2014: Growth Portfolio gallops ahead

On this occasion we've treated our semi-annual performance analysis of the model Income Portfolio and Growth Portfolio as a two-part series. In 2014: Income Portfolio lights up we got back to basics, explaining the aims of the portfolio and how it might help you.

In this review of the Growth Portfolio, we'll review our broader investment strategy and how this has driven the construction of the portfolios.

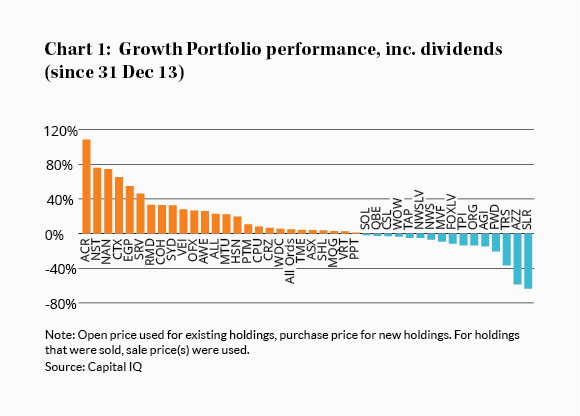

For the record, the Growth Portfolio produced a 14.5% return in 2014, well ahead of the 5.0% return of the All Ordinaries Accumulation Index. Since inception the portfolio has produced a 10.2% return, comparing favourably with the index's 8.1% return. The portfolio's performance was average before the GFC, but since 31 Dec 2009 it has returned 12.9% annually compared to 6.4% for the index and we'll be working hard to keep that going.

Key Points

- Growth Portfolio returned 14.5% in 2014

- Compares to 5.0% from the All Ords

- Adding companies selectively and patiently

Value investing 101

Let's start with our investment approach, and why we believe it produces superior risk-adjusted returns to the index.

First, we're not restricted in any way. Unlike fund managers that are forced to sacrifice their strategies to conform for the investment platform guardians, we don't have to own anything; we're not index huggers. Like you, we can buy smaller companies, such as Hansen Technologies and Ainsworth Game Technology, that large funds tend to avoid because they're unable to get enough stock to make much difference to their results.

Second, we can think long term. Without pressure from impatient clients we can invest today and wait patiently for the returns without fear of redemptions. This is the private investor's greatest advantage over the professionals and it should never be taken for granted.

We can also hold cash if we don't like the alternatives. We'd prefer to be fully invested in cheap stocks, but cash holds enormous value when panic strikes.

Armed with this flexibility and an investing approach that has stood the test of time, we can build portfolios to suit our needs without taking large risks or running with the herd. This is your edge in a market increasingly focused on the short term, where share ownership is measured in minutes and days rather than years.

Broader views

We've also held some broader views over the past three years that are coming to fruition. Most notably we've expected Chinese growth to slow, causing pain for Australia as the resources boom has fizzled out (see The coming China crash).

