What A Month, Dangerous Times, Trade vs Ideology, Jackson Hole, Europe, and more

Last Night's Markets

What A Month

Dangerous Times

The Trade Or Ideology War?

Fire in the hole

The Advantage

The Global Slowdown Is Actually Europe

It's Your Money: The Perfect Storm

TCI migration to Eureka Report

Research and Diversions

Ask Alan

Next Week

Last Week

Last Night's Markets

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 26,403.3 | 0.2% |

| S&P 500 | 2,926.5 | 0.1% |

| Nasdaq Composite | 7,962.9 | - 0.1% |

| The Global Dow USD | 2,951.5 | 0.4% |

| Gold | 1,532.50 | - 0.3% |

| Crude Oil WTI | 55.06 | - 2.9% |

| Australian Dollar / US Dollar | 0.674 | 0.1% |

| Bitcoin / US Dollar | 9,652.5 | 1.3 % |

| U.S. 10-Year Bond Yield | 1.498 | 0.0% |

What A Month

A weird and difficult month ended pretty tamely this morning, with a flat session on Wall Street, although the final session for the month in Australia yesterday was far from flat – a solid rise of 1.5%.

Perhaps the best way to tell the story of the month is through some charts.

The ASX200 started badly and then basically stayed there, returning minus 3.1% for the month:

.png)

The Aussie Vix (of volatility) index likewise started with a jump and then more or less stayed high:

The Australian dollar gold price surged to a record high:

.png)

And speculative positions in gold in the US also ended the month at a record high:

.png)

Negative yielding bonds hit a record high:

.png)

The Australian 10-year bond yield fell to a record low under 0.9%:

.png)

The US 30-year rate also went to a record low:

.png)

The US yield curve definitely started forecasting recession, unless it isn’t:

.png)

And finally the Chinese yuan had its biggest monthly fall in 25 years:

.png)

Marketwatch is carrying a story this morning that history shows that when August is bad, September is worse, but on average the rest of the year is positive. However so many records were broken and so much uncharted territory was charted, I don’t think history is much use.

The month began with a Federal Reserve rate cut on July 31st, which President Trump attacked because it wasn’t explicitly the start of a long rate-cutting cycle, and the market agreed.

The next day it was about China: “...We look forward to continuing our positive dialogue with China on a comprehensive Trade Deal…”

Three weeks later things had got worse on both subjects: “..My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?

And that tweet pretty much summed up this month – it was all about Trump, Xi, and Powell. That is, it was about monetary policy, interest rates, and the trade war: we live in dangerous times.

Dangerous Times

There are two separate, dangerous things going on at the moment that are being combined in a lot of the commentary, understandably so: the US-China trade war and the continuing collapse in bond yields and the failure of monetary policy.

They are related to some extent of course, because the bond market like all other financial markets and business generally, is being tossed around by the trade-focused Trump Twitter feed, but they are two fundamentally different forces.

I don’t know how either of these things is going to turn out, and while I’ve been reading plenty of commentary that purports to know, everyone’s guessing. There are no precedents for either the America/China conflict or the appearance of negative interest rates; there are no lessons from history, and no way of knowing what’s going to happen.

That won’t stop me from writing about it today, of course – that’s what you pay me for. I’m just warning you that I don’t have any clear, simple answers, only a lot of questions and a few ideas.

The first thing to say that this combination of swirling forces is dangerous, and if anyone wanted to de-risk their investment portfolio and sit it out, I’d fully understand. I’m not recommending that because I still believe, on balance, the things I’ve been writing here for a while are true – that Trump is engaged in a theatrical re-election strategy that will probably end tamely and that central banks will do whatever takes to prevent a recession or bear market – that they have more less abolished them, or at least tried to.

But as time goes on those things look less certain. Let’s take it one mess at a time.

The Trade Or Ideology War?

The difficulty in assessing the trade war is that Trump is both right and bonkers.

What I mean is that the US has a point about China: it’s virtually a rogue state in some ways. Its Government allows rampant intellectual property theft, probably sponsors it in fact, manipulates its currency to advantage, fixes trading and market access rules that are both unfair and capricious and in general doesn’t operate the same rules as the rest of us.

Australia is being reminded of that at the moment with the case of the Sydney-based writer, Yang Hengjun, an Australian citizen who has been held without charge or access to lawyers in China for seven months and has now been charged with espionage, even though it’s perfectly clear he isn’t a spy, just an agitator for democracy.

But Trump’s way of dealing with all this is fraught with danger. By coming on so hard, doing it in public via Twitter and not being consistent – calling Xi an enemy one day and great leader the next – he is creating a situation where accidents can happen, because the other side is in a place where they can’t be seen to back down.

At the moment it’s an exchange of tariff increases and threats of more of them, ahead of talks next month, with a tentative, suggested threat to break up the supply chains that American companies have established with China, with the tweet that “our great American companies are hereby ordered to immediately start looking for an alternative to China”.

If that’s where this battle ends up, with all the investments and supply deals that American firms have made in China, and vice versa, being torn out, and Chinese students being ejected from the US (with pressure on Australia to do the same) then the world is going to be a very different place to the one we’ve become used to over the past few decades.

Since the collapse of the Soviet Union and the Tiananmen Square crackdown of 1989, the west has basically ignored the way the Chinese Communist Party goes about things and left it to the corporate world to manage the relationship for profit, basically because it’s been assumed that China’s dictatorship would eventually collapse and democracy would eventually follow the introduction of capitalism.

At first, that meant exploiting the cheap labour, bringing down the cost of clothing and gadgets and filling stores with Chinese goods. For Australia, it meant a huge resources boom, two or three of them in fact. Companies like BHP, Apple, and Walmart have been big winners.

But it’s beginning to dawn on the conservative political establishment in the US that, if anything, the China Communist Party is becoming more powerful and more autocratic, not less. As a result they have started to part company with the corporate world on the subject of China.

