Why the market's optimism doesn't wash

John Addis

Why the market's optimism doesn't wash

The ability to forget might be one of the human mind's greatest assets, at least in my case. It's been three years since I foolishly accepted my wife's invitation to do a hot yoga class. After nearly drowning in my own sweat and afterwards needing assistance to get out of the car (something to do with my ‘electrolytes' apparently) I'm considering giving it another go.

Investors appear to be in a similar mood. In the first 10 days of trading last year the US S&P500 lost $US1.4 trillion, led by falls in materials, financials and tech stocks. It was the worst ever start to a year here, too. The ASX200 lost 3.3 per cent in three days, driven by falling commodity prices, weak global growth – that hardy perennial – and Kim Jong-un lighting the blue touch paper on a nuke.

Except for bad hair, all of that is behind us now. Optimism is back, triggered, unfathomably, by a man many would consider unfit to run a pawn shop. Since Trump's election on November 8, the S&P500 has risen 5.1 per cent. (Incidentally, although more widely quoted, the Dow Jones Industrial Average is a misleading relic best ignored.) In Australia, the bank sector index is up 18 per cent since Trump's victory and the ASX200 has risen 12.3 per cent. The optimism seems overdone.

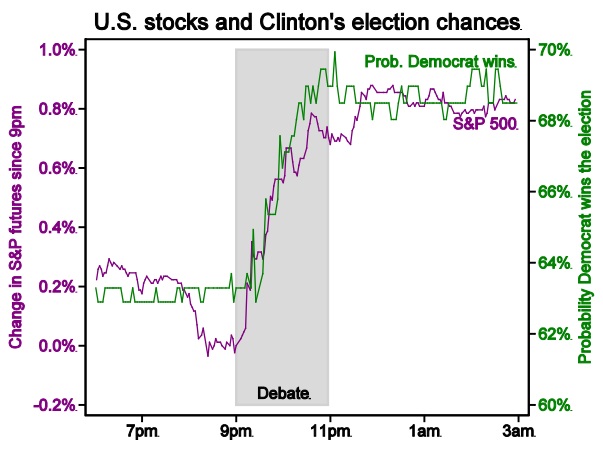

Prior to the election, few thought a Trump victory would be good for stocks. In fact, US markets were rising on the expectation of a Clinton win. The chart below, via Bloomberg and economists Justin Wolfers and Eric Zitzewitz, makes the point.

Explaining how it rose after Clinton lost would require a stiff drink and a good shrink. And yet here we are, watching aghast as markets ascend and scions of finance climb aboard a train no one thought would leave the station.

David Folkerts-Laundau, chief economist at Deutsche Bank, is an atypical passenger. A sober city gent with a mediocre track record befitting his profession, Folkerts-Landau believes Trump's plans could see US GDP growth hit 2.4 per cent this year and 3.6 per cent in 2018. Can't remember anyone forecasting that before Trump won, but there it is.

