WEEKEND ECONOMIST: Slip, slipping away

This week's federal budget contained quite a few surprises. We had been 'primed' by selective leaks to expect that the tax receipts estimates were going to be significantly revised down from those in the Mid Year Economic and Fiscal Outlook, which printed in October 2012.

The revisions incorporated in the budget were a deterioration of the fiscal position of $20.6 billion in 2012-13 and $20 billion in 2013-14. For 2012-13 the slippage was explained by payments up by $4.0 billion and total revenue down by $16.6 billion. For 2013-14 the slippage was explained by payments up by $3.4 billion and revenue down by $16.6 billion. For 2012-13 the main revenue slippage was company tax ($5.2 billion), resource rent taxes ($3.7 billion) and individual income tax ($2.9 billion. For 2013-14, the main revenue slippage was company tax ($7.0 billion); resource rent tax ($3.3 billion) and individual income tax ($3.7 billion).

Key points to note from the breakdown:

– slippage was not entirely on the revenue side - payments also contributed significantly.

– within revenue, while the majority of slippage came in company and resource rent tax, there was also significant slippage of individual income tax.

– the slippage announced on budget night was reportedly more than the market had been lead to believe in the days before the budget announcement.

All of the additional slippage seemed to come in outlays, although there was no indication of this. In explaining the sharp deterioration in the revenue position of the budget since MYEFO the government noted, "weaker commodity prices and a persistently high Australian dollar which has put pressure on domestic prices, have hit company profits across most of the economy, including the resources sector".

Attributing the 'blame' for the slippage between MYEFO and the budget to commodity prices and the Australian dollar seems a little curious. Note that in MYEFO the government's forecasts for the terms of trade in 2012-13 were a fall of 8 per cent and in 2013-14 a fall of 2.75 per cent. In the 2013 budget the government amends the forecasts to a fall of 7.5 per cent and 0.75 per cent respectively.

Assumptions around the Australian dollar were U$S1.02 for MYEFO and $US1.03 for the budget. Therefore we are confronted by the curious situation where the government has revised up its forecast for the terms of trade; kept the Australian dollar assumption broadly the same; attributed the revenue slippage to the commodity price-Australian dollar interaction and revised down revenue by around $16 billion in both 2012-13 and 2013-14.

The government did not make a forecasting error with its terms of trade and Australian dollar forecast at MYEFO. The logical explanation for the significant slippage between MYEFO and the budget is that there was a misjudgment of the relationship between the terms of trade, Australian dollar and corporate profits-company tax collections. It places some doubt that the intuitive explanation for the slippage – Australian dollar held up despite a fall in commodity prices – is only part of a much broader story . It seems more likely that the slippage is telling us a broader story about the Australian economy. Disinflation and margin compression evident in the Australian economy at present are not necessarily related to the higher Australian dollar or commodity prices. It may be that these disinflationary forces have played a much larger role in revenue slippage than indicated by the government.

Certainly, one forecast change between MYEFO and budget supports this assertion. For MYEFO, the gross non-farm product deflator was forecast to increase by 1 per cent in 2012-13, compared to zero per cent in the budget, and to increase by 2.5 per cent in 2013-14, compared to 2 per cent in the budget. In effect the reduction in the forecast for nominal GDP growth from 4 per cent (MYEFO) to 3.25 per cent (budget) is explained by lower inflation in the domestic economy rather than the terms of trade-Australian dollar effect.

This observation has implications for the government's forecast in later years. The assumption in the forecast is that the commodity price-Australian dollar nexus will be restored to a more normal relationship (if only because the terms of trade forecasts are quite flat). Accordingly growth in nominal GDP is assumed to return to 5 per cent, after the "anomaly" of 2012-13. But what if the explanation for the weakness of nominal GDP growth is more around disinflationary pressures in the domestic economy? These pressures may persist for much longer than assumed in the government's forecasts.

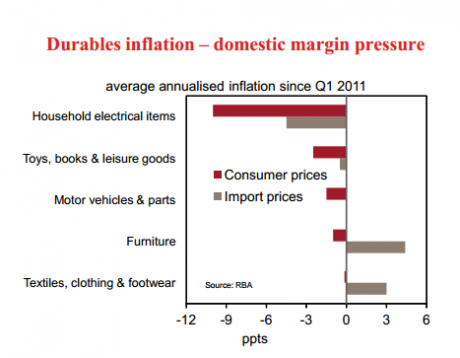

A recent piece in the Reserve Bank's Statement on Monetary Policy highlighted these structural forces. In this analysis the Reserve Bank pointed out that consumer durable prices in Australia had fallen by much more over the last two years that would have been expected given observed moves in import prices. The Bank pointed out: "over the past two years the average rate of deflation in consumer prices (of a number of durable goods) has been greater than the average rate of import price deflation". (See chart for details).

The Reserve Bank goes on to note that: "liaison with business suggests that competitive pressures have been particularly pronounced in the past few years, which may in turn be partly attributable to the emerging presence of online vendors, based in Australia and overseas".

The bank concludes that moves to increase efficiency through cutting overheads, negotiating lower rents, streamlining distribution may have explained these price falls.

We have considerable sympathy with these observations. Note that further support for this view can be found in the unexpected deterioration in personal taxes ($2.9 billion in 2012-13; $3.7 billion in 2013-14). Downward pressure on wages would be a potential source of this downgrade – consistent with businesses efforts to reduce costs.

The government's explanation for the slippage in the revenue numbers may be putting too much emphasis on commodities/Australian dollar and not enough on the more pervasive and sustainable disinflation forces that may now be part of Australia's economic landscape.

Bill Evans is Westpac's chief economist.