I started buying and selling shares based on my research with some success. But in reality, it was more luck than anything.

I had always watched Alan Kohler on the ABC and decided that any company he is associated with must be good.

In about 2012. I subscribed to Eureka Report and InvestSMART. I read their recommendations, and also did a lot more research into the Australian system of super and investment.

I managed to keep our funds growing whilst withdrawing some living expenses and after consolidation paid off any housing loans we had.

The GFC set us back a bit, but my wife decided to go back to work full time as a teacher. So her salary helped regain some of the losses.

As time went on I decided that it was a good idea to get InvestSMART to do the research and instead of me just following their recommendations, to buy into their funds that follow their own advice.

It saves me time and it's good to know that InvestSMART watches the markets and adjusts accordingly.

It works for me!

It gives me a measure of reassurance, because I trust InvestSMART’s decisions. I believe in their integrity and expertise. Especially in bad market downturns, which I try to see as opportunities.

I believe that between InvestSMART and I our funds are in reasonably safe hands. This strategy saves money and time.

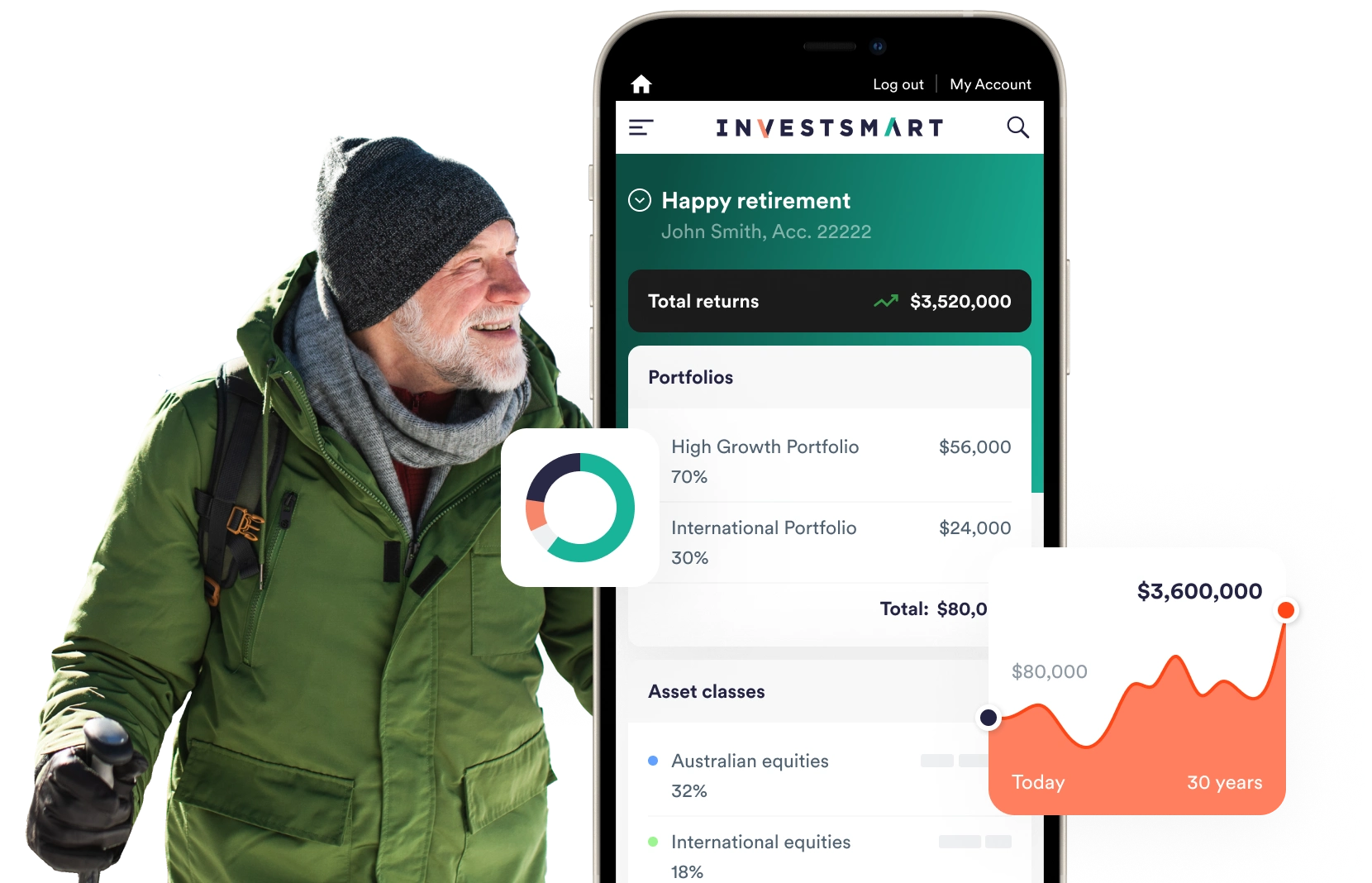

I/we can enjoy our retirement with sufficient funds to travel overseas and tour our wonderful country in a caravan. We have done about 150k km around Australia and are still finding new and wonderful things to see and do. And our funds are still growing quite well.

Thanks to InvestSMART and Alan Kohler, Mitchell Sneddon, and every person in the organisation.

I have nothing but praise for the service, the information and quick responses to stupid questions and requests I make from time to time.

Eureka Report is compulsory reading every Saturday morning!

Great job guys.

