US Jobs, Big Picture, The Budget, Bank margins and the yield curve, more

Last Night's Markets

US Jobs

The Budget

Some Big Picture Thoughts

Bank margins and the yield curve

Labor and Cancer

The Great US Margin Expansion

House Prices

Climate Change

The $451 Capped Fee

Research and Diversions

Facebook Live

Next Week

Last Week

Last Night's Markets

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 26,425.0 | 0.15% |

| S&P 500 | 2,892.7 | 0.46% |

| Nasdaq Composite | 7,938.7 | 0.6% |

| The Global Dow USD | 3,072.5 | 0.24% |

| Gold | 1,295.70 | 0.11% |

| Crude Oil WTI | 63.29 | 0.00% |

| Australian Dollar / US Dollar | 0.71 | - 0.1% |

| Bitcoin / US Dollar | 5,040.8 | 3.6 % |

| U.S. 10-Year Bond Yield | 2.495 | - 0.1% |

US Jobs

March payrolls in the US came in at 196,000, which was better than the 177,000 consensus forecast and heaps better than the (upwardly revised) gain in February of 33,000.

But it’s all been a bit muddied by a new series of attacks of the Fed and attempts to influence it by President Trump.

In the midst of a new campaign to get the southern border declared an emergency and build a wall, and attacking the Washington Post and New York Times as fake news, President Trump is now also trying to “put the Fed under his thumb”, as the NY Times put it.

He told reporters that the Fed “really slowed us down” in 2018 with rate hikes, even though the economy is in one of the longest expansions in history, and then he acknowledged the strength of the economy, tweeting: “Despite the unnecessary and destructive actions taken by the Fed, the Economy is looking very strong, the China and USMCA deals are moving along nicely, there is little or no Inflation, and USA optimism is very high!”

The full quote to reporters is: “I personally think the Fed should drop rates; I think they really slowed us down. There is no inflation. In terms of quantitative tightening, it should actually now be quantitative easing.”

On top of that, he nominated the former CEO of Godfather’s Pizza, Herman Cain as a member of the Fed which, if anything, attracted more criticism than is recent nomination of Stephen Moore. Both men apparently have form as being inclined to do whatever Trump wants.

By the way, Cain was a nominee for Republican candidate for President in 2016, but dropped out over allegations of sexual harassment and infidelity. Moore is accused of owing Federal taxes, and Paul Krugman described him in a tweet as an “incompetent, dishonest hack”.

Krugman also described Cain as a clown, and also tweeted that “choosing Cain is an assertion that Trump can pick anyone, and expect the party to kneel down”, not that Krugman is unbiased, mind.

Economists are now in a state of furious alarm about Trump’s efforts to control the Fed, both with his statements and his appointments, and the confirmation hearings for both men in Congress will be very interesting: will the Republicans “kneel down” is the question.

Meanwhile, the payrolls report was pretty good, although wages growth fell a bit from 3.4% to 3.2%, but stocks rallied moderately on the news.

Despite that drop, the trend in wages growth remains clearly up, as this chart from the FT shows:

.png)

As a commentator on Marketwatch put it: “That picture points to what most experts have been saying all along — the economy will slow down this year, but likely not past the low 2% range where it has been banging along for years now.”

Which means it’s likely to just keep the Fed on hold for the rest of the year – unless of course Trump can bully them into a cut with Messrs Moore and Cain inside the citadel.

The Budget

A few things to note about the 2019 Federal Budget, apart from the likelihood that it will be Josh Frydenberg’s first and last … probably. I only say probably not because I (definitely) don't think he’ll be presenting next year’s budget, but because he might be stuck as Shadow Treasurer, rather than Opposition Leader, because Scott Morrison apparently wants to stay on, and you never know - they might win in 2022, as I’ll explain, so Frydenberg gets another go.

The first thing of note is that the improvement in 2018-19 had nothing to do with Government decisions: they only worsened it.

The May budget last year forecast a deficit for 2018-19 of $14.5 billion. Tuesday’s budget has it down to $4.2 billion, a $10.3 billion turnaround with three months to go till June 30.

According to the budget papers, the contribution of “parameter and other variations” to this turnaround – that is, the economy and commodity prices – was $14.1 billion. So Government measures contributed minus $3.8 billion.

Second, the $7.1 billion surplus predicted for 2019-20, and touted by Treasurer Josh Frydenberg as having been “delivered”, is meaningless.

As discussed, last year’s budget forecast was out by $10.3 billion, or 73%, and the year still has three months to go!

I went back over the past ten years of budgets and compared them with the outcomes for each year, with the following result:

| Budget forecast (millions) | Outcome (millions) | Difference (millions) | |

| 2018-19 | -$14,500 | -$4,200 | -$10,300 |

| 2017-18 | -$29,400 | -$10,100 | -$19,300 |

| 2016-17 | -$37,100 | -$33,200 | -$3,900 |

| 2015-16 | -$35,100 | -$39,600 | $4,500 |

| 2014-15 | -$29,600 | -$37,900 | $8,300 |

| 2013-14 | -$18,000 | -$48,500 | $30,500 |

| 2012-13 | $1,500 | -$18,800 | $20,300 |

| 2011-12 | -$22,600 | -$43,400 | $20,800 |

| 2010-11 | -$40,800 | -$47,700 | $6,900 |

| 2009-10 | -$57,600 | -$54,800 | -$2,800 |

The average miss is $12.76 billion. Counting any of those budgets as reality – as each of them was, by the Treasurer concerned – was ridiculous.

The closest was in 2009-10, when Wayne Swan’s budget in May 2009 predicted an absolute blow-out deficit of $57.6 billion and it turned out to be “only” $54,800.

The biggest miss, by some distance, was Swan’s last budget in 2013, six months before the election in September that year, which forecast a deficit of $18 billion. The outcome, including nine months of Joe Hockey’s austere stewardship, was a deficit of $48,500.

In each of 2011-12 and 2012-13 the deficits were $20 billion bigger than budgeted, and in 2017-18 it was $20 billion smaller ($10.1 billion versus budget forecast of $29.4 billion).

In other words, it is perfectly ludicrous to talk about “delivering” a surplus in the coming financial year, using the words “is” and “will be”. The 2019-20 fiscal balance could end up being anything. We’ll find out in 18 months, and the only thing we definitely know is, it will not be a surplus of $7.1 billion.

And the third point is that this was a very tentative, even timid budget, more concerned with having responsible surpluses over the forward estimates than buying votes.

For example, “lower taxes for hard working Australians” will cost just $750 million in 2019-20 and will actually produce savings (!) of $250 million in 2021-22.

The increase in the instant asset write-offs for small business is budgeted to cost $200 million in 2019-20, $500 million in 2020-21, and then also start actually making money - $300 million over the following two years.

These are all small numbers, not the vote-buying you’d expect from a Government on the ropes.

