US labour market can withstand the chill

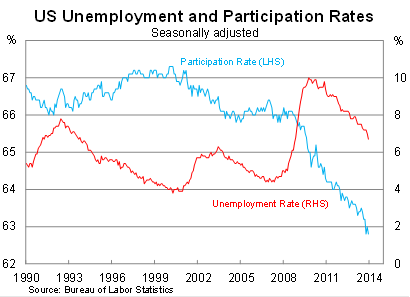

The US unemployment rate fell to 6.7 per cent in December, down from 7.0 per cent in November, while non-farm payrolls disappointed. However, the labour market data is not as good or as bad as the headlines suggests; there is more than meets the eye.

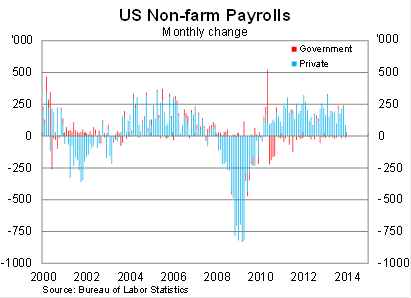

US non-farm payrolls rose by just 74,000 in December, well below market expectations, after averaging growth of 214,000 over the prior four months. There were 87,000 new jobs in the private sector, while the government shed 13,000 jobs over the month.

The retail sector drove most of the gains, rising by 55,000. By comparison, construction declined by 16,000 after recent solid gains. All of the growth was in service-producing industries.

The decline in the unemployment rate, down by 0.3 percentage points, was mainly due to a further deteriorating in the participation rate. The participation rate is at its lowest level since early 1978, partially reflecting both discouraged workers and an aging population, and has accounted for around two-thirds of the fall in the unemployment rate over the last year. If the participation rate had remained unchanged in 2013, the unemployment rate would be around 7.5 per cent.

Compared with previous months, this is a fairly disappointing result. However, there are a number of factors that we should bear in mind before we question the sustainability of the US recovery.

First, this is a single month of data. Payrolls data can be volatile and single months, whether strong or weak, do not necessary say a lot about conditions. For example, non-farm payrolls slowed to just 89,000 in July 2013 but it was followed by solid growth over the following four months.

Second, there were strong weather effects in December during the week that the payrolls survey took place. Unseasonably cold weather kept some employees away of their jobs, particularly in weather-sensitive industries such as construction.

It was the coldest December in the US in four years, with snowfall 21 per cent higher than normal. Some estimates suggest that this reduced payrolls by between 50,000 to 75,000 jobs and I expect this to be accounted for in the January data.

Third, there have been recent upward revisions to payrolls growth. If that continues, then the December result may not be as weak as initially recorded.

Due to these factors it is believed that the Fed will overlook this result when they meet on January 29-30. They are widely expected to continue to taper its now US$75 billion asset purchasing program.

Current market expectations are for the Fed to cut the program by $US10 billion at each of its next six meetings before finishing the program in October. I’d be surprised if it was as orderly as that, particularly given the Fed’s insistence that the process is data dependent, but I also expect the program to be over by the end of 2014.

The Fed will have to make some changes though with their forward guidance threshold of 6.5 per cent for the unemployment rate – after which they will consider raising interest rates – looking increasingly irrelevant. The Fed will not raise interest rates anytime soon, certainly not before 2015, and yet the current unemployment rate is at 6.7 per cent.

The Fed should lower the threshold to 6.0 per cent at their January meeting – an idea they rejected during December. Their forward guidance loses both its relevance and guidance once you pass their unemployment threshold, which could happen as soon as next month. Unless the Fed makes an adjustment, it will become increasingly unclear what the Fed intends to do and when they intend to do it.

Readers shouldn’t dwell on this soft result. I’m certainly not concerned about the monthly variation and expect solid job creation to resume in January, particularly given the weather effects during December.

The US labour market is not strong right now, but it certainly became stronger over 2013. But obviously there is still much improvement to be made and we shouldn’t ignore the fact that demographics are making the labour market look a lot better than it actually is.

Nevertheless, the Fed was justified to begin its taper on January 1 and they should be able to wind down its asset purchases over the next year. Just don’t expect it to be as orderly as the market anticipates.