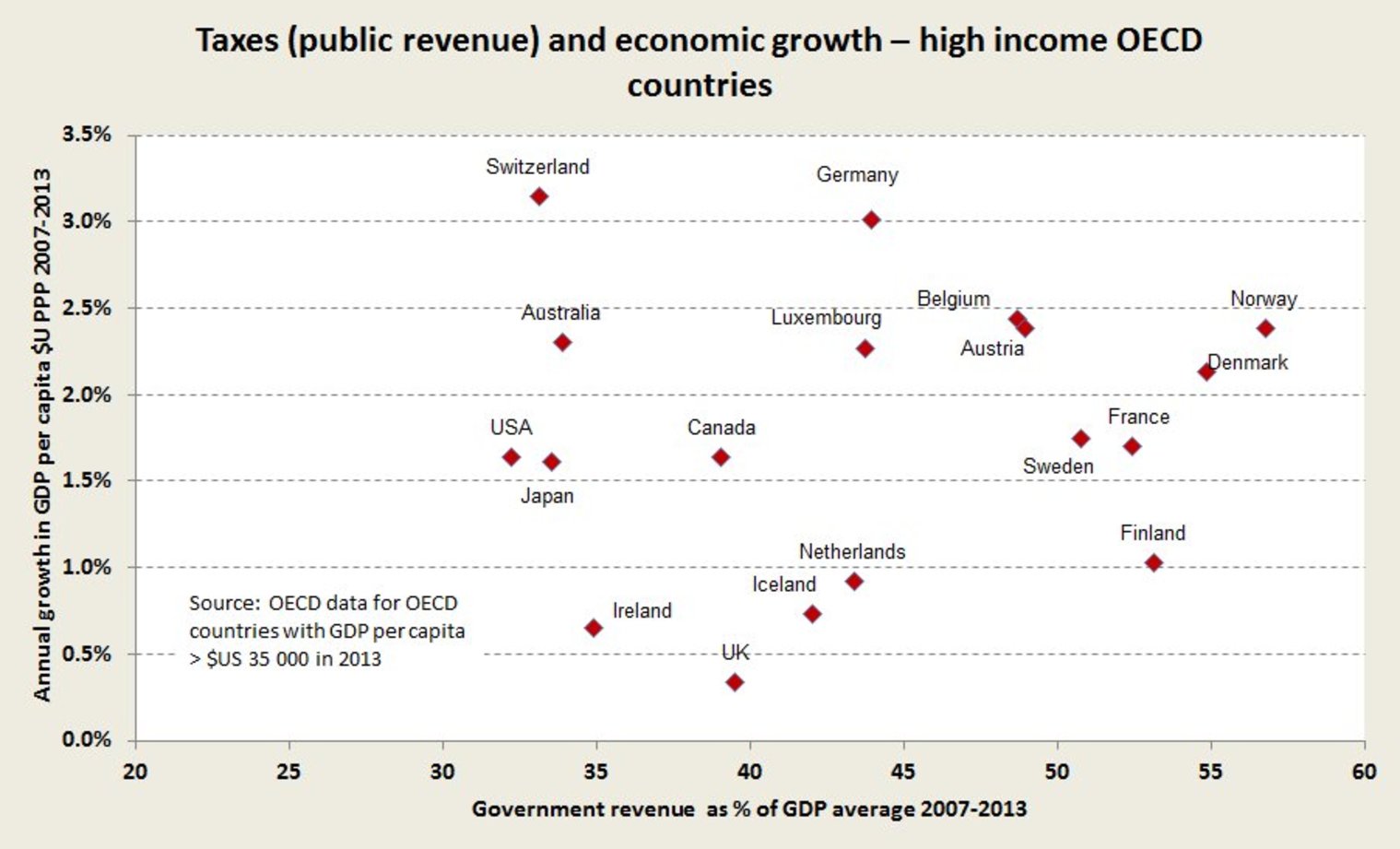

Such optimism is founded on the belief that corporate tax cuts and infrastructure spending will boost growth and justify the share prices we're now witnessing. There are only two problems with this view. First, there's no evidence that corporate tax cuts boost economic growth (see this paper by The Australia Institute).

In fact, there's no correlation between overall tax rates and growth at all, as the chart below, via Ian McAuley of the University of Canberra, indicates. The data isn't off the charts, it's all over it. Self-interest better explains why bodies like the Business Council of Australia bore us with their claims that lower corporate taxes cure everything from low economic growth to plantar warts. Sorry Grant, there's no evidence for it, and plenty against.

As for Trump's infrastructure program, details are scarce. If you've flown into a US airport recently, or tiptoed over a wobbly Detroit bridge, you'll know the country has much to do. Unlike tax cuts, there is evidence that infrastructure investment boosts economic growth and employment in the near term and productivity over the long term.

But with Republicans averse to increasing public debt, the private sector will probably be called upon to finance spending, and the appetite for doing so may not be that great. Neither of these rebuttals to optimism is getting much traction, much like the growing possibility of a US-China trade war, which this week the ABC called “the single biggest threat to Australia”.

