Wealth warnings abound on gold

Summary: Kalgoorlie's famous Diggers and Dealers conference was the breath of fresh air needed by a downtrodden mining sector. |

Key take-out: Gold's success has the industry bullish about the mining investment clock, but some were warning about excess exuberance. |

Key beneficiaries: General investors. Category: Commodities. |

Gold put the buzz back into Kalgoorlie's annual Diggers and Dealers conference this week but the biggest story from an event famous for boys behaving badly in Western Australia's isolated mining centre was that the gold recovery comes with a number of wealth warnings.

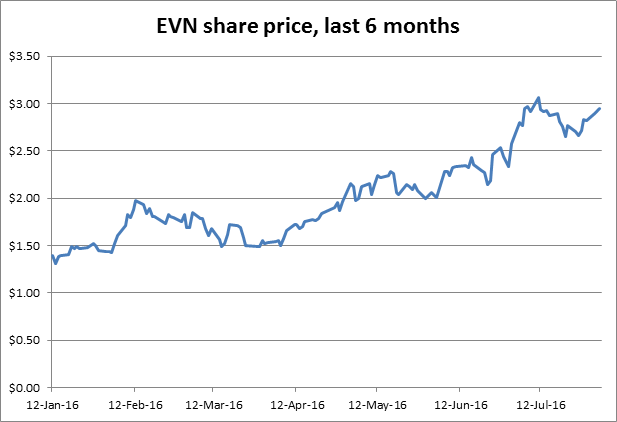

Jake Klein, chief executive of Evolution Mining (EVN), delivered one of these, telling the 1800 delegates that there was a risk of the gold industry repeating past mistakes which could destroy more value than that created by a high gold price.

Source: Bloomberg, Eureka Report

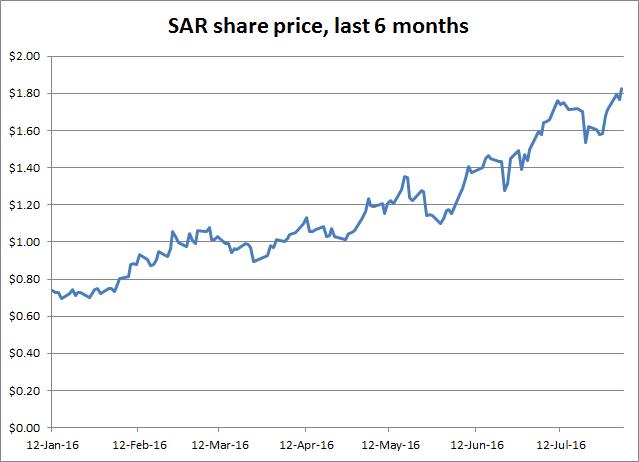

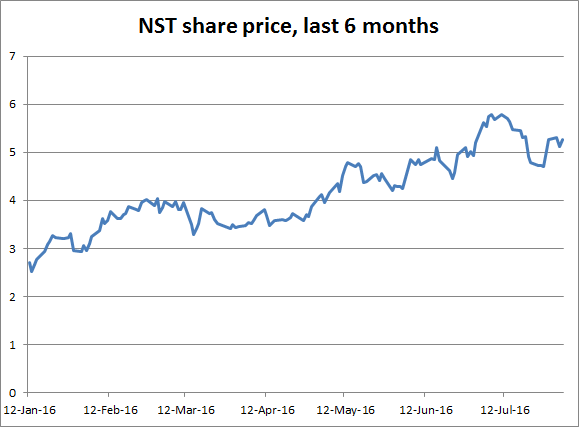

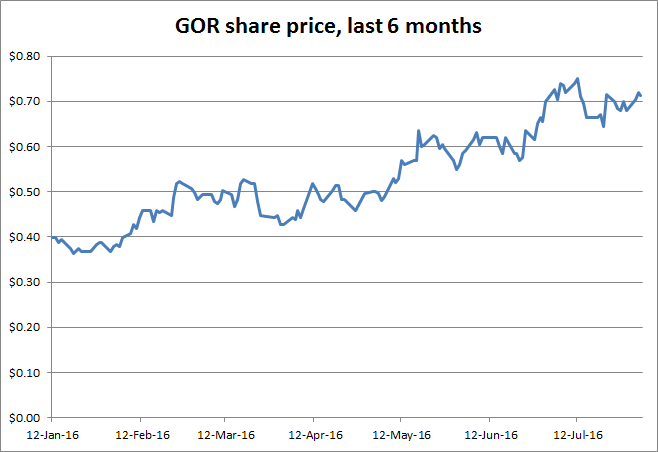

A second warning can be found in the share register of Klein's company, along with the list of shareholders in other equally well-known gold stars, such as Saracen (SAR), Gold Road (GOR) and Northern Star (NST).

All of those goldmining companies – which have seen their shares prices more than double over the past six months – have attracted hot money from New York-based funds which often hunt in packs, keen to not miss a fashionable market trend.

Source: Bloomberg, Eureka Report

Gold, quite correctly, is seen as one of the best performers in a world of super-low (and even negative) yields on most other forms of investment, performing the role of sheet-anchor at a time of uncertainty, much like other safe-haven rivals like Swiss francs and US dollars.