Donald Trump has come to personify the political side of that divergence, but he’s not alone: there’s a deep political movement in the US that wants to reshape the relationship with China and, in a sense, to put it in its box and prove that democratic capitalism is the only path to national success. In fact, it's kind of essential for them to show that.

This was all laid out clearly in a speech last October by Vice President Mike Pence. It was an important moment and contributed to the big sharemarket correction in the fourth quarter of 2018 (Fed chairman Jerome Powell’s hint on that US interest rates were going to rise some more came at the same time, so it’s hard to separate the two causes of the correction).

It’s worth recalling a few of the things Pence said:

“After the fall of the Soviet Union, we assumed that a free China was inevitable. Heady with optimism, at the turn of the 21st Century, America agreed to give Beijing open access to our economy, and bring China into the World Trade Organization.”

“Over the past 17 years, China’s GDP has grown 9-fold; it has become the second-largest economy in the world. Much of this success was driven by American investment in China. And the Chinese Communist Party has also used an arsenal of policies inconsistent with free and fair trade, including tariffs, quotas, currency manipulation, forced technology transfer, intellectual property theft, and industrial subsidies doled out like candy, to name a few.”

“America had hoped that economic liberalization would bring China into greater partnership with us and with the world. Instead, China has chosen economic aggression, which has in turn emboldened its growing military.”

“Today, China has built an unparalleled surveillance state, and it’s growing more expansive and intrusive – often with the help of U.S. technology.”

“And when it comes to religious freedom, a new wave of persecution is crashing down on Chinese Christians, Buddhists, and Muslims…”

“We will continue to take action until Beijing ends the theft of American intellectual property, and stops the predatory practice of forced technology transfer…”

And so on… you get the picture. That speech laid out a plan, and that is what Trump is now implementing. And it’s a plan aimed as much at US companies, as China.

After the uproar that followed Trump’s tweet about “hereby ordering” American companies to look for alternatives to China, he explained that he could declare a national emergency and use the International Emergency Economic Powers Act of 1977, which gives him enormous unilateral power to intervene in international commerce involving US companies.

His economic adviser, Larry Kudlow, subsequently said Trump didn’t plan to do that, and later Treasury Secretary, Steve Mnuchin said: “I think what he was saying is he’s ordering companies to start looking,” Mr. Mnuchin said. “He wants to make sure to the extent that we are in an extended trade war, that companies don’t have these issues and move out of China.”

An interesting sidelight to this is the relationship between Donald Trump and Apple CEO Tim Cook. Apple is possibly the biggest user of Chinese manufacturing but up to now, it has escaped the tariffs. On September 1, the Apple Watch, AirPods, and HomePod will be hit by a 15% tariff.

This was on CNBC the other day: President Donald Trump likes Apple CEO Tim Cook. But it’s not necessarily because he’s running a big and successful business. Rather, Trump said Cook calls him “whenever there is a problem.” “That’s why he’s a great executive,” Trump told reporters on Wednesday outside the White House. “Because he calls me and others don’t.”

“Last week, Cook joined Trump for dinner at the Trump National Golf Club in Bedminster, New Jersey. Their warm relationship stands in stark contrast to Trump’s position on other top executives, whom he frequently antagonizes. “Others go out and hire very expensive consultants,” Trump said. “Tim Cook calls Donald Trump directly”…

The trouble with that from Apple’s point of view is that Trump has shown how capricious he can be: friend one minute, enemy the next. Tim Cook and the rest of corporate America need to be very careful.

Would Trump really order Apple and other US companies out of China by declaring a national emergency? I doubt it, but anything is possible with Mr Trump, and in any case this trade war is not a trade war and has a long way to run.

It may be that a better way to think about it is as a conflict between America’s conservative political classes and its corporate sector, not between the US and China.

And if the Democrats take the White House next year, would it all go away? Maybe, but at this stage Trump seems to be a fair chance to win if they don’t impeach him, or maybe another Republican would get up in the primaries. In any case, it might be hard to put this genie back in the bottle – after all, a lot of what China gets up to is not exactly approved of by Democrats either.

So I’m starting to think an easy deal in the near term is looking difficult. For one thing, China’s Communists do not have to cave in: they own US$1.15 trillion in US Treasury bonds and notes, which is 27% of all US government debt owned by foreigners, and its technology is close to the point where they don’t need America anymore.

For a lasting deal that would fully satisfy American demands expressed in the Pence speech last year, Xi Jinping would need to change Chinese laws to include all the market-opening anti-IP theft and transparency improvements that the US is demanding, and he’s unlikely to do that.

And the US would also have to start trusting Chinese technology and the ideologues in the US would have to stop trying to bring down the Chinese Communist Party to prove that democratic capitalism is the best form of government. That’s not going to happen in a hurry either.

The good news is that Trump is very focused on re-election, more focused on that than winning a great ideological battle with the Chinese Communists. If he gets a deal he can boast about on Twitter, maybe he’ll just overrule the anti-China warriors and move on.

We can only hope.

Fire in the Hole

The annual central bank symposium in Jackson Hole last weekend was a pretty unusual affair, as far as one can tell from reading the papers being presented, stuck far away from the natural beauties of Wyoming in a Melbourne winter, as I was: it seems to have been an all-in giving up.

That is, central bankers no longer know what to do; they’re out of ideas; they’ve given up. As Australia’s Philip Lowe remarked in his address to the gathering: monetary policy “is not the best lever’, but “the other possible levers are hard to move, or are stuck.”

Despair would be too strong a word, but certainly the theme of the conference – “Challenges for Monetary Policy” – didn’t come close to express the poo they’re in.

No one was talking about recession, but they were also staring bleakly at a future of low growth, low inflation, and low interest rates, without much of a clue what to do about it.

In his opening address, Federal Reserve chairman Jerome Powell said: “We face heightened risks of lengthy, difficult-to-escape periods in which our policy interest rate is pinned near zero.” His answer? “A public review of our monetary policy strategy, tools, and communications.” Right.