There’s $400 million a year for congestion, $100 million for road safety and some money for Victoria and Western Australia, all back-ended, and not much at that, really.

And this is all paid for by the “extension and expansion of the ATO Tax Avoidance Taskforce on Large Corporates, Multinationals and High Wealth Individuals”, in other words the old stand-by of a crackdown on rich tax avoiders, which may or may not bear fruit.

It is supposed to raise $3.6 billion over four years, and is the single largest revenue measure in the budget. It comes from $1 billion in extra cash to the tax office, which is not a bad ROI. Any corporation in the land would happily invest for that kind of payback.

The problem is that the $1 billion is real money; the $3.6 billion is not real. It’s a forecast, and as always with these things, there will never be a public reckoning of how it went.

It’s tempting to look at the budget and remember that it’s the start of a five-week election campaign, so more and greater giveaways will presumably be unveiled as it proceeds.

Except that within ten days of the Prime Minister calling the election, the Department of Finance will publish the PEFO – the Pre-Election Fiscal Outlook - so any further spending would have to be matched with savings or tax increases, or be confined to the mysterious “decisions taken but not announced” buried in the budget papers.

These total a bit more than $3 billion over the four-year forward estimates, including $2.66 billion in 2022-23, but that’s not very much money, and not enough to turn around a 55-45 deficit in the polls.

And the surplus itself certainly won’t do it: in 2013 Wayne Swan predicted surpluses for 2015-16 and 2016-17 and Labor still lost, and in 2007 Peter Costello predicted huge surpluses forever and the Coalition lost in a landslide six months later, with the Prime Minister even losing his seat. Surpluses simply do not win elections.

So it seems to me that the Morrison Government has given up on this election and is attempting to preserve dignity and reputation for a successful run in 2022.

This is not stupid, in fact it’s a good idea. They can’t possibly win this election, and their own polling must make that clear. The best thing to do is to start preparing for 2011.

And the economy is slowing, so it’s a good one to lose. It’s unlikely to be as deep a slowdown as in late 2008, after the hapless Wayne Swan, in his first budget, had predicted a surplus of $21.7 billion in 2008-09 and $19 billion a year thereafter, forever.

The outcome for 2008-09 turned out to be a deficit of $27.1 billion and $54.8 billion in 2009-10, after which the Coalition almost won the election, and Labor went into minority government, shaken and bruised.

But even without a GFC and a Global Recession, economic growth over the next few years is very unlikely to support the surpluses predicted this week, and Labor’s tax policies, especially the ban on negative gearing existing properties, will make things worse.

If China fails to fails to stimulate fully, or its stimulus fails, then Chris Bowen will find himself presiding over deficits throughout the Labor Government’s first term.

In which case, the Coalition would be a decent chance to win in 2022, unless the wipe out next month is simply too great to make up.

Also a loss next month and then a few years in Opposition might have the added benefit of cleaning out the wing-nuts in the Coalition who are blocking a proper climate change policy, along with the modernisation of both the Liberal and National parties.

Some Big Picture Thoughts

Things are certainly changing quickly in the markets these days. As the year began, we wouldn’t have expected to be starting the best first quarter of the year since 1991, but that’s what it was: the ASX200/All Ordinaries rose 10%, beating the 9% first quarter of 2015, making it the best since the 12.8% March quarter of 1991, coming out of the recession bear market.

The S&P 500 also had a good one - the best first quarter since 1998, and the MSCI world index rallied a wild 13.2% for the quarter.

At the same time the Aussie 10-year bond yield crashed from 2.3 to 1.8%, a fall of 21%.

Stocks and bonds are in different universes at the moment: the sharemarket is reacting to the pivot by central banks from being hawks to doves, while the bond market is looking at the sluggish economies and fading inflationary pressures.

They’ll potentially converge when it becomes clearer whether the US economy’s soft patch was temporary or more permanent, possibly leading to a recession, and we won’t really know that until late May, early June, when the first quarter economic data starts coming in.

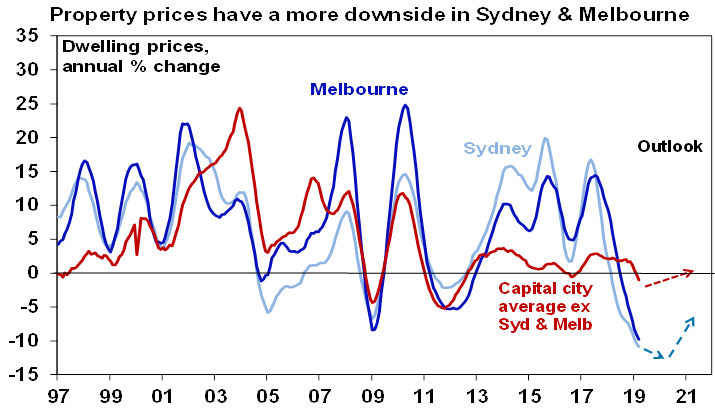

My view is that the risks tilt towards the downside, but there’s nothing to suggest a recession is around the corner, either here or in the US. The big caveat on that for Australia is the property market: if the house price decline extends beyond 20% then all bets are off.

I think the sharemarket will remain focused on the cure rather than the disease (that is, central bank action rather than the slowdown itself) so there is unlikely to be a significant correction, but that first quarter was pretty big and the market is no longer cheap, so some kind of reversal might be on the cards.

The key thing to watch is China, not so much the trade talks with the US, which are becoming a running joke of photo opps and press releases, but the state of its economy and government stimulus.

The Shanghai Composite index has rallied a whopping 30.2% since January 3, so investors there are certainly looking forward to a promising year of continuing fiscal and monetary stimulus, and there’s no reason to doubt that.

The central bank has almost certainly not finished easing policy yet, and it is very likely that the bank reserve requirement ratio will be cut further in 2019.

The People’s Bank of China is no longer constrained by what the US Federal Reserve and the European Central Bank are doing, since they have become more dovish, and bond yields in the US and Europe have declined sharply recently. This means that the PBOC does not need to worry as much about a divergence between Chinese interest rates and those in other major economies, so the monetary policy outlook therefore still favours lower bond yields.

Fiscal stimulus is likely to be less than previous years and recent data suggests that wouldn’t be needed anyway: The jump in China’s manufacturing PMI for March suggested a sharp rebound in industrial production from the record low figure in February. The output sub-index rallied from 49.5 in March to 52.7 prior, indicating businesses are expanding production quickly after the Lunar New Year holidays in February.

ANZ’s excellent China economist Raymond Yeung commented: “All in all, March’s PMI data suggest that the cyclical downturn in China’s GDP growth may have found a bottom in Q1, registering 6.4% y/y, according to our forecasts.”