Past US presidents have cautiously avoided truculent anti-Chinese rhetoric, recognising its damaging consequences. Trump is a different banana, a man who appears to derive an animating sense of purpose from a fight. This is not to say a trade war will happen, only that investors are underestimating its probability whilst overplaying the beneficial impact of tax cuts and infrastructure spending.

So the reasons for the current market boom are thin in my view, and US stocks at least look pretty expensive. Locally, the bigger blue chips look fully priced, although we have had some luck recently with Sydney Airport, Flight Centre and ASX, all of which have crept back onto the Buy List. Still, with global markets up and little justification for the price rises, investors are generally getting less compensation for the risks they're taking.

Perhaps this goes back to our tendency to forget the past and focus on what's in front of us. There are long-standing trends that threaten the global economic system under which most of us have prospered over the past few decades but, hey, who wants a tax cut and a new airport?

Globalisation has lifted hundreds of millions out of poverty in the East but is pushing ever-growing numbers of people into it in the West. With income growth stagnating in many Western countries, including Australia, and most of the benefits captured at the top, the political status quo is under threat.

In prosperous Austria for example, the recent presidential poll was tightly contested by a Green and the successor to a party founded in 1956 by a former SS officer (the Green won, just). Add Trump, Corbyn, Syriza, Podemos, Marine Le Pen and Pauline Hanson to the list of politicians previously deemed incapable of ascending to power. Some of us may regret these developments and others may welcome them. But we should all try to understand them because they will affect the environment in which we invest, perhaps dramatically.

I'll return to this theme in coming weeks but let's take a crack at a thumbnail sketch in the meantime. In hindsight, the global financial crisis was as politically transformative as it was economic. After crashing the global economy the bankers got bailed out and the public paid the price (yes, I know, it's more complicated than that but we haven't got all day).

In the years that followed, asset prices boomed while everything except China and commodity prices stagnated. The bankers kept their jobs and grew their wealth while factories closed, wages fell and 9.3 million Americans lost their homes. Income inequality had been increasing for decades, offset by the growing use of debt, but in the aftermath of the GFC there was no hiding it. It became an issue.

Why should this concern investors? Because, unlike tax cuts, there's plenty of evidence to suggest that income inequality is correlated to economic growth, albeit negatively. People on average or low wages spend most of their income; those at the top tend to shovel it into assets, which is why asset prices can rise even when economies are moribund. So, if income inequality continues to rise, economic growth is likely to be weaker, in which case, hands up who's happy with 4 per cent a year?

What else? Well, despite the Silicon Valley guff about disruption, many industries are increasingly concentrated, including those dominated by the likes of Google, Facebook, Uber, Apple and Amazon. Investment choice is declining as a result.

