Why... are oil stocks not dropping?

Summary: The oil price has fallen sharply since mid-June due to concern about a supply glut, but Woodside and Oil Search shares have been protected as most of their revenue comes from selling LNG under long-term contracts. One investment bank says oil is a “buyer's market”, and that oil producers need to accept the low-price environment and then attack costs. |

Key take-out: There is little Australian investors can do except watch events unfold on international markets. But even if Australian oil and gas producers are protected by LNG contracts, they could eventually feel the pinch. |

Key beneficiaries: General investors. Category: Oil and gas. |

Oil is down 25 per cent. Yet Woodside Petroleum and Oil Search are down 3 per cent – a difference which leads to an obvious question: what's up?

There is no easy answer because there is rarely a direct, or immediate connection between a commodity market and an equity market. It can take time for one market to affect another.

But what has been happening to the price of oil over the past month does point to an interesting time ahead for producers of oil and gas, not that Australian equity investors appear to see it that way… just yet.

The reason for the sharp fall in the oil price since mid-June can be attributed to ongoing concern about the oil-supply glut which might get worse if Iran makes a return as a major oil producer after reaching a nuclear development program standstill with the rest of the world.

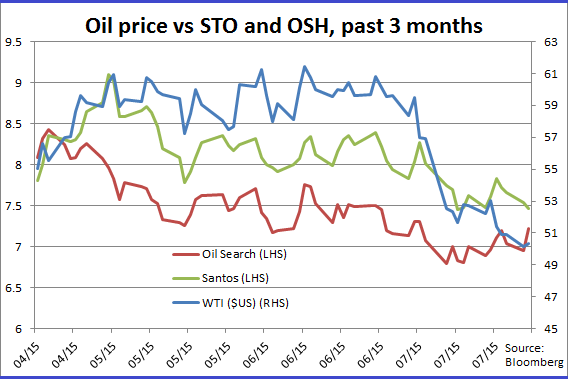

It's the glut and Iran which are behind a fall in the oil price from a mid-June high of $US67 a barrel to the current price of around $US50/bbl for oil traded in the US, the West Texas Intermediate (WTI) price.

Woodside and Oil Search are protected from the full effect of what's happening on the oil market because most of their revenue comes from the sale of liquefied natural gas (LNG) under long-term contracts.

That's why Woodside shares have slipped modestly from $35.61 on June 19 to $34.60 and Oil Search is down from $7.43 to $7.21. Santos, however, is more exposed to the oil price which is why it has fallen further, down 13 per cent from $8.35 to $7.45.

Another factor holding up the Woodside share price is its very generous dividend policy which sees the company distribute more than 80 per cent of its profits to shareholders which has made it a “must have” for yield hunters.

In time, and that's the key to the price differences, the oil price does flow through to all producers of oil and gas and that's when even oil-sector investor favourites such as Woodside, Oil Search and Santos could feel the pinch like everyone else exposed to oil.

For now, there is a disconnection between the oil market and the Australian equity market, aided somewhat by the falling value of the Australian dollar against the US dollar – though because most oil company costs are in US dollars that protection will not last long.

Traders who took short positions after the Iran deal was announced will today be sitting on handsome profits, as are the owners of oil carrying ships who are having a bumper season thanks to the sharp increase in the amount of oil being moved around the world – the upside of the glut.

What everyone in the oil business is watching with growing concern is whether oil will test the six-year low of $US42/bbl reached in March, a price close to 68 per cent below its 2011 high of $US130/bbl.

If oil does test that March low soon it will not be the fault of Iran because that country is at least six months, and possibly several years, away from making a full scale return.

The challenge for Iran is that it needs an estimated $US240 billion in fresh investment to refurbish its old oil fields, some of which have been in production for 70 years, and develop new oil fields.

It's the challenge ahead which prompted Helima Croft, global head of commodity strategy at investment bank RBC, to this week question whether Iran would be able to quickly bring an additional one million barrels of oil a day to the world market. Her estimate is that it will be hard to add even half that amount.

While Iran might be an unknown influence on the market in the short term there is no doubt that the threat of more oil, whenever it might arrive, has sent a jolt through the energy sector.

Ed Morse, global head of commodities at the investment bank Citigroup this week described oil as a “buyer's market”.

Andy Brown, international director for upstream (crude oil production) at Royal Dutch Shell, said in an interview with the Reuters news agency that he only expected a slow recovery in oil prices over the next five years.

“We are not banking on an oil price recovery overnight,” Brown said. “It will take several years but we do believe fundamentals will return.”

There is little Australian investors can do except watch events unfold on international markets where it is entire countries as well as companies being influenced in negative and positive ways by the low oil price.

The outlook for oil (and other forms of energy) is causing a combination of concern and delight across the investment world.

For consumers it's a bonus. For producers it means tough times, which Citigroup summed up in an analysis of the world's biggest oil producers by describing it as a time for “feet to the fire”.

The Citi view is that even the biggest oil producers face a time when the oil price could trade below marginal costs.

“With return on equity (ROE) below cost of equity (COE) we think high quality management teams will be the ones that place a priority on putting their house in order,” Citi said.

The bank said that involved a two-step process. Firstly, to accept that we live in a low-price oil environment, and then to drive a self-help program by attacking costs.

Australian oil and gas producers, even if protected by long-dated LNG supply contracts, will eventually feel the same heat as that being felt today in the global oil market.