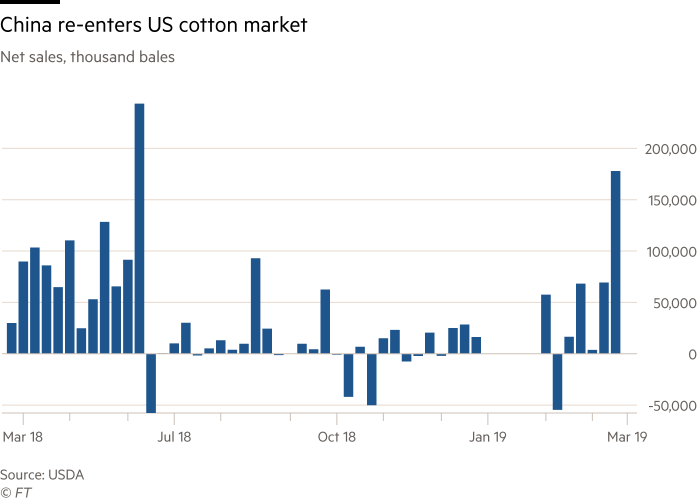

And finally the news from the trade war front seems likely to be good. The Financial Times reported yesterday that China has ramped up its purchases of US farm goods as a gesture of goodwill, and had this chart of the cotton trade:

Robert Lighthizer, the US trade representative, testified in February that “absolutely cotton is a factor” in the trade discussion, and sure enough, China started buying it.

That’s not great for Australian cotton producers, by the way, but they’re not listed: investors will win if the trade war ends because China buy more American cotton instead of Australian.

Bloomberg reported that President Trump was due to meet Chinese Premier Liu He on Thursday and “Drafts of an agreement to end (the) nearly year-long trade war would give Beijing until 2025 to meet commitments on commodity purchases and allow American companies to wholly own enterprises in the Asian nation, according to three people familiar with the talks.”

So it does look like they’re heading for a deal. Whether that solves the more fundamental issues around China’s hacking and IP theft is another matter.

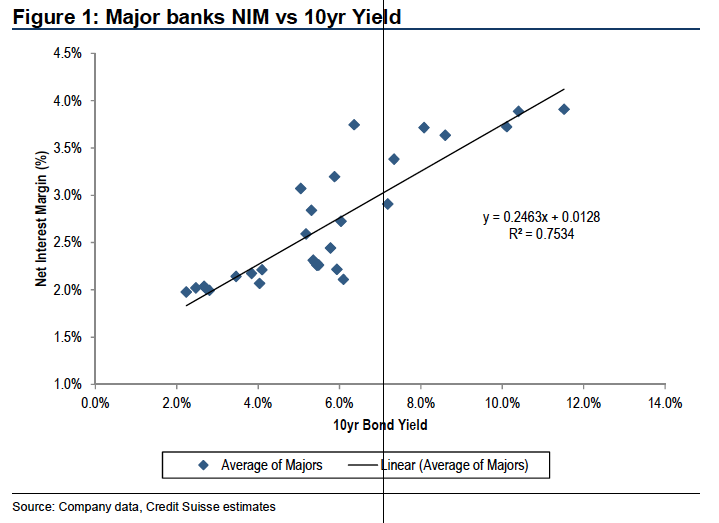

Bank margins and the yield curve

In the livestream Q&A session on Thursday, Andrew asked about the yield curve and bank margins: “I think it was in your overview that you mentioned a reason for banks not lending was that banks fund short and lend long. Could you please explain this mechanism in a bit more detail please and relationship with inverted yield curve and bank margins.”

This is an important issue for most SMSF investors, since most are overweight banks and the yield has flattened.

Fundamentally, banks are maturity transformation machines, by which I mean that they transform short maturity debt into long maturity debt and pick up the margin between the two. There’s usually a margin, because long term loans cost more than short term ones.

The tension occurs when the providers of the short term debt want their money back quickly, but the bank doesn’t have access to it, since it’s been long on 25-year mortgages. That’s called a bank run.

The correlation with the 1-year yield, on the hand, is 0.75, as the chart above shows.

Labor and Cancer

That the centrepiece of Bill Shorten’s budget reply speech was a plan to remove out of pocket expenses for cancer patients is enormously significant I think.

He said the $2.3 billion cancer plan would cover up to 6 million free cancer scans, 3 million free appointments with specialists, and affordable medicines within Labor's first four years in office.

Obviously this is good news for anyone with cancer, because it’s clear that for most people the diagnosis is financially as well as emotionally devastating, because of all the tests required, separate to the hospital stay that would be covered by health insurance.

But my question is: how can it possibly be left at cancer?

How can we have a situation where we are relieved at being diagnosed with cancer, rather than, say, heart disease, diabetes, or something else that isn't cancer, because at least we won’t go broke if it’s cancer.

It seems to me Shorten is taking us down a path towards a new model for funding healthcare in Australia. I’m not saying this is bad, just big.

When he lost the 1996 election, Paul Keating remarked: “when you change the government, you change the country.”

Bill Shorten’s budget reply speech reinforced the truth of that: covering all the costs of people diagnosed with cancer is a classic thin end of a wedge, it seems to me. The thick end would be a fundamental reshaping not only of the health system, but the tax system as well, to pay for it.

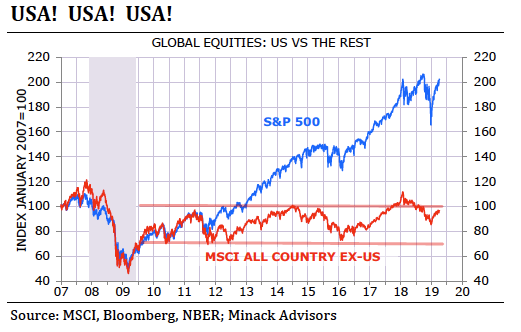

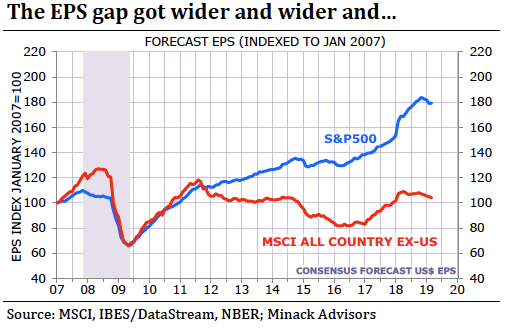

The Great US Margin Expansion

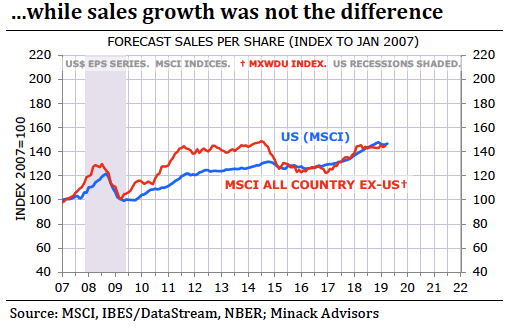

Gerard Minack had a fascinating note this week on the performance of the US sharemarket in the 10 years since the GFC, which he rightly says has been astonishing.