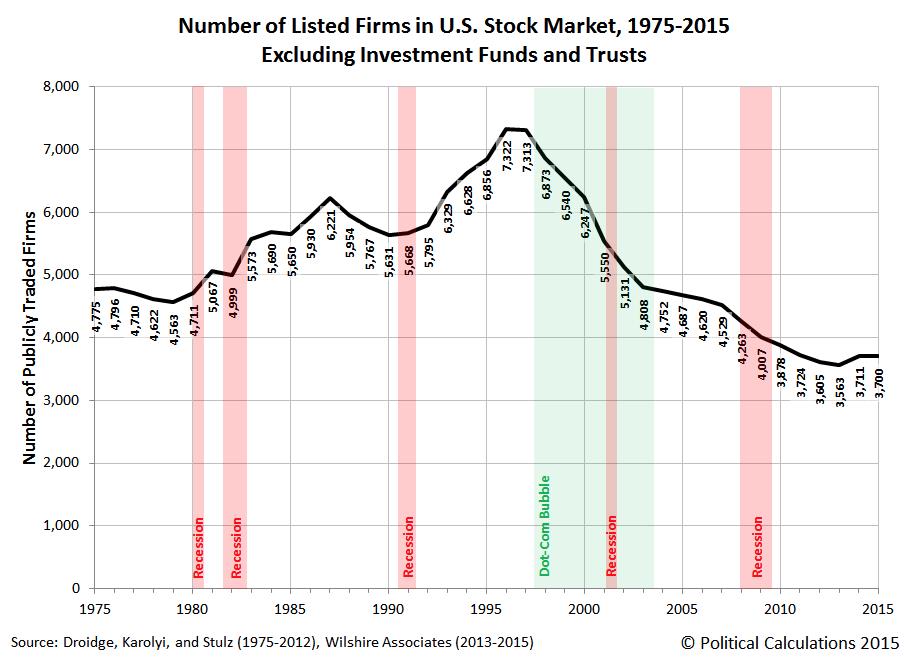

The Wall Street Journal reports that the number of US-listed companies has declined by more than 30 per cent since peaking in 1997, a result of mergers and acquisitions, fewer floats and more companies remaining private. If one excludes funds and trusts from those figures, as does the chart above, it's worse. Monopolies and duopolies abound and where they don't, governments have willingly created them. Think Sydney Airport, the energy sector, toll roads, the ASX and the forthcoming float of the ASIC registers.

Such businesses can make wonderful investments because of their pricing power, but they also create a sense that in many areas of our lives we're being ripped off. Capitalism is meant to deliver innovation and price competition but if the average citizen doesn't see much of either and the game looks rigged, why not change the game? Why not vote for a Trump or a Farage? When you don't have anything, what have you got to lose?

Anatole Kaletsky calls this a crisis in market fundamentalism, arguing that, “When a particular model of capitalism is working successfully, material progress relieves political pressures. But when the economy fails – and the failure is not just a transient phase but a symptom of deep contradictions – capitalism's disruptive social side effects can turn politically toxic.”

Some conventional politicians are awakening to the need to address these issues but outsiders are beating them to it. In the meantime, Trump's policies are likely to irritate rather than appease the anger. Where that political energy goes when his support base realises they've been had is anyone's guess.

So, it's complicated, fascinating and not a great way to kick off 2017. But we are where we are. As events unfold, we'll be here to help you navigate a way through them, picking the eyes from the opportunities that arise when the market realises the optimism is overdone. In the meantime, there's always the diversions of Donald Trump's Twitter feed or hot yoga to keep your brain sparking. But please, don't overdo it.

Readings and Viewings

Welcome back from the holiday break. As you know, the news never stops, and there are always plenty of interesting items from around the world. As we head into 2017, there will lots of things to report no doubt.

Here are a few of the early cabs off the rank, starting with Volkswagen going into a $US4.3 billion high-speed emissions-fuelled reverse spinout this week after the company pleaded guilty to criminal charges.

Meanwhile, Fiat Chrysler shares lost 10 per cent in the US on Thursday night after it was drawn into the emissions scandal.

It's been a big week for Yahoo too, with its CEO stepping aside and the company announcing it will change its name to Altaba following its takeover by Verizon. It's an unusual name change, and in this article Fortune lists some other corporate shockers.

Australia's property market continues to run hot, but we're not the only ones. UK housing prices are also surging.

But New Zealand house prices are being impacted by banks enforcing tighter loan-to-valuation ratios.

On the other side of the equation, a little-known piece of legislation in New York known as “Loft Law” has helped a Manhattan couple to pay no rent for seven years. But the landlord says they owe $410,000 in back-rent and electricity charges.

If you're fed up completely, this is the latest list of the best places in the world to retire in 2017. Australia doesn't rate a mention.

The big news here this week has been MP travel rorts … $2500 on a polo match, family air tickets to Perth. But that's chicken feed. Reports show that Barack Obama's travel has cost US taxpayers $US100 million over eight years.

In the UK, however, it's still all about Brexit. And many are confused about Prime Minister Theresa May's strategies around the EU.

Over in Canada, bankers are sounding super happy about Donald Trump as he heads closer to his inauguration.

And there's also optimism on the energy front, with US experts predicting this year will be good for gas prices. But how that flows through in Australia remains to be seen.