On Monday, Australian Treasurer Josh Frydenberg came out with his answer and it ain’t fiscal stimulus that would involve putting off the return to surplus: companies should invest more to lift productivity, instead of paying out so much in dividends. Nice idea. Good luck with it.

Economists, including those running central banks, all now agree that fiscal policy must now come to the party, but the trouble with that is that it’s run by elected politicians, so it’s usually haphazard, ill-targeted and insufficient.

Australia and Germany won’t do it because they’re more interested in budget surpluses, even though borrowing at less than 1 per cent or, in Germany’s case, zero, is clearly a no-brainer and should be done in vast quantities on the longest possible time-frames for investment in infrastructure.

America’s ruling Republican Party is totally unconcerned about budget deficits but has targeted its fiscal stimulus at tax cuts for the wealthy, which is precisely the wrong way to stimulate the broader economy.

The Democrats, and much of the Left, broadly defined, are now talking about Modern Monetary Theory (MMT), which basically means monetising fiscal deficits in the way that quantitative easing monetised debt that was owned by banks.

But printing money to pay for budget deficits feels far more profligate and dangerous than a central bank printing money to buy bonds from banks for the simple reason that they are not elected – if we give politicians control of the money printing presses, where will it end? It hardly bears thinking about!

But that’s where we are if there’s another recession. After all, central bankers are acknowledging that monetary policy alone won’t do it anymore, fiscal policy has to get involved as well.

And if governments are all up to their eyebrows in debt already, then simply adding to the debt load will be a recipe for not doing enough. That applies more to the US, Europe and Japan more than Australia, but both sides of politics in this country have so convinced themselves and the electorate that deficits are bad and surpluses are good, that breaking out of that even when there’s a recession will be difficult.

My friend Gerard Minack summed it up neatly in a note last February: “The theory behind Modern Monetary Theory (MMT) is both correct and obvious. But a factual theory is a descriptive device that has no policy implications.

“MMT is controversial because many of its adherents argue that the theory permits aggressive fiscal expansion. Whether or not you agree with that conclusion, I think MMT is likely to be used to justify aggressive and unconventional policies in the next cycle. If MMT were deployed as many MMT advocates suggest then it would bring the curtain down on secular stagnation.”

Not that there will necessarily be a recession any time soon, but with low productivity and persistent policy uncertainty hampering both investment and consumption, economic growth is likely to be a function of population growth for quite a while.

And that’s not going to get unemployment down below 5 per cent or inflation above 2 per cent – ever.

The issues at the heart of economics now – the things that have changed everything – are technology, debt and globalisation, and it’s hard to work out which of them is the most important.

It’s almost impossible to overstate the significance of the technology revolution: from social media to artificial intelligence, cloud computing, drones, facial recognition, online retail and smartphones … it’s not just businesses that are being disrupted, economics itself has been disrupted through the loss of pricing power for both businesses and labour leading to low inflation and low wage growth.

Globalisation brings the discussion back to China and the US backlash against the way it has used far more than labour cost arbitrage to grow its economy, but has also added currency manipulation and all the other things Mike Pence talked about.

And finally – debt.

In a note this week Gerard Minack wrote: “The most significant trend of the past 40 years for investors has been the decline in interest rates. There have been cycles in rates, but in most markets – most crucially, in the US – the cycles have been a sequence of lower peaks and lower troughs.”

This 40-year trend has led to a relentless rise in private sector debt, but the remarkable thing is that this has been accompanied by a decline in the investment share of GDP – something Josh Frydenberg was pointing to this week.

.png)

What’s been going on? Well, according to Gerard, “the private sector increasingly used debt to buy or leverage existing assets rather than to invest to create new ones. This reflected two factors. The first was the trend decline in interest rates, which made financial leverage increasingly attractive. The second was arguably the biggest policy blunder of the era: the financial system was deregulated, so lenders became much more willing and able.

“The result was the increasing financialization of the economy: anything with reasonably stable or predictable cash flows could be securitized and leveraged (or leveraged and then securitized). The result was an explosion in gross financial assets, matched by a rise in financial liabilities.”

Which is why the situation is dangerous, but it’s also why I’ve been saying that central banks have “abolished recessions”. It’s half tongue in cheek, but there’s simply no way that they can rapidly increase interest rates like they used to. The result would be catastrophic.

Nevertheless, at some point interest rates will rise. Either the bond bubble will break and/or something will cause inflation to start rising.

The good news is that the two other big influences mentioned above – technology and globalisation – should ensure that this doesn’t happen for a long time.

The Advantage

This might be a good moment to reflect on the advantage that individual investors have over professional wealth managers.

They definitely have more resources and better access to companies then we do, but we don’t work under the lash of monthly and quarterly returns, with career risk hanging over us.

The time-frame and the mentality of an individual is, or at least should be, entirely different. Our time horizon is the one we set; monthly performance is interesting, but irrelevant.

Nor do we have to worry about tracking error, or relative performance. Did we beat the index last quarter? It might be a point of quiet personal pride, but it doesn’t really matter.

James Kirby and I got this question from someone named Tim in this week’s Money Café: “I’m 27 and have saved around $100,000 to put into the market. I have been sitting on the sideline for the past 8 months due to the market volatility associated with Brexit, Hong Kong, Trump, etc…. How will I know when to jump in? And what macroeconomic factors should I be looking at as an indicator of when might be the best time. I have a very long term view!”

Both of us replied: just get going. There are always things to worry about like Brexit, Hong Kong, Trump etc. If you have a very long term view, the right time is now. There’s no need either to wait or “jump in”, and volatility is not relevant. There will be dumps and bumps along the way, but as an individual investor you can ride them and keep an eye on the long term.

Unless you’re a trader (in which case I have nothing to say to you), investing is the business of taking careful positions in high quality companies and other assets and sticking with them through market stampedes, and only selling if something fundamental changes, either with the company or the world.