From trough to peak the S&P 500 is up 340%, for an average annual gain of 16%. What’s more, this has been a solo bull market: the rest of the world has been range-bound.

The main reason for the outperformance is superior earnings per share (eps) growth, and the reason for that is margin expansion, not sales growth:

Says Gerard: “In short, US out-performance has largely been due to stronger EPS growth, and that stronger EPS growth has been almost solely due to margin increases.”

This is a very important point, not just about the corporate world and the sharemarket, but the world in general.

America’s huge profit margin expansion is in large part due to its dominance of technology.

The big surge in the first chart above was from 2016 to 2018, and it was driven by the tech giants: Bloomberg’s FANG index, which includes Amazon, Apple, Facebook, Google and Netflix, plus a few more, went from around 1000 in May 2016 to a peak of 3000 in June 2018 – tripling in two years.

There was also a huge boom at the same time in (so far) unlisted companies like Uber, Lyft (now listed), Airbnb and so on. Which are likely to hit market this year.

So these were two years that shook the world, and the ramifications will play out for decades, including in such things as regulation of social media, AI and facial recognition, as well as America’s efforts to prevent China from stealing a piece of the action.

Gerard’s conclusion is a little more prosaic, but worth noting, even if he ends on the fence: “The forward looking point is this: can US corporates continue to widen margins relative to their offshore peers? If the answer, over the medium term, is no, then it’s likely that US out-performance will not persist – although this is not a reason to expect US under-performance.”

Me? I’m off the fence. The outperformance can’t and won’t persist, because the tech companies’ margins will be pressured by both regulation and competition from China.

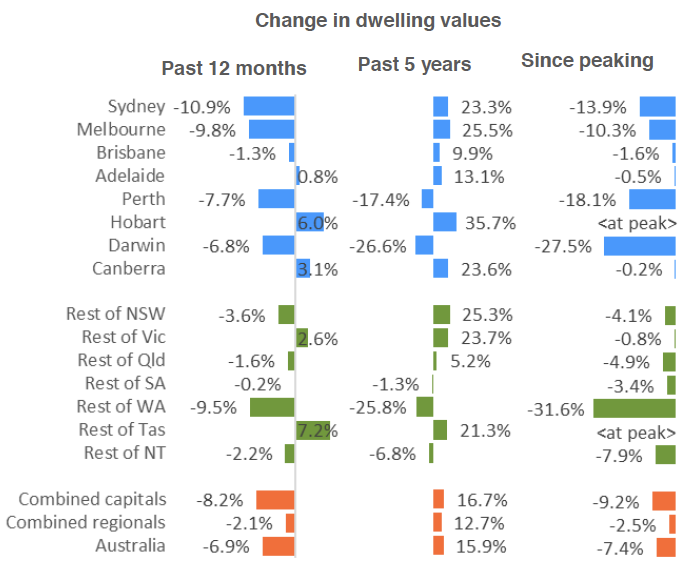

House Prices

This chart from CoreLogic is the best, and clearest, display what’s going in the residential property market:

You really don’t need anything else, apart from an accurate prediction about what will happen from here. Unfortunately I haven’t got one of those.

Climate Change

On my way to the budget in Canberra on Tuesday, I stopped off in Sydney and delivered a brief, angry speech to the Smart Energy Council’s exhibition and conference at the Convention Centre.

I spoke from notes, rather than a fully crafted speech, but a couple of subscribers asked me to put it into today’s Weekend Briefing, so here are the notes:

The main thing I want to discuss talk about is what should happen now?

- What government policies?

- What business practices?

- How should investors respond?

- What should you and I do?

However let‘s talk about how and why Australia stuffed it up.

We were doing OK until 2009.

- In 1998 Australia was the first country to set up a government agency dedicated to reducing greenhouse gas emissions – the Australian Greenhouse Office, which as the Parliament House archives, puts it, was responsible for managing the Prime Minister’s package. That was 5 months after the Kyoto meeting.

- At the same time, Environment Minister signed the Kyoto Protocol, but didn’t ratify it – therefore not binding.

- The AGO releases a series of discussion papers, setting out the design for emissions trading schemes.

- November 2000, the Senate Standing Committees on Environment, Communications, Information Technology and the Arts releases “The Heat is On: Australia’s Greenhouse Future.” More than 100 recommendations, criticises the Government for lack of action

- In 2002 the Minister for the Environment and Heritage Dr David Kemp & Minister for Foreign Affairs Alexander Downer publish “Global Greenhouse Challenge: The Way Ahead for Australia” – in part a mealy-mouthed justification for Howard not ratifying Kyoto, but did more or less say that climate change was real and important.

- 2006 – Howard sets up Prime Ministerial Task Group on emissions trading under leadership of Peter Shergold, Head of PM & C.

- May 2007, Shergold Report released recommending ETS.

- Both parties went to 2007 election with ETS.

- Rudd finally ratified Kyoto agreement in December 2007.

In other words from 1997 to 2007 there was lots of action and momentum.

Within two years it had gone entirely pear-shaped.

What went wrong?

Part of it was that the Green’s success at the 2007 election helped redefine Australian politics to some extent.

- Greens 9% of the national vote and directly contributed to John Howard losing his seat.

- Labor moved towards environmental issues, rather than industrial relations (no longer the battleground it was)

- Coalition in Opposition had to oppose, and therefore had to oppose the climate change policy.

- In any case – there is a natural tendency to define yourself by being against what your enemies think

- Also – politicians are constitutionally able to believe anything and therefore nothing. How else can you explain their trust of science when they go to the doctor, but the refusal to accept the science of climate? It’s worse than cynicism, it’s nihilism.

But the main thing, in my view was the election of Malcolm Turnbull as Liberal leader and leader of the Opposition in 2008.

This drove Australia’s right-wing mad – both within the party and the right wing media, led by 2GB and News Corp.

Why was he such an interloper? Why wasn’t he their Bob Hawke? Probably because he was head of Republican Movement, who kicked the monarchist Peter King out of Wentworth. Also he was known to have flirted with the Labor Party. He was a flash jack lawyer.

For ten years the Australian Right has been obsessed with him, with trying to vomit him out of the Liberal Party like a bad oyster, and they have been using climate change to do it.

In 2009 the leader of that push was Nick Minchin. When Turnbull was negotiating with Rudd to pass a bipartisan emissions trading scheme, Minchin turned the party against him using the CPRS negotiations.

Minchin helped define the conservative wing of the Liberal Party as climate change deniers.

Result: day of infamy when the CPRS failed to pass the Senate – August 13, 2009.