| Stock (ASX code) | Buy / Sell | Shares (No.) | Price ($) | Value ($) | Date |

| Transpacific industries (TPI) | Buy | 10,000 | 1.09 | 10,850 | 23/7/14 |

| QBE Insurance (QBE) | Sell | 700 | 10.56 | 7,392 | 29/7/14 |

| Acrux (ACR) | Sell | 3,125 | 1.87 | 5,844 | 31/7/14 |

| OzForex (OFX) | Buy | 3,000 | 2.28 | 6,825 | 7/8/14 |

| Transpacific industries (TPI) | Buy | 2,500 | 1.02 | 2,550 | 19/8/14 |

| Transpacific industries (TPI) | Buy | 1,500 | 0.94 | 1,410 | 20/8/14 |

| Virtus Health (VRT) | Buy | 1,500 | 7.85 | 11,775 | 8/9/14 |

| Monash IVF (MVF) | Buy | 2,000 | 1.67 | 3,340 | 8/9/14 |

| ASX (ASX) | Buy | 200 | 36.34 | 7,268 | 15/9/14 |

| AWE (AWE) | Sell | 4,175 | 1.6825 | 7,024 | 15/9/14 |

| Caltex (CTX) | Sell | 150 | 28.36 | 4,254 | 15/9/14 |

| Cochlear (COH) | Sell | 40 | 67.40 | 2,696 | 15/9/14 |

| Computershare (CPU) | Sell | 710 | 12.19 | 8,655 | 15/9/14 |

| Echo (EGP) | Sell | 1,500 | 3.21 | 4,815 | 15/9/14 |

| M2 Telecommunications (MTU) | Sell | 1,650 | 7.505 | 12,383 | 15/9/14 |

| Macquarie Group (MQG) | Sell | 85 | 58.735 | 4,992 | 15/9/14 |

| Sonic Healthcare (SHL) | Sell | 500 | 16.73 | 8,365 | 15/9/14 |

| Sydney Airport (SYD) | Sell | 1,605 | 4.27 | 6,853 | 15/9/14 |

| Trade Me (TME) | Buy | 1,856 | 3.14 | 5,828 | 15/9/14 |

| Acrux (ACR) | Sell | 3,125 | 1.35 | 4,219 | 19/9/14 |

| Transpacific industries (TPI) | Buy | 3,500 | 0.838 | 2,933 | 25/9/14 |

| Aristocrat Leisure (ALL) | Sell | 1,500 | 6.03 | 9,045 | 17/10/14 |

| Hansen Technologies (HSN) | Buy | 5,000 | 1.52 | 7,600 | 29/10/14 |

| Monash IVF (MVF) | Buy | 1,500 | 1.375 | 2,063 | 30/10/14 |

| Ainsworth Game Technology (AGI) | Buy | 2,400 | 3.03 | 7,272 | 6/11/14 |

| Echo (EGP) | Sell | 2,250 | 4.02 | 9,045 | 7/11/14 |

| Ainsworth Game Technology (AGI) | Buy | 1,970 | 2.44 | 4,807 | 21/11/14 |

The consequences have included falling interest rates and a lower Aussie dollar, and the casualties include a multitude of businesses. Those linked directly to the resources industry include miners like BHP Billiton and Rio Tinto and mining services companies like WorleyParsons and Monadelphous, but cyclical companies such as retailers and property groups also face tough times. Avoiding these companies has served the portfolios well so far.

Turning from the cyclical to the structural, or from the temporary to the permanent (though slowing growth in China will be permanent), we've been careful not to get caught out on the wrong side of technology. We're in the age of disruption thanks to smart phones and the internet, so we've generally avoided stocks such as Cabcharge, which faces a flood of new competition, old media, such as Fairfax and Ten Network, and discretionary retailers susceptible to the invasion of foreign and online retailers.

In summary, we've got a value investing framework or set of principles to guide our decisions, mitigate risk and compound our money as quickly as possible, and we've identified several trends to help steer us away from potential trouble spots. This keeps things as simple as possible. Or as Warren Buffett put it, 'I don't try to jump over 7-foot hurdles: I look for 1-foot hurdles that I can step over.'

Stock picks

So how has all this manifested itself in individual stock selection?

The portfolio has owned plenty of stocks that we deemed cheap but are also benefiting from the falling Aussie dollar vis-à-vis the US dollar. In 2014 this group included ResMed, with a total return of 33%, Nanosonics (75%), Acrux (108%), Cochlear (33%), Aristocrat Leisure (23%), Servcorp (46%), Hansen Technologies (20%), Platinum Asset Management (11%) and Computershare (8%).

It's notable that the poorest performers aside from Ainsworth Game Technology (down 15%) were those linked to the resources sector and the Australian economy: Silver Lake (down 64%), Antares Energy (down 59%), The Reject Shop (down 37%), Fleetwood (down 20%), Origin Energy (down 14%) and Transpacific Industries (down 13%). The worst performers were only held in small amounts though, due to their speculative nature, so they had little impact on the portfolio.

So what should you expect from here? We don't know what opportunities will come our way in 2015, and that's the beauty of value investing. You don't need to know when the bargains will appear, you just need to be prepared.