The Global Slowdown Is Actually Europe

Anatole Kaletsky of GaveKal wrote a fascinating piece this week that contained this table:

.png)

While global growth has obviously weakened since Donald Trump launched the US-China trade war in May-June 2018, very little of the pain has been felt by either the US or China.

Kaletsky points out: “despite all the talk about a US recession and a China slowdown, the US economic data has actually strengthened slightly relative to expectations last October (the growth projection for 2019 is up 0.1pp), and there has been no weakening in the Chinese data. The data from the eurozone, by contrast, has deteriorated dramatically, accounting for almost all the downgrade to global growth (since Japan, Britain and most emerging economies have not changed much). Within the eurozone, Germany has suffered a far bigger downgrade than any other country, with even Italy doing less badly relative to expectations.”

And the reason for this is a good lesson for the Australian Government:

“Since early 2017, Europe has continued aggressively consolidating budget deficits and toughening bank regulations and capital requirements. Meanwhile Trump has engaged in a huge fiscal expansion, and China has significantly, if reluctantly, eased credit.”

The lesson for Australia is that fiscal stimulus works and that austerity does the opposite. You end up with an austere economy as well.

It’s Your Money: The Perfect Storm

(Here is another brief extract from my book, It’s Your Money):

The movie The Perfect Storm came out the same year the Commonwealth Bank took over Colonial – 2000. In the film, the crew of a fishing boat, the Andrea Gail, handsomely captained by George Clooney, decide to go out into a gathering storm. Unfortunately, it turns out to be a rare confluence of three storms, not one, and the boat and all those on board are lost, after riding up and then being swamped by a memorably large wave.

The perfect storm for Australian banks was also the confluence of three winds: the unregulated superannuation system set up by Paul Keating and ACTU chief Bill Kelty; the idea that financial supermarkets – banking, super and life insurance – were a good idea; and the explosion in executive salaries combined with the sole focus of companies on making money for shareholders and executives.

There was one final event that sealed the banks’ fate, culturally at least: it was the financial system inquiry headed by David Murray, which delivered its report to the government in 2014. Murray had by then become a sort of supreme godfather of the financial services sector – today we would call him a ‘thought leader’ – having been CEO of the Commonwealth Bank and having established the Australian Government Future Fund, an independently managed fund into which the government deposits funds for the future payment of superannuation to retired civil servants. His central recommendation and key theme was that the banks needed to be ‘unquestionably strong’. He basically told the regulator, APRA (the Australian Prudential Regulation Authority), to raise the banks’ capital ratios (meaning the amount of money they hold in reserve) to achieve that end. It was a misdirection. Not only were the banks already unquestionably strong, but Murray ensured that bank regulation remained focused on profits and capital strength rather than customer outcomes and competition. In other words, in the face of growing evidence that the banks’ biggest problem was the way they were treating customers, Murray said, ‘No, no, the biggest problem is their strength and stability – focus on that, not the customers.’ ‘Consumer outcomes’, as he called them, came well down the report, and the recommendations were vague – for example: ‘Introduce a targeted and principles-based product design and distribution obligation.’ APRA and the banks were only too happy with that.

By that stage it was probably too late to change the direction of bank behaviour and regulation before the ordure hit the fan – it was already in the air, heading for the rotating blades. By 2014, more and more stories were coming out about appalling consumer outcomes, and calls for a royal commission were becoming insistent, but the Murray Inquiry ignored all that, instead puffing fresh wind into the sails of the banking industry’s Andrea Gail as it sailed into its perfect storm. The wave came in the form of the Hayne Royal Commission.

TCI migration to Eureka Report

The Constant Investor site will be closing down in the coming weeks, and no new content will be posted to the site, as of Thursday 29 August, 2019.

All new and old content from The Constant Investor website is now available within the Eureka Report section of the InvestSMART website.

The Constant Investor mobile app will also be closing down in the coming weeks, so please start using the InvestSMART app which can be accessed below:

Apple/iOS: https://apps.apple.com/au/app/investsmart/id1083732584

Android: https://play.google.com/store/apps/details?id=com.investsmart.investsmart

For any account or payment enquiries, please email support@investsmart.com.au or call 1300 880 160.

Research and Diversions

Research

Building long term wealth in a low-growth world.

Ray Dalio: The biggest China risk investors face is having no exposure.

How US Secretary of State Mike Pompeo’s journey from Trump critic to Cabinet member and Trump ally mirrors that of the Republican Party (podcast).

The MBA degree is in crisis. “Graduating M.B.A. students this year have had no trouble landing very good jobs. In most cases, starting pay has hit record levels. Yet, for the second consecutive year, even the highest ranked business schools in the U.S. are beginning to report significant declines in M.B.A. applications and the worst is yet to come, with many M.B.A. programs experiencing double-digit declines.”

France won't be the only one to tax tech giants. Similar proposals are popping up across Europe.

A story about the efforts to replace GDP with a better measure of economic progress. It’s called the Inclusive Wealth Index and it shows the aggregation through accounting and shadow pricing of produced capital, natural capital and human capital for 140 countries. The global growth rate of wealth tracked by this index is much lower than growth in GDP. In fact, the 2018 data suggests natural capital declined for 140 countries for the period of 1992 to 2014.

The inevitable crash is coming. The failure to make systemic changes after the crash is bringing us right back to where we were.

Brexit as economic warfare. “Never before has a major trading nation deliberately disengaged from deep integration with its nearest and wealthiest neighbours. But this is not entirely true. There are two precedents: 1939 and 1914.”

German-American ties are breaking down. “Germany has become the antithesis to Trump's America ... The conflict centers on concrete interests and political issues, but of course also on the personal chemistry between Trump and Chancellor Angela Merkel.”