The two men most responsible for this disaster were Minchin and Bob Brown. I can’t decide who was worse.

Brown probably. That the Greens failed to support the CPRS because it didn’t go far enough was a shocking mistake, a permanent stain on them.

In 2014, when the Abbott gang repealed Julia Gillard’s ETS, it would have been five years old and embedded in the economy – much harder to get rid of, if not impossible.

After that, Turnbull’s days were numbered. Minchin and the right managed to replace him with Abbott by one vote in December 2009.

Don’t need to go through what happened then. Abbott’s mob decided cynically to use climate change to win the 2010 election and make the ALP a one-term government.

His chief of staff Peta Credlin later admitted that it wasn’t a carbon tax, but they made it one.

That almost worked in 2010, if not for Tony Windsor and Rob Oakeshott.

They kept it up relentlessly for three years and eventually it did work in 2013 (and Julia Gillard’s legislation was repealed on another day of infamy in July 2014 – I’ll never forget the picture of the gang on the floor of house congratulating each other).

I think the Australian Right wing’s decade-long project to thwart effective action on climate change is one of the most destructive and self-destructive episodes in our political history.

After over-reaching on industrial relations with WorkChoices, the Liberal Party settled on climate change denial and support for coal as their core purpose and ideological underpinning.

This has fired the party and more broadly the Australian right for a decade.

Now that has crumbled. It’s untenable. They are lost, left arguing half-heartedly about the pace of emissions reduction, the size of the renewable target, enthusiastically supporting pumped hydro because it’s “fair dinkum power. 100% fair dinkum”, when in fact it’s storage for renewables, and needs most of the coal-fired power in the country to shut down.

But I can’t help thinking that the debate about emissions is old now. Yes, we need a national policy that provides a credible path to meeting international commitments that doesn’t involve using Kyoto credits, but the costs of solar, wind and battery storage have collapsed to the point where it’s probably OK now.

No one’s going to build a coal-fired power station. And probably no one will build a new coal mine, but maybe they will. There’s obviously going to be demand for a while from India and China at least.

It’s time to deal with the reality of climate change, and what it means.

It’s happening now. Nothing we do will stop it, and it’s pretty clear the UNFCCC process isn’t going to stop it either. It’s too late.

What I want to know – what I demand from Government - is not how we are going to reduce carbon emissions by x per cent on 2005 levels, or whatever the latest thing is, but how difficult is life going to be for my grandson.

I don’t know that. I don’t know whether to be not worried for him because it’s all crap as Maurice Newman says, a little worried, really worried, or leave a note for when he turns 18 suggesting a move inland, well inland, with plenty of food storage in a bunker.

Specifically, we urgently need a permanent commission made up of scientific/economic/financial/social experts to advise the government and community on what’s most likely to happen, should be done and what it will cost.

Some of the issues that come to mind are:

- Insurance;

- Emergency services;

- Immigration policy (will Bangladesh be inundated? What about Pacific Islands? What if a million people head this way in boats);

- Regional population if droughts persist, especially the Murray Darling Basin;

- Barrier Reef and tourism, and so on;

- The collapse of coal exports, and eventually natural gas;

- What will the cost of global warming be to Australia over 50 years? How will it be funded?

I get that the government might not want to alarm people, but maybe the answer isn’t that alarming. And if it is, best to be open, I think. We all need to know what we’re in for.

It is absolutely scandalous that we don’t know, and are subjected to this endless debate about whether climate change is real, so confusion and ignorance reigns. We can all see that it’s real – what we need to know is what will it mean? And how much will it cost?

What should have been going in over the past 20 years is the sort of honest leadership that tells the community that climate change is going to cost money – in higher electricity prices and remediation costs.

Instead we had one side of politics saying that if we ignore it, if we don’t believe it, it won’t cost a thing, and it’s the other side’s foolish ideology that will cost you money.

Of course prices went up anyway, because of that behaviour getting in the way of investment.

Now I think it’s time for a more difficult type of leadership – to find out the truth about what we and the world are in for, to tell us the truth about it, and to start planning and saving up for it.

The $451 Capped Fee

As I’m sure you know by now I’m such a big fan of InvestSMART’s $451 per year capped fee ETF products, it’s the reason I sold The Constant Investor to them and joined up as editor in chief. I think it’s a game changer, and the first time there’s an investment product I feel comfortable getting behind and promoting wholeheartedly.

The thing is, although there is still percentage in the ETFs themselves, InvestSMART’s support and overlay is really all you need on top – it potentially replaces the fees that advisers charge. Most simply don’t need an adviser using these products, which saves an enormous amount.

More and people are getting on board and seeing the benefits, so I thought I’d include a couple of testimonials today:

“On the face of it, 1-2% investment management fees doesn’t seem like a large amount, but when calculating the total impact on my returns over time, it clearly has a significant negative impact. With that in mind, I’ve transitioned to InvestSMART capped fee products to minimise investment costs, which will significantly improve my returns when compared to my previous investments. I’m extremely happy with the transparency and information available on the portfolios, but possibly the biggest appeal to me with investing with InvestSMART has been the responsiveness and willingness of the team to assist with questions I've had. I’d happily recommend InvestSMART to others." – Stephen, Adelaide (InvestSMART investor since 2017),

“I did a lot of research and compared other firms before choosing the InvestSmart “capped fee portfolio”. This feature provides me with the certainty of both knowing my account will not be drained by additional fees found in the fine print. I have only been with InvestSmart a few months and am pleased with the above average personal customer service, ease in accessing the online information and the performance of my investment.” – Neil, Brisbane (InvestSMART client since March 2019).

Research and Diversions

Research

Ray Dalio, who obviously doesn’t have enough to do these days, has written a long and detailed essay on how and why capitalism needs to be reformed. It’s good! If a little hard going. But he’s always worth reading – I used to love getting his reports (on paper) in the early days of Bridgewater, 35 years ago. He was all in favour of capitalism back then, but things have changed lately, it’s true.

Amazon is the real IoT/Cloud company that can disrupt the consumer experience on every level of our times. Amazon is coming, and it’s coming for you.

WTF is Amazon? “It’s a bookseller, a retailer, a plane, a drone delivering something, no it’s just f***ing Amazon.” Here’s a chart of its workforce:

.jpg)

Shoshana Zuboff’s “The Age of Surveillance Capitalism” explains how Big Tech came to dominate our lives.

Getting the bank of mum & dad right.

Stampede of the unicorns – will it burst the bubble? “…if there was ever an animal born to burst a bubble, it’s the unicorn.”

The impact of China espionage on the United States. “In my recent study at Penn State University, I analyzed 274 cases of Chinese espionage. Several high-level conclusions can be drawn from those cases, which represent the last 20 years of Chinese espionage operations.”