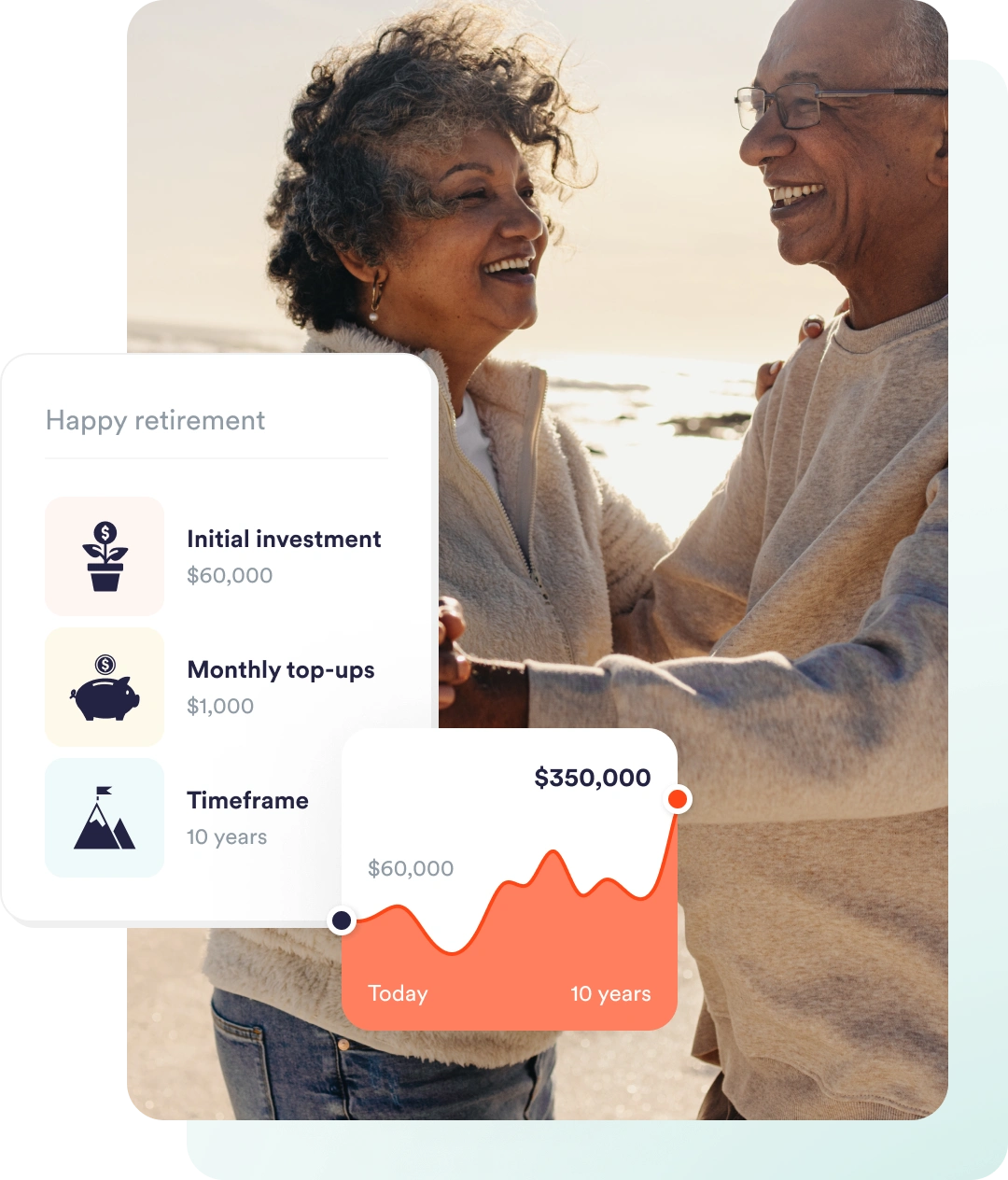

Saving for happy retirement

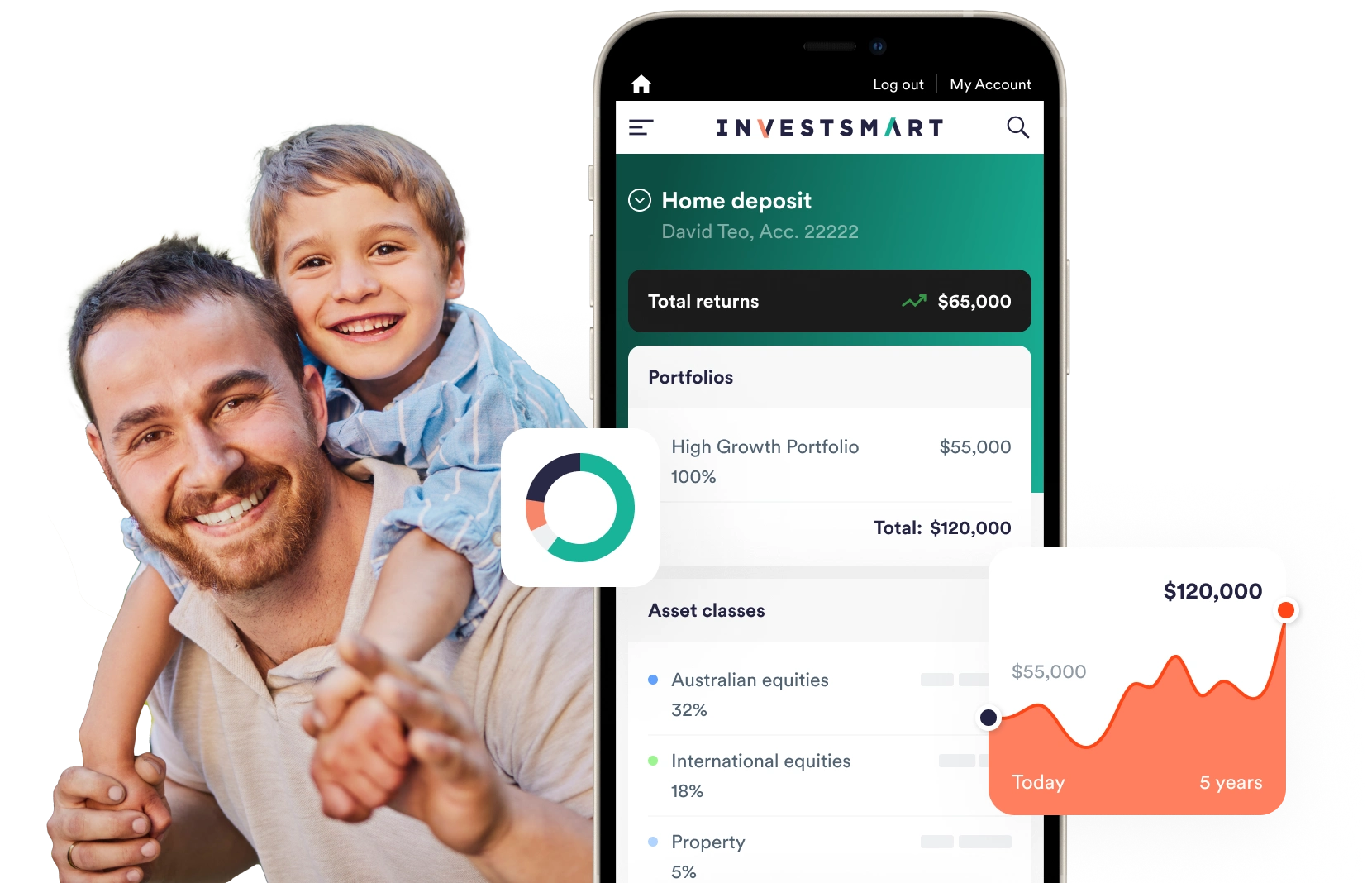

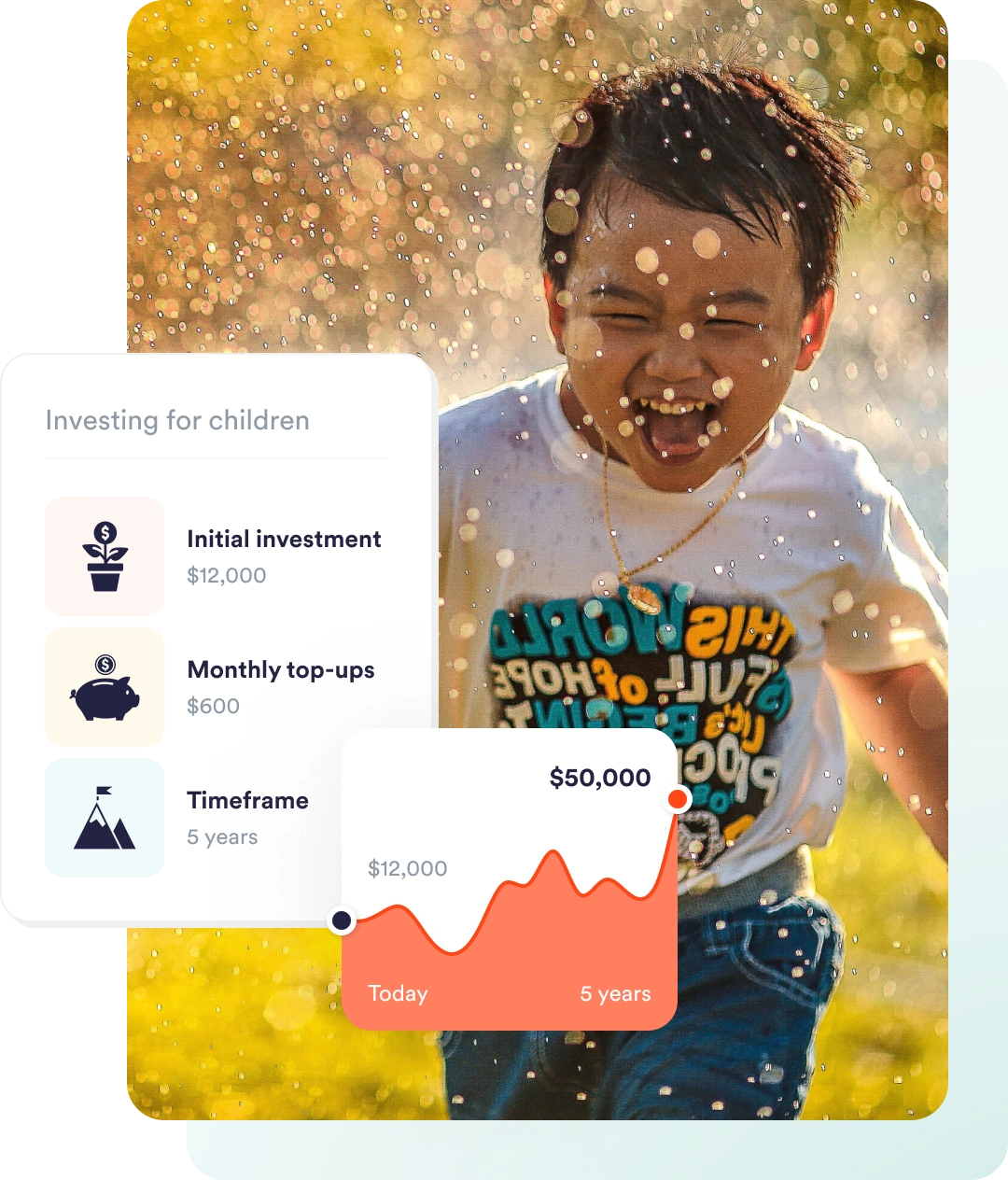

Saving for kids education

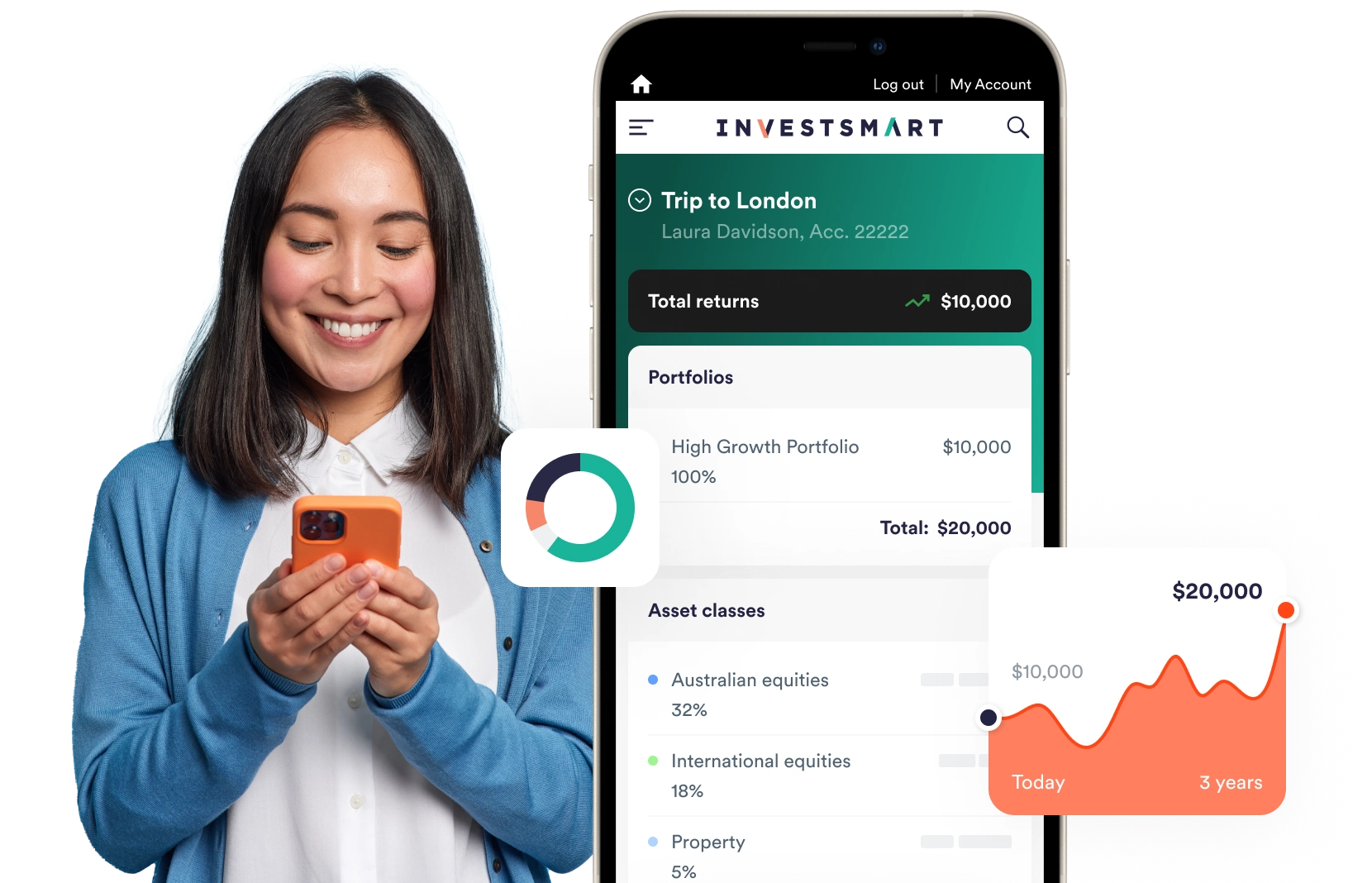

