3P Learning: A textbook case

Recommendation

The Largs Public School was Australia's first. Opened in 1858, it almost certainly featured a blackboard, from which students copied words and numbers into dog-eared workbooks. Students have been taught in pretty much the same way ever since although, slowly, the internet is having an impact. Software hasn't quite replaced the blackboard and textbook but, taking its cues from online gaming, it is changing the way students learn. And Australian company 3P Learning is at the heart of the changes, here and overseas.

3P's main product is Mathletics, an online mathematics tool used in 48% of Australian schools. Mathletics asks the same kind of questions the very first teachers at Largs would have asked their students all those years ago. The difference is in the learning environment, and how the answers are assessed.

Colourful, dynamic images make it fun for kids to learn while algorithms intelligently adjust question difficulty. Students, with the software adjusting to their learning rate, are neither bored nor disheartened. They can even compete with other students from around the world. With the competition a crusty old textbook and a blackboard, it's no wonder kids love it. Mathletics has brought a gun to a knife fight (okay, poor analogy for an educational product but you get the picture).

Key Points

-

Mathletics is strong in Australia and New Zealand

-

Potential for growth abroad

-

BUY up to $1.20

The mechanics of each module work much like the games kids play on their phones. Students receive credits for each correct answer, which they can use to improve their online avatar. This incentivises them to answer more questions, improving their maths skills by stealth. It seems to work. An independent study found that a 30-minute weekly session on Mathletics leads to a 9% improvement in NAPLAN performance. Teachers love it, too, because marking is automated and performance, by students, class and school, is easily monitored.

Building inertia

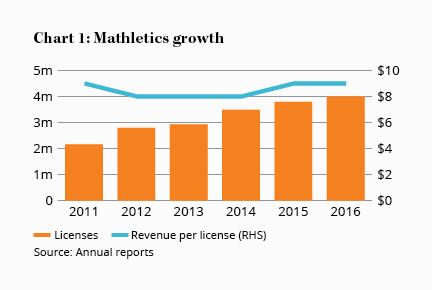

So how does 3P make money? Annual licences to Mathletics are sold to schools (just 9% of licences are sold direct to students), with fees levied on a per student basis. At less than $10 per student per year, it's a high-value item available at a low price. Fees are paid upfront too, which supports a low working capital model and great cash generation.

Mathletics is a good product but, make no mistake, it can be replicated. A well-resourced upstart would likely get change from $10m to develop an equivalent product, although that may not matter so much. The strength of the 10-year old business is in having almost half the Australian education system already on board.

Teachers, educational administrators and parents are familiar with it. Mathletics is even written into over 40 curriculums. Competitors might try and displace it but it wouldn't be easy. Mathletics is already cheap, so there isn't much room to compete on price. The company's customers like it and whilst a competitor might launch a better product, it's hard to envisage it being so much better customers would switch en masse.

These traits were well understood (and marketed) when 3P floated in 2014. The brokers pitched it as ‘the REA of education', which is how the eye-watering PER of 35 was justified. But with sales undershooting expectations and the surprise departure of the founding chief executive, the shares are now down around 60% on the float price.

This disappointing performance is the source of the opportunity. 3P remains a very attractive business with a hidden option inside. At current prices, the Australian business is pretty cheap while the potential of global expansion is effectively free.

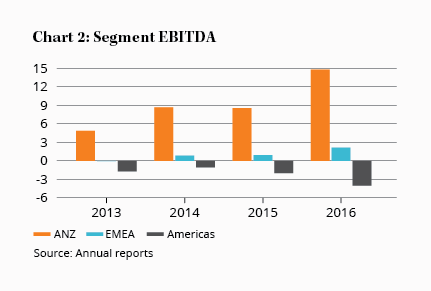

The company has a market capitalisation of $145m. Last year, the Australian and New Zealand business alone generated EBITDA of $15m (after incurring the corporate and development expenditure for international expansion). That means we're paying just nine times EBITDA for this business alone. With attractive cash generation and low investment requirements, this is an attractive price for a high-quality software business.

It's all about options

Now, what about those free options? The first is the global opportunity. Mathletics already has strong positions in New Zealand, the UK and Canada (used by 31%, 24% and 7% of total schools respectively). But the company's biggest target is the United States.

3P initially used a distributor but in 2012 implemented its own sales channels. That move looks to have paid off. US licences have been growing at 40% a year for the past five years, reaching one million students in June. The region still loses money (to the tune of $4m in FY16) but it has recently reached breakeven on a cash flow basis. Not much growth is required from here to swing US operations from being a drag on profits to a profit centre.

A word of caution: 3P lacks the first mover advantage overseas it has in Australasia. Consequently, its brand lacks awareness in these new markets, which are also more competitive. It would be a mistake to assume 3P can dominate the US and Europe in the same way it does Australia. But the beauty of the software business model is the low cost of entry to new markets. Development costs have already been paid. As long as sales can be made at a reasonable cost of acquisition, 3P can make good money in large markets with smaller market shares.

The second option is in the company's untapped pricing power. Before the 2014 float, the price of Mathletics was raised by $1.50 a year, a 15% increase. There is scope for further price increases that could have a massive impact on profitability. If each Mathletics student were to pay an extra $2 a year, company EBITDA would increase by 60%.

Such an increase is unlikely to come in one fell swoop but a number of smaller increases over time looks possible. The degree to which they occur ultimately depends on the competitive environment, but the potential is clear.

What else? The third option is in the company's other products, Intoscience and Spellodrome, plus its licensing agreement with Reading Eggs. With existing relationships with half of Australia's schools, selling additional products like these, both here and overseas, makes sense.

Finally, 3P has minority stakes in two US-based software-as-a-service (SaaS) businesses. As these are private entities, it's difficult to value them. What we do know is that the combined cost was $56m. In the 2016 financial year 3P paid $49m for 40% of Learnosity, which provides SaaS-based applications that helps educational content providers create tests and automate marking. The smaller holding is in Desmos (costing $7m for 17%), which provides a range of graphical applications. The pair contributed almost nothing to earnings in FY16, but with Learnosity users increasing nearly tenfold in 2016, it's possible these investments will soon start to pay off.

Time to buy

It all looks rather good; A strong domestic business available at an attractive price, plus a number of options, only one of which would need to pay off to unlock real value. Below $1.20, we recommend risk tolerant investors BUY for up to 4% of their portfolios.

Recommendation