The CBD (cannabidiol) boom is way ahead of the science. “People think it’s great for everything,” says cognitive neuroscientist Kent Hutchison of the University of Colorado Boulder. That can’t possibly be true, he says. “But I do think it’s going to be great for some things. We just need to figure out what those things are.”

I’ve started reading this New York Times investigation of the Murdoch family, but it’s going to take a while – it’s basically a book! Huge amount of work has gone into it, and it looks very thorough. I hope you’re not out of NYT free articles (I’m a subscriber).

My friend John Abernethy of Clime Investment Management on the budget: “The minority of Australian TV viewers that chose the Budget Address rather than tuning in to Married at First Sight were still entertained by coverage that combined poor quality acting with choreographed hugs.”

Abernethy again: “It is our view that the maintenance of negative rates of interest across both Europe and Japan with no positive economic result, is an act of economic insanity. Further the continuation of quantitative easing for nearly 8 years (in Europe) and over 15 years (in Japan) with no discernible economic benefit are also acts of economic madness.”

“You could make a strong argument in March 2019 that the pulse of American politics is the Twitter of AOC (Alexandra Ocasio-Cortez) A politician that’s 6 years too young to be able to even run as the next POTUS, this means even in 2024 she will be too young for that office while our President is 72 years old.”

A good, clear piece on Brexit’s Irish paradox, from The New Yorker.

The mass psychology of Brexit. “Madness, Nietzsche wrote, is rare in individuals, but in groups it is the norm. Britain today is like a child that has been not only abandoned but literally dropped by its parents. It has broken into two different social groups, two politics, two worldviews but also, beneath the surface, two divergent ways of reorganising what psychoanalysts call an object world.”

The seven mistakes that led to the (shameless stupidity of) Brexit. How Britain chose to self-destruct and make itself a global laughing stock. “(It) will probably go down in history as among the most hilariously, weirdly, astonishingly tragic set of choices a rich country ever made, (right up there with America cheerily electing a wannabe cartoon Fuhrer, of course.)”

More Brexit: “Remainers and Leavers alike have been caught off-guard by the strength of feeling aroused. And it’s not even remotely fanciful to imagine that the schism within Britain will haunt the polity for decades.”

The new German question. It may seem now as though Germany has ceased to pose any threat, thanks to its thoroughgoing transformation into a liberal democracy after World War II. But is this Germany the only conceivable Germany? “With the order that made today’s Germany possible now under attack, including by the United States, the world is about to find out.”

How innovation happens. “The procession of technological discoveries is inevitable. When the conditions are right — when the necessary web of supporting technology needed for every invention is established — then the next adjacent technological step will emerge as if on cue. If inventor X does not produce it, inventor Y will.” You might need to increase the size of the text here - it’s pretty small.

The Reserve Bank will be too late to stop an Australian recession (says Matthew Haupt of Wilson Asset Management). “With the cash rate sitting at 1.5 per cent, the predicted cuts will not materially stimulate the economy, let alone stave off a recession. This means that Australia is dependent on the short-term benefits of fiscal stimulus. With a federal election looming, it is expected that both parties will compete to outspend each other on infrastructure and other programs. However, this injection is likely to fall short.”

Russiagate is this generation’s WMD. “Nobody wants to hear this, but news that Special Prosecutor Robert Mueller is headed home without issuing new charges is a death-blow for the reputation of the American news media.”

Tech giants will overtake our homes — and once you’re locked into one ecosystem, you won’t be able to escape…

Diversions

Vic Carroll died this week, aged 94. I knew him a bit, not well enough. He was editor of the both the Sydney Morning Herald and the Financial Review, before I was – he rescued it, in fact, when Murdoch nearly killed it with The Australian. This is my friend, and former boss, Max Suich’s magnificent obituary about Vic for the SMH this week. “…by force of example, persuasion and a strong streak of stubbornness, he played a major role in persuading the Fairfax family and management of the corporate and social benefits of allowing editorial diversity within and competition between the separate arms of their influential media empire. It is a tradition now lost to the centralisation prompted by the digital revolution.”

Here’s the Mark Humphries skit from the Budget lock up, in which he says he thought Alan Kohler was the name of a knock-off soft drink from Aldi. Apart from that lame joke, it’s pretty good! He’s funny! (I also like watching him on Pointless, which I was dismayed to learn has been canned).

A century ago Charlotte Perkins Gilman was the “leading intellectual of the women’s movement”. She was also a xenophobe, a racist and a eugenicist. Such views were then quite common among progressives, but how could she have been so right on gender, and so wrong on race?

“Lately, I’ve been discussing how we are beginning to run the risk of irreversible civilizational collapse now.” OK, but what are you talking about? “Collapse, in the simplest definition, simply means that progress can turn into regress — suddenly, swiftly, seemingly overnight. No matter how mighty a nation is, this century.”

Fascinating piece: “Bach and Joni Mitchell, two sides of the same coin”.

Remarkable/scary animation of global temperatures from 1850.

Subscriber Michael Kennedy sent this in: Hugh Laurie on the piano with a singer named Gaby someone doing a song called “Weed Smoker’s Blues”. Very nice.

Candid interview with Abigail Disney, about what it’s like to grow up rich: “You don’t have to answer this, but I’m trying figure out how much you inherited, or a ballpark if you’re not comfortable talking about it.

Well, and the number has changed over the years. I’ll tell you this: I could be a billionaire if I wanted to be a billionaire, and I’m not because I don’t want to be a billionaire. That’s an insane amount of money. But it’s the easiest thing in the world to make money if you start with money. And then people give themselves credit for being that smart when they’re not.”

Really interesting story about the use of pigeons for communication in World War One – Operation Columba. “(It) was conceived and run by a raggle-taggle band of secret service officers, pigeon-fanciers, aristocratic animal lovers and soldiers, who didn’t always work well together.”

Inside the race to build the burger of the future – the post-meat burger. “We just can’t feed an expanding world population on meat, not if we keep growing it the way we’re growing it.”

Muddy Waters and the Rolling Stones doing Baby Please Don’t Go, live at the Checkerboard Lounge. Fantastic!

During a debate over the deal-no-deal, a group of protesters stripped to their underpants, super-glued their bodies to a glass wall & began to chant. Here’s the bit I like... MPs just carried on regardless. So very British.

The life of a labourer in India. At the start he is a near-slave, mid-way through 13 years of bonded labour, trapped by a $15 debt to a local usurer carrying a 120% interest rate. Forty years on, a free man, he still works long days in the fields, but he considers this a happy old age. He is poor, but he is “no longer destitute, no longer in bondage.”

The day the dinosaurs died. “Within two minutes of slamming into Earth, the asteroid, which was at least six miles wide, had gouged a crater about eighteen miles deep and lofted twenty-five trillion metric tons of debris into the atmosphere. When Earth’s crust rebounded, a peak higher than Mt. Everest briefly rose up. The energy released was more than that of a billion Hiroshima bombs.”

