When investing, think of Germaine Greer

John Addis

When investing, think of Germaine Greer

We have all had schisms in our lives, a break in our understanding of how we perceive the world and the way it truly is. Whether it's a health scare, an affair perhaps, or the emergence of new life, the world looks different to how we thought it was. (Yes, this Weekend Briefing, my last of the year, is a little different. Please bear with me until something useful emerges.)

For me, the last six months have been a bit like that. I did not anticipate the UK exiting the EU or US voters electing Trump. Nor did I expect interest rates to be at record lows eight years after the financial crisis. Neither did I foresee that event igniting a burgeoning political movement of the right. And I certainly didn't expect asset prices to be where they are given the state of the global economy. The only comforting constant has been Sydney and Melbourne property prices, which I've never understood.

It's a challenging environment for investors because facts, truths and reason seem to no longer carry the weight they once did.

Even before his inauguration, Trump has walked back from key promises. Politicians do that, of course, but most have the decency to wait a few months and use words that help us all pretend it isn't so. The nakedness of his reversals seem somehow new.

During the Brexit campaign, a big red bus toured the UK plastered with a slogan that read, “We send the EU £350 million a week. Let's fund our NHS instead”. The Vote Leave campaign deleted this “fact” from its website as soon as it had won. This week, the UK Government announced it would require an extra £58.7bn in borrowings to cover the cost of Brexit.

The post-fact world is aided by professional forecasters, who perpetually prepare us for things that don't happen and miss the things that do. In 2014, the OECD said Australia's interest rates would rise the following year. They didn't. The same claim was made in 2015 for 2016, with the same result. And this week the Financial Review reported that the OECD believes rates would rise next year, with no reference to previous forecasts being wrong.

The clincher was my 11-year-old son, bless him, who on the way to football training last Wednesday asked if I had heard of fake news, using the example of the Brazilian football team that hadn't really been in a plane crash.

Even the scions of the financial press are sliding. This from the Financial Times on Thursday, about OPEC agreeing to cut oil supply: “They've pulled a rabbit out of the hat. But the devil is in the details and compliance with the cuts will be what makes or breaks the deal”. Three cliches in less than 30 words: Thank you, Yasser Elguindi of Medley Global Advisors.

Can we really live in a world where an ASX announcement can lay fair claim to being a zenith of truth, clear language and honest intent? If facts are passé and language has become a string of addled expressions, knocking into each other like drunk drivers on a freeway, what can investors do when truth and falsehood carry equal weight and the stupid and the smart receive equal air time?

I'm going to make a few suggestions of my own and then one from Germaine Greer (yeah, that surprised me, too).

1. Forget what you can't control. Concentrate on what you can.

Peter Lynch once said that, “if you spend more than 13 minutes analysing economic and market forecasts, you've wasted 10 minutes.” The OECD wastes a lot more time than that and we probably do, too.

Instead, think about your asset allocation and portfolio structure. Do any of your stocks breach our recommended portfolio weighting, for example? In my case, South32's share price rise has taken it from about 4 per cent of my portfolio to 8 per cent, breaching our 7 per cent portfolio limit.

I also own two stocks – Acrux and Gage Roads Brewing – that haven't worked out. These were small holdings that have become even smaller. I should have sold out and moved on. This Christmas I will be shooting the dogs, allowing me to allocate more time and mental energy to opportunities.

2. Cheap stocks are your best protection

Last week, the ASX investor newsletter asked me for a comment on the risks no one was thinking about. It felt a little like that Chinese exam where you have to write down everything you know and the first one to finish is taken out the back and shot.

I don't know what the future holds but I do know buying and owning cheap stocks is the best protection against whatever risk anyone can dream up. This Christmas, I'm going to forget about Brexit, Trump and the ABCC legislation because, as George Soros said, “the more complex the system, the greater the room for error”.

Economies are complex, perhaps beyond detailed understanding. Instead, why not focus on companies and industries, deepening your knowledge and experience? Then use that knowledge to act on opportunities – cheap stocks trading at less than they're worth – because that margin of safety is your best protection against risk, whatever form it takes.

3. Check your asset allocation

With banks and residential property having been such great investments over the past few decades, many investors are a little too complacent about their skewed asset allocations. InvestSMART's free portfolio tool assesses your portfolio's asset allocation against what we recommend as a sensible weight for conservative, balanced and growth investors.