The Amazon fires are more dangerous than weapons of mass destruction. “The destruction (Jair Bolsanaro) inspired—and allowed to rage with his days of stubborn unwillingness to douse the flames—has placed the planet at a hinge moment in its ecological history. Unfortunately, the planet doesn’t have a clue about how it should respond.”

.png)

Starbucks reports a $1.6 billion liability on its stored-value payment cards — which sounds like a problem, but is in fact a gold-mine. It is money which regular customers have put on to their card accounts with Starbucks, but not yet spent. It is an interest-free loan to Starbucks — and then some. Typically 10% of such deposits never get used.

“When it comes to fighting misinformation, Facebook doesn’t have a technical problem. It has a problem of will and resolve, which is deep-rooted in the questionable set of values the company is built upon. The good news: it can be reversed. The bad news: not with the current management of the company.”

The sheer scale of Big Tech means that much of it is invisible to the everyday user. Even engineers and administrators don't understand the inner workings of their own platforms.

Todd Hoare of Crestone Wealth Management: “In early August, we made the decision to move tactically underweight equities. Adopting a more cautious stance is perhaps not surprising given this is now the longest economic expansion on record. However, it’s not the longevity of this current expansion, nor equity market valuations, that caused us to adopt a more defensive position, but signs that the ongoing trade dispute had pivoted further away from a resolution.”

Just how bad are the Amazon rainforest fires? In a word: bad. In two words: really bad.

What lies beyond capitalism? “Capitalism can’t be reconciled with the teachings of Jesus of Nazareth – or so claims the New Testament translator David Bentley Hart. Christ condemned not just greed for riches, but their very possession, and Jesus’ first followers were voluntary communists. With technologized market forces dominating our world, is a truly Christian economics still possible?”

Americans don’t really understand what capitalism is. Or, how the opposite of capitalism isn’t socialism, it’s my local record store.

Big carmakers are placing their bets on batteries. At the same time, they can expect more competition from rivals unburdened by complex supply chains and large workforces. Also, self-driving cars and ride-sharing are forcing car companies to rethink their established business model. The electric race may prove to be a practice lap for wider disruption.

The self-destruction of American power. America reached its zenith as a world power when the Berlin Wall fell in 1989, and entered its decline with the invasion of Iraq in 2003. Many factors combined to cut short the American moment; the greatest of them was the aftermath of 9/11.

The economics of migration. “If people make decisions on the basis of their own economic self-interest, this will maximise efficiency, output, and, on some measures, welfare … The main beneficiaries of immigration are likely to be the immigrants. They are taking advantage of the opportunity to move, believing that they will be better off, and by a sufficient amount to justify the costs.”

Marketing explained. “Good marketing is the act of changing things for the better by telling true stories to the right people. Good marketers make promises and keep them. Good marketing is responsible for the culture we live in and the lives we live.”

Diversions

Donald Trump apparently mused the other day about dropping a nuclear bomb into a hurricane to make it go away, according to a scoop in Axios. It’s not the first time that idea has come up, and yes, it’s still stupid.

America is addicted – not to drugs, but to the war on drugs. “The war on drugs has been one of America’s most grievous mistakes, resulting in as many citizens with arrest records as with college diplomas. At last count, an American was arrested for drug possession every 25 seconds, yet the mass incarceration this leads to has not turned the tide on narcotics.

Harper’s Index. It’s great. I used to run it each week in the Financial Review when I was editor in the 1980s. This month, for example: Percentage of Canadians who will return a lost wallet containing money: 64; Of Americans who will: 57.

A cop diary: “The transformation from citizen to prisoner is terrible to behold, regardless of its justice. Unlike my sister the teacher or my brother the lawyer, I take prisoners, and to exercise that authority is to invoke a profound social trust.”

The info war of all against all. An essay about how various political movements and actors—from Putin’s Kremlin advisers, to the left-wing Spanish populist party Podemos, to the Austrian far-right Identitarian Movement—are using new media technologies not just to take over the mainstream, but to do so by disrupting the meanings of words and images themselves.

How Trump gets away with lying, explained by a magician. “Here, I will reveal five tactics magicians and politicians use to gain your trust.”

Why the US lags behind on graphic cigarette warnings. (It’s the First Amendment.)

Why we shouldn’t farm octopuses. They are one of the most complex and intelligent animals in the ocean. They can recognise individual human faces, solve problems (and remember the answers for months) and there is some evidence they experience pain and suffering. Also, they eat a lot.

“Heavy drinking is a substitute for companionship, and it’s a substitute for suicide.”

In India, a million electric rickshaws sprang up out of nowhere and are now being used by 60 million people a day. The government and vehicle makers are struggling to catch up.

Russia lost its history with the Soviet collapse; now it is the West’s turn to experience a “Russianisation of reality”.

This is a story about Trump’s harsh and inhumane asylum seeker policies, but I was struck by this fact in the story: “migrants from Northern Triangle countries to the U.S. can expect their wages to increase on average by 13 to 14 times over wages at home. This study, which was released last fall — but has since received almost no attention — is worth revisiting.”

Chris Arnade wrote most of his latest book, Dignity, sitting in a McDonald’s. “When I told people I was writing a book they would look at me like I was crazy, then they would ask me the title. I tried various things, and found that what resonated most was: ‘You can learn everything about America in a McDonald’s’. So that was my working title”.

The power of a good sentence, and why writing one is not that easy.

When marijuana is legalised, alcohol sales go down and junk food sales go up.

Eric Cantona received the 2019 UEFA President’s Award at the Champions League draw in Europe, and delivered a short speech that started with Shakespeare and ended with football, and well, you decide the rest.

Happy birthday Sir George Ivan Morrison (Van Morrison), 74 today. Hard to pick a song, so many to choose from. Here’s Madam George from Astral Weeks.

And here’s his wonderful spot at The Band’s Last Waltz concert – Caravan.

And Thursday was the 45th birthday of Mick Moss, from Antimatter. He’s good. Here’s “Epitath”, from the 2005 album, “Planetary Confinement”.