The worst disease ever recorded. “…the fungus has caused the decline of 501 frog and amphibian species—about 6.5 percent of the known total. Of these, 90 have been wiped out entirely. Another 124 have fallen by more than 90 percent, and their odds of recovery are slim. Never in recorded history has a single disease burned down so much of the tree of life.”

Emily Wilson talks about her widely acclaimed translation of the Odyssey; and about Stoicism, Plato, Milton, Michael Jackson, forks, Pericles, adjuncts, Ikea, and orange cats. On Odysseus: “He’s better at disguising, better at telling stories, better at fictionalizing his own life, better at coming up with a plausible way to get out of any impossible situation. Does that make him admirable? In a way, it does. He’s a survivor.”

Happy birthday Dave Swarbrick, who have turned 78 yesterday, had he not died in 2016. I went through a big Fairport Convention phase for a few years – loved them to bits. He was the fiddler, and what a fiddler he was! Here he is solo, so you can get a good idea of how good he was.

And this is one of my favourite Fairport songs, the beautiful To Althea From Prison, with Dave Swarbrick singing as well as playing the violin. Gorgeous video to go with it too…

“Stone walls do not a prison make not iron bars a gate

Minds innocent and quiet take that as a hermitage

If I have freedom in my love and in my soul am free

Angels alone that soar above enjoy such liberty.”

And tomorrow is Billie Holiday’s birthday, born 1915. Here is some rare footage of her singing “Strange Fruit” live in 1959, just before she died, aged 44, of cirrhosis. This video is absolutely riveting.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Facebook Live

If you missed #AskAlan on our Facebook group this week (or if you don’t have access to Facebook) you can catch up here. And there's also the Facebook Livestream page where you can also opt to just listen to the questions and answers.

If you’re not on Facebook and would like to #AskAlan a question, please email it to askalan@investsmart.com.au (new email!) then keep an eye out for the Facebook Live video in next week’s Overview.

Next Week

By Craig James, Chief Economist, CommSec.

Australia: Reserve Bank and consumer confidence in focus

- In Australia over the coming week, ‘top shelf’ data is conspicuous in its absence. Consumer confidence readings will attract most interest.

- The week kicks off on Tuesday when the weekly consumer sentiment index is issued from ANZ and Roy Morgan. This survey will provide the first indication on how the Federal Budget went down with Aussie consumers.

- Also on Tuesday,the Australian Bureau of Statistics releases the February data from its publication: “Lending to households and businesses”.

- In January, the value of lending to households fell by 2.4 per cent after a 3.6 per cent decline in December. Lending for housing fell by 2.1 per cent, investor lending was down 4.1 per cent and lending for owner-occupier dwellings fell by 1.3 per cent.

- The value of loans for home alterations and additions fell by 0.7 per cent to a record-low of $281 million.

- On Wednesday there is another check on consumer confidence, this time from the monthly survey by Westpac and Melbourne Institute. In March, consumer sentiment index fell by 4.8 per cent to 98.8 after rising by 4.3 per cent to 103.8 points in February. The sentiment index is below its long-term average of 101.3.

- Also on Wednesday, the ABS releases two building publications – “Building Activity and “Construction Activity” – both for the December quarter. Most interest will be in the component data on dwelling starts.

- The number of dwelling units commenced fell 5.7 per cent to 54,803 dwellings in the September quarter following a fall of 4.7 per cent in the June quarter.

- There are a number of speeches from Reserve Bank officials on Wednesday. Deputy Governor, Guy Debelle, speaks at the American Chamber of Commerce event in Adelaide. Melissa Hope, Head of Note Issue Department, and Lindsay Boulton, Assistant Governor (Business Services), speak at a currency conference in Dubai.

- On Thursday, the ABS releases “Overseas Arrivals and Departures” containing data on tourism and migration flows.

- Also on Thursday, Deputy Governor, Guy Debelle, delivers a speech via video conference to an audience in Hong Kong.

- On Friday, the Reserve Bank releases the February data on credit and debit cards.

- Also on Friday the Reserve Bank releases the semi-annual Financial Stability Review.

Overseas: US inflation data and Federal Reserve in focus

- A raft of reports on inflation are released in the US over the coming week. In addition the minutes of the last Federal Reserve meeting are released. In China inflation and trade data are of most interest.

- The week begins on Monday in the US when data on factory orders and consumer inflation expectations are expected. Orders may have fallen 0.3 per cent in February after two gains of 0.1 per cent.

- On Tuesday in the US, the National Federation of Independent Business (NFIB) releases its business optimism index for March together with the IBD/TIPP economic optimism gauge, JOLTS job openings and the regular weekly data on chain store sales.

- The NFIB business optimism index bounced from 2-year lows in February. And job openings on January lifted to levels just short of record highs.

- On Wednesday in the US, the consumer price index is due for release alongside the monthly Budget Statement, weekly mortgage finance data and the minutes of the last Federal Reserve policymaking meeting – the Open Market Committee.

- The core rate of inflation – excludes food and energy – is tipped to remain at a 2.1 per cent annual rate in March.

- On Thursday in the US, another gauge of inflation – the producer price index (PPI) – or measure of business inflation, is released. The annual core PPI is expected to ease from 2.5 per cent to 2.4 per cent. Also on Thursday the usual weekly data on claims for unemployment insurance is issued.

- On Friday in the US, there yet two more inflation measures are to be released – data on export and import prices. The University of Michigan releases its preliminary estimate of consumer sentiment for April.

- In China, the key data is released over Thursday and Friday.

- On Thursday data on consumer and producer prices is released together with vehicle sales.

- On Friday in China, export and import figures for March are issued. At present forecasts suggested a widening of the trade surplus from US$4.1 billion to US$26.4 billion.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital.

Investment markets and key developments over the past week

- Share markets pushed higher over the last week helped by more “green shoots” pointing to improving global growth this year, including Chinese business conditions PMIs & the US ISM index and a stabilisation in Eurozone composite PMIs, and more indications that the US and China are getting closer to a deal on trade (albeit with issues around enforcement and the removal of last year’s tariff hikes yet to be agreed). This saw US, Eurozone and Australian shares make it to six month or so highs. Reflecting the risk on tone bond yields rose. While the copper price fell, oil rose as did iron ore helped by a new cyclone related supply disruption. The US dollar was little changed and the $A pushed just above $US0.71.

- Brexit got nowhere decisive and time is running out. Either the UK parliament gets its act together pretty quick and seeks an extension (which remains our base case with Parliament voting to reject a no deal Brexit, albeit by a margin of just 1) or it crashes out on April 12. A long extension raises all sorts of issues around the UK being forced to participate in EU elections in May, new UK elections and another referendum. But remember the Brexit comedy is a sideshow for global investors.

