Value Investor: Light ahead for New Hope?

While conditions remain challenging for thermal coal producers, New Hope Corp Ltd (ASX: NHC) is well positioned to ride out the downturn due to its productive efficiency, strong management team, a diversified and quality asset portfolio and strong balance sheet.

For the first half of fiscal 2014, NHC reported a 67 per cent fall in net profit after tax to $22.7 million, in line with company guidance provided in February.

Coal Mining and Logistics operations contributed just $7.3 million (down 88 per cent on first half fiscal 2013) to the after tax result whilst Treasury & Investments delivered $15.4 million, largely consisting of interest income on its cash balance.

Management attributed the depressed result to a range of factors, including significantly lower thermal coal prices, a relatively high AUD-USD exchange rate, the closure of the New Oakleigh mine and increasing pressure on offsite transportation costs. Coal prices and currency are beyond management’s control.

It is a challenging time for thermal coal miners, with prices at multi-year lows in an oversupplied market. This is the result of the coal industry’s overinvestment in new capacity during the 2003-2011 upturn.

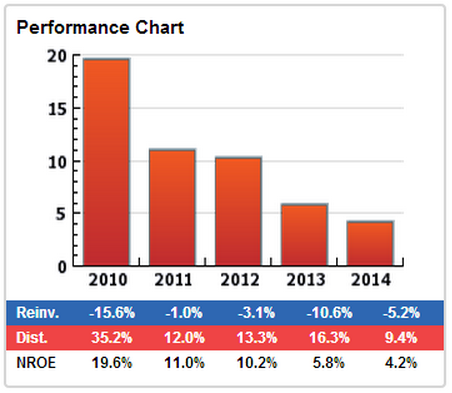

NHC’s average revenue per tonne sold was down 7.1 per cent versus first half fiscal 2013. The spot thermal benchmark price has continued its downward trajectory since early 2011. This has caused a drop in profitability (see below).

Figure 1: NHC Normalised Return on Equity

Source: StocksInValue

Environmental legislation and investment in energy efficiency are undermining the long term outlook and are structural risks to a much-needed recovery in coal prices. However, thermal coal remains a low cost source of energy and will continue to attract demand from emerging markets. Growth in coal demand is expected to come from Asia with flat demand expected in the rest of the world.

The oversupply in the market puts pressure on profit margins, but NHC remains focused on the variables it can control, namely costs and productivity. Marketing, transportation and administration costs all improved over the half.

Positively, the balance sheet remains strong with no debt and over $1.1 billion in cash or cash equivalents. While this reduces profitability, it suggests NHC is well positioned for acquisitions, further development, exploration and the ongoing payment of franked dividends in coming years.

Growth depends heavily on the development of the New Acland open cut coal mine. The development is a priority for NHC and currently is at the environmental approvals stage. Assuming approval, New Acland’s development timeline plans for construction in 2015.

The board declared a fully franked interim dividend of 6 cents, in line with first half fiscal 2013. This translates to a payout ratio of 475 per cent. NHC can pay out more than 100% of earnings due to its large stock of retained earnings in the form of the $1.1 billion cash pile. There is also a large stock of surplus franking credits.

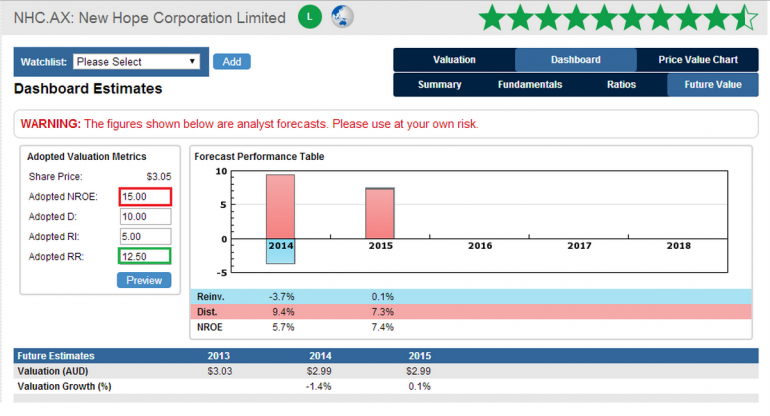

Despite a currently low Return on Equity due to cyclical pressures, we maintain a through the cycle view of NHC’s profitability and adopt a sustainable Return on Equity of 15 per cent (red below). This figure, which is twice consensus ROE of 7.4 per cent in fiscal 2015, assumes the company invests some of its surplus cash in acquisition or organic expansion. The low Required Return of 12.5 per cent (green) reflects historically strong financial performance, a management team we rate highly, and the large cash balance.

Figure 2 – NHC Future Valuation

Source: StocksInValue

We derive a valuation for fiscal 2014 of $2.99.

NHC is currently trading close to valuation. Given its sensitivity to commodity and currency movements which are outside management’s control, we would require a minimum 15 per cent margin of safety before considering investment.

Written by Brian Soh, associate analyst, with insights from Adrian Ezquerro of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For an obligation free, FREE trial please visit StocksInValue.com.au or call 1300 136 225.