Watch for the dollar's commodities bounce

Summary: Increasing demand for Australian minerals is already boosting commodities prices. If it continues, our trade deficit could be reversed quickly – and our economy will move back into stronger growth. |

Key take-out: The hidden story behind the latest commodities turnaround is that the Australian dollar will continue to rise, and it's not a stretch for it to top US90 cents. |

Key beneficiaries: General investors. Category: Commodities. |

It's been three years since anyone worried about the Australian dollar being an economic headwind, rising so high against the US dollar that it damages the competitive edge of exporters.

But what's happened recently to the price of coal, even if it is a short-term surge, and a similar unexpected rise in the price of iron ore, is coinciding with a rush of liquefied natural gas (LNG) shipments and could be the start of an export-led growth phase for Australia.

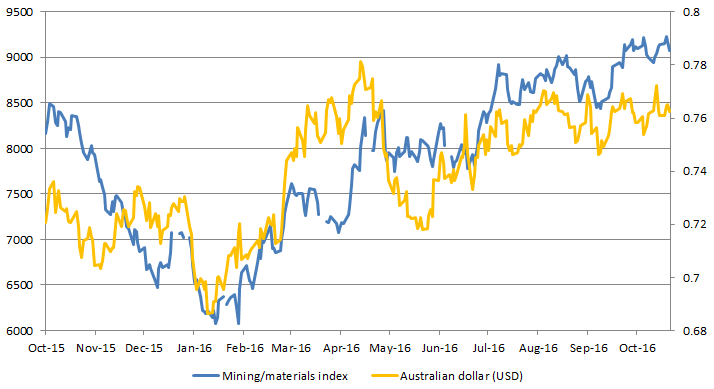

An upward trend in the exchange rate can already be seen, and significantly it runs parallel to the resource-sector recovery that can be traced back to mid-January – a time when the dollar was valued at US68.75c and the ASX mining index was at its low of 1639 points.

Since mid-January the mining index has rocketed up by 68 per cent to 2751 and the exchange rate has risen by 11 per cent to around US76.43c.

That rise in the exchange rate has largely been explained as a function of Australia having a more attractive interest rate regime than some other countries with a forecast rise in US rates tipped to push the Australian dollar down.

Important as interest rates are in dictating the flow of money around the world there is an offsetting force developing in Australia as the capital investment phase of the mining boom (now a bust) morphs into the entirely predictable surge in the volume of exports – or tonnes over the wharf to put it more simply.

Missing from the resource-sector equation, until now, has been a price recovery to magnify the effects of volume increases – but that might be changing with coal an early warning of the latest turn in the commodity-price cycle.

Forecasts for the Australian dollar rising as high US90c are scarce, but there was one last week from the research director of the US-based Carlyle Group, Jason Thomas, during a visit to Australia.

With close to $US180 billion of assets under management around the world Carlyle is a close observer of exchange rates. And while Thomas's tips for the Australian dollar to reach US85c in the next five years, and perhaps as high as US90c, were based on the US dollar falling, the effect on Australian exporters who mainly sell in US dollars would be the same, whatever the cause.

Analysts at HSBC Bank have been quick to spot what is shaping as a significant improvement in Australia's trading position, telling clients last week that the “coal-price spike shifts the Australian story”.

“As we first noted last week the coal price spike could be a big deal for Australia,” HSBC said.

“For the past five years, Australia's story has been about absorbing the negative income shock that came from the end of the commodity price super cycle and rebalancing away from mining.

“The lift in commodity prices changes the story. Nominal gross domestic product (GDP), corporate profits, tax revenue and wages growth, and maybe even CPI (consumer price index inflation) could all get a boost. Much depends on how long the price rise is sustained”.

Westpac Bank has also noted the changing nature of the trade position as a long-running deficit in the trade balance fades rapidly from a peak of more than $4 billion a month early this year to $2 billion in August, before the effect of the coal-price rise had been felt.

UBS, an investment bank, went a step further late last week as the full impact of the spectacular rise in coal prices was factored into spreadsheets leading to a question: “trade surplus ahead?”

“With the trade deficit already halved this year to $2 billion in August, most of the (coal price) spike was after this. Indeed, given that the recent lift in coal is worth around $3 billion a month, the deficit will likely disappear in coming months, and could even be a surplus,” UBS said.

Foreign ownership of many coal assets will trim the full effect locally but the impact of the coal-price rise could be significant.

While more evidence of a recovery is needed to start getting excited (or dismayed) about the prospect of a higher dollar it is worth looking at the trends which link trade and currency.

The last time Australia enjoyed a sustained run of trade surpluses was in 2009 and 2010, a time when the dollar was in the US90c range, heading for a 2011 peak of $US1.09.

We've got a long way to go to get back there, if ever, but it would be wise to keep a keen eye on currency markets as the commodity price-cycle turns in Australia's favour just as the volume-cycle reaches full pitch.