360 Capital morphs into a fund manager

Recommendation

In 2009, as I was sifting through the ruins of the commercial property sector, a friend urged me to look at a small A-REIT called Trafalgar. Like every A-REIT at the time, its portfolio of B-Grade office properties was trading at a large discount to its net tangible assets (NTA).

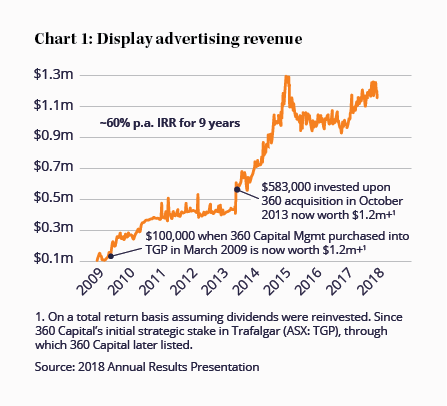

What distinguished Trafalgar was a man named Tony Pitt, who'd bought a major shareholding and planned to sell the assets one by one to eliminate the discount. Over a few years he delivered on his promise much to shareholders' benefit (see Chart 1).

I then sold my shares, thanked my friend for the recommendation, paid my tax, and moved on to 'better' opportunities, missing the huge share price gains as Pitt reversed his strategy and began making acquisitions. Renaming the company 360 Capital, he kept buying undervalued property, purchased Becton's funds management business and rode the recovery in commercial property prices.

Key Points

-

Shareholder with skin in the game

-

Large potential in funds management

-

Current price could prove cheap

Clean slate

Now, Pitt is again starting with a clean slate. Having sold 360 Capital's last major property to NextDC, which also happened to be the tenant, 360 Capital is flush with cash and a new strategy.

When emerging from downturns like the global financial crisis, owning equity maximises your returns as asset prices recover. At the opposite end of the business cycle, Pitt now wants to supply debt, which comes with cosy covenants, rather than equity.

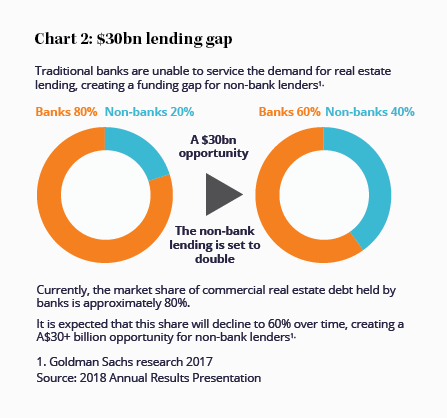

You don't need to sacrifice returns too much, either. Property development returns have increased due to the withdrawal of Australian banks, which have been forced to ration credit to satisfy regulators as they prepare for lower housing prices and higher bad debts.

Big opportunity

This market opportunity can be quite lucrative. Providing debt for a year or two on a small property development typically earns a 10-11% annual return. Not bad when interest rates are below 2%, if you get your money back. Anecdotally, those returns have recently been more like 15%.

Chart 2, which shows the (expected) falling market share of Australia's banks for property lending, is a visual description of the size of the opportunity.

Let's now look at how this might unfold in practice. A typical development for 360 Capital might be a $30m suburban doctor's office. Because of the small size, in a worst-case scenario where the developer goes under, leaving the project unfinished, Pitt could take control and complete it. More capital might be required, either directly from 360 Capital's balance sheet or by finding a new developer and/or investor, but that shouldn't be a problem.

If the story ended here, you'd currently be paying net tangible asset value (NTA) for 360 Capital. Given Pitt's track record that could be very cheap indeed.

Over time, shareholders would receive distributions as if owning an A-REIT. The value of 360 Capital, meanwhile, would grow as profits are banked from completed projects and reinvested in new ones.

That's pretty good for a company where a shrewd, shareholder-friendly chief executive owns a quarter of the shares and is orientated towards leaner times, but retains the potential to capitalise on higher development returns while they last.

Lending platform

Unfortunately, the rapid fall in construction has severely reduced the number of developments. But the story doesn't end here.

360 Capital also owns a 50% stake in a property lending platform called AMF Finance, which earns fees from matching developments requiring capital with investors willing to supply it.

Here's how it works. Let's say you're a high net worth individual with $25m to invest over the next few years in our theoretical suburban doctor's office. You plug your details into the AMF Finance system, after which you get a list of projects in which to invest along with the associated terms. You pay a fee for being offered deals on a silver platter, without having to do any of the dirty work.

As projects mature, 360 Capital can then repackage or 'securitise' this debt for less risk-tolerant investors willing to accept lower returns. This releases cash for 360 Capital's next development. Sometimes, 360 Capital can turn over its capital more than once a year. With the right fee structure, this can be extraordinarily profitable.

These are early days. The platform only completed $110m of deals during 2018, although the potential is substantial if investors get the right outcomes. Potential 360 Capital shareholders aren't currently paying much for this potential given the stock's price slight premium to net tangible assets.

Recently, the company launched three small funds aiming to raise $25m each from yield-hungry investors. Following that, Pitt announced a joint venture with successful telecommunications businessman David Yuile.

Yuile led Nextgen Networks from 2014-15 before selling to Vocus and was chief executive of data centre operator Metronode before it, too, was taken over in 2018. Yuile is renowned for turning around businesses and selling them at large premiums.

The US$250m fund will invest in all manner of modern telecommunications assets, such as data centres and telecommunications towers, designed to provide investors with a 10% annual return.

It should sell itself in an environment of falling interest rates, and that seems to be the case. The fund is now going to be listed on the ASX, and the company has launched a pre-IPO raising up to $50m including a co-investment of $25m. Again, this is only the beginning for 360 Capital's funds management business, and you're not paying much for it at the current price.

Last year, 360 Capital paid a 5.5-cent distribution but it's unclear what will be paid in future.

The bull case is clear. Tony Pitt is a canny operator with his own money on the line. In a blue-sky scenario, the AMF Finance business could one day be collecting fees on deals valued in the hundreds of millions of dollars along with the fees from the new funds that have been launched.

Just as importantly, Pitt has prepared the business for leaner times. Even if the funds management doesn't grow like we expect, at worst, you'll own a well-run, entrepreneurial business that's investing in a profitable niche. Pitt excelled during the global financial crisis. We expect nothing less from him during the next downturn.

We recommend 360 Capital for up to 4% of well-diversified portfolios at prices below $1.10. Note, however, that the stock is relatively illiquid, so we recommend being patient when building a position and using limit orders. We believe there is a fund manager trying to sell its shares, so there's no need to push up the price.

On the flipside, it would also likely be very hard to sell shares in a downturn. If you're not genuinely prepared to own this stock for the long term then you may want to stick to larger, more liquid stocks. BUY.

Note: The Intelligent Investor Equity Growth Portfolio, Ethical Portfolio and Income Portfolio own shares in 360 Capital.

Note: We are buying 69,393 shares in 360 Capital at $1.015 in The Intelligent Investor Model Growth portfolio. We are also selling 16,033 shares in Scentre Group at $4.05 and buying 66,665 shares of 360 Capital at $1.015 in the Intelligent Investor Model Income portfolio.

Recommendation