also enjoying higher profits from a development business heavily weighted towards the Sydney market. There has been a shortage of new housing in Sydney over the past decade so we can understand the strategy but with Sydney's house prices being the most expensive in the nation, its share price offers no compensation for the risks. AVOID.

Other options

| Company name | Market cap ($m) | Gearing (%) | Dist yield (%) | Premium (disc) to NTA (%) | Reco | Portfolio limit (%) | Potential upgrade? |

|---|---|---|---|---|---|---|---|

| ALE Property | 751 | 51 | 4.4 | 97 | Hold | 6 | Below $2.70 |

| Hotel Property Investments | 400 | 42 | 5.9 | 39 | Hold | 4 | Below $2.20 |

| National Storage REIT | 522 | 26 | 4.7 | 49 | Avoid | n/a | n/a |

Pub-owners ALE Property and Hotel Property Investments are priced at significant premiums to NTA although the latter offers a reasonable yield. Both are slow growers but ALE Property has the potential for a 10% increase in rents in 2018 and a potentially larger rent increase in 2028 when its properties undergo a market review. Both remain HOLDs.

National Storage REIT owns and manages self-storage centres around Australia. Since listing in December 2013 it's hoovered up storage facilities consolidating this highly fragmented sector. It recently raised capital to reduce debt and further capital raisings are likely as it continues to expand. Costly to build, storage centres require little ongoing expenditure and there is always the option to convert them to residential use (National Storage owns the land under half its centres). While it will benefit from Australia's increasing population and demand for space, storage fees are likely to be one of the first areas where customers make cuts if they encounter financial difficulties. A full valuation means it's one to AVOID.

What next?

While A-REITs may continue to rise as interest rates fall, the opposite is more likely should interest rate expectations prove incorrect or economic conditions deteriorate further. Even at current prices, an analysis of asset backing, occupancy rates and income suggests investors aren't being sufficiently compensated for the risks. We're not going to join the rush for yield and will instead keep looking for A-REITs and other shares selling at a discount to their estimated value.

Note: The model Income portfolio holds shares in ALE Property, BWP Trust, Hotel Property Investments and Westfield Corp.

Recommendation