- The 2019-20 Australian Federal Budget gets back to surplus but fails to excite. To be sure this budget contained good news with help for low to middle income households, an enhanced plan for reducing taxes next decade (or giving back fiscal drag to be precise), more tax cuts for small business and a further uplift in infrastructure spending all with a return to surplus after 11 years in deficit. After several years of being wide off the mark, budget projections since the 2015-16 Budget have been pretty consistent in terms of their surplus timing and we are now there (well at least we will be in a few months). Against this though, the immediate boost to low to middle income households is relatively modest (at up to $1080 its around half the up to $1000 and $900 payments made by the Rudd Government in the GFC), we remain of the view that the Government’s GDP growth and wages forecasts are on the optimistic side and the Budget is a bit academic as much of it will depend on who wins the May election.

.png)

Source: Australian Treasury, AMP Capital

- In terms of the election, Opposition leader Bill Shorten’s Budget reply speech confirmed that a Labor Government will adopt a very different approach to economic policy. The key elements of this include supporting the Government’s immediate “tax cuts” for middle income earners and increasing them for low income earners, butincreasing (not decreasing) tax rates for higher income earners, restricting negative gearing, halving the capital gains tax discount, ending cash refunds for franking credits, a more aggressive climate policy, higher minimum wages with some labour market reregulation and more spending on health and education. As always, much of this will be dependent on Senate passage and that’s not assured in some areas (like negative gearing). But it will likely lead to nervousness in the Australian share market and the changes to negative gearing and capital gains tax will be negative for property prices.If Labor wins, expect a mini-budget in the September quarter.

- But its clear that both sides of politics are aiming for budget surpluses and committed to tax relief for low and middle income households to be received after they complete their 2018-19 tax returns. The latter will provide some boost to spending in the September quarter (although the Rudd payments in the GFC indicate that much will be saved) which along with likely RBA rate cuts, continuing strong infrastructure spending, improving business investment and strong export demand should keep the economy growing despite the drag from the housing downturn – just not as strongly as the Government and RBA are forecasting.

Major global economic events and implications

- US data was a bit messy but mostly encouraging. On the downside underlying capital goods orders and retail sales fell in February. But the level of capital goods orders remains high, retail sales for January were revised up, construction spending and auto sales were strong, jobless claims fell to a new low and business conditions ISMs and PMIs are solid and consistent with reasonable growth.

- The Eurozone’s composite business conditions PMI fell slightly but it is showing tentative signs of stabilising.Meanwhile, unemployment held steady at 7.8% in February but with core inflation falling to 0.8% year on year in March pressure remains on the ECB to boost growth.

- Japan’s March quarter Tankan survey showed a deterioration in business conditions for manufacturers (albeit from relatively high levels) but conditions for non-manufacturers remain strong.

- Chinese business conditions PMIs rose in March adding to signs that Chinese growth may be bottoming. To be sure seasonal volatility associated with the timing of the Lunar New Year holiday may be helping but stimulus is likely helping too.

Australian economic events and implications

- Australia saw some upbeat February data over the last week with a bounce in retail sales and building approvals and the trade surplus rose to a new record high. And the pace of house price falls slowed a bit in March according to CoreLogic. This all provides a bit of confidence that March quarter GDP growth may have improved a bit from the dismal pace of 0.3% and 0.2% seen in the September and December quarters respectively. However, there are reasons for caution. First, economic data often runs hot and cold. Since Christmas we have had a long cold patch so a hot patch isn’t surprising. Second, its hard to see the surge in food sales, department stores, clothing and household goods that drove the bounce in February retail sales being sustained given ongoing soft wages growth and falling home prices. Third, the bounce in building approvals was driven by volatile apartments and the trend remains down. Fourth, the record trade surplus is good news but its mainly being driven by high bulk commodity prices not by volumes. Fifth, business conditions PMIs and business confidence readings were soft in March. Finally, we saw the pace of home price declines slow a year ago only to accelerate again and in any case house price declines are now quite broad based across capital cities and the negatives that are driving house price falls notably in Sydney and Melbourne remain in place including tight lending standards, record unit supply, a collapse in foreign demand, uncertainty around the tax treatment of property investment and price falls feeding on themselves. So we still see further soft economic growth and home price falls ahead.

Source: CoreLogic, AMP Capital

- Finally, while the Melbourne Institute’s Inflation Gauge saw a bit of a bounce in March this seems to happen every few months and underlying inflation is still running at just 1.6% year on year.

- Meanwhile, the RBA remained on hold for the 32nd month in a row but there were two marginal dovish tilts in its post meeting statement. First in acknowledging weak December quarter growth particularly in consumer spending and second in noting that it will “continue to monitor developments”.

What to watch over the next week?

- In the US, the minutes from the Fed’s last meeting (due Wednesday) will likely confirm its dovishness and this is likely to be supported by March CPI data (also due Wednesday) showing core CPI inflation remaining around 2.1% year on year. Job openings and hirings for February are likely to have remained strong and small business optimism (both due Tuesday) will be watched for a bounce.

- US March quarter earnings reports will start to flow. These are likely to see a distinct slowing to a slight decline or flat year on year as last year’s tax cut drops out and in response to slower growth but its also likely to be the low point for this year.

- The European Central Bank (Wednesday) is unlikely to undertake further monetary easing having just done so at its last meeting, but its likely to signal a willingness to do more.

- Chinese data for March is expected to show continuing benign underlying inflation (Thursday) and an improvement in export and import growth (Friday). Credit data will also be released.

- In Australia expect a continuing downtrend in housing finance (Tuesday) and a possible bounce in consumer confidence (Wednesday) thanks to the tax cuts. The RBA’s six monthly Financial Stability review will be released on Friday.

Outlook for investment markets

- Share markets – globally & in Australia - have run hard and fast from their December lows and are vulnerable to a short-term pullback. But valuations are okay, global growth is expected to improve into the second half of the year, monetary and fiscal policy has become more supportive of markets and the trade war threat is receding all of which should support decent gains for share markets through 2019 as a whole.

- Low yields are likely to see low returns from bonds, but they continue to provide an excellent portfolio diversifier and bond yields could still fall further in the next few months. Expect Australian bonds to outperform global bonds.

- Unlisted commercial property and infrastructure are likely to see a slowing in returns over the year ahead. This is particularly the case for Australian retail property. However, lower for even longer bond yields will help underpin unlisted asset valuations.

- National capital city house prices are expected to fall another 5-10% into 2020 led by Sydney and Melbourne on the back of tight credit, rising supply, reduced foreign demand, price falls feeding on themselves and uncertainty around the impact of tax changes under a Labor Government.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 1% by year end.

- The $A is likely to fall into the $US0.60s as the gap between the RBA’s cash rate and the US Fed Funds rate will likely push further into negative territory as the RBA moves to cut rates. Being short the $A remains a good hedge against things going wrong globally.