FSA faces new competitor

Recommendation

The typical economic dream might go something like this. You begin with a country that has a young, healthy workforce and is rich in resources. The economy then enjoys a decade-long boom due to productivity gains and a northern neighbour hungry for iron ore. Rock-bottom interest rates make household debts more manageable and fire up corporate profits. With everything going well, unemployment falls to its lowest level in years. Investors rejoice.

That's the Disney version, at any rate; but for some it's no fairy tale.

Key Points

-

National savings declining

-

High indebtedness gives little wiggle-room

-

New competitor, but low risk to FSA

For a small group of companies, this story - Australia's for the past decade - has been a burden. Bankruptcy and debt agreement administrators, such as FSA Group, prefer a darker tale: high interest rates, mass unemployment, ballooning household debts and falling property prices. The more chaotic, the better.

So it says a lot for FSA Group that it has been able to increase revenue by 55% and double net profits over the past 10 years, despite the difficult environment.

Undergrowth

There have been some compensations. For one thing, the conditions have favoured large incumbents and discouraged new competition. The high fixed costs and regulatory requirements of administering debt agreements create economies of scale, and a slow-growing market therefore makes it harder for small participants to remain profitable. Although FSA's market share has fallen from 48% to 40% over the past 5 years, the number of companies registered as administrators has fallen from 33 to 30 today. A rosy economy knocks out small competitors much as a forest fire clears the undergrowth.

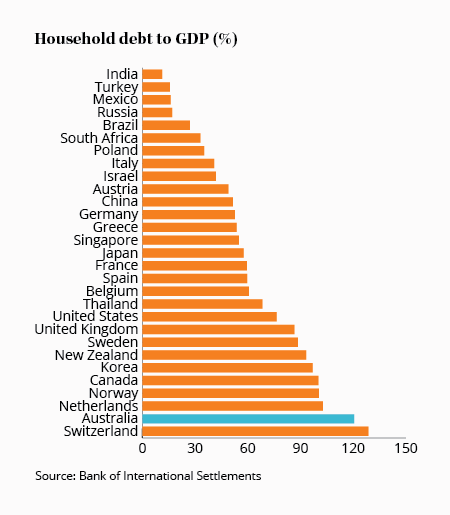

What's more, the prolonged period of low interest rates and unemployment has lulled borrowers into large debts that they couldn't afford if interest rates were higher. Australia is now one of the most indebted countries in the world, with household debts some 120% of GDP, up from 65% in 1999. We're twice as leveraged as Spain, Greece or China (see Chart).

At the same time, people are saving less. In 2018, the national saving rate hit 2.5%, down from 8% in 2015 and the lowest in a decade. Despite record low interest rates and record high levels of debt, the average Australian has practically no disposable income. A sharp rise in interest rates would likely create a flood of borrowers unable to make their repayments.

New competitor

This opportunity hasn't been overlooked by foreign operators. Just under a year ago, Hong Kong's largest bankruptcy administrator, Credit Intelligence, announced that it would set up shop in Australia 'either by acquiring existing insolvency businesses, employing experienced Australian insolvency practitioners or a combination of both'.

Though Credit Intelligence still had zero local revenue as of December, the company is the first we see that could pose a threat to FSA's debt agreement business, particularly if it chooses the acquisitive approach and builds scale quickly.

For one thing, Credit Intelligence has plenty of industry experience: Hong Kong's Individual Voluntary Arrangements (IVAs) are similar to Australia's Part IX Debt Agreements, so Credit Intelligence probably has a good grasp of client needs, business operations, marketing tactics and the like.

The company has net cash of $3.5m and can use its existing overseas income to fund the Australian expansion, which overcomes the main barrier to entry other than regulation - the fact that debt agreement fees are spread across the life of the agreement, so a start-up must cover all its expenses up-front and wouldn't turn a profit for several years.

That said, we expect it will be a slow grind for Credit Intelligence. For one thing, even with its Hong Kong business, it's still a minnow, with just a tenth of FSA's revenue and a market capitalisation of only $13m. FSA has a well-known brand, a far larger marketing budget, and established relationships with banks and other credit providers.

FSA's diversity of products is also a strength. The company offers a multitude of debt solutions, such as debt agreements, personal insolvency agreements, bankruptcy, online bill payments, mortgage refinancing, and car loans. And FSA's customers tend to have lower levels of financial literacy and aren't necessarily shopping around for the best interest rate or lowest administration fees ... they want fast and convenient solutions, and FSA offers the best choice, being a debt agreement originator, subprime lender, and broker all in one.

We don't expect FSA's industry dominance to be lost any time soon. Management has said that shareholders should expect earnings growth of 5-15% a year in the medium term. If that materialises, FSA's price-earnings ratio of 10 and fully franked dividend yield of 5.6% will look like a bargain - even more so if Australian households get squeezed by rising interest rates.

We're buying 33,000 shares in our Model Growth Portfolio and 32,000 shares in our Model Income Portfolio at $1.10, giving a total cost for the respective portfolios of $36,300 and $35,200 and weightings of about 2.5% each. SPECULATIVE BUY.

Note: With several substantial shareholders, FSA Group's stock is highly illiquid with a large spread between bid and offer prices. To ensure you aren't caught overpaying, it's important that your buy orders have a limit price and are not made 'At Market'.

Disclosure: The author owns shares in FSA Group.

Recommendation