Why bauxite is defying the commodity slump

Summary: The price of bauxite has been rising in the face of a slump in iron ore and coal prices. The Indonesian Government has banned the export of unprocessed ore, while there is steady demand for aluminium. One insider expects a bauxite shortage as early as 2016 when China's stockpile is depleted. High production costs in Australia mean the amount of unprocessed ore exported is rising. |

Key take-out: International pressures including the Indonesian ban and the outbreak of Ebola in West Africa are a positive development for Australian bauxite miners. |

Key beneficiaries: General investors. Category: Commodities. |

It's been a long time since a tonne of bauxite, the ore of aluminium, cost as much as a tonne of thermal coal or a tonne of iron ore, but that point is not far away thanks to bauxite rising and the other two falling.

There are multiple grades of the three bulk minerals which can make price comparisons difficult but as a rough guide Australian bauxite delivered to China has risen by 33% from $US45 a tonne three years ago to around $US60/t today.

Over the same time thermal coal has fallen by 50% from $US140/t to $US70/t and iron ore has fallen by 58% from $US185/t to $US80/t.

Over the next few years, thanks to a complex set of issues which are evolving in the bauxite business, its price is expected to rise to around $US80/t – by which time it could be trading at a higher price than its more prominent bulk rivals.

The collapse of coal and iron ore prices have been well reported and are reflected in widespread mine closures, hefty corporate losses and, more recently, the failure of four small iron ore mining companies with Pluton Resources the latest to flop.

A different situation is unfolding in the bauxite world where investment is rising and new mines planned, a point explored in Eureka Report earlier this year (Bauxite's blistering pace, May 30).

The most powerful force in the bauxite market for the past 12 months has been the same as that affecting the nickel market: a ban by the Indonesian Government on the export of unprocessed ore of any sort. But there is also steady demand for aluminium in the construction and vehicle manufacturing industries.

A secondary and newer factor affecting the market is concern about future investment in one of the world's major sources of seaborne traded bauxite – West Africa, a region hit by the outbreak of the deadly Ebola virus. No shipments have been delayed, yet, but plans for a number of projects have been put on hold with buyers starting to look for more reliable sources of future supply.

The outlook for bauxite and alumina (or aluminium oxide) was the theme of a conference in Singapore last week at which a manager from Alumina Ltd, Australia's biggest bauxite miner and alumina refining company, forecast a looming shortfall of bauxite in China as a result of the Indonesian ban.

The shortage had been expected to develop earlier but appears to have been delayed by a big build-up of stockpiles ahead of the ban, a Chinese defensive measure which has, so far, delayed the arrival of higher prices.

Andrew Wood, Alumina's group executive for strategy and development, told the Reuters news agency on the sidelines of the Asian Bauxite and Alumina Conference that “we could see a shortage (of bauxite) as early as 2016 when China's stockpile is depleted and before new mines from places like Guinea come on board”.

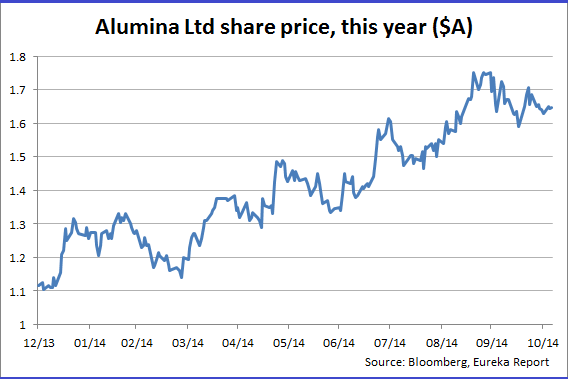

Alumina is a partner in Alcoa Worldwide Alumina and Chemicals, the world's biggest supplier of alumina, and has been a beneficiary of the Indonesia bauxite ban. Since the start of the year its share price has risen by 59% from $1.03 to recent sales at $1.64.

Smaller mining companies looking for ways into the bauxite market have also done well though like any bulk commodity the business model is largely driven by non-mining matters such as transport costs and access to infrastructure (railways and ports).

It's infrastructure issues which explain why big companies such as Alcoa, BHP Billiton and Rio Tinto are the major players in the aluminium industry which starts with bauxite mining and proceeds up a value adding chain to refining (alumina) and then smelting (aluminium).

Understanding the industry is tricky for anyone on the outside but these are the big issues:

- Over-development of aluminium smelting, especially by countries with access to cheap energy such as Saudi Arabia and Canada, caused a crisis for everyone exposed to the metal, especially Rio Tinto which overpaid for Canadian-based Alcan in 2007. The aluminium glut is slowly being absorbed but it remains a metal driven more by the price of electricity than simple supply and demand factors.

- Bauxite mining has received less investment than alumina refining or aluminium smelting and while it is a relatively easy commodity to mine and readily available in a number of countries there are important grade, impurity, logistics and political issues affecting its supply.

- Most Australian bauxite is currently consumed in the value-adding alumina refining process. That is especially true of WA bauxite which has a lower aluminium content (38%) compared with bauxite mined in Queensland and the Northern Territory where it averages around 50% aluminium.

- Because production costs in Australia (especially for energy) are rising faster than most other countries a significant change has started in the bauxite/alumina sector which is seeing a rise in the export of unprocessed ore, a switch encouraged by Indonesia's withdrawal from that part of the business.

- Rio Tinto's decision to close its bauxite refinery at Gove in the Northern Territory and turn the project into an ore-exporting business is the best example of what high Australian energy costs are doing to the industry.

- Alcoa (with its partner, Alumina) and BHP Billiton are unlikely to make the switch to bauxite exporting from the their WA mines because it is lower grade ore, but a number of small companies are looking at ways to start bauxite exports from WA, Queensland and Tasmania.

What happens next in the bauxite business will be heavily influenced by the raw material buying plans of China, the actions of the Indonesian Government and control of Ebola in West Africa.

For Australian bauxite miners the international pressures are a positive development, though for the wider community the loss of value-added alumina production because of high energy costs, and its replacement by low-value dig-and-deliver bauxite exporting, could be damaging.