Yes, super is too expensive - so ban the skim

Jim Minifie of the Grattan Institute has performed a great service by describing in detail how expensive superannuation is in this country, and what a huge hole the fees excavate into Australians’ retirement savings.

But while he has clearly exposed the problem, Minifie has not, in my view, nailed either the cause of it, or the solution.

The fact is 20 years after Australia’s version of a national retirement savings system began, and despite quickly building one of the largest pools of money on the planet through mandatory contributions, the system is an inefficient, inequitable mess that benefits the industry that feeds on it far more than those who are supposed to benefit -- the people and the government.

Superannuation tax concessions are supposed to be an investment in reducing the cost of the government aged pension, yet reliance on the pension is rising, not falling, as Treasurer Joe Hockey is now pointing out almost daily.

It's also unfair: according to the Australia Institute, the top 5 per cent of income earners get 30 per cent of the tax benefits while the bottom 20 per cent get none.

And it's comparatively expensive: Australia’s super fees are as much as three times greater than elsewhere in the world, and costs have gone up even as increased scale should have brought costs down.

Over the past 10 years the average fee has come down from 1.38 per cent to 1.19 per cent, while the total funds under management have increased from $600 million to $1.7 trillion. That means total fees being extracted from super have increased from $8.28 billion to $20.23bn.

In the Grattan Institute report released yesterday, called Super sting: how to stop Australians paying too much for superannuation, Jim Minifie writes that the average fund has increased in size from from $700m to $4.2bn over the past decade, which should have produced cost savings of 20 per cent, or $2bn a year.

Yet the average cost of running these funds, according to Minifie, has increased by 20 per cent, not fallen.

Expenses per account holder have gone up even more: by 50 per cent, from $550 in 2004 to $820 in 2013. Fees increased by 51 per cent, from $820 a year to over $1300 in 2013.

The impact of these fees on the average retirement balance, assuming a 40-year contribution period and real wage growth of 1.8 per cent, is more than 27 per cent, or $250,000.

"Across the superannuation system in the decade from 2004 to 2013 (excluding the self-managed sector), gross earnings before fees were $378bn in 2013 dollars. Fees reduced net earnings by $158bn, over 40 per cent of gross earnings, to just $220bn.”

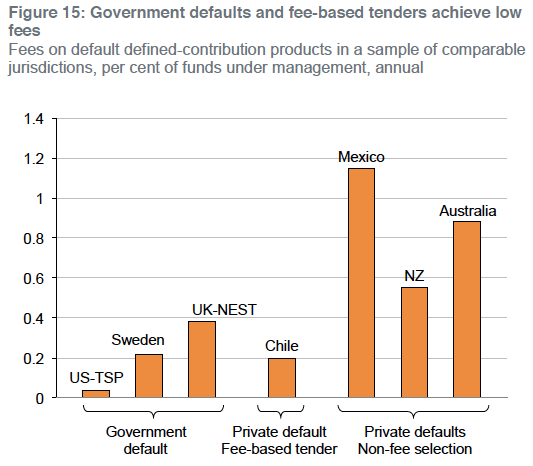

This graph compares Australia’s fees with those of some other countries:

Do Australia’s high fees provide value for money? Not according to the Grattan report: they are simply damaging retirement savings.

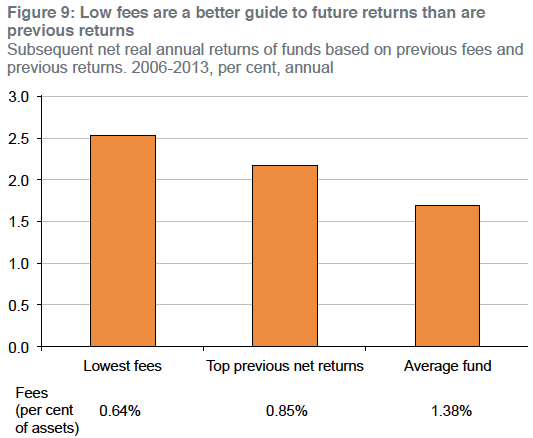

Minifie examined the subsequent performance of three groups of super funds over the period 2007-2013: low fee funds, previously high performing funds and all funds. Here are his results in a graph:

But having broken new ground in revealing just how expensive Australian superannuation is, and what impact the fees have on retirement balances, Minifie comes to this unsatisfying conclusion:

"Fees in Australia are high for one main reason. The system relies on account-holders and employers to put pressure on fees, but many do not."

Yes, but why not? It’s plain that competition is not working to bring prices down, and nothing the government has done has changed that. The Grattan Institute report rightly concludes that "Stronger Super" has not increased fee pressure and fees for MySuper products are not lower than their precursors.

The report puts forward two reforms it says are "urgently" needed to get fees down:

1. The government should hold a fee-based tender to select one of more non-government funds to be the default funds; and

2. The government should make tax time super choice time -- taxpayers should be given the chance to compare fees when they do their tax returns and be able to switch funds on the spot.

I’m sure that a government tender would make some difference and might even get the average fees down to the 0.5 per cent that Jim Minifie and the Grattan Institute think they should be.

But even at 0.5 per cent, super fees would compound at more than double the inflation rate and fund members would still not understand what they were paying or what they were getting for the fees.

As I wrote here two weeks ago (Superannuation is too costly, so bill me, April 14) the problem is that super is the only utility where the customers hand over their money, so the service providers don’t have to send a bill -- they just skim a percentage off the accounts.

Most people don’t understand percentages or the power of compound interest, and they don’t read the fine print of their annual super fund statements that disclose the fees they paid, so they don't know what they are paying. They won’t do it at tax time, either.

According to the Grattan report, the average super fee last year was $1300, or $108.33 a month.

If Australians got a monthly bill for $108.33 that they had to sit down and pay by cheque or BPAY, they would soon start taking notice of the service they were getting and putting pressure on the provider to get the fees down.

There is genuine competition among the electricity, gas and telecommunications utilities that do send out bills: in fact we’re all getting pestered by door-to-door salesmen offering cheap deals.

Super is also a utility, but as the Grattan Institute points out there is no price-based competition. That's because in this business the utilities hold our money and confuse us with percentages.

A government-run tender, as Jim Minifie suggests, is a possible solution.

But a far better solution would be banning the funds from taking their fees out of the accounts, and forcing them to send out bills instead.