The man on his own there is our Scott Morrison. That’s the problem with being the sixth PM in as many years – nobody knows who you are.

.jpg)

.jpg)

.png)

.png)

.jpg)

.jpg)

.png)

.jpg)

.png)

.png)

.png)

.png)

Ask Alan

In this week's Ask Alan livestream, Alan Kohler looks into the trade war between the US and China, runs through how analyst briefings and investor roadshows work, and more.

Don't forget the weekly #AskAlan livestream has migrated to Eurek Report at InvestSMART, which can be found here. And if you would like to #AskAlan a question, please email it to askalan@investsmart.com.au.

Next Week

By Craig James, Chief Economist, CommSec

Australia: the ‘Spring Tsunami’ of economic information

- In sharp contrast to the previous week, a barrage of new economic information is expected in the coming week. The ‘Spring Tsunami’ will include data on economic growth as well as a Reserve Bank Board meeting.

- The week kicks on Monday with a raft of economic indicators. Leading the way is the Business Indicators publication from the Australian Bureau of Statistics (ABS). Data included is company profits, stocks, wages and sales.

- The CoreLogic home value index will also get plenty of attention on Monday with home prices rising again in August.

- Also on Monday figures on job advertisements are released with the monthly inflation gauge and surveys of manufacturing purchasing managers conducted by both Commonwealth Bank and Australian Industry Group. Both surveys indicate that modest expansion of the manufacturing sector is proceeding.

- On Tuesday the Reserve Bank Board holds its monthly meeting. No change in interest rate settings is expected. The Reserve Bank Governor has indicated that the Board is gathering information to determine whether another rate cut is warranted.

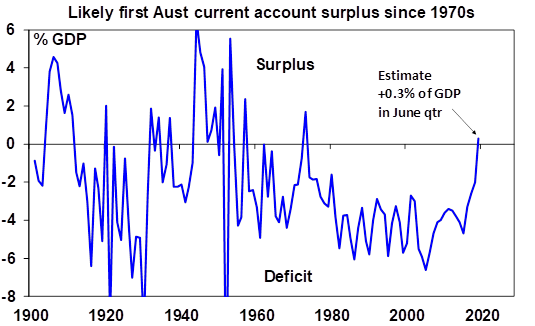

- In economic data on Tuesday, the broader gauge of Australia’s trade or external position is released in the form of the current account figures. The current account has been in deficit since 1975. But that could all change on Tuesday with a small surplus forecast by a number of analysts.

- Also on Tuesday, the June quarter government finance statistics are released – a key input to the quarterly economic growth figures.

- Those economic growth estimates for the June quarter are issued as part of the “National Accounts” publication to be released on Wednesday. While there is still some information to be received (such as the government data) the economy probably grew by around 0.5 per cent in the June quarter to be up 1.8 per cent over the year.

- Also on Wednesday, the Federal Chamber of Automotive Industries (FCAI) is expected to release the August data on new car sales. The anecdotal evidence suggests that a larger number of budding home buyers are purchasing late model used cars in preference to buying new cars.

- On Thursday, the ABS issues the publication “International trade in Goods and Services”. In June the trade surplus hit a record high of $8 billion with exports to China at record highs.

Overseas: US jobs data grabs the spotlight

- As in Australia, a barrage of new economic information is set for release in both the US and China over the week. The monthly US jobs data (non-farm payrolls) is of most interest, but investors will have to wait until Friday to assess this new information.

- The week begins on Monday in China when the private sector media company, Caixin, releases the August survey of purchasing managers in the manufacturing sector. Earlier (on Saturday August 31) the “official” National Bureau of Statistics purchasing manager indexes on manufacturing and services are issued.

- After the Labor Day holiday in the US on Monday, the flow of economic data begins on Tuesday. First cab off the rank is data on construction spending together with surveys of purchasing managers in the manufacturing sector from the Institute of Supply Management (ISM) and Markit.

- Also on Tuesday is data on US new car sales and the IPD/TIPP economic optimism gauge.

- On Wednesday in China, Caixin releases the results of a survey of purchasing managers in the services sector.

- On Wednesday in the US, one of the weekly economic highlights is released. The Federal Reserve releases the Beige Book – a qualitative summary of economic conditions across Federal Reserve district banks.

- In economic data, the July trade figures (exports and imports) are released on Wednesday, together with weekly readings on chain store retail sales and mortgage applications as well as the regional ISM New York index. The monthly trade deficit sits near US$55 billion.

- On Thursday, the weekly figures on jobless claims are issued in the US, along with the ADP survey of private sector payrolls and factory orders. Results of the surveys of purchasing managers in the services sector will be published by ISM and Markit. The ISM index was at 53.7 in July with Markit at 53.0. Any reading above 50 represents expansion of the services sector.

- On Friday, the all-important US monthly Employment Situation survey publication is released containing data on non-farm payrolls or employment. The US jobs market is solid, with the good outcomes driving wage increases, and in turn, consumer spending.

- Analysts expect that jobs grew by 160,000 in August with the jobless rate near 49-year lows at 3.6-3.7 per cent. Average hourly earnings may have lifted by around 3.0 per cent over the year, still with a healthy gap above inflation.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital

Investment markets and key developments over the past week

- The past week saw share markets boosted by renewed hopes for US-China trade talks helped by a conciliatory approach from China. This saw US and Eurozone shares rise and Japanese and Chinese shares recover from earlier declines. Australian shares fell sharply early in the week but ended higher as renewed optimism on US-China trade talks boosted material and industrial stocks and good earnings news helped consumer staples with IT, financials and health stocks also seeing good gains. Bond yields fell further with a sharp fall in Italian bond yields after a new Government was formed. Oil and metal prices rose but the iron ore price fell further. The $A fell on the back of weak economic data and a rise in the $US.

