Iron ore's new boom

Recommendation

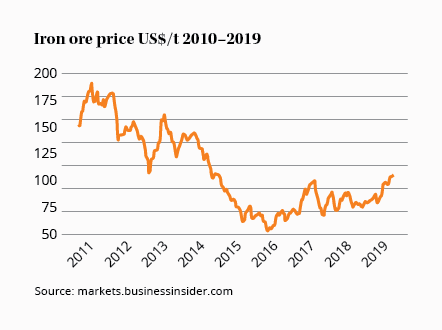

The iron ore boom was supposed to be over. Between 2005 and 2011, benchmark prices rose from less than US$30 a tonne to an astonishing US$185, a price never achieved before - or since.

At those prices, North Korean smugglers were risking their lives to get red dirt across the border and western miners were tearing apart any ore-bearing land they could find. There was talk of a US$6bn rail project in Cameroon and a US$10bn project in Guinea was seriously considered. The boom was on and we were wary.

In 2010 we warned the bubble would burst (see Iron ore: it's (not) different this time) and burst it did - spectacularly.

Key Points

-

Good reasons for booming iron ore prices

-

At spot prices, miners are cheap

-

High prices are the solution to high prices

By the middle of 2015, prices had fallen to less than US$40 a tonne. Iron ore miners all over the world went bust; even the once mighty Anglo-American retreated from iron ore.

Every miner cut spending and volumes to refocus on profits. Discipline returned. Costs came down and the industry recovered. All the while, Chinese consumption has continued to rise.

In 2015, at the bust's nadir, China imported about 900 million tonnes of iron ore. It now imports about a billion tonnes. Demand has been steadily rising while supply has been consistent and cheaper. Balance had been restored; but then came a new shock.

A dam shock

Revelations of safety breaches from Brazil have placed a rocket under iron ore prices. They have risen more than 50% in the past three months, and now trade at over US$100 a tonne as Vale, the world's largest producer, has been forced to close 85 million tonnes of output indefinitely.

That output looks unlikely to come back online any time soon. Vale announced the reopening of a major mine earlier this month but was slapped down by the Brazilian regulator and it remains closed.

With serious breaches being uncovered in at least 10 mines and dozens more being affected, the Brazilian government is more likely to force larger, prolonged shutdowns than to encourage a hasty return to normal production.

The price of iron ore is reflecting a genuine supply shock rather than optimistic exuberance about Chinese consumption. This time - maybe - it is different.

Different response

The response from industry peers has been surprisingly mute even as operating margins exceed those of the Great Boom.

Rio and BHP have sanctioned new projects but these are aimed at replacing depleted reserves not chasing current margins. Total output from the Big Two should remain stable rather than grow.

Fortescue, the world's fourth-largest producer, has announced several new projects - but these are aimed at improving grades and will add only modestly to output. Without a definitive supply response, current iron ore prices could persist for years.

Vale's woes will take at least 3-5 years to remedy and, in the meantime, legacy producers will be minting money. Does that mean we ought to buy them?

Spotty value

Spot prices suggest the three major miners - BHP, Rio and Fortescue - are bargains. If we apply US$100 iron ore to BHP and Rio, we should expect earnings per share to rise by at least 50%.

Using spot prices, both miners are currently trading at free cash flow yields of over 15%. That's not bad for two of the best miners in the business with rock solid balance sheets and industry best assets.

Fortescue is even more attractive at spot prices. We estimate earnings could triple or quadruple, generating a free cash flow yield of 35%. On those measures, Fortescue may be the cheapest large-cap stock in the country.

Fortescue has had a double benefit: iron ore prices have risen and the discount between high- and low-grade iron ore has narrowed spectacularly.

This, of course, was the basis of our Speculative Buy on the stock (see Fortescue: Options and opportunity). Grade discounts of 40% have narrowed to 15% and, in our view, they're likely to stay around there.

Buying now, however, ignores the cyclicality of these businesses. Iron ore is temporarily high because of the woes of one producer and the discipline of many. Extrapolating prices risks simplifying a situation that is intricately complex.

Chinese demand, for example, appears brittle. It is highly correlated to steel prices and, ominously, steel prices are falling. We also don't know how Chinese producers - who claim to produce about a billion tonnes of iron ore a year - will react. Will smaller, second-tier miners, unconstrained by investor discipline, also restrict supply?

High prices - especially when accompanied by the spectacular returns on offer today - tend to be the solution to high prices.

We can't know the mechanism or the path, but we have seen enough booms to know that supply and demand find a way to balance. That should be our base case, which means iron ore prices ought to find their way lower, eventually.

Long and short

For traders, there may be a short-term opportunity in iron ore miners. In our view, the market doesn't appear to recognise that these disruptions will take years, not months, to rectify.

Broking analysts still have iron ore assumptions for the next few years that are far too low. Special dividends and additional shareholder returns are likely and may surprise many.

For longer-term investors, however, this may provide an opportunity to take profit. We retain Sell prices for Rio at $110 and BHP at $45. Those levels capture full value if we assume iron ore prices fall back to US$50-60 per tonne - and they aren't far off. For the time being, though, we recommend you HOLD BHP and Rio.

Fortescue is different. We have always valued it with a heavy discount because of its single commodity risk, balance sheet and concerns over capital allocation. There is a case for now closing the valuation gap between Fortescue and its larger peers.

Recent investments in grade mean that average grades should increase, improving the asset base. The balance sheet - an existential threat for years - is now fully repaired and should not be counted in the negative, while management has deployed capital admirably.

We're raising our Buy price from $5 to $6 and our Sell price from $9 to $10, narrowing the valuation gap between it and peers, and raising our portfolio limit from 3% to 4%. HOLD.

We note, however, that prices could far exceed those levels if iron ore price expectations change. Investors in this sector have a habit of ignoring facts for a long time before embracing them in no time. This will be an interesting little boom to watch.

Disclosure: The author owns shares in Fortescue Metals.

Recommendation