When outsourced solar sells ...

SolarBuzz

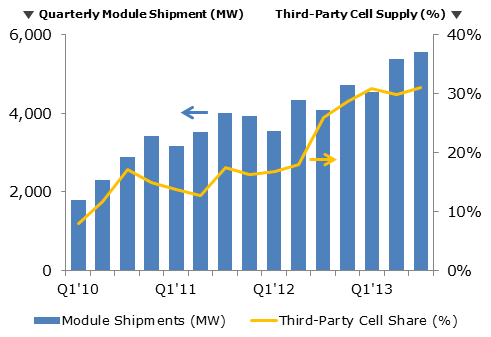

Almost one-third of c-Si modules being shipped today by the leading (tier 1) c-Si module suppliers for solar PV installations are using c-Si solar cells made by third-party suppliers. The substantial increase in the use of outsourced cells is primarily due to the following factors:

– Chinese module suppliers are increasing their market share within the United States. The US end-market requires that Chinese PV modules use non-Chinese-made PV cells to avoid import duties.

– The top four c-Si Chinese brands sold into the US market (Yingli Green Energy, Trina Solar, Canadian Solar and Renesola) have increased shipments from 30 MW in Q1’10 to approximately 600 MW in Q3’13, thereby increasing industry outsourcing.

– As one of the leading countries for solar-cell manufacturing, Taiwan cell makers are only beginning to add meaningful levels of module capacity; therefore, Taiwan cell makers still rely upon supplying cells to module manufacturers to sell to the end-market.

– Third-party module supply is also currently on the rise, with many leading c-Si module suppliers operating on a fab-lite basis (part in-house AND part third-party sourcing). This trend is expected to continue during 2014, because leading c-Si module suppliers can grow quarterly shipment levels through the use of OEM partners (typically tier-2 manufacturers).

– The c-Si value-chain from wafer-to-module remains largely a buyer’s market, with many tier-2 Chinese companies having no option but to act as OEM suppliers to tier-1 competitors. The use of third-party cells in shipped c-Si modules from tier-1 manufacturers has increased from below 10 per cent in Q1’10 to over 30 per cent during most of 2013.

Figure 1: c-Si Shipments & Outsourcing Trends

Source: NPD Solarbuzz Module Tracker Quarterly and NPD Solarbuzz PV Equipment Quarterly

While historically, tolling and contract manufacturing was widely used at the wafer and cell stage, it is now beginning to shift to the module stage also. This shift is happening, because it allows manufacturers to avoid releasing capex for additional in-house capacity.

The use of third-party suppliers for wafers, cells and modules will continue to grow over the next few quarters, with many of the leading Chinese suppliers looking to increase market-share in the United States. Capacity additions during 2014 will be a combination of new production lines, increased OEM supply contracts, and ramping up tools that were delivered 12-18 months back when excess capacity was delivered by equipment suppliers.

The options available to leading c-Si module suppliers are delaying decisions on capex for integrated ingot-to-module capacity. This delay is reflected currently in the lack of new orders being reported by PV equipment suppliers.

However, some of the leading c-Si manufacturers (covering ingot/wafer, cell and modules) will add in-house capacity during 2014. This added capacity will be driven by technology differentiation or simply wanting increased module capacity to retain final assembly/shipment under in-house ownership. Module capacity also has the lowest cost, and can be added within six to eight weeks, if factory space permits.

Finlay Colville is vice president of SolarBuzz.

This article was originally published by SolarBuzz. Reproduced with permission.