There's cash in the portfolio with a stream of dividends to come, and it owns a bunch of high-quality businesses that collectively will do just fine over the coming decade.

The best advice we can offer is to stay flexible, keep things simple, do your homework, avoid getting caught up in fads, avoid getting emotional about your stocks, have a bear market action plan (look out for ours in due course) and, if you're going to panic, panic early!

| Stock (ASX code) | Price Movement Since 30/06/14 (%) | Most Recent Reco. | Shares (no.) | Price ($) | Value ($) | Per cent of portfolio |

| Ainsworth Game Technology (AGI) | -22 | Buy | 4,370 | 2.36 | 10,313 | 2.8 |

| Antares (AZZ) | -63 | Hold | 13,300 | 0.195 | 2,594 | 0.7 |

| ASX (ASX) | 3 | Buy | 400 | 36.74 | 14,696 | 4.0 |

| Caltex (CTX) | 59 | Hold | 390 | 34.21 | 13,342 | 3.6 |

| Carsales (CRZ) | -2 | Hold | 900 | 10.42 | 9,378 | 2.6 |

| Cochlear (COH) | 26 | Hold | 160 | 77.70 | 12,432 | 3.4 |

| Computershare (CPU) | -5 | Buy | 1,190 | 11.80 | 14,042 | 3.8 |

| Fleetwood (FWD) | -27 | Spec. Buy | 3,200 | 1.70 | 5,440 | 1.5 |

| Hansen Technologies (HSN) | 20 | Hold | 5,000 | 1.82 | 9,100 | 2.5 |

| Macquarie Group (MQG) | -2 | Hold | 139 | 58.29 | 8,102 | 2.2 |

| Monash IVF (MVF) | -16 | Buy | 3,500 | 1.40 | 4,900 | 1.3 |

| Nanosonics (NAN) | 73 | Hold | 5,000 | 1.37 | 6,850 | 1.9 |

| News Corp - nonvoting (NWSLV) | 1 | Spec. Buy | 90 | 19.30 | 1,737 | 0.5 |

| News Corp - voting (NWS) | 0 | Spec. Buy | 300 | 18.52 | 5,556 | 1.5 |

| Northern Star Resources (NST) | 18 | Spec. Buy | 5,400 | 1.49 | 8,046 | 2.2 |

| Origin Energy (ORG) | -20 | Buy | 650 | 11.67 | 7,586 | 2.1 |

| OzForex (OFX) | 24 | Buy | 3,000 | 2.83 | 8,490 | 2.3 |

| Perpetual (PPT) | -2 | Buy | 240 | 46.30 | 11,112 | 3.0 |

| Platinum Asset Management (PTM) | 15 | Hold | 1,800 | 7.24 | 13,032 | 3.5 |

| ResMed (RMD) | 27 | Hold | 3,550 | 6.94 | 24,637 | 6.7 |

| Servcorp (SRV) | 17 | Hold | 1,636 | 5.60 | 9,162 | 2.5 |

| Silver Lake (SLR) | -62 | Spec. Buy | 2,800 | 0.195 | 546 | 0.1 |

| Soul Pattinson (SOL) | -7 | Buy | 570 | 13.68 | 7,798 | 2.1 |

| Sydney Airport (SYD) | 12 | Hold | 5,072 | 4.71 | 23,889 | 6.5 |

| Trade Me (TME) | 5 | Buy | 4,640 | 3.43 | 15,915 | 4.3 |

| Transpacific industries (TPI) | -21 | Under Review | 17,500 | 0.86 | 15,050 | 4.1 |

| The Reject Shop (TRS) | -29 | Buy | 1,000 | 6.15 | 6,150 | 1.7 |

| Virtus Health (VRT) | 0 | Buy | 1,500 | 7.85 | 11,775 | 3.2 |

| Vision Eye Institute (VEI) | -3 | Hold | 11,466 | 0.725 | 8,313 | 2.3 |

| Woolworths (WOW) | -13 | Hold | 615 | 30.68 | 18,868 | 5.1 |

| Cash | 58,803 | 16.0 | ||||

| Total | 367,653 | 100.0 | ||||