- China to play the adult in the room in the face of Trump’s trade war tantrums? Who knows but it does seem China may be changing its strategy to dealing with the trade war. Looking at President Trump’s tweet storm on China last weekend and subsequent comments at the G7 meeting and listening to Taylor Swift’s new album made me think that he needed to refocus from “Me” to “You Need to Calm Down”. Trump’s maximum pressure approach has been resulting in more escalation and his demeaning style and constant flip flops calling into question his credibility were looking like an impediment to a deal. However, comments by China’s Ministry of Commerce spokesperson Gao Feng that: China would not immediately retaliate to the latest US tariff increases; urging discussion of how to remove them; saying that a resumption of talks is vital; and noting that US-China interests were intertwined suggest that it may be changing its strategy (which has so far seen it retaliate to each round of US tariff hikes) in the interests of resolving the dispute. To get anywhere it probably requires President Trump to show some goodwill by delaying or cancelling some of the latest tariff increases and we need to see face to face meetings start up again. But China’s more mature stance does point to a possible off-ramp to the trade war. There is a long way to go though and re-establishing trust will be difficult after the experience since mid-last year. Share markets may still have to fall further to pressure Trump to resolve the issue. But at least there may be some light at the end of the tunnel.

- Over in Europe Brexit has taken another twist with PM Johnson suspending Parliament from 10 September to 14 October adding to the uncertainty around what will happen when the latest Brexit deadline is reached on 31 October. On the one hand the suspension is designed to make it harder for Parliament to block a no deal Brexit. On the other hand, it could drive the divided opposition to a no deal Brexit in Parliament to quickly unite in the shortened time available posing a threat to Johnson’s plans and his government. The Brexit comedy continues!

- Meanwhile, Italy has a new coalition Government between the left wing Five Star Movement (5SM) and the centre left establishment Democratic Party (PD). It should be a bit more stable than the previous far left/far right coalition that always seemed doomed to failure, but not much given that 5SM grew out of opposition to the establishment parties like the PD. At least it heads of another election for now.

- In Australia, it’s pretty well known that we are likely to have seen our first current account surplus in the June quarter since 1975 but a speech by RBA Governor Guy Debelle highlights how significant this is. Yes the surge in iron ore and coal prices played a role in that and since they have now reversed the surplus will likely dip back into deficit but, as Debelle points out, the reasons for the improvement are more than just commodity prices so the deficit is likely to be well below the norm of recent decades going forward. What’s more there has been a significant improvement in our foreign liabilities with a shift away from short term debt to long term debt and a growing net equity position (ie Australia having more foreign equity than foreigners having Australian equity). What’s more our liabilities tend to be in Australian dollars and our foreign assets are in foreign currency so when the $A falls our net foreign labilities go down! This all means that our reliance on foreign capital inflow has declined and the $A can happily play its role as a shock absorber and decline when things go wrong with the global economy without causing debt servicing problems. So much for all the talk in the 1980s about Australia being like a boiling frog!

Source: ABS, AMP Capital

Major global economic events and implications

- US economic data was generally okay over the last week with consumer confidence remaining strong, regional manufacturing conditions indexes for August actually improving, jobless claims remaining low, the goods trade deficit narrowing a bit and core durable goods orders continuing to trend up gradually albeit shipments were soft.

- The German IFO business survey slid again in August but the French INSEE business survey is holding up much better highlighting that its primarily a German problem. Meanwhile Eurozone bank lending picked up in July, but is still soft.

- Japan’s labour market remained tight in July (although its being helped by a falling population) and industrial production bounced more than expected but retail sales were very weak.

Australian economic events and implications

- Australian data releases were a mixed bag. A broad-based plunge in construction activity and a fall in business investment will act as another drag on June quarter GDP growth. Against this business investment plans point to modest growth in business investment over the year ahead led by mining investment. Meanwhile new home sales were soft in July according to the HIA, credit growth remains soft (with owner occupier credit up but investor credit still falling) and building approvals continue to plunge with another sharp fall in July.

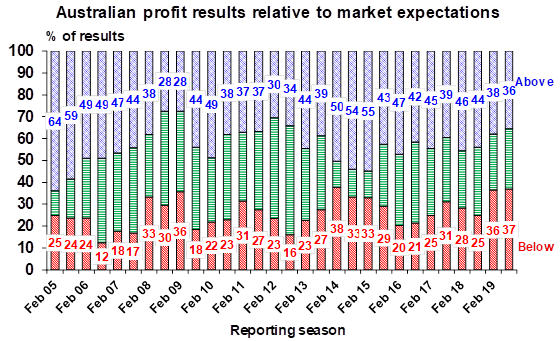

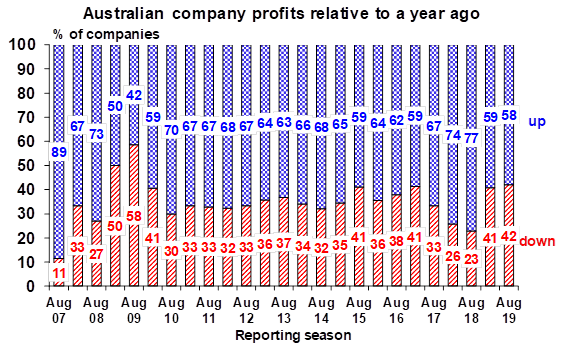

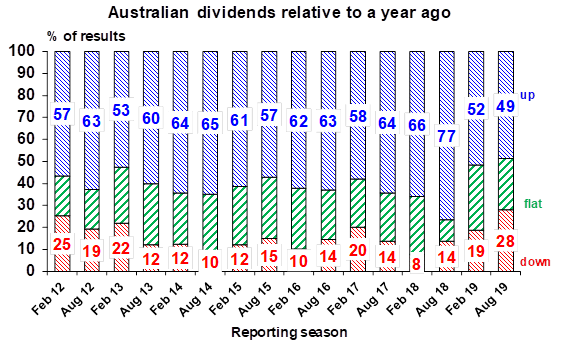

- The Australian June half reporting season is now complete. The overall picture is soft with earnings growth barely positive in 2018-19, but there are some positive signs. The weakness was pretty broad based:

- Only 36% of results have surprised on the upside which is below the long-term norm of 44% and is the lowest since 2012.

