Caltex primes the pump

Recommendation

Caltex has changed. Once a large oil refiner with a franchised network of fuel stations, the business is unrecognisable to what it was a decade ago.

It has since closed its largest refinery, doubled down on its infrastructure business with acquisitions which expand its distribution and supply arms and has planned an ambitious lift in retail.

The fuel and infrastructure business is still the most capital hungry and the largest contributor of profit, with about two-thirds of the group total. But chunky capital expenditures are going towards the retail business, which is set to grow quickly as a result.

This transformation has turned an awful business into a decent one, yet Caltex is not out of the woods.

Key Points

-

Business has improved dramatically

-

Recognised disruptive threats

-

Responding well so far

On the simple numbers, the stock appears cheap, trading on a price-earnings ratio of just 10 and an enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA, this ratio adjusts for debt but doesn't allow for capital expenditure) of six. The stock provides a fully franked dividend of 4.4%.

An infrastructure business

Those numbers get you a decent business. Caltex sources, refines, distributes and sells fuel to big miners, commercial fleets, businesses and individuals. This is generally a steady, predictable business that has consistently generated returns on capital in the mid-teens.

New competitors are discouraged by an asset base that has taken decades to assemble. Only one existing competitor - BP - offers a similar level of end to end logistical services as Caltex, although there are competitors along the value chain.

Scale, however, matters. The large fixed asset base needed to store and distribute fuel means large volumes are rewarded with large margins and no-one supplies more fuel than Caltex, which accounts for over a third of the market. The top four suppliers account for about 90% of fuel supply.

The downside of an asset-heavy business, however, is the enormous cost of maintaining the empire. Caltex must spend $200m-300m a year to keep its assets humming and then add cash to generate growth.

A retail business

Alongside this decent quality fuels business sits a retail operation with enormous potential. Caltex operates over 300 fuel sites and is currently taking over management of another 500. Its retail network will soon grow to about 800 sites.

Sales through that retail network amount to about 3m transactions a week, worth almost $1bn. This is a decent-sized retailer in its own right.

At the moment, most of the revenue comes from fuel sales. Non-fuel income is just $150m, but that will grow as Caltex takes control of its sites and rental revenue morphs into sales revenue.

The roll-out

Caltex is investing heavily to lift non-fuel sales through its network. It has partnered with Woolworths to roll out Metro stores on its sites and has built its own retail format, known as The Foodary. It has also partnered with niche retailers such as Boost Juice and added services and prepared food sales.

Early results are promising. The best-performing new format sites have doubled non-fuel sales and lifted margins. On average, sales are up by a third and there is a long growth runway.

Yet this is also a risky strategy. Convenience retail is hard in Australia where supermarket density is among the highest in the world. About 80% of the population lives less than 10 minutes from a major supermarket, which perhaps explains why the sector has never enjoyed the success it has overseas. Who needs convenience stores, when you have a spread of supermarkets like ours.

To fund the retail expansion and for international expansion - Caltex has bought fuel businesses in New Zealand and the Philippines - Caltex's balance sheet has swelled, and it now carries net debt of over $1bn. This isn't a dangerous amount of debt but it is more than twice what the business carried a few years ago.

Long-term threat

The reason for this aggressive expansion is that management has recognised a looming threat to its core business: fuel volumes are falling.

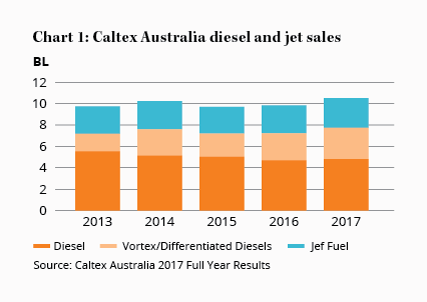

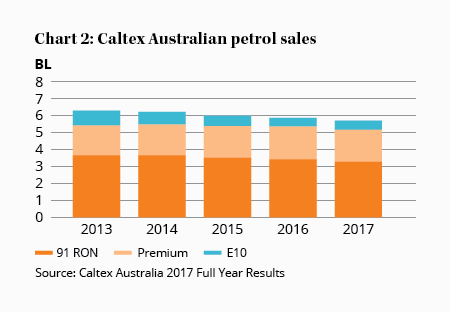

Charts 1 and 2 tell the story. Petrol volumes have been falling for a number of years. The reasons for that should be clear to anyone with a car. Although the national car fleet has grown, fuel efficiency has grown more quickly. Engines are now smaller, more efficient and, increasingly, using some form of electric assistance.

Toyota, the market leader in Australia, will soon offer a hybrid version of every model, and hybrids are accounting for as much as 40% of sales of some models. Fuel volumes can only go one way.

Diesel and jet fuel volumes are larger than petrol sales and have been far more resilient, even growing modestly. It is true that jet fuel should remain a growth business and airlines face few disruptive threats but the forces lowering petrol volumes should also lower diesel volumes over time.

Caltex has managed to offset lower fuel volumes with higher margins as higher-octane fuels are bought. But that's a one-off trend that has run its course. Margins won't double again and could face pressure as competitors fight for a shrinking pie.

A large fixed cost base has been a key reason why Caltex, as market leader, has generated superior returns. But such operating leverage also works in reverse.

It will only take small changes in volumes to cause big changes in margins. With all industry peers facing fixed cost economics, competition is likely to intensify as volumes fall.

Response

The threat is clear and has been recognised by the market, which explains the low multiples, and by Caltex itself, which explains its strategic moves.

Those moves make sense. The international expansion (we still shudder at the words) has been sensibly pursued and is, to date, working. The retail expansion is still in its early phase and is showing promise, but it's riskier than it may appear.

Retail is a unique business requiring specific skills to succeed. We wonder whether a traditional infrastructure style business like Caltex can create a successful retailer.

It might make sense in time to formally separate the infrastructure business from the retail business. At the moment it might be attractive to collect both retail and wholesale fuel margins, but as the retail business changes and grows away from fuel, a split may make more sense.

We also note that Caltex sits on $2bn worth of retail property and an array of valuable infrastructure assets, and has about $800m of franking credits. A break-up of the business, either voluntarily or forced by an acquirer, could release value.

More safety please

By shedding its poor businesses and investing in its strong ones, Caltex generates surprisingly high returns on capital and, over the short term, is a resilient cash flow machine.

Over the long term, however, it's hard to ignore the threats to fuel volumes. Caltex has responded well, but we need cheaper prices to compensate for the higher risk. Low multiples for Caltex are appropriate and don't, in our view, represent a mispricing.

We're lowering our Buy price from $25 to $22 and our Sell price from $40 to $35 and nudging our maximum recommended portfolio weighting down to 5%. HOLD.

Recommendation