The problem with gold, and goldmining companies, is that neither fits comfortably into a financial model because to predict their fates you need to guess the future gold price – and guessing the gold price is impossible, despite what some gold guru might tell you.

On Monday our resources analyst Gaurav Sodhi hammered home the point about the guesswork in gold by noting that its price is impossible to predict and no amount of analysis produces a better outcome, which was why the Intelligent Investor team has ceased coverage of gold stocks – though it was interesting to see that Gaurav declared an ongoing personal interest in two gold stocks, Silver Lake (SLR) and Northern Star (NST).

Source: Bloomberg, Eureka Report

The point in dropping formal research and coverage while an analyst retains a personal interest is to demonstrate that gold has an undeniable appeal and can generate rich rewards while it is enjoying good times, which is precisely the message from Klein's attempt to hose down excess exuberance.

Klein, who can take credit for turning Evolution into a top 100 company on the ASX with a market value of $2.95 billion, is also aware that North American funds have lifted the position in his company from ownership of 15 per cent a year ago to 25 per cent today.

It has been North American (mainly New York) fund buying that has played a major role in tripling Evolution's share price over the past 12-months, from 94c at this time last year to $2.93. Over this time the underlying gold price has risen by 20 per cent – whether measured in US or Australian dollars.

The same situation can be found on the share registers of Northern Star (24 per cent North American funds), Gold Road (33 per cent) and Saracen (25 per cent) – and most other leading Australian gold stocks, including Doray and Dacian.

Source: Bloomberg, Eureka Report

In the short term, the arrival of the North Americans in the Australian gold sector is a positive event which has made local investors feel richer.

The question – which is as tricky as guessing the gold price – is how long will the North Americans stay?

It's one which is also beyond the scope of any amount of analysis.

Warnings aside this year's, Diggers and Dealers conference was the breath of fresh air needed by the downtrodden mining sector with regular delegates (I've been making the trek to Kalgoorlie for 25 years) rating it the best since 2011, when the gold price last peaked.

Promoters of other metals, such as lithium, nickel and uranium, tried to spruik their stories but they were drowned out by the gold guys who dominated the speakers list and the party circuit which is an essential part of the event.

To understand why Diggers and Dealers has a reputation for excess it is necessary to imagine the 1800 delegates, and perhaps as many non-delegates, descending on a relatively small and remote inland city where there is little to do once your leave the conference centre at the Eastern Goldfields Arts Centre where the talking is done and, in an adjacent temporary marquee, where the mining companies have their booths.

It is a hot-house environment and the only diversion after a day at the conference is a visit to one of the many nearby hotels, or to attend one of the sponsored dinners which can be uninspiring events but serve to concentrate even further the hot-house atmosphere.

Critically, there is no escape from Kalgoorlie for the duration of your stay and mining is the only topic of conversation. It might sound like fun, but it's not.

Other observations include:

The keynote speaker, John Lipsky, tipping a rise in US interest rates in the next two months despite the approaching presidential election. A former deputy managing director of the International Monetary Fund and former Salomon Brothers banker, Lipsky delivered a heavyweight and, at times, humorous talk that included a mocking comment on his economics background: “There are three types of economists. Those who can add up, and those who can't.”

If Lipsky is right about US interest rates rising soon, even if by a tiny amount, there could be a significant knock-on effect on investment markets, including the appeal for those busy NY fund managers to consider their gold exposure against the potential rewards from shifting to other investments which could benefit from an interest-rate rising trend.

An attempt to survey the mood of meeting by asking delegates where the mining industry sat on the investment clock, with 12 being the top (boom conditions) and six being the bottom (where we've just been). The consensus was seven, heading towards eight but with a long, slow, grind back to 12 – and hopefully not too quickly.

The failure of lithium stocks, which have at times been hotter than gold stocks, to catch the eye of delegates – perhaps a sign that the lithium story is being recognised as the passing fad that it is.

A modest improvement in sentiment towards nickel which is enjoying a relief rally thanks to the threat of a ban on the export of unprocessed ore by the Government of the Philippines.

The almost total absence of iron ore miners, with Fortescue Metals the sole iron ore sponsor, was worth noting. The fading from view of the iron ore producers demonstrates how quick the trip can be from hero to zero.

Flashes of the “good old days” when companies could expect a market reaction to an announcement timed to benefit from the concentration of investors and stockbrokers. The biggest mover at this year's event was Cassini Resources (CZI) which enjoyed a sharp 58 per cent price rise (3.4c to 5.4c) after announcing a deal with OZ Minerals on its Nebo-Babel nickel and copper project, before slipping back to 4.6c.

Busy mining entrepreneur, Michael Fotios, unveiled a new member of his extensive stable of companies in the form of Eastern Goldfields Ltd which is redeveloping the historic Davyhurst goldmine, but with little impact on the market so far.

A courageous podium appearance by Peter Cook, executive director of the copper and gold focused Metals X, who gave his talk while wearing a North Melbourne football jumper and hat. Amusing, but it did nothing for the company's share price which lost 7c to $1.70. Hopefully not a sign for Cook's team in the AFL final series that starts soon.

These kind of conferences serve a useful purpose in pulling together both sides of the mining industry. Explorers and producers on one side, investors and brokers on the other, in a town where is little else to do except talk business while dodging “tired and emotional” newcomers who have failed to appreciate that a three day event is a marathon, not a sprint.