And then there's the overhang to our economy of China, of course, with the Asian giant set to cut steel and coal production again.

To more corporate news, and Israeli high-tech companies raised a record $US4.8 billion in venture capital last year. The nation has the largest representation of listed companies on the NASQAQ outside of the US.

Uber lost $2.2bn in nine months, and doubts are rising of the start-up darling's future in a driverless car world.

Could blockchain take India cashless? That's the question being asked as this country, also known for its IT prowess, moves further up the cryptocurrency chain.

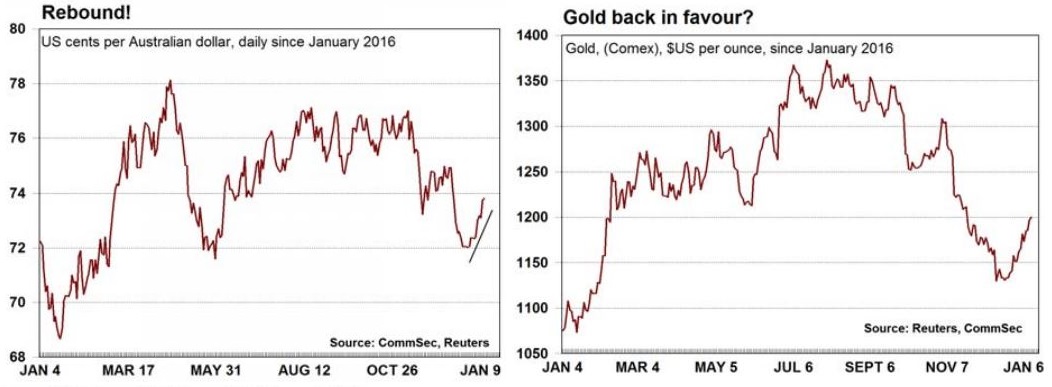

On a brighter note, the gold price has been rising steadily over recent weeks and some forecast it will crack through $US1300 shortly. But that won't do the late US pop singer Prince any good, even though he died with a stash of gold bars.

If you're a Bob Dylan fan, you're bound to like his latest album – a new release of live recordings from 1966.

Another old rocker is Stevie Wonder, who this week serenaded current first lady Michelle Obama.

Meanwhile, Robert Mankoff – the cartoon editor of The New Yorker magazine – explains the science of humour.

Lastly, the Australian funds management group Hunter Hall has been in the news over the sudden resignation of its founder and key shareholder Peter Hall. We spoke to him last year, well before the current events, and he had this to say on video.

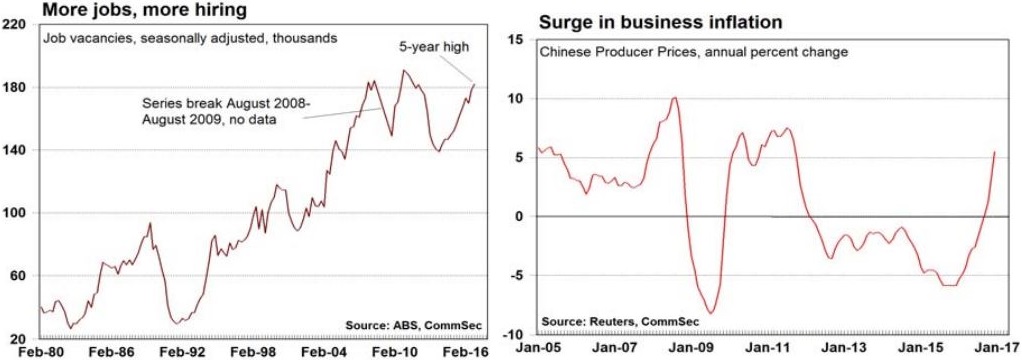

Last Week – in six charts

Savanth Sebastian, CommSec

Savanth Sebastian is a senior economist at CommSec.