- Only 58% of companies have seen earnings rise from a year ago compared to 77% this time a year ago.

- While there have been some hefty dividend payments from some companies, only 49% of companies have raised their dividends which is well below the norm of 62% and 28% of companies have cut their dividends which is the most in the last seven years suggesting greater caution.

- And earnings downgrades have dominated upgrades by more than two to one.

- As a result, 2018-19 earnings growth has come in around 1.5% from around a 2% consensus expectations at the start of August. Resources stocks are seeing earnings growth around 13% compared to a 2% decline for the rest of the market, but with healthcare stocks also seeing double digit earnings growth. Downgrades have been greatest amongst energy stocks, financials, telcos and industrials. The good news though is that some retailers were upbeat about rate cuts and tax cuts boosting spending and property related companies pointed to signs of increasing housing demand. While Australian shares fell around 3.2% in August this was due global trade war concerns with investors reasonably forgiving of the soft profit reporting season overall on the back of low interest rates and hopes for a stimulus boost to growth to come. While consensus earnings expectations are for a pick up in earnings growth to 7.5% this financial year, the slowdown in economic growth, cautious outlook statements and falling commodity prices suggest some downside risk to this.

Source: AMP Capital

Source: AMP Capital

Source: AMP Capital

What to watch over the next week?

- In the US, expect the August manufacturing conditions ISM (Monday) to fall further to 50.5 on the back of trade fears and jobs data (Friday) to show a 160,000 gain in payrolls which along with downward revisions to previous data will be consistent with slowing but still strong US jobs growth. Unemployment is likely to be unchanged at 3.7% and wages growth is likely to be around 0.3% month on month or 3.3% year on year. In other data, expect to see a slight improvement in the trade balance (Wednesday) and a slight fall in the non-manufacturing conditions ISM (Thursday).

- Chinese Caixin business conditions PMIs will be released Monday and Wednesday and are likely to remain weak for manufacturers.

- In Australia, the RBA should be cutting interest rates again on Tuesday but looks likely to leave them on hold. While house prices in Sydney and Melbourne may be bouncing higher, growth looks to have remained very soft in the June quarter, the growth outlook remains weak with the housing construction downturn gathering pace and threat from Trump’s trade war increasing and there is no sign of any pick up in wages growth and inflation with unemployment looking more likely to drift up than down. However, the RBA looks inclined to wait for an “accumulation of additional evidence” including seeing what sort of impact the recent rate cuts and tax cuts have provided to the economy. So, it’s likely to remain on hold in wait and see mode on Tuesday. That said it’s a close call – we wouldn’t be surprised if the RBA cuts and we continue to see two more rate cuts by year end taking the cash rate to 0.5%.

- Australian June quarter GDP data (Wednesday) will likely show growth at its weakest in 19 years. We expect a 0.4% quarter on quarter rise in GDP but with annual growth slowing further to just 1.3% year on year from 1.8% in the March quarter. This would be slower than the GFC low of 1.5% year on year and the weakest annual gain seen since December quarter 2000 after the GST started up. Net exports are expected to provide a 0.2 percentage point contribution to growth as are inventories and public spending growth is likely to be positive, but this is expected be offset by continued softness in consumer spending and falling dwelling and business investment. In other data, the current account (Tuesday) is expected to show its first surplus since 1975, retail sales for July (Tuesday) are likely to show a 0.3% lift helped by tax cuts and the trade surplus for July (Thursday) is expected to have remained big, but expect a sharp fall for August as the recent slump in iron ore and coal prices impact.

- CoreLogic data is expected to show a solid 0.8% gain in home prices for August on Monday driven by gains in excess of 1% in Sydney and Melbourne as the election and rate cut boost continues but with other cities remaining soft. Improved demand against a backdrop of low listings suggest the bounce may have further to go yet but a return to boom time conditions remains unlikely given still tight lending conditions, record unit supply and weak economic growth. The rebound in the Sydney and Melbourne property markets could present a problem for the RBA in thinking of cutting rates further. But as we saw over the 2011-17 period the RBA will do what it believes is right for the “average” of Australia but it may have to resort to tighter regulatory controls again if it needs to cool the Sydney and Melbourne property markets once more for financial stability reasons. In other words, we don’t see the rebound in the Sydney and Melbourne property markets as a barrier to further monetary easing.

Outlook for investment markets

- Share markets remain at high risk of further weakness in the months ahead on the back of the ongoing US/China trade war, Middle East tensions and mixed economic data as we are in a seasonally weak part of the year for shares. But valuations are okay – particularly against low bond yields, global growth indicators are expected to improve by next year and monetary and fiscal policy are becoming more supportive all of which should support decent gains for share markets on a 6-12 month horizon.

- Low yields are likely to see low returns from bonds once their yields bottom out, but government bonds remain excellent portfolio diversifiers.

- Unlisted commercial property and infrastructure are likely to see reasonable returns. Although retail property is weak, lower for longer bond yields will help underpin unlisted asset valuations.

- The combination of the removal of uncertainty around negative gearing and the capital gains tax discount, rate cuts, tax cuts and the removal of the 7% mortgage rate test are leading to a rise in national average capital city home prices driven by Sydney and Melbourne. But beyond an initial bounce, home price gains are likely to be constrained through next year as lending standards remain tight, the supply of units continues to impact and rising unemployment acts as a constraint.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 0.5% by early next year.

- The $A is likely to fall further to around $US0.65 this year as the RBA cuts rates further. Excessive $A short positions, high iron ore prices and Fed easing will help provide some support though with occasional bounces and will likely prevent an $A crash.

.png)