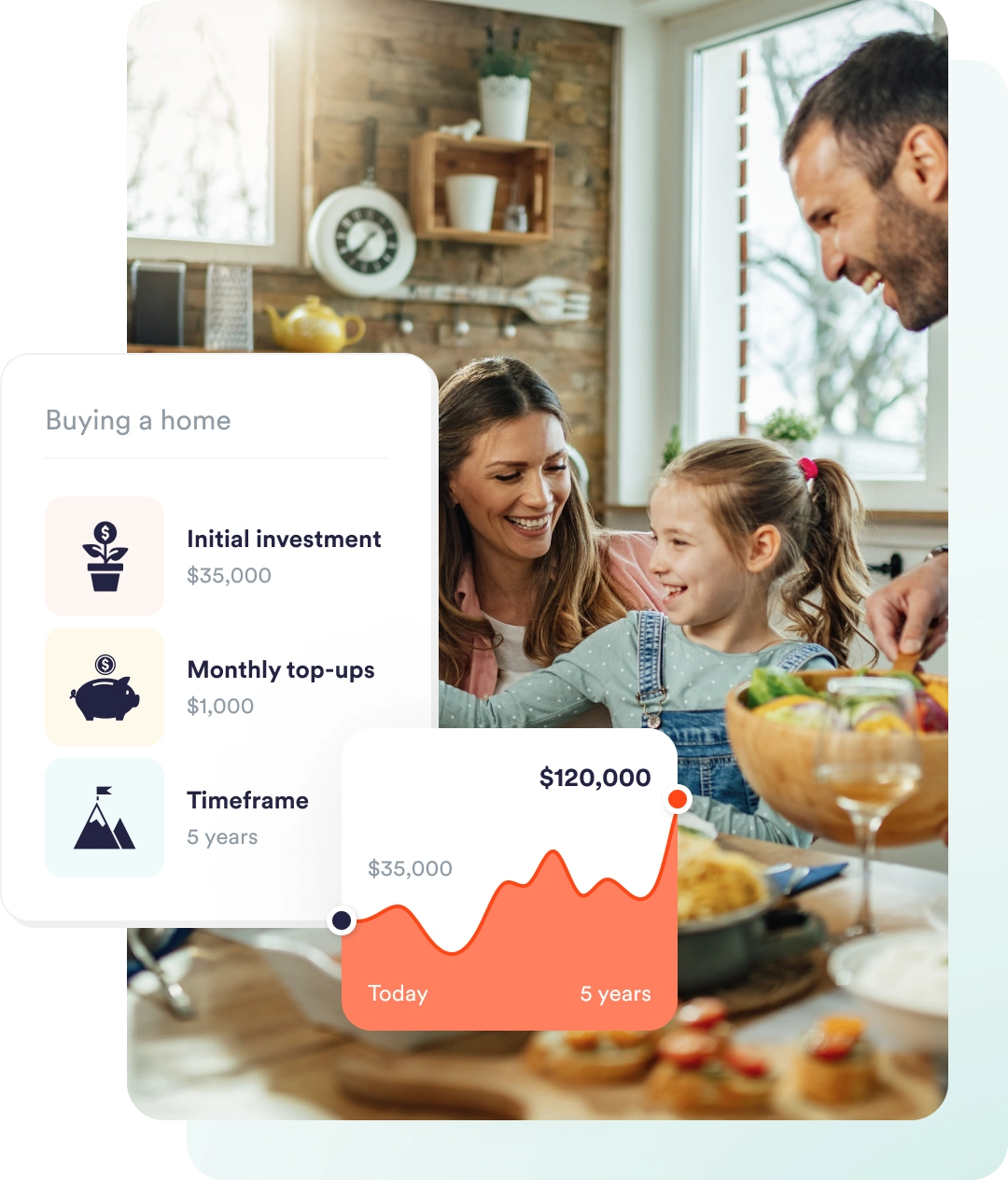

Saving for a property

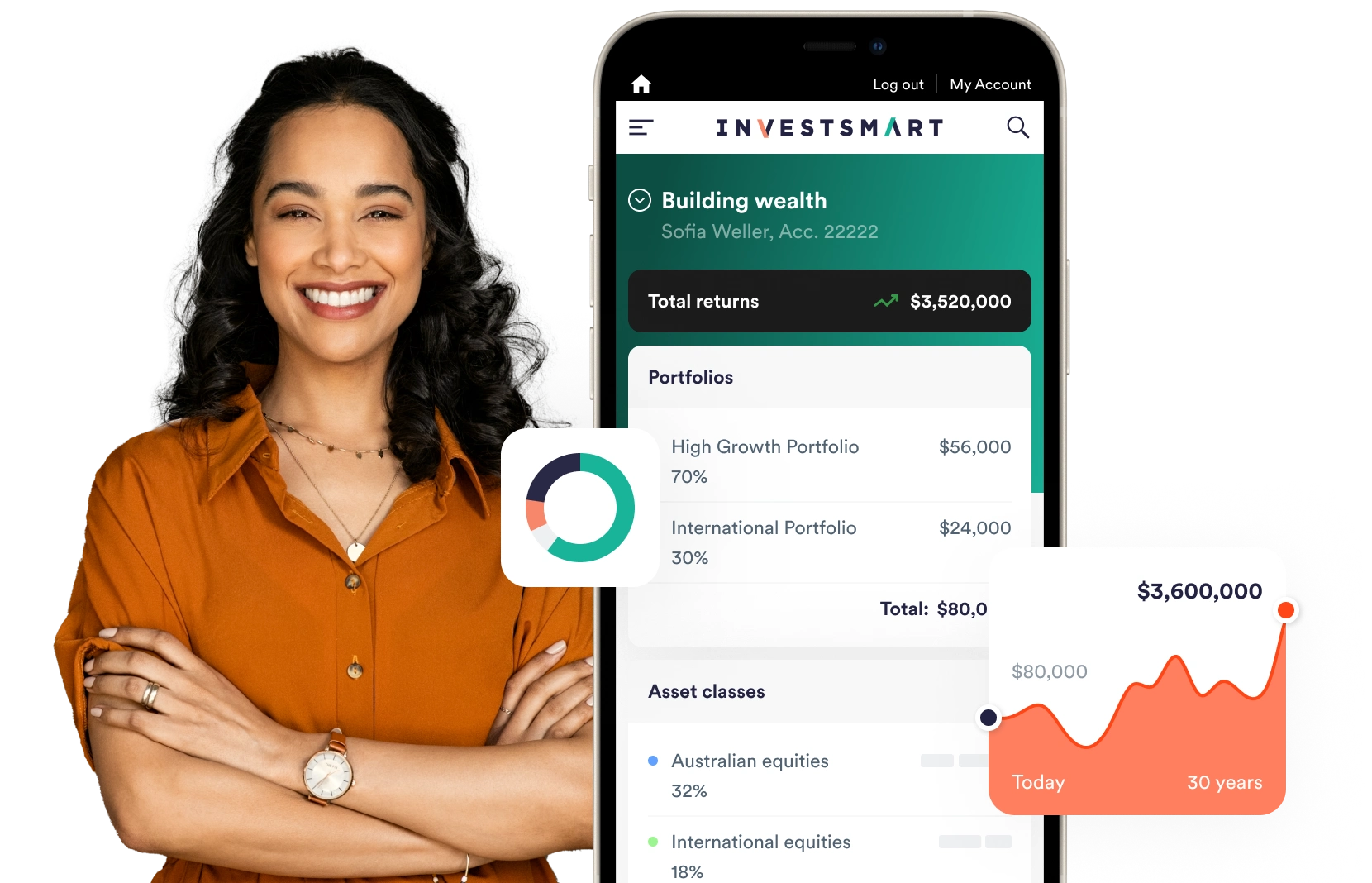

Wealth Protection

Need help planning and finding the right investment portfolio?Get StartedBalanced Portfolio

Growth Portfolio

High Growth Portfolio

Ethical Growth Portfolio

Single asset class ETF portfoliosCash Securities PortfolioHybrid Income Portfolio

Australian Equities Portfolio

International Equities Portfolio

Property & Infrastructure Portfolio

Need help planning and finding the right investment portfolio?Get StartedConservative Portfolio Balanced Portfolio Growth Portfolio High Growth Portfolio Cash Securities Portfolio Hybrid Income Portfolio Australian Equities Portfolio International Equities Portfolio Property & Infrastructure Portfolio Ethical Growth Portfolio See all ETF portfolios How it works Capped fees Who we are Portfolios performanceETF Insights

Paul's Insights

Podcasts & videos

Portfolio updates

Top Performing ETFs

Compare Your Fund

Need help planning and finding the right investment portfolio?Get Started