Next Week

Craig James, CommSec

Mixed data offerings in Australia

Economic data releases over the coming week cover a variety of topics including consumer confidence and spending, housing activity and the job market. Thursday's job figures are the highlight.

In Australia, the week kicks off on Monday with the release of the Overseas Arrivals and Departures publication from the Australian Bureau of Statistics (ABS). Not only does the data cover tourism flows but also longer-term migration in and out of the country. A lower Australian dollar is encouraging more tourists to choose Australia over other destinations. Tourist arrivals are up 12.7 per cent over the year while departures are up just 4.3 per cent.

On Tuesday, there are three indicators of note: housing finance, new vehicle sales and the weekly series of consumer sentiment.

Based on data from the Bankers Association, the number of new home loans may have fallen 1.5 per cent in November. In part, home buyers have become more wary about purchasing property. But also there are fewer homes on the market than a year ago, causing budding buyers to be more patient.

The vehicle sales data for December has already been released by the industry body – the Federal Chamber of Automotive Industries. The sales data issued by the ABS on Tuesday merely recasts the bottom-line figures in seasonally adjusted and trend terms.

On Wednesday the ABS releases the Building Activity publication which includes the latest figures on dwelling starts (commencements). Starts have been volatile in recent quarters – falling 9.5 per cent in the June quarter after lifting 8 per cent in the March quarter. Starts should have rebounded in the September quarter.

The weekly consumer confidence data is released on Tuesday with the monthly measure issued on Wednesday.

On Thursday, the ABS releases the monthly labour market figures for December. After an out-sized 39,100 lift in jobs in November, we are looking for a more sedate 10,000 lift in jobs in December. But little change is expected in unemployment and the participation rate with the jobless rate steady at 5.7 per cent. Forward-looking indicators point to modest reductions in the jobless rate over the coming year.

On Friday the CommBank Business Sales Index is released with new home sales data.

Overseas: Quiet start to the week

Overseas, there is plenty to watch in the coming week. But events are largely confined to the second half of the week including the US Presidential Inauguration and Chinese economic growth figures on Friday.

The week kicks off on Tuesday in the US with the release of the influential Empire State manufacturing survey and regular weekly data on chain store sales.

On Wednesday in the US the December data on consumer prices and industrial production are released with the National Association of Home Builders index for January and November data on capital flows. Consumer prices are edging higher, influenced by firmer gasoline prices. And production may have lifted 0.4 per cent after a similar sized fall the previous month.

On Thursday in the US, the December data on housing starts is released with January data for the influential Philadelphia Federal Reserve index. Starts slid 18.7 per cent in November but are tipped to have rebounded by 10 per cent in December. On the same day the weekly data on claims for unemployment insurance is released.

On Thursday in China, the December data on house prices is expected. And on Friday the spotlight shines brightly on the December quarter economic growth figures – released alongside the latest monthly data on retail sales, production and investment. The Chinese economy probably expanded at a 6.7 per cent annual pace in the quarter and economists expect growth of between 6-7 per cent over 2017.

And on Friday in the US, Donald Trump is formally sworn in as President. Sharemarkets have been rallying on hopes for tax cuts and infrastructure spending. Now we want to see the legislation outlining the changes.

Sharemarkets, interest rates, exchange rates and commodities

The US earnings season cranks up a notch in the coming week.

On Tuesday, earnings are expected from 18 companies including Morgan Stanley and Advanced Micro Devices.

On Wednesday, around 27 companies are to report including Charles Schwab, Citigroup, Goldman Sachs and US Bankcorp.

On Thursday, profit results are listed for 35 companies including American Express, E-Trade, Atlassian, BNY Mellon and IBM.

On Friday, only eight companies are slated to release earnings including General Electric.

According to Zacks, fourth quarter “earnings for the S&P 500 companies are expected to be up 3.1 per cent from the same period last year on 3.9 per cent higher revenues. This would follow the 3.8 per cent growth in Q3 earnings on 2.3 per cent higher revenues, the first instance of positive earnings growth for the index after five quarters of back-to-back declines.”

Craig James is chief economist at CommSec.