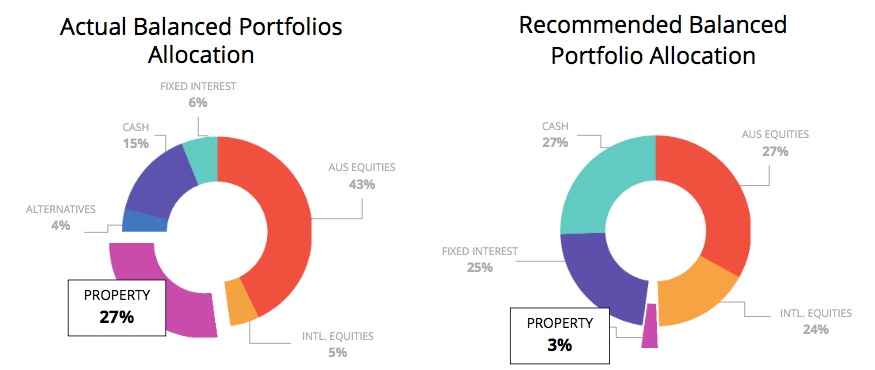

Here's what it looks like for balanced investors:

The recommended weightings are on the right, the actual weightings, derived from 7000 balanced portfolios in the tool, are on the left. The over-exposure to property and Australian equities, of which I'm guessing the big banks form a major part, is quite startling.

You may quibble with our minimal allocation to property, but do you really want a quarter of your assets in a class that, by most conventional measures, is among the most expensive in the world? Or in the case of growth investors, a third? In a spare hour over the holidays, use the Portfolio Health Check to establish your asset allocation and adjust accordingly. The risk of a property crash is probably higher than you think. And also consider international diversification.

4. Are you the person to manage your money?

Value investing is easy to understand and hard to do because many people don't have the stomach for buying stocks in a crisis. It also takes time and many of us don't have enough of it to do it well. If that sounds like you, maybe you shouldn't be managing your own money.

If you like our style and performance track record and don't want to be your own fund manager, consider the Intelligent Investor Equity Income or Equity Growth Portfolio. If not, try a low cost managed fund or one of our separately managed accounts. With a third of my portfolio professionally managed, I can attest to the virtues.

5. Follow the portfolio advice of Germaine Greer

In 2006, Germaine Greer was awarded a Golden Bull for the year's worst written communication, deemed this: “The first attribute of the art object is that it creates a discontinuity between itself and the unsynthesised manifold.” Luckily, I had an artist friend explain it to me. I shall now proceed to botch that explanation.

The ‘unsynthesised manifold' is a concept from Kant that refers to “everything that is out there, regardless of whether we perceive it or not” – Greer's words, not mine. The phrase describes “the endless flood of undifferentiated sensory data we accumulate throughout our waking hours” and the way art can arrest it.

I hope this is starting to make some sense. To be fully conscious we have to find a way to turn off the noise, to subvert the flow of sensory data. Art achieves that through the environments of galleries and museums. Churches through quiet, awe-filled spaces and me, by climbing on my bike and riding through the forest. Wherever you seek refuge from the buzz and hum, make that the place for your biggest investment decisions.

Readings and Viewings

What US stock has recorded the best growth on the Dow Jones Index since the US election? This one may surprise you.

Which is a nice lead-in the appointment of Donald Trump's pick for the role of Treasury Secretary. Government Sachs is returning to Washington.

But while Trump's appointees are drawing plenty of criticism, his nominee for Secretary of Defence is a good one from most accounts.

Meanwhile, back to finance, America's investment bank giants are moving from a period of stability and fragility to one of growth.

The Financial Times on India's ongoing cash drought.

Yet another article warning about private debt levels: "China is drowning in it, and the whole world has too much of it."

What Cate Blanchett's failed home sale shows about China's squeezed buyers.

How a jobs crisis in US academia might be fueling an intellectual renaissance in the public realm.

The Guardian reports that six weeks after the battle of Mosul began, the expected exodus isn't happening.

In the wake of his less-than-even-handed Castro eulogy, Canada's national news magazine has joined those declaring the Justin Trudeau honeymoon over.

Speaking of Fidel, a visit to the "dystopian" Havana that tourists never see: The last communist city.

A peak inside business with an interior designer to San Francisco's flush tech elite.

With Hollande out, the French presidency is down to two. Euronews introduces Francois Fillon. "Catholic and from conservative western France, Fillon says he will restore France's pride and institutions, vowing to take pragmatic, if difficult, steps."

British mothers are leading a fresh fight against ongoing austerity.

We thought this'd be an easy answer: Is arguing online actually good for your mental health?

In the wake of SpaceX founder and CEO Elon Musk's plans for an Interplanetary Transport System, The New Atlantis highlights the hurdles to colonising Mars.

