Will the rich create a solar elite?

Yesterday I suggested that people had got carried away with the death spiral idea that wealthy consumers will seek to escape rising power prices by using solar and batteries to reduce their consumption of power from the grid, which then leaves the poor – like pensioners – behind to pay the rather hefty bill for past fixed investments in network infrastructure.

In that article I explained that the foreseeable increases in network charges to recover lost revenue from reduced grid demand due to solar PV was not big enough to spur large numbers of people to spend several thousand dollars on solar and batteries.

Today I’d like to address the concern that solar is like Robin Hood in reverse, robbing from the poor to pay the rich.

Now, it is true that the best predictor of whether or not a household is likely to take up solar is whether the house is owned by the occupant. This suggests the very poor – who will never afford to purchase a home – are not likely to be owners of shiny new solar systems. But it would be very wrong to conclude that solar uptake is a function of income and materially regressive in nature.

ACIL-Allen Consulting have undertaken an analysis of solar PV installations by postcode, taking into account data up to August this year, to identify relationships between household characteristics such as income, age, home ownership, etc, and uptake of solar PV.

ACIL-Allen concluded in the report prepared for the Australian Renewable Energy Agency that:

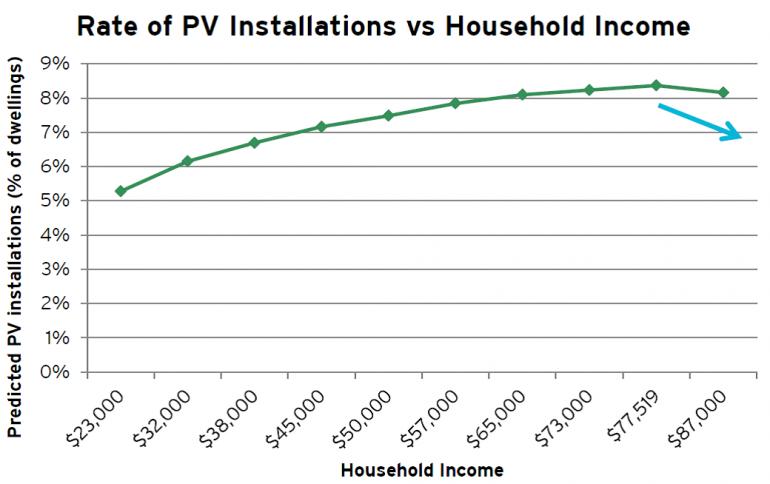

The chart below illustrates what they found. Locations characterised by low incomes still take up solar at about 5 per cent of dwellings which then peaks out at slightly above 8 per cent of dwellings at annual household incomes of $77,519. After this, rises in levels of household income actually correlated with reductions in solar PV uptake.

Source: Ivor Frischknecht, Distributed generation and the next frontier, presentation to the All Energy conference October 9, 2013.

Now, one has to appreciate that this is based on postcode data – it’s not actual analysis of the specific households taking up solar. For example there may be some reasonably well-off people living in postcodes characterised by low average incomes that are taking up solar. But what it’s safe to say is that solar is not about to fundamentally reshape income inequities.

It’s also worth noting that those on low incomes tend to have noticeably lower levels of electricity consumption than the rest of the population. Yesterday I estimated that because self-consumption of solar output reduces the amount of electricity over which network infrastructure costs can be smeared, the charge is about $4.83 higher per MWh consumed from the grid. For the average household this works out to something around an extra $8.50 on their quarterly bill. But for those in the lowest income quintile their lower average electricity consumption (4.4 MWh versus 7MWh) means the quarterly bill impact is closer to about $5.30, and this would be substantially offset by solar’s effect in depressing wholesale electricity prices, as detailed by the Melbourne Energy Institute.

What’s also interesting is the study found that contrary to common belief, income from Australian Government pensions was also positively correlated with PV uptake. This aligns with anecdotal feedback from solar retailers who’ve found solar popular with retirees. This boils down to their predictable but constrained income flow. They don’t like surprises in their expenses, and were extremely sensitive to the increases in power prices that have occurred. Solar PV may have involved a significant upfront investment but it creates much greater predictability about costs. The system can reliably operate for 20 years, insulating retirees to a large extent from further price rise surprises.

Solar, in combination with batteries, isn't about to suddenly create some major social schism where the rich abandon our shared electricity network, much like they’ve abandoned state government schools. So everyone just needs to calm down.

*Part one: Solar batteries ... enemy of the poor?