As it's still pretty cold for December in parts of Australia, we'll outsource recipe of the week to the Americans, who celebrated Thanksgiving last week. Here's Mother Jones appealing twist on traditional Thanksgiving grub.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

The past week saw further gains in Japanese and Chinese shares but US, European and Australian shares along with the $US had a bit of a consolidation, after the post US election rally led to overbought positions. However, energy shares and the oil price got a huge boost after OPEC agreed on a production cut. While the oil price rose, metal prices slipped and the iron ore price had a volatile ride with the latter weighing a bit on the Australian dollar.

After a “yes they will, no they won't” soap opera OPEC agreed on an oil production cut of 1.2 million barrels a day. While stronger than talked about in September this was made necessary by a ramp up in production since then. The cut adds to confidence that we have seen the low in oil prices and that deflationary forces are in retreat. So good news for energy producers and central banks. But there is a danger in getting too excited. Around $50/barrel is where the median shale oil producer is economic and so shale production will start to ramp up again (the US rig count is already well up from its lows) and it's questionable whether OPEC discipline will really hold…so I am sceptical that the oil price will go too high. Maybe $55 or $60 tops. Inflation is already picking up as the 2014 to early 2016 oil price plunge drops out, but so far the flow on to core inflation has proven to be muted. Don't forget that the oil price is still less than half 2013-14 levels. For Australian petrol prices the OPEC cut might add 5 cents a litre at the bowser but that will be lost in normal day to day price volatility.

China appears to be seeing another one of its periodic policy tightening phases with increasing measures to cool the hot property market, a crackdown on capital outflows to ease downwards pressure on the Renminbi, tighter monetary conditions and measures around shadow banking and commodity markets. The Chinese share market may be a beneficiary though to the extent capital outflows are limited and need to find a home domestically and it's not seen as too hot.

Major global economic events and implication

US data remained strong with September quarter GDP growth revised up to 3.2 per cent, consumer confidence rising sharply in November (maybe as election noise was lifted), the ISM manufacturing conditions index rising further in November, home prices continuing to rise, construction spending up and jobs indicators remaining strong. The Fed remains on track for a December rate hike. Meanwhile President elect Donald Trump's picks for various cabinet positions including Treasury secretary are adding a bit to confidence in his administration such that the dial is still pointing to Trump the pragmatist as opposed to Trump the populist.

In the Eurozone economic sentiment moved higher in November and bank lending accelerated a touch pointing to slightly stronger economic growth. Unemployment even fell to its lowest since 2009. Meanwhile CPI inflation rose as the impact of the plunge in oil prices continues to fall out but core inflation remains stuck at a low 0.8 per cent year on year.

Japanese data was better than expected with continuing jobs market strength, stronger than expected household spending, a continuing upswing in industrial production and gains in housing starts and construction orders.

Chinese business conditions PMIs were on balance better than expected in November and remain consistent with stable to maybe even stronger GDP growth.

Indian September quarter GDP growth accelerated to 7.3 per cent yoy (from 7.1 per cent) boosted by consumer and public spending. Growth may slow in the current quarter because of “demonetisation” (the replacement of old large denomination currency notes with new notes but only after deposit in bank accounts)…but the impact on the November manufacturing conditions PMI, which saw a fall from 54.4 to 52.3, suggests only a moderate impact.

Australian economic events and implications

Weak business investment data both for the September quarter and intentions for the current financial year along with another sharp fall in building approvals added to a sense of near term economic gloom regarding Australian economic growth. As we noted a week ago, there is a significant risk that September quarter GDP growth will be negative – thanks to weak retail sales volumes, a fall in dwelling investment, a continuing fall in business investment and weak net exports. While a continuing decline in mining investment is no surprise the failure to see stronger non-mining investment is disappointing. However, there is no reason to get too gloomy.

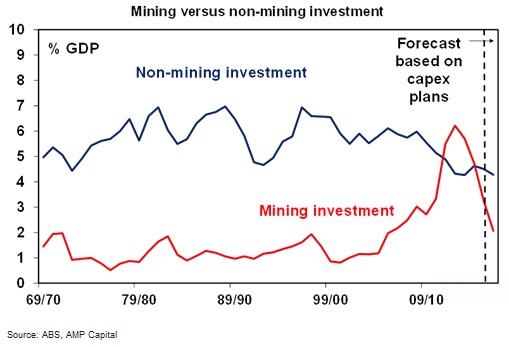

Weak and possibly negative September quarter GDP growth looks like payback for stronger than expected GDP growth over the year to the June quarter of 3.3 per cent. And looking forward the ramp up in resource export volumes has further to go, there is still a huge pipeline of housing activity yet to be completed so home building is likely to rebound in the short term, strengthening approvals for non-dwelling construction are a positive sign, the drag from mining investment is fading as it reduces in importance and its likely to be close to a bottom in the next 12-18 months (see chart), recent retail sales data have improved with three months in a row of solid growth up to October suggesting a consumer bounce back in the December quarter, another rebound in the manufacturing conditions PMI for November suggests that the September quarter growth soft patch may be over and the rebound in commodity prices tells us that the income recession in Australia is over.

However, recent soft data highlights that its way too early to be talking about a 2017 RBA rate hike as the OECD and some others have been doing. In fact given the downside risks to near term growth and inflation along with the $A remaining too high we remain of the view that the RBA will cut the cash rate again during the first half of 2017.

Just finally, home price momentum remained solid in November according to CoreLogic – except in Melbourne where unit prices lost 3.2 per cent. The apartment supply surge is starting to impact in that city and it will likely spread to others next year with unit prices in areas of large supply increases in Sydney and Melbourne likely to fall 15-20 per cent over the next few years.

Shane Oliver is chief economist of AMP Capital.

Next Week

Craig James, CommSec

Economic growth and Reserve Bank board meeting

Week two of the summer tsunami beckons – a fortnight where almost 20 key economic events are scheduled. Highlights include the Reserve Bank Board meeting on Tuesday and economic growth figures on Wednesday.

In Australia the week kicks off on Monday. The Australian Bureau of Statistics (ABS) releases the Business Indicators publication. New car sales data is released while ANZ releases the November data on job advertisements.

The Business Indicators publication includes data on profits, sales, wages and inventories. The inventories data will provide another clue to how fast the economy grew in the September quarter.

And the job ads data will provide insights on where the job market is headed. The October data put job ads at four-year highs.

On Tuesday, the Reserve Bank Board meets for the last time before February 2017. No change in rate settings is expected.

Also on Tuesday there are more pieces of the economic growth jigsaw puzzle to be provided. The Government finance accounts are released with the broader trade accounts – balance of payments. The weekly consumer sentiment data is also released on Tuesday.

On Wednesday, the ABS releases the National Accounts publication for the September quarter. Apart from including the latest economic growth figures, there are insights into income and spending of consumers and businesses.

We expect that the economy grew by around 0.4 per cent in the September quarter, pushing economic growth down from 3.3 per cent to 2.8 per cent – around the ‘speed limit' of growth for the economy.

On Thursday, the ABS will release the October trade data (exports and imports). Exports may have been boosted by record output of the mining sector as well as higher mineral and metal prices. A deficit near $500 million is forecast.

On Friday, the ABS will issue the October data on housing finance. Most interest is in the new finance commitments by banks and brokers. We tip a 1.5 per cent fall in the number of loans to owner occupiers with the value of all lending largely unchanged.

But analysts will start looking more closely at the loans actually advanced as well as loan cancellations for sharper insights on where the housing market is headed.

China takes centre-stage

While there are the usual bevy of US economic indicators to be released in the coming week, Chinese trade and inflation figures may get more interest by Australian investors.

The week kicks off on Monday in the US with the release of the Institute of Supply Management (ISM) survey for the services sector. The activity index may have lifted from 54.8 to 55.2 – well above the 50 break-even level.

On Tuesday, data on US international trade is released with factory orders and the usual weekly figures on chain store sales.

On Wednesday in the US, consumer credit data is released with the JOLTS survey of job openings. The usual weekly data on housing finance is also on the agenda.

Consumers are taking on more debt at low interest rates with credit seen lifting $US18 billion in October – close to the average monthly lift in the past three years.

On Thursday in the US, the usual weekly data on claims for unemployment insurance is due. While on Friday, data on wholesale sales/inventories are released together with the first estimate of consumer sentiment for the month of December.

Turning to Chinese economic data, trade data is released on Thursday while inflation figures – both producer and consumer prices – are released on Friday. The exports data is more a reflection on the state of the global economy – more will be exported if the demand lifts. And imports data is more a reflection of Chinese spending as well as price trends. Exports are down 7.3 per cent over the year but imports are down by just 1.4 per cent.

The Chinese inflation data should confirm that deflation (or even, disinflation) is not a major concern, but neither is inflation. Still, it is a trend that needs close monitoring.

Financial markets

The end of the year is fast approaching so it is worth checking where we currently stand.

The ASX200 is up by around 2.7 per cent over 2016 so far with the All Ordinaries up 3 per cent. But total returns on shares are up 7.2 per cent, highlighting the importance of dividends.

The Aussie dollar started the year near US72c. The low point of US68.24c occurred in January while the high of US78.35c occurred in April. The Aussie is up around 1 per cent so far in 2016.

And 90-day bills started 2016 at 2.38 per cent with 10-year bonds at 2.89 per cent. Currently 90-day bills are at 1.76 per cent and 10-year bonds at 2.78 per cent, after yields fell to 1.85 per cent in August.

Craig